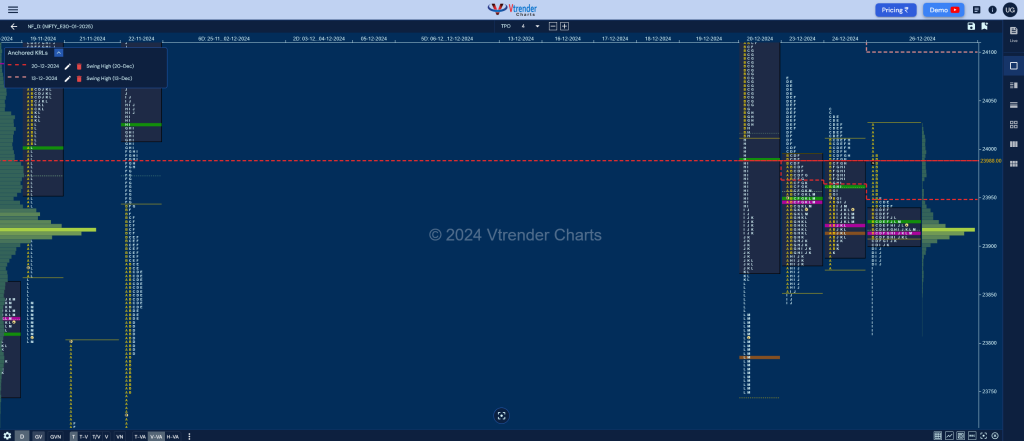

Nifty Jan F: 23919 [ 24026 / 23709 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 15,736 contracts |

| Initial Balance |

|---|

| 116 points (24026 – 23911) |

| Volumes of 52,598 contracts |

| Day Type |

|---|

| Normal Variation – 217 pts |

| Volumes of 2,45,279 contracts |

NF continued the balance mode as it remained inside last 2 days range & value but got some initiative sellers at the open seen in the A period tail from 23992 to 24026 who went on to repair the poor lows from Monday and left a nice responsive buying tail from 23900 to 23809 leaving a 3-1-3 profile for the day with a close around the prominent POC of 23915 which is also the RO (RollOver) point of the Jan series.

The auction has formed a nice 3-day composite with Value at 23891-23915-23978 and has a good chance to move away from this zone for a tag of the higher VPOC of 24146 from 20th Dec on the upside whereas on the downside the objective coud be the HVN of 23684 from 21st Nov.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23915 F and VWAP of the session was at 23927

- Value zones (volume profile) are at 23903-23915-23937

- HVNs are at NA** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (20 – 26 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 23915

- The VWAP & POC of Dec 2024 Series is 24251 & 24621 respectively

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

Business Areas for 27th Dec 2024

| Up |

| 23927 – VWAP (26 Dec) 23978 – 3-day VAH (23-26 Dec) 24026 – IS30 high (24 Dec) 24069 – Sell tail (23 Dec) 24113 – SOC (20 Dec) 24147 – VPOC (20 Dec) |

| Down |

| 23915 – 3-day POC (23-26 Dec) 23880 – Buy tail (26 Dec) 23840 – Buy tail (3-day comp) 23784 – HVN (20 Dec) 23748 – Buy Tail (22 Nov) 23683 – HVN (20 Nov) |

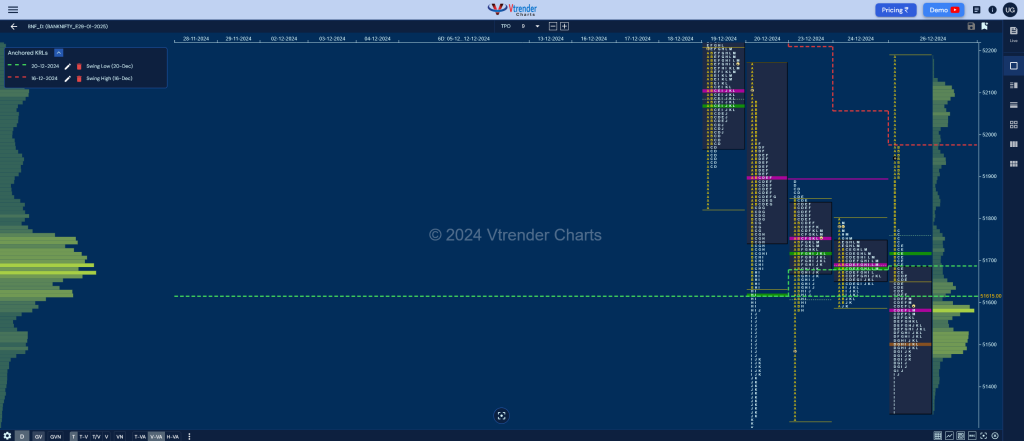

BankNifty Jan F: 51575 [ 52186 / 51335 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 19,275 contracts |

| Initial Balance |

|---|

| 534 points (52186 – 51652) |

| Volumes of 38,166 contracts |

| Day Type |

|---|

| Normal Variation – 851 pts |

| Volumes of 97,345 contracts |

BNF opened higher and continued to rise first scaling above the 20th Dec VPOC of 51900 and then taking out that day’s Selling Tail but could not sustain and daw supply coming back strongly as they not only left an extension handle at 51900 in the B period but went on to complete the 80% Rule in the 2-day composite and almost tagged the IB low of 51325 from 23rd while making a low of 51335.

The auction however saw profit booking seen in the responsive buying tail till 51430 and climbed back to the dPOC of 51584 into the close leaving an Outside Bar in terms of range with overlapping to lower value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51583 F and VWAP of the session was at 51722

- Value zones (volume profile) are at 51340-51583-51684

- HVNs are at NA** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19 – 24 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 51750

- The VWAP & POC of Dec 2024 Series is 52607 & 53355 respectively

- The VWAP & POC of Nov 2024 Series is 51417 & 52129 respectively

- The VWAP & POC of Oct 2024 Series is 51559 & 51239 respectively

Business Areas for 27th Dec 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.