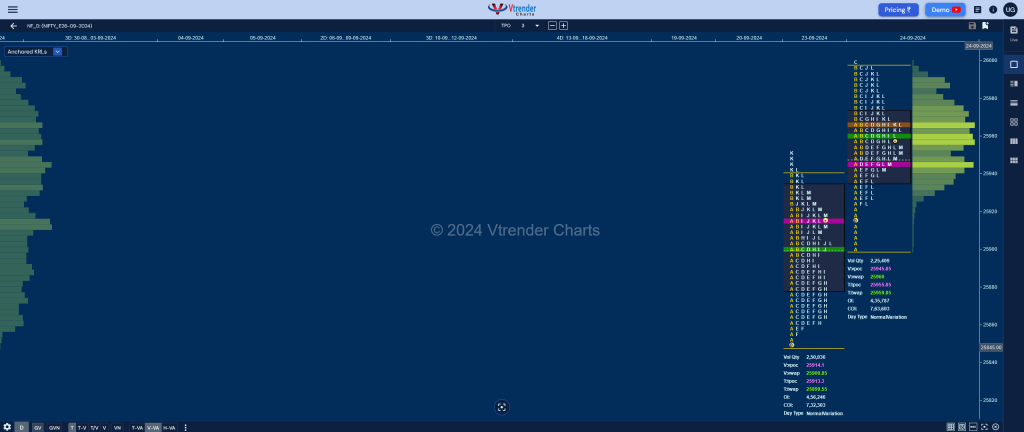

Nifty Sep F: 25944 [ 26000 / 25899 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 11,187 contracts |

| Initial Balance |

|---|

| 96 points (25996 – 25899) |

| Volumes of 43,756 contracts |

| Day Type |

|---|

| Normal – 100 pts |

| Volumes of 2,25,409 contracts |

NF made an OAIR start but took support right at previous VWAP of 25900 indicating that the buyers were still in play as they went on to probe higher for the rest of the IB (Initial Balance) which was followed by the dreaded C side extension to the BRN (Big Round Number) of 26000 triggering a probe back to day’s VWAP which was broken.

The auction made lower lows till the F TPO but took support in the A period buying tail while making a low of 25925 and remained in a narrow range for the rest of the day with couple of failed attempts to get above IBH in the J & L resulting in another swipe lower into the close back to 25925 forming a ‘p’ shape profile for the day with a close right at the POC of 25945 which will be the opening reference for the next session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25945 F and VWAP of the session was at 25960

- Value zones (volume profile) are at 25935-25945-25973

- NF confirmed a FA at 24987 on 12/09 and completed the 2 ATR objective of 25315 on the same day.

- HVNs are at 25339** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (13-19 Sep) – NF remained above previous week’s uppermost extension handle of 25285 & has formed a Normal Variation weekly profile to the upside with mostly higher value at 25371-25449-25494 which is also a nice balance with POC & VWAP aligning so can give a move away from here with the PLR staying to the upside as long as this week’s VWAP of 25447 is held

- (06-12 Sep) – NF opened the week below previous value & formed a Trend Day Down breaking below 25168 and making a low of 24855 on Friday and made new lows of 24816 at open on Monday but left an initiative buying tail signalling the end of the downside as it formed a nice base at the 2-day composite POC of 24905. The auction then got accepted in Friday’s selling tail as it formed a 2-day balance with a prominent POC at 25096 and continued to fill it up for the first half of Thursday where the attempt to extend lower got swiftly rejected at 24987 resulting in buyers coming back strongly to give a big trending move higher getting back into previous week’s value and completing the 80% rule to the dot not only confirming a FA on the daily timeframe but doing it on the weekly as well leaving a Neutral Extreme profile to the upside with completely lower Value at 24868-24979-25116 with the all important VWAP at 25059 which will be the swing level for the rest of the series with the extension handles of 25250 & 25285 being the immediate support to hold

- (30Aug-05Sep) – NF has formed a Neutral profile with completely higher Value at 25253-25338-25414 with the VWAP at 25303 as it probed higher for the first 2 sessions hitting new ATH of 25399 & 25420 respectively but failed to get fresh demand and instead got initiative sellers at 25409 who pushed the auction lower where it took support right at previous week’s POC of 25168 and gave a bounce back to 25324 which was again met with supply resulting in a close below Value

- (23-29 Aug) – NF has formed a Double Distribution (DD) profile with completely higher value at 25121-25168-25245 with the DD zone being from 25094 to 24994 and this week’s VWAP at 25186

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 25270

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

Business Areas for 25thSep 2024

| Up |

| 25960 – VWAP (24 Sep) 26000 – PDH 26056 – 1 ATR (25855) 26101 – 1 ATR (25900) 26146 – 1 ATR (yPOC 25945) 26201 – 1 ATR (DH) |

| Down |

| 25945 – POC (24 Sep) 25900 – VWAP (23 Sep) 25855 – Buy Tail (23 Sep) 25798 – Daily Ext Handle 25742 – L TPO VWAP (20 Sep) 25680 – HVN (20 Sep) |

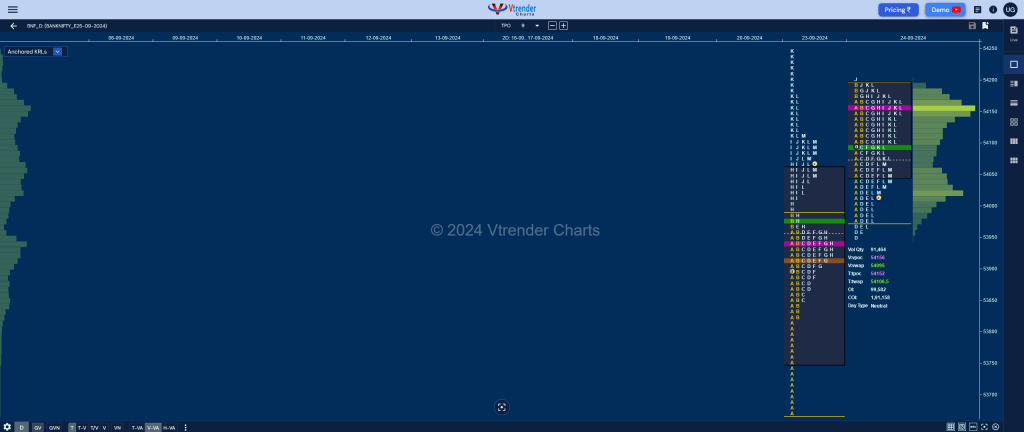

BankNifty Sep F: 54026 [ 54200 / 53954 ]

| Open Type |

|---|

| OAIR (Open Drive) |

| Volumes of 6,055 contracts |

| Initial Balance |

|---|

| 214 points (54194 – 53980) |

| Volumes of 24,337 contracts |

| Day Type |

|---|

| Neutral – 246 pts |

| Volumes of 91,464 contracts |

BNF formed an inside bar as expected filling up the upper part of previous day’s DD profile as it took support above yPOC of 53943 and made a high of 54200 unable to negate the responsive selling tail from 54175 to 54252.

The auction has highest volumes at 54156 and has closed around the IBL with a probable FA at highs and will remain weak below 53980 for a probe towards the buying tail references of 53825 & 53687 from 23rd Sep along with 20th Sep’s VPOC of 53576.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 54156 F and VWAP of the session was at 54095

- Value zones (volume profile) are at 54048-54156-54192

- HVNs are at 51656** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29Aug-04Sep) – BNF opened the week & the new series taking support just above the weekly HVN of 51295 but has formed a narrow 573 points range balance with overlapping to higher Value at 51550-51656-51721 with an attempt to probe higher on 03rd Sep being rejected as big supply came back at the tag of the weekly VPOC of 51853 so a bigger imbalance is on the cards in the coming week for a move away from this week’s prominent POC of 51656 with the daily FA at 51525 being an immediate support

- (22-28 Aug) – BNF has formed a Gaussian Curve on the weekly timeframe with completely higher value at 51402-51514-51584 with the VWAP being at 51452 and has a lower HVN at 51295

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 51415

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

Business Areas for 25th Sep 2024

| Up |

| 54077 – 24 Sep Halfback 54156 – POC (24 Sep) 54252 – Swing High (23 Sep) 54394 – 1 ATR (HVN 53910) 54445 – 1 ATR (PDL 53954) 54561 – 1 ATR (54077) |

| Down |

| 54011 – M TPO low (24 Sep) 53910 – HVN (23 Sep) 53825 – Buy Tail (23 Sep) 53687 – IB tail mid (23 Sep) 53576 – VPOC (20 Sep) 53447 – Weekly IBH |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.