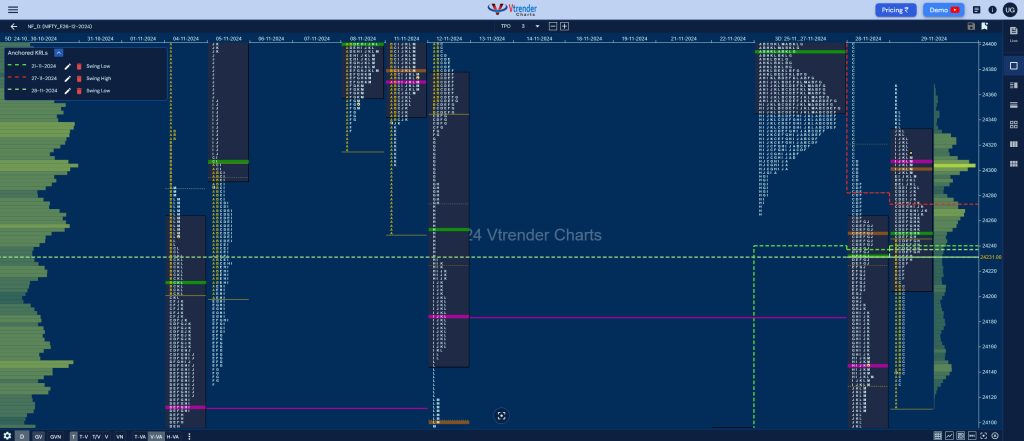

Nifty Dec F: 24304 [ 24368 / 24112 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 28,263 contracts |

| Initial Balance |

|---|

| 135 points (24247 – 24112) |

| Volumes of 70,992 contracts |

| Day Type |

|---|

| NormalVariation(3-1-3)-256pts |

| Volumes of 2,63,296 contracts |

NF formed an inside bar in terms of range post the Trend Day down of the previous session consolidating in the elongated profile while being accepted above the important Trend Day levels of 24146 & 24231 which were the POC & VWAP respectively but stalled right at the C TPO supply point of 24365 leaving a responsive selling tail before closing right at the dPOC.

On the upside, it will need to take out the supply at 24365 & extension handle of 24415 for a probe towards the initiative selling of 24467 and the swing high of 24524 in the coming session whereas on the downside, today’s VWAP of 24250 will be the immediate support along with the SOC of 24215 & initiative buying seen at 24173 below which the auction could test the RO point of 24125 & the responsive buying seen at 24075

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24306 F and VWAP of the session was at 24250

- Value zones (volume profile) are at 24205-24306-24331

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (22 – 28 Nov) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Dec 2024) is 24125

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

- The VWAP & POC of Sep 2024 Series is 25516 & 25415 respectively

Business Areas for 02nd Dec 2024

| Up |

| 24314 – L TPO VWAP (29 Nov) 24365 – C TPO VWAP (28 Nov) 24415 – Ext Handle (28 Nov) 24450 – IS (28 Nov) 24485 – RS POC (28 Nov) 24524 – Swing High (28 Nov) 24577 – Sell tail (11 Nov) 24638 – Sell Tail (07 Nov) |

| Down |

| 24300 – Closing HVN (29 Nov) 24250 – VWAP (29 Nov) 24215 – PBL (29 Nov) 24173 – IB low (29 Nov) 24125 – RO point (Dec) 24075 – Buy tail (28 Nov) 24026 – HVN (22 Nov) 23978 – Nov VWAP |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.