Nifty Aug F: 10933 [ 11040 / 10901 ]

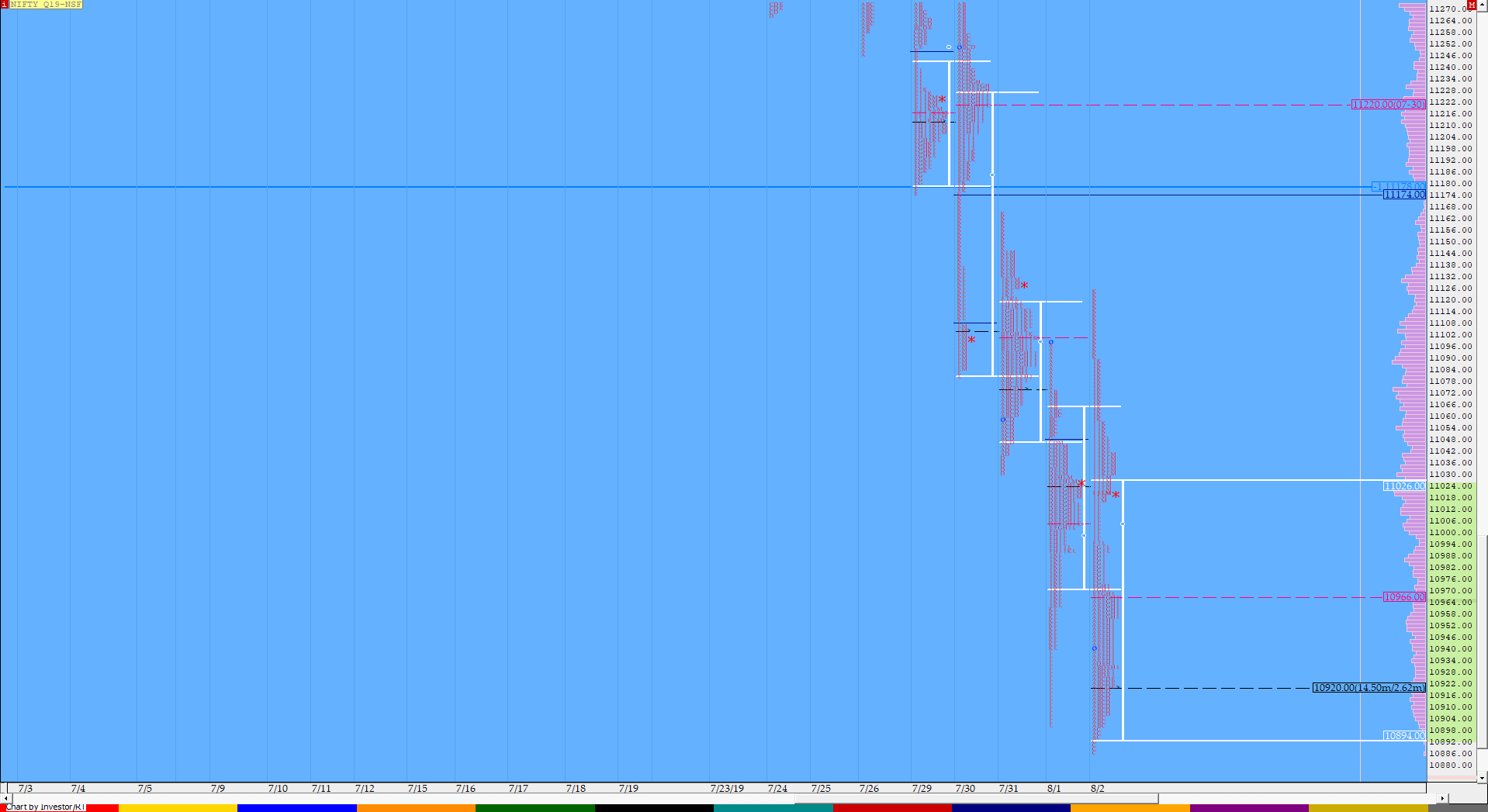

NF opened below the yPOC of 11027 and probed lower but took mechanical support at previous day’s IBL of 10990 as it made a low of 10988 in the ‘A’ period & having failed to take out that FA of 10977 moved higher to make new day highs in the ‘B’ period as it got above 11027 making a high of 11040 but was unable to stay above yPOC leaving a narrow IB (Initial Balance) range of just 51 points. (Click here to view the profile chart for August NF for better understanding) The auction then stayed in a narrow range for the next 3 periods making a balance inside the IB and made an initiative move in the ‘F’ period breaking below IBL as it left an extension handle at 10988 while negating previous day’s FA of 10977 and in the process confirmed a multi-day FA at 11083 thus changing the PLR (Path of Least Resistance) firmly to the downside. NF made a low of 10945 in the F period falling just short of the 2 IB extension after which it balanced for the next 2 periods as ‘G’ & ‘H’ made double inside bars below the PDL (Previous Day Low) after which the down side probe resumed in the ‘I’ period as the auction continued to trend lower till the ‘K’ period as it made lows of 10901 completing the 1 ATR move down from 11083 and also tagging the composite low it had been forming since the last 6 sessions. The last 2 periods remained inside the ‘K’ period building volumes at 10930 to where the dPOC of the day was finally shifted indicating that NF may remain in this composite as it left an irregular DD (Double Distribution) Trend Day down and though it seemed to have moved away from the Value of the 6-day composite, it has been forming a larger composite on the monthly time frame (click here to view the composite) with Value at 10921-11061-11140 so till the auction remains above 10920 there is a chance of tagging the VWAP & POC of the composite at 11027 & 11061 respective. Acceptance below 10920 would mean a test of the monthly lows of 10807 could be coming.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Double Distribution Trend Day – Down

- Largest volume was traded at 10930 F

- Vwap of the session was at 10972 with volumes of 104.3 L and range of 138 points as it made a High-Low of 11040-10901

- NF confirmed a multi-day FA at 11083 on 21/08 and tagged the 1 ATR objective of 10909. The 2 ATR target on the downside comes to 10736.

- NF had confirmed a FA at 10807 on 05/08 and tagged the 2 ATR objective of 11085 on 08/08. This FA has not been tagged and is now positional support

- The Trend Day POC & VWAP of 13/08 at 11075 & 11043 were again tagged on 16/08 but once again the auction could not close above them.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10906-10930-10990

Hypos / Estimates for the next session:

a) NF needs to stay above 10930-935 for a rise to 10952-960 & 10976-988

b) Staying below 10920, the auction can test 10902-892 & 10865

c) Above 10988, NF can probe higher to 11010 / 11040 & 11061

d) Below 10865, auction becomes weak for 10844 / 10822-818 & 10804-802

e) If 11061 is taken out, the auction can rise to 11083 / 11106 & 11124-136

f) Break of 10802 can trigger a move lower to 10785 / 10768-758 & 10740-734

BankNifty Aug F: 27739 [ 28050 / 27668 ]

report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day (Down)

- Largest volume was traded at 27920 F

- Vwap of the session was also at 27894 with volumes of 32.7 L in a session which traded in a range of 462 points making a High-Low of 28050-27668

- The Trend Day POC & VWAP of 13/08 at 27740 & 28063 are immediate references on the upside. The auction stayed above 27740 on 13/08 which is now important support.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27785-27920-28128

Hypos / Estimates for the next session:

a) BNF needs to sustain above 27777 for a move to 27822-863 & 27920-945

b) Immediate support is at 27723-705 below which the auction can test 27665-660 / 27610 & 27536

c) Above 27945, BNF can probe higher to 28010-040 / 28090 & 28130

d) Below 27536, lower levels of 27490-486 / 27440 & 27390-352 could come into play

e) Sustaining above 28130, BNF can give a fresh move up to 28185 / 28227 & 28270-291

f) Break of 27352 could trigger a move down 27288-258 / 27200 & 27165-148

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout