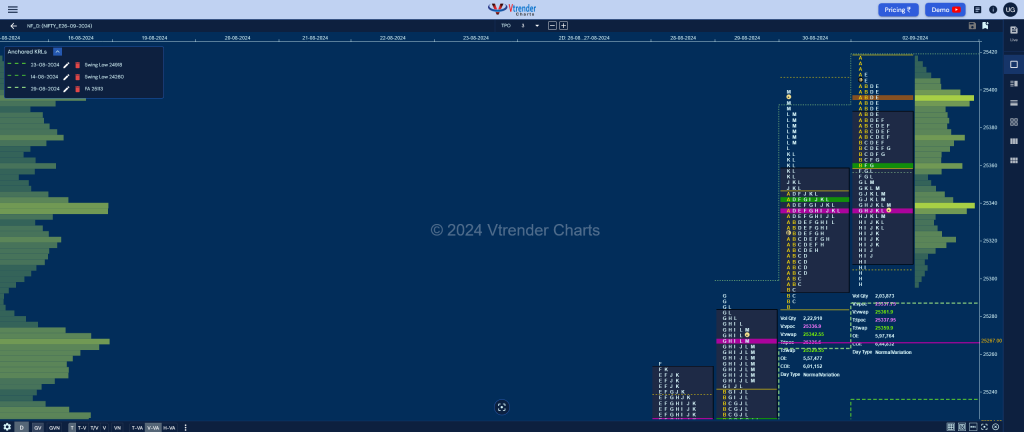

Nifty Sep F: 25340 [ 25420 / 25295 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 27,658 contracts |

| Initial Balance |

|---|

| 65 points (25420 – 25355) |

| Volumes of 67,623 contracts |

| Day Type |

|---|

| Double Distribution – 125 pts |

| Volumes of 2,04,112 contracts |

NF opened higher and saw profit booking by the buyers as it got back into previous range in the Initial Balance (IB) even breaking below the spike low of 25365 and went on to make a low of 25355 taking support right at previous VAH.

The pullback above VWAP in the D & E TPOs however did not attract any fresh demand and this opportunity was taken by the sellers who pushed the auction lower making a hat-trick of REs (Range Extension) from the F to the H periods completing the 80% Rule in previous value and saw profit booking as the POC shifted lower to 25337 leaving a Double Distribution kind of a profile with the upper HVN at 25395 and the DD level at 25355 which will be the reference for the next open.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25337 F and VWAP of the session was at 25362

- Value zones (volume profile) are at 25310-25337-25387

- NF confirmed a FA at 25113 on 29/08 and completed the 1 ATR objective of 25286 on the same day. The 2 ATR target comes to 25460

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 Aug) – NF has formed a Double Distribution (DD) profile with completely higher value at 25121-25168-25245 with the DD zone being from 25094 to 24994 and this week’s VWAP at 25186

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 25270

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

Business Areas for 03rd Sep 2024

| Up |

| 25355 – SOC (02 Sep) 25395 – Upper HVN (02 Sep) 25420 – PDH 25460 – 2 ATR (FA 25113) 25505 – 1 ATR (yPOC 25337) 25563 – 1 ATR (HVN 25395) |

| Down |

| 25320 – RB POC (02 Sep) 25267 – VPOC (29 Aug) 25226 – NeuX VWAP (29 Aug) 25180 – SOC (29 Aug) 25146 – K TPO POC (29 Aug) 25113 – FA (29 Aug) |

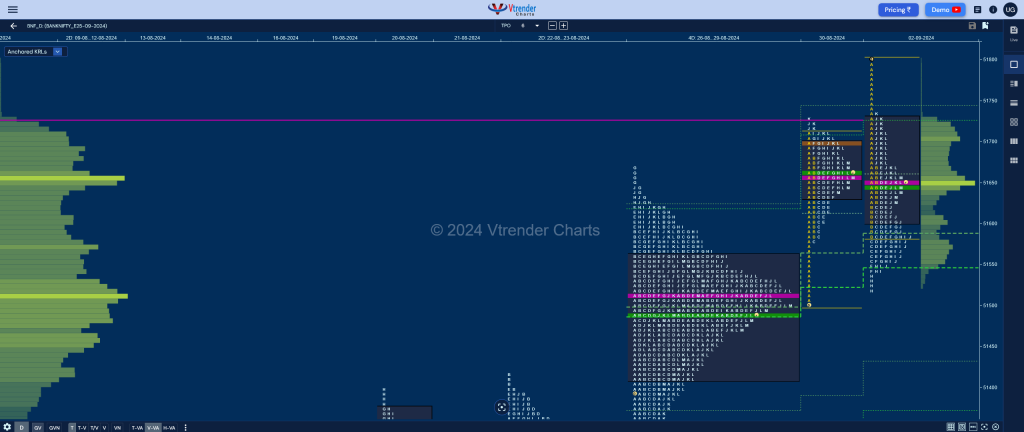

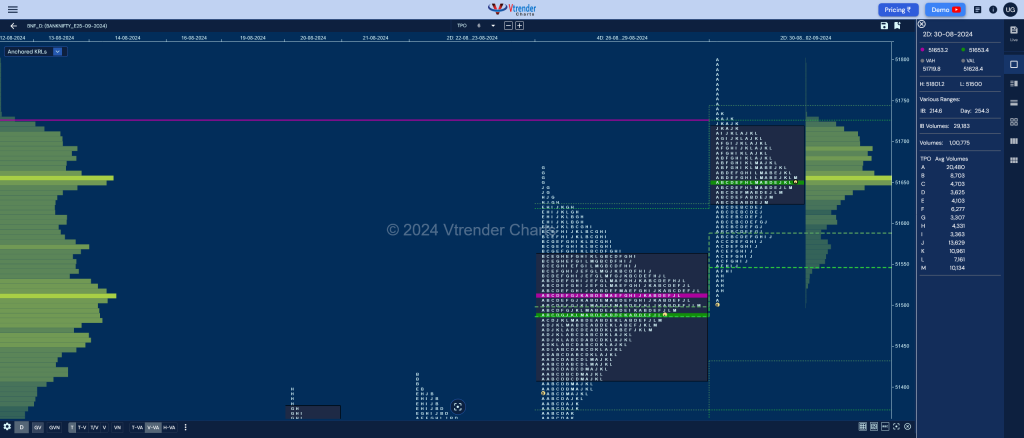

BankNifty Sep F: 51650 [ 51820 / 51519 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,449 contracts |

| Initial Balance |

|---|

| 235 points (51820 – 51585) |

| Volumes of 25,403 contracts |

| Day Type |

|---|

| Normal – 301 pts |

| Volumes of 1,03,756 contracts |

BNF opened higher but did not show any volumes in OF above the VPOC of 51730 as it got back into previous range & value even testing the buying tail from 51580 to 51500 while making couple of REs in the C, F & H TPOs but took support right above the 4-day prominent POC of 51512 as it made a low of 51519 and left a small but important responsive buying tail

The auction then went on to get back above VWAP in the J period triggering a short covering bounce to 51733 but once again the VPOC of 51730 showed more supply coming back resulting in a drop down to 51627 into the close before closing right at the POC of 51650 leaving a ‘b’ shape profile hence the ‘p’ shape of last Friday combined with the current forming a 2-day composite.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51651 F and VWAP of the session was at 51645

- Value zones (volume profile) are at 51604-51651-51729

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (22-28 Aug) – BNF has formed a Gaussian Curve on the weekly timeframe with completely higher value at 51402-51514-51584 with the VWAP being at 51452 and has a lower HVN at 51295

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 51415

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

Business Areas for 03rd Sep 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.