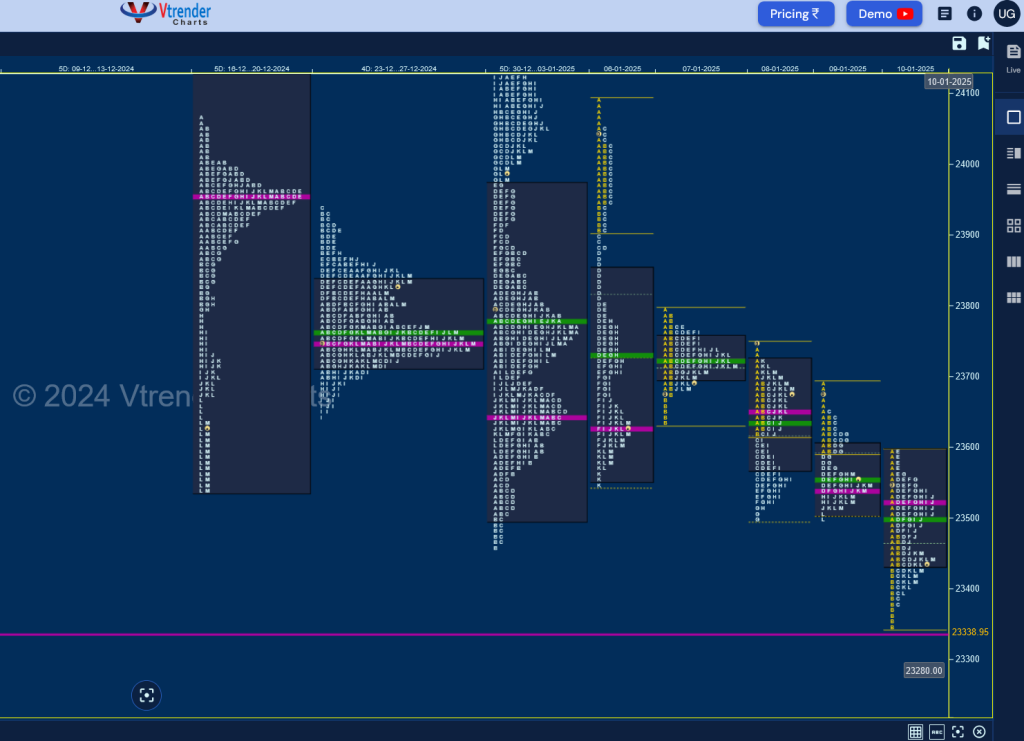

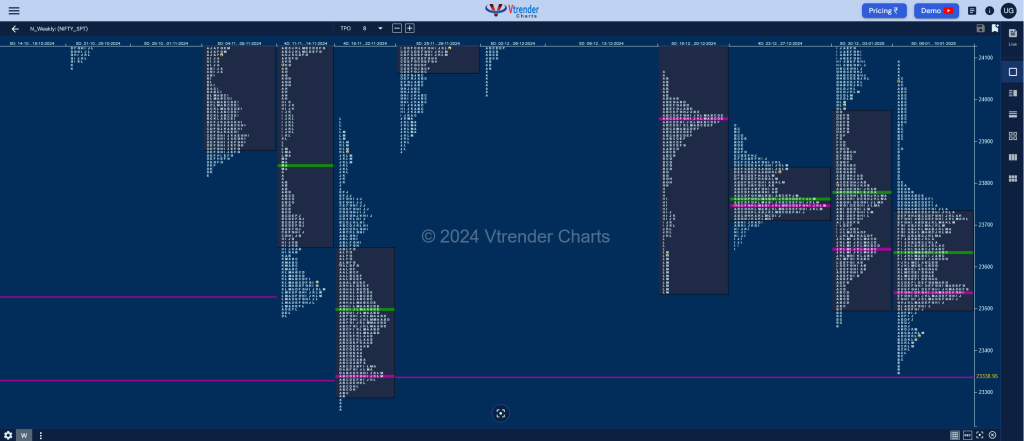

Nifty Spot: 23431 [ 24090 / 23344 ] Long Liquidation

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one to the upside forming an Outside Bar both in terms of range & value which is at 23496-23646-23696 but will need to stay above the daily POC of 24040 for a test of the selling tail from 24196 to 24226 which if taken out could lead to a upmove to the daily VPOCs of 24394 & 24657 whereas on the downside, Nifty has immediate support at the Trend Day VPOC of 23957 below which it go for a test of the extension handles of 23877 & 23822 with 23751 being the Swing reference and a break of which could trigger a further first to the daily VPOC of 23591 and then to the weekly one at 23339 in the coming week‘

Monday – 23616 [ 24090 / 23552 ] Trend (Down)

Tuesday – 23708 [ 23795 / 23637 ] Normal (Inside Bar)

Wednesday – 23688 [ 23751 / 23496 ] Normal Variation (Down)

Thursday – 23526 [ 23689 / 23503 ] Normal Variation (Down)

Friday – 23431 [ 23593 / 23344 ] Normal

Nifty did not give any follow through to previous week’s Neutral Extreme close to the upside and infact left an initiative selling tail on Monday from 24054 to 24090 to form a huge 538 points range Trend Day breaking below the Swing Low of 23751 with ease which triggered a further drop to the daily VPOC of 23597 as it made a a low of 23551 and as expected the imbalance got back to balance mode on Tuesday forming a narrow 157 point range Inside Bar but left another tiny but important A period singles right below Monday’s D TPO selling zone from 23800 to 23911.

The auction then resumed the downmove on Wednesday leaving yet another initiative selling tail resulting in new lows for the week at 23496 and followed it up with an Inside Day on Thursday but showed rejection at previous POC of 23655 with the 4th consecutive A TPO tail of the week as it settled down around the 2-day POC of 23538 and confirmed an Open Rejection Reverse start on Friday where it left the biggest initiative tail of the week breaking below 31st Dec Swing Low of 23460 and almost tagging the downside objective of this week which was at 23339 while it made a low of 23344 and saw some profit booking coming in as it left a strong responsive buying tail in the IB which led to a test of the A singles but could only make a marginal new high for the day which was rejected forcing a drop back to 23396 into the close.

The weekly profile resembles a Long Liquidation one with an initiative selling tail from 24054 to 24090 along another zone of singles from 23911 to 23800 which will now be an important supply zone for the rest of the month whereas we have a nice balance in the lower part of this profile with Value at 23503-23538-23735 which will be a good candidate for the 80% Rule to play out in the coming week provided Nifty can get back above 23503 & sustain whereas on the downside, June series VWAP of 23247 will be the support below weekly VPOC of 23339 below which it could go in for a test of the daily VPOC of 23199 (07th June) and the weekly one of 22745 in the coming week(s).

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 13th Jan – 23431 [ 23593 / 23344 ] Normal

| Up |

| 23440 – TPO HVN (10 Jan) 23485 – J TPO h/b (10 Jan) 23523 – POC (10 Jan) 23566 – PBH (10 Jan) 23616 – PBH (09 Jan) 23655 – POC (08 Jan) 23706 – M TPO high (08 Jan) |

| Down |

| 23430 – M TPO h/b (10 Jan) 23380 – Buy Tail (10 Jan) 23339 – Weekly VPOC (18-22 Nov) 23289 – Buy tail (21 Nov) 23247 – A TPO h/b (11 Jun) 23199 – VPOC (07 Jun) 23151 – PBL (07 Jun) |

Hypos for 14th Jan – 23086 [ 23341 / 23047 ] Neutral Extreme (Down)

| Up |

| 23100 – Weekly IBH 23165 – Ext Handle (13 Jan) 23220 – POC (13 Jan) 23261 – SOC(13 Jan) 23331 – Sell tail (13 Jan) 23380 – Tail (10 Jan) |

| Down |

| 23063 – Buy tail (13 Jan) 23004 – Ext Handle (07 Jun) 22954 – B TPO h/b (07 Jun) 22904 – Buy Tail (07 Jun) 22846 – IB tail mid (07 Jun) 22805 – VAH (06 Jun) |

Hypos for 15th Jan – 23176 [ 23265 / 23134 ] Neutral Centre (Inside Bar)

| Up |

| 23176 – Prev Close 23227 – IBH (14 Jan) 23261 – Sell tail (14 Jan) 23331 – Sell tail (13 Jan) 23380 – Tail (10 Jan) 23440 – TPO HVN (10 Jan) |

| Down |

| 23152 – VAL (14 Jan) 23100 – Weekly IBL 23063 – Buy tail (13 Jan) 23004 – Ext Handle (07 Jun) 22954 – B TPO h/b (07 Jun) 22904 – Buy Tail (07 Jun) |

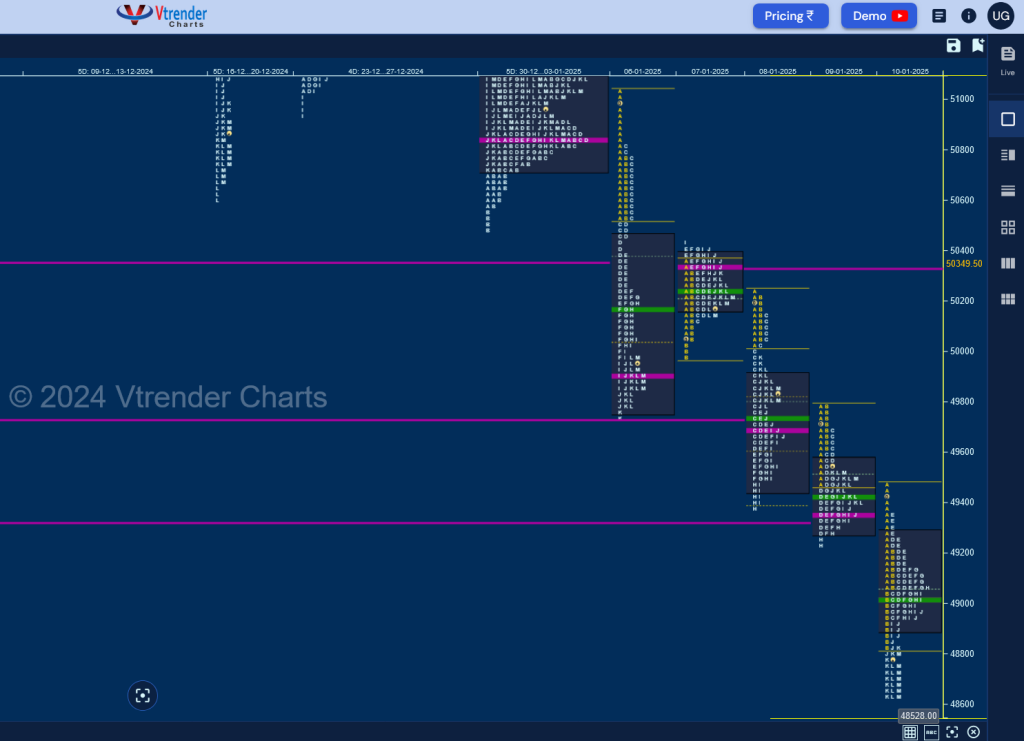

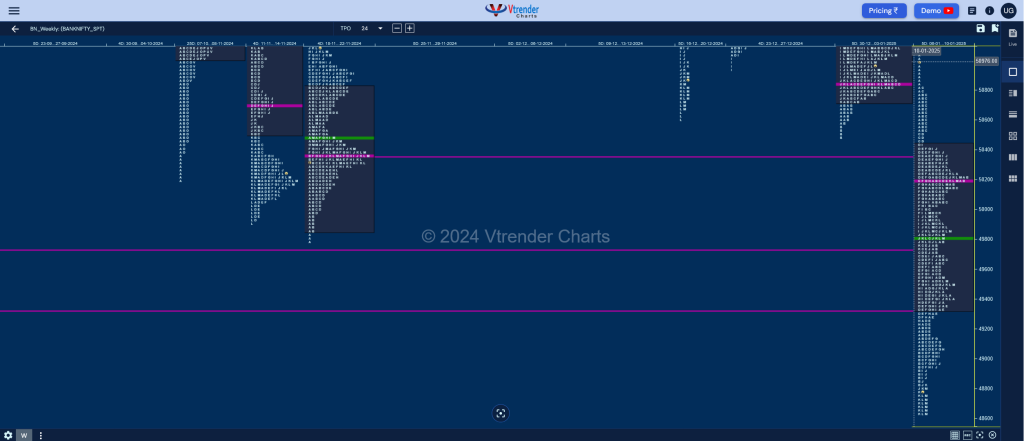

BankNifty Spot: 50988 [ 51979 / 50485 ] Normal Variation (Down)

Previous week’s report ended with this ‘The weekly profile has formed an Outside Bar range wide and is once again a 3-1-3 one resembling a nice balance with mostly overlapping value at 50720-50851-51317 with a close right in the middle of the zone so BankNifty could continue filling up this higher timeframe composite in the coming week making it smoother before giving a definite move away with the downside objectives being the weekly VPOCs of 50371, 49733 & 49326 whereas on the upside, the Swing high of 51672 will be the first target above which the higher objectives will be the VPOC of 52289 & sell side extension handle of 52547 from 18th Dec‘

Monday – 49922 [ 51026 / 49751 ] Trend (Down)

Tuesday – 50202 [ 50447 / 49969 ] – Normal (Inside Bar)

Wednesday – 49835 [ 50246 / 49389 ] – Normal Variation (Down)

Thursday – 49503 [ 49798 / 49230 ] – Normal Variation (Down)

Friday – 48734 [ 49483 / 48631 ] – Normal Variation (Down)

BankNifty was the weaker of the 2 indicies as it confirmed an initiative selling tail from 50813 to 51026 right at previous week’s POC of 50851 and went on to form a Trend Down weekly profile breaking below all of the 3 weekly VPOCS mentioned above leaving completely lower Value at and continued the imbalance into the close while making a low of 48631 on Friday indicating that the downmove is still not over and can continue in the coming week towards May 2024 POC of 47726 & the 2 ATR objective of 47472 from December’s FA of 53888

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 13th Jan – 48734 [ 49483 / 48631 ] – Normal Variation (Down)

| Up |

| to be updated… |

| Down |

| to be updated… |

Hypos for 14th Jan – 48041 [ 48606 / 47898 ] Neutral Extreme (Down)

| Up |

| 48070 – M TPO h/b (13 Jan) 48215 – H TPO h/b (13 Jan) 48385 – SOC (13 Jan) 48573 – Sell tail (13 Jan) 48715 – M TPO h/b (10 Jan) 48888 – J TPO h/b (10 Jan) |

| Down |

| 48016 – Weekly IBL 47833 – VPOC (05 Jun) 47721 – Weekly 1.5 IB / May POC 47588 – F TPO h/b (05 Jun) 47426 – Weekly 2 IB 47264 – Ext Handle (05 Jun) |

Hypos for 15th Jan – 48729 [ 49007 / 48403 ] – Normal Variation (Up)

| Up |

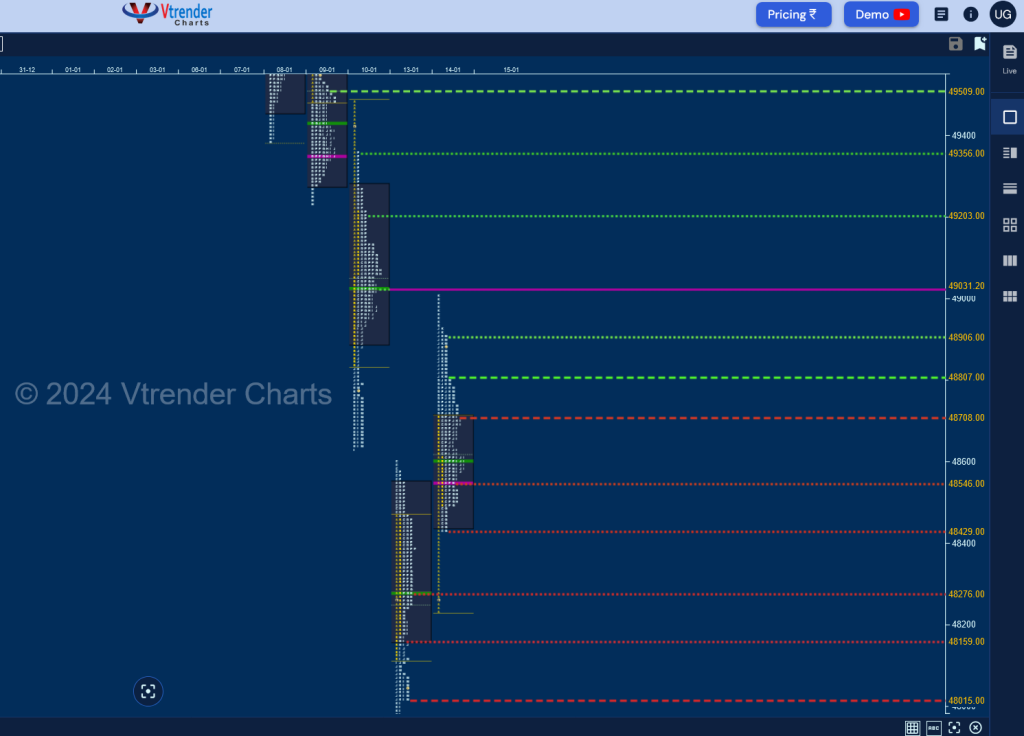

| 48814 – M TPO h/b (14 Jan) 48910 – M TPO high (14 Jan) 49031 – VPOC (10 Jan) 49210 – E TPO h/b (10 Jan) 49359 – Sell Tail (10 Jan) 49514 – 09 Jan Halfback |

| Down |

| 48713 – VAH (14 Jan) 48550 – POC (14 Jan) 48430 – Buy Tail (14 Jan) 48278 – VPOC (13 Jan) 48161 – I TPO h/b (13 Jan) 48016 – Weekly IBL |