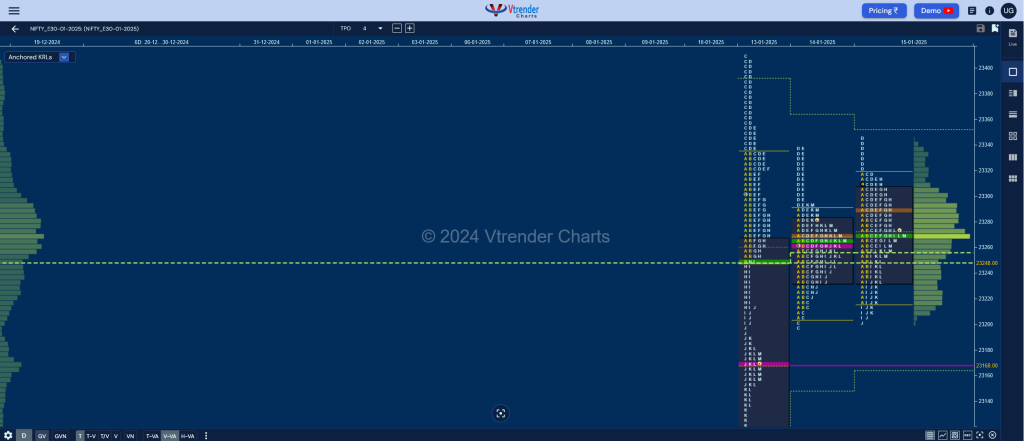

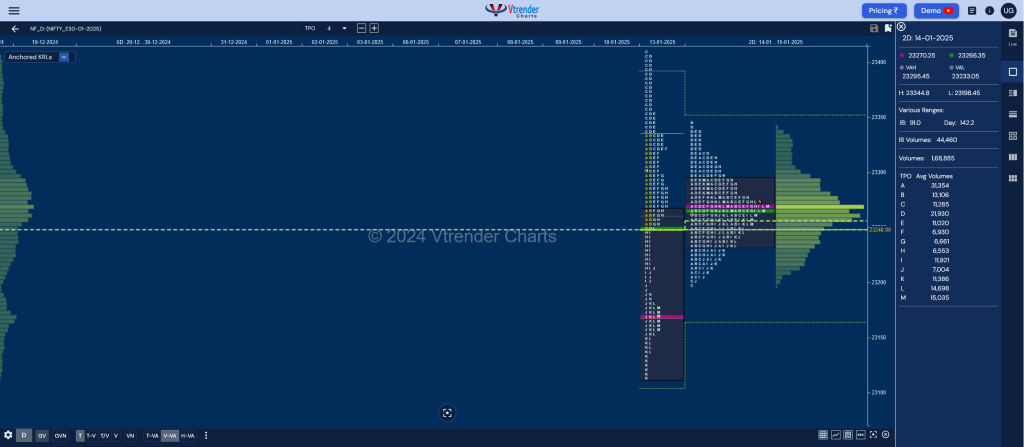

Nifty Jan F: 23265 [ 23345 / 23201 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 14,187 contracts |

| Initial Balance |

|---|

| 111 points (23325 – 23214) |

| Volumes of 34,890 contracts |

| Day Type |

|---|

| Neutral Centre – 144 pts |

| Volumes of 1,43,790 contracts |

NF made an Open Auction start on low volumes and did couple of rounds in previous Value completing the 80% Rule and even repaired previous session’s poor highs but did not find fresh demand triggering a probe lower and confirmation of another FA at 23345 but the downside held just above yesterday’s FA of 23198 as it made a low of 23201 indicating demand holding it.

The auction has left back to back Neutral Centre profiles on the daily timeframe with FAs at the extremes of 23198 & 23345 forming a nice 2-day Gaussian Curve and looks set for a fresh imbalance from here in the coming session with one of the FAs needing to give a gatepass on initiative volumes.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23271 F and VWAP of the session was at 23269

- Value zones (volume profile) are at 23234-23271-23306

- HVNs are at 23645** / 23798 / 24113 / 24285 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (20 – 26 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 23915

- The VWAP & POC of Dec 2024 Series is 24193 & 24621 respectively

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

Business Areas for 16th Jan 2025

| Up |

| 23270 – POC (15 jan) 23315 – IS 30 high (15 Jan) 23363 – D TPO VWAP (13 Jan) 23430 – Weekly IBL 23495 – HVN (10 Jan) 23554 – VWAP (10 Jan) 23602 – Monthly IBL |

| Down |

| 23233 – 2-day VAL (14-15 Jan) 23198 – FA (14 Jan) 23136 – Buy tail (13 Jan) 23076 – Monthly 2 IB 23022 – 1 ATR (yPOC 23271) 22991 – Weekly ATR 22920 – Weekly 3 IB |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.