Nifty Jan F: 23265 [ 23345 / 23201 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 32,098 contracts |

| Initial Balance |

|---|

| 96 points (23332 – 23236) |

| Volumes of 56,900 contracts |

| Day Type |

|---|

| Neutral Centre – 192 pts |

| Volumes of 2,18,388 contracts |

NF opened lower and stayed below previous lows of 23346 while completing the 80% Rule in the 3-day composite (13th to 15th Jan) even making a big RE (Range Extension) in the D TPO as it broke below 13th Jan’s VPOC of 23168 while making a low of 23150 but saw profit booking by sellers as it left a steady responsive buying tail to get back into the 3-day Value thereby triggering the 80% Rule to the upside.

The auction made an attempt to extend higher in the G period but could only make marginal new highs of 23342 displaying rejecting resulting in a hat-trick of the 80% Rule coming into play this time again to the downside which it completed in the T TPO and coiled into the close leaving a record 4th consecutive Neutral Centre profile on the daily.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23265 F and VWAP of the session was at 23256

- Value zones (volume profile) are at 23236-23265-23308

- HVNs are at 23264** / 23645 / 23798 / 24113 / 24285 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (20 – 26 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 23915

- The VWAP & POC of Dec 2024 Series is 24193 & 24621 respectively

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

Business Areas for 20th Jan 2025

| Up |

| 23276 – L TPO VWAP (17 jan) 23313 – AVWAP (16 Jan) 23371 – VPOC (16 Jan) 23424 – Swing High (16 Jan) 23464 – PBL (10 Jan) 23512 – VPOC (10 Jan) |

| Down |

| 23265 – POC (17 Jan) 23222 – HVN (17 Jan) 23180 – Buy tail (17 Jan) 23136 – Buy tail (13 Jan) 23076 – Monthly 2 IB 23024 – 1 ATR (yPOC 23265) |

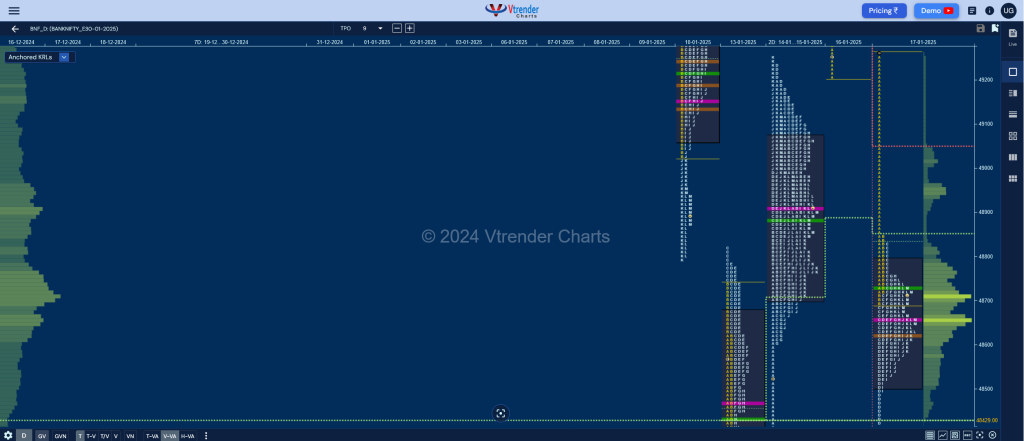

BankNifty Jan F: 48685 [ 49288 / 48425 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 19,174 contracts |

| Initial Balance |

|---|

| 598 points (49288 – 48691) |

| Volumes of 47,150 contracts |

| Day Type |

|---|

| Normal Variation – 863 pts |

| Volumes of 1,27,070 contracts |

BNF also opened lower and negated previous session’s A period buying tail forcing the stuck buyers to liquidate dishing out an Open Rejection Reverse (ORR) start as it not only swiped through the Value of last 2 days but went on to enter the initiative buying tail from 14th Jan and tagged 13th Jan’s VPOC of 48470 where it left a small responsive buying tail to mark the end of the downside.

The auction remained in a narrow range for the rest of the day forming a ‘b’ shape profile and will need to take out one of the opposing A singles (14th Jan & 17th Jan) for a move away in that direction in the coming sessions.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48655 F and VWAP of the session was at 48734

- Value zones (volume profile) are at 48508-48655-48797

- HVNs are at 51491 / 49529** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19 – 24 Dec) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 51750

- The VWAP & POC of Dec 2024 Series is 52436 & 53355 respectively

- The VWAP & POC of Nov 2024 Series is 51417 & 52129 respectively

- The VWAP & POC of Oct 2024 Series is 51559 & 51239 respectively

Business Areas for 20th Jan 2025

| Up |

| 48734 – VWAP (17 Jan) 48888 – A TPO SOC (17 Jan) 49056 – AVWAP (16 Jan) 49210 – Buy Tail (16 Jan) 49340 – VAL (16 Jan) 49489 – VPOC (16 Jan) |

| Down |

| 48655 – POC (17 Jan) 48500 – Buy tail (17 Jan) 48361 – I TPO VWAP (13 Jan) 48200 – HVN (13 Jan) 48032 – 1 ATR (yVAH 48797) 47890 – 1 ATR (yPOC 48655) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.