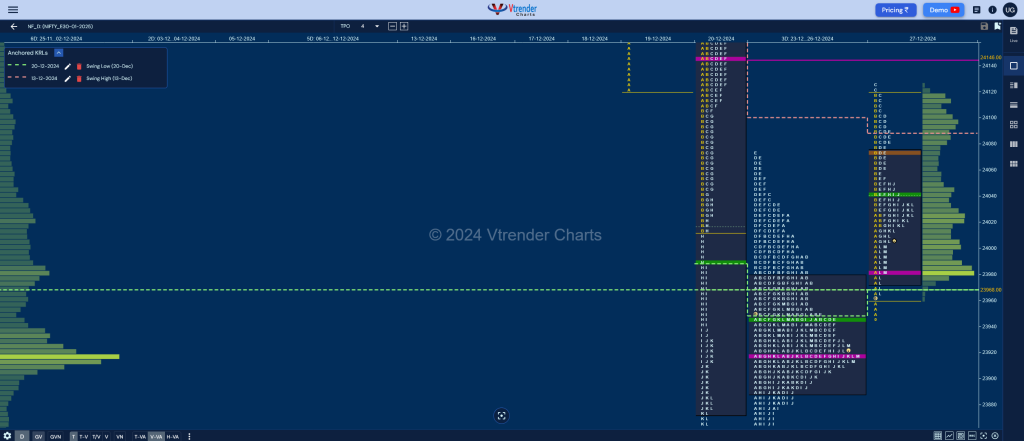

Nifty Jan F: 23992 [ 24128 / 23960 ]

| Open Type |

|---|

| OD(Open Drive) |

| Volumes of 24,632 contracts |

| Initial Balance |

|---|

| 194 points (24119 – 23925) |

| Volumes of 80,297 contracts |

| Day Type |

|---|

| Normal – 206 pts |

| Volumes of 1,97,296 contracts |

NF made an Open Drive start moving away from the 3-day balance leaving an extension handle at 24025 as it scaled above 23rd Dec high of 23074 while making a high of 24119 in the B period which was followed by a typical C side extension to 24128 and the mandatory VWAP test in the D TPO where the buyers failed to respond.

This empowered the sellers to come back as the auction then remained below VWAP for the rest of the day turning the probe to the downside negating the entire rise of the open as it went on to make a low of 23967 and saw the entry back into the 3-day Value being rejected with a small tail forming a Normal Day with completely higher value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23984 F and VWAP of the session was at 24040

- Value zones (volume profile) are at 23974-23984-24074

- HVNs are at NA** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (20 – 26 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 23915

- The VWAP & POC of Dec 2024 Series is 24237 & 24621 respectively

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

Business Areas for 30th Dec 2024

| Up |

| 23998 – M TPO VWAP (27 Dec) 24040 – VWAP (27 Dec) 24091 – IS30 high (24 Dec) 24147 – VPOC (20 Dec) 24210 – PBH (20 Dec) 24268 – Sell Tail (20 Dec) |

| Down |

| 23984 – POC (27 Dec) 23945 – 3-day VWAP (23-26 Dec) 23891 – 3-day VAL (23-26 Dec) 23840 – Buy tail (3-day comp) 23784 – HVN (20 Dec) 23748 – Buy Tail (22 Nov) |

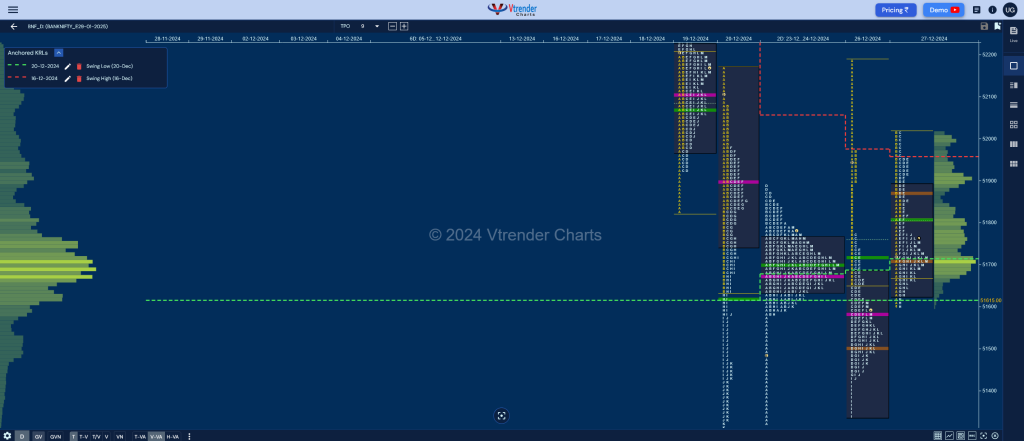

BankNifty Jan F: 51724 [ 52018 / 51520 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 9,553 contracts |

| Initial Balance |

|---|

| 498 points (52018 – 51520) |

| Volumes of 28,988 contracts |

| Day Type |

|---|

| Normal – 498 pts |

| Volumes of 70,118 contracts |

BNF opened higher moving away from previous Value as it made a probe into the initiative selling tail from previous session but ended up leaving similar highs at 52018 & 52014 where supply started to come back forcing the break of VWAP negating the strong open.

The auction then went on to make a low of 51601 taking support just above yPOC of 51583 before settling down to close at 51724 just below the RO point of the Jan series and will need to get some initiative volumes at this level for a move away from the Inside Bar it has formed.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51805 F and VWAP of the session was at 51809

- Value zones (volume profile) are at 51629-51805-51890

- HVNs are at NA** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19 – 24 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 51750

- The VWAP & POC of Dec 2024 Series is 52570 & 53355 respectively

- The VWAP & POC of Nov 2024 Series is 51417 & 52129 respectively

- The VWAP & POC of Oct 2024 Series is 51559 & 51239 respectively

Business Areas for 30th Dec 2024

| Up |

| 51734 – M TPO VWAP (27 Dec) 51840 – E TPO POC (27 Dec) 51967 – C TPO VWAP (27 Dec) 52077 – Sell tail mid (26 Dec) 52186 – Swing High (26 Dec) 52314 – Sell tail mid (19 Dec) |

| Down |

| 51715 – AVWAP (20 Dec) 51583 – VPOC (26 Dec) 51430 – Buy tail (26 Dec) 51335 – Weekly IBL 51235 – M TPO VWAP (20 Dec) 51137 – Buy tail (20 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.