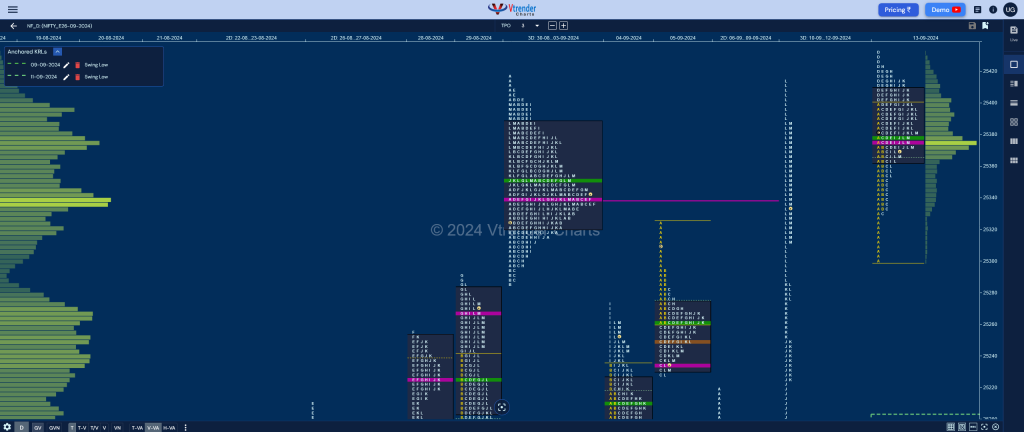

Nifty Sep F: 25372 [ 25433 / 25300 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 28,919 contracts |

| Initial Balance |

|---|

| 110 points (25410 – 25300) |

| Volumes of 57,361 contracts |

| Day Type |

|---|

| Normal – 133 pts |

| Volumes of 1,74,129 contracts |

NF opened in the previous session’s NeuX zone making a low of 25300 as it took support just above the higher extension handle of 25285 and made an attempt to extend higher in the D period but could only manage to hit 25433 and saw no addition of volumes indicating that it was back to balance mode.

The auction remained in a narrow range for the rest of the day holding above VWAP for most part leaving a ‘p’ shape profile for the day with a close right at the overlapping POC & VWAP level of 25376 with an important A period buying tail from 25330 which will be the reference on the downside for the next session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25376 F and VWAP of the session was at 25378

- Value zones (volume profile) are at 25362-25376-25409

- NF confirmed a FA at 24987 on 12/09 and completed the 2 ATR objective of 25315 on the same day.

- HVNs are at 25339** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (06-12 Sep) – NF opened the week below previous value & formed a Trend Day Down breaking below 25168 and making a low of 24855 on Friday and made new lows of 24816 at open on Monday but left an initiative buying tail signalling the end of the downside as it formed a nice base at the 2-day composite POC of 24905. The auction then got accepted in Friday’s selling tail as it formed a 2-day balance with a prominent POC at 25096 and continued to fill it up for the first half of Thursday where the attempt to extend lower got swiftly rejected at 24987 resulting in buyers coming back strongly to give a big trending move higher getting back into previous week’s value and completing the 80% rule to the dot not only confirming a FA on the daily timeframe but doing it on the weekly as well leaving a Neutral Extreme profile to the upside with completely lower Value at 24868-24979-25116 with the all important VWAP at 25059 which will be the swing level for the rest of the series with the extension handles of 25250 & 25285 being the immediate support to hold

- (30Aug-05Sep) – NF has formed a Neutral profile with completely higher Value at 25253-25338-25414 with the VWAP at 25303 as it probed higher for the first 2 sessions hitting new ATH of 25399 & 25420 respectively but failed to get fresh demand and instead got initiative sellers at 25409 who pushed the auction lower where it took support right at previous week’s POC of 25168 and gave a bounce back to 25324 which was again met with supply resulting in a close below Value

- (23-29 Aug) – NF has formed a Double Distribution (DD) profile with completely higher value at 25121-25168-25245 with the DD zone being from 25094 to 24994 and this week’s VWAP at 25186

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 25270

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

Business Areas for 16thSep 2024

| Up |

| 25376 – POC (13 Sep) 25422 – Sell tail (13 Sep) 25460 – 1 ATR (RO 25270) 25500 – Weekly 1.5 IB 25566 – 1 ATR (yPOC 24376) 25595 – 2 ATR (VWAP 25215) |

| Down |

| 25366 – 13 Sep Halfback 25330 – Buy Tail (13 Sep) 25285 – Ext Handle (12 Sep) 25250 – Ext Handle (12 Sep) 25215 – NeuX VWAP (12 Sep) 25169 – J TPO VWAP (12 Sep) |

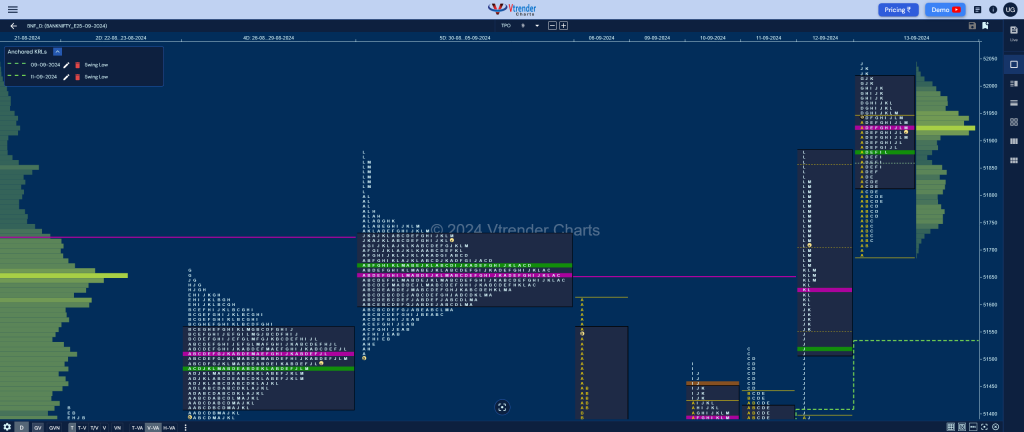

BankNifty Sep F: 51929 [ 52044 / 51692 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 11,552 contracts |

| Initial Balance |

|---|

| 253 points (51944 – 51692) |

| Volumes of 27,347 contracts |

| Day Type |

|---|

| Normal – 352 pts |

| Volumes of 1,09,186 contracts |

BNF also made an OA start and took support well above previous POC of 51625 forming a Normal Day with mostly higher value as it made a high of 52044 stalling just below the HVN of 52070 from the important profile of 01st Aug and will need to sustain above it in the coming session for continuation of the upmove.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51922 F and VWAP of the session was at 51880

- Value zones (volume profile) are at 51821-51922-52013

- BNF confirmed a FA at 51519 on 11/09 and completed the 1 ATR target of 51141 on the same day & the 2 ATR comes to 50763. This FA was negated on 12/09 and the upside 1 ATR goal of 51897 was tagged on 13/09, the 2 ATR objective comes to 52275

- BNF confirmed a FA at 51150 on 12/09 and completed the 2 ATR objective of 51907 on 13/09.

- HVNs are at 51656** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29Aug-04Sep) – BNF opened the week & the new series taking support just above the weekly HVN of 51295 but has formed a narrow 573 points range balance with overlapping to higher Value at 51550-51656-51721 with an attempt to probe higher on 03rd Sep being rejected as big supply came back at the tag of the weekly VPOC of 51853 so a bigger imbalance is on the cards in the coming week for a move away from this week’s prominent POC of 51656 with the daily FA at 51525 being an immediate support

- (22-28 Aug) – BNF has formed a Gaussian Curve on the weekly timeframe with completely higher value at 51402-51514-51584 with the VWAP being at 51452 and has a lower HVN at 51295

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 51415

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

Business Areas for 16th Sep 2024

| Up |

| 51929 – M TPO h/b (13 Sep) 52070 – HVN (01 Aug) 52232 – VPOC (01 Aug) 52349 – Swing High (01 Aug) 52470 – Weekly 3 IB 52590 – 2 ATR (51760) |

| Down |

| 51880 – VWAP (13 Sep) 51760 – C TPO POC (13 Sep) 51625 – VPOC (12 Sep) 51519 – NeuX VWAP (12 Sep) 51397 – Ext Handle (12 Sep) 51268 – Weekly POC (05-11 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.