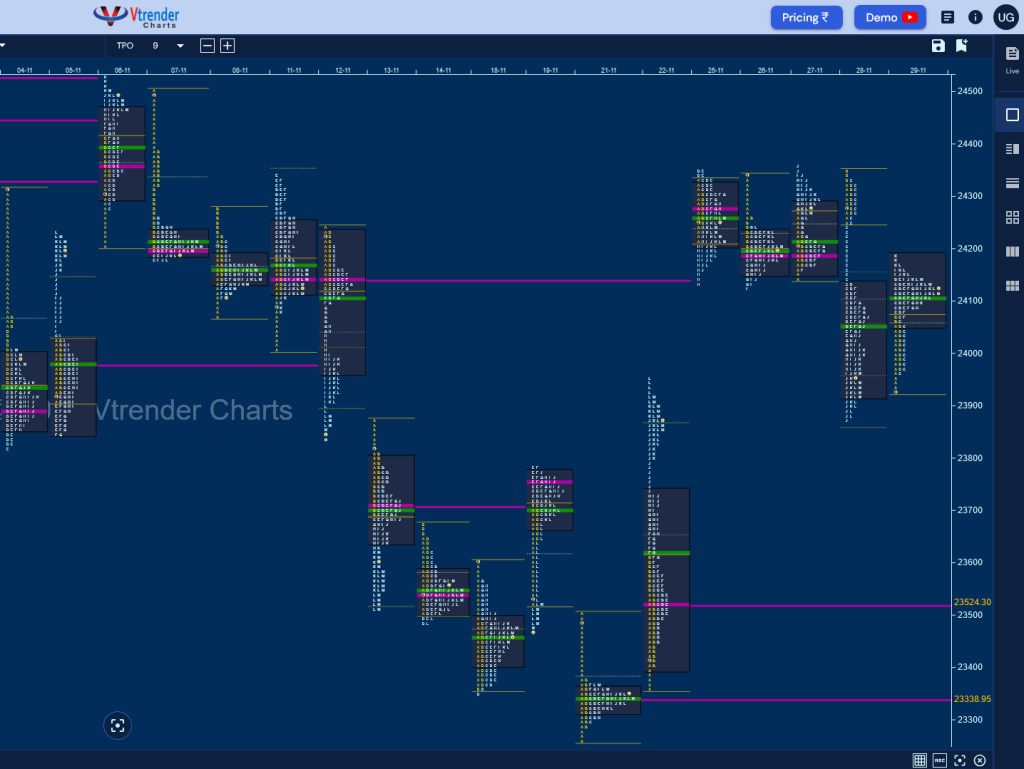

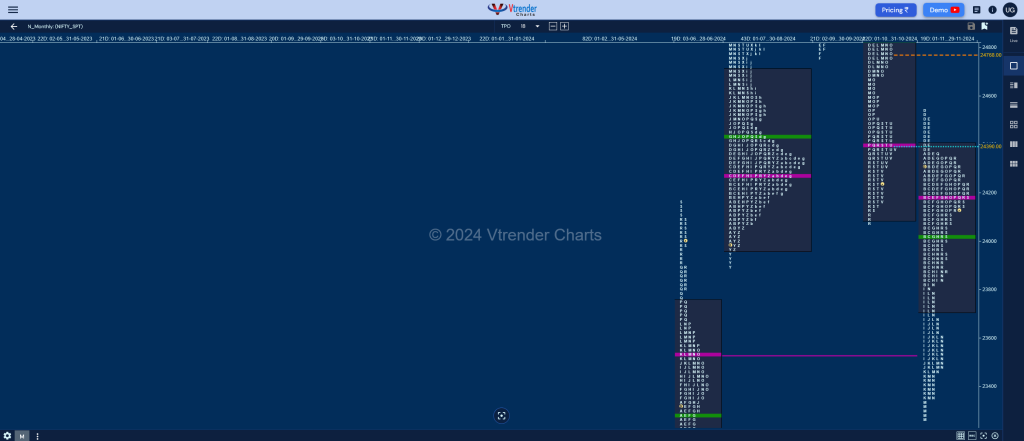

Nifty Spot: 24131 [ 24537 / 23263 ] – Normal Variation (Down)

Nifty made a follow up to previous month’s ‘b’ shape long liquidation profile with a Normal Variation one to the downside as it not only broke below previous month lows but went on to sustain below the August Swing Low of 23893 testing the important June monthly profile’s POC of 23535 and went on to make a low of 23263 holding just above June’s VWAP of 23247 indicating return of demand as it confirmed a weekly FA at lows.

The auction then made a bounce back to 24354 making similar highs over 4 days in the last week as it was unable to take out the initiative selling tail from 24382 to 24503 from 07th Nov confirming another weekly FA here triggering a sharp dip down to 23873 on 28th Nov where it formed a Trend Day Down before consolidating with an inside bar on the last day of the month closing around the middle of the monthly profile which has formed Value below previous month’s POC of 24400 which will be the important swing reference on the upside for December above this month’s POC of 24185 whereas on the downside, the RollOver (RO) point of 24125 will be the immediate reference below which we have the series VWAP of 23978 as a probable support staying below which Nifty could fill up the zone till 23600 before giving a move away from this larger timeframe balance it is forming.

Monthly Zones

- The settlement day Roll Over point (Dec 2024) is 24125

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

- The VWAP & POC of Sep 2024 Series is 25539 & 25415 respectively

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

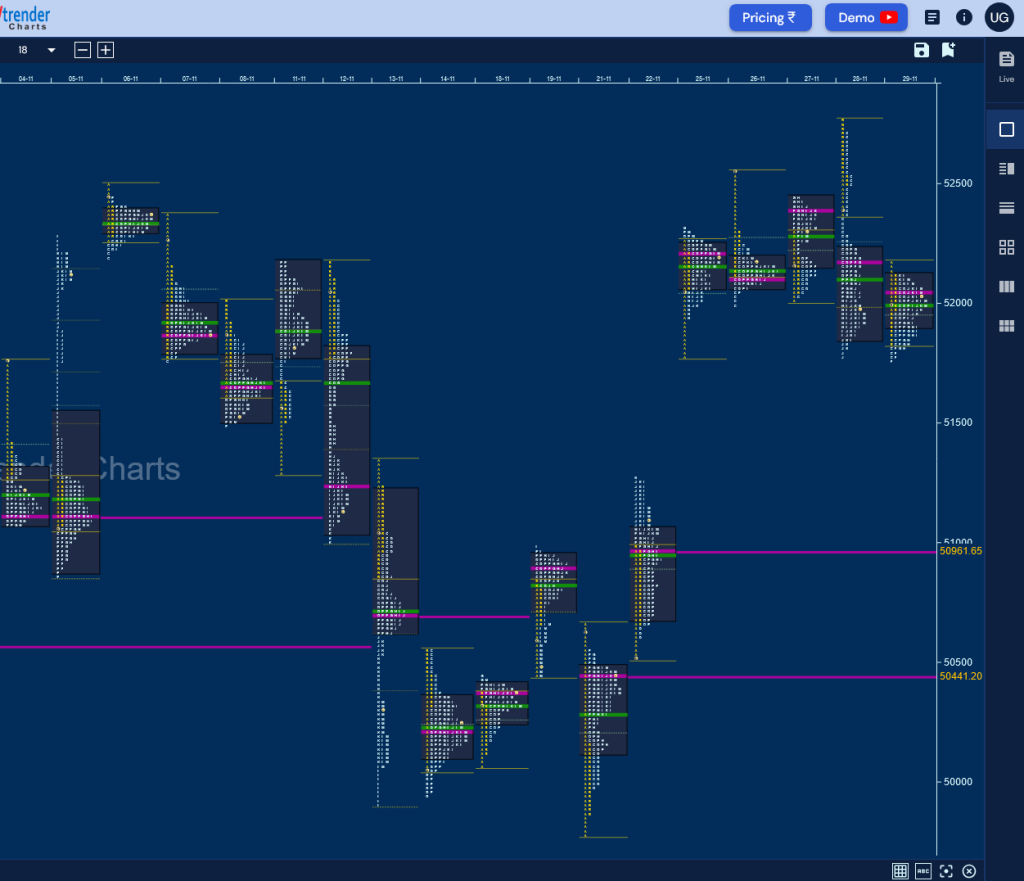

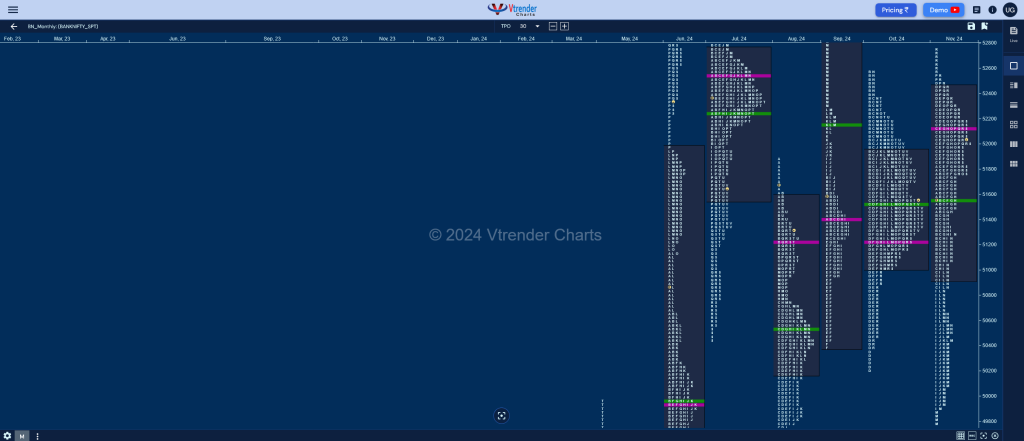

BankNifty Spot: 52055 [ 52760 / 49787 ] – Neutral

BankNifty continued to remain in previous month’s Gaussian Curve completing the 80% Rule in the October Value area zone multiple times in the first part of the month before leaving an extension handle at 50865 to signal a move away to the downside on 13th Nov as it went on to break below previous month’s low of 50194 and went on to tag the important references of daily VPOC of 49950 & FA of 49806 from 16th Aug while making a low of 49787 which was also the halfback from 14th Aug’s Swing Low of 49654 displaying buyers coming back.

The auction not only confirmed a weekly FA at 49787 along but went on to negate the extension handle of 50865 & complete the 2 ATR objective of 52725 as it trended higher in the last part of the month hitting new highs of 52760 on 28th Nov but left a small initiative selling tail showing that the Oct supply zone was still prevailing forcing a dip down to 51759 on the last day before it closed the month with a well balanced weekly Gaussian Curve. The monthly profile is a Neutral one with completely overlapping Value at 50910-52129-52451 as the larger timeframe balance continues in BankNifty with the RollOver point for the December series being at 52620 which it will need to take down and sustain for more upside in the coming month whereas on the downside, November series VWAP of 51417 will be an important support level.

Monthly Zones

- The settlement day Roll Over point (Dec 2024) is 52620

- The VWAP & POC of Nov 2024 Series is 51417 & 52129 respectively

- The VWAP & POC of Oct 2024 Series is 51559 & 51239 respectively

- The VWAP & POC of Sep 2024 Series is 52236 & 51404 respectively

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively