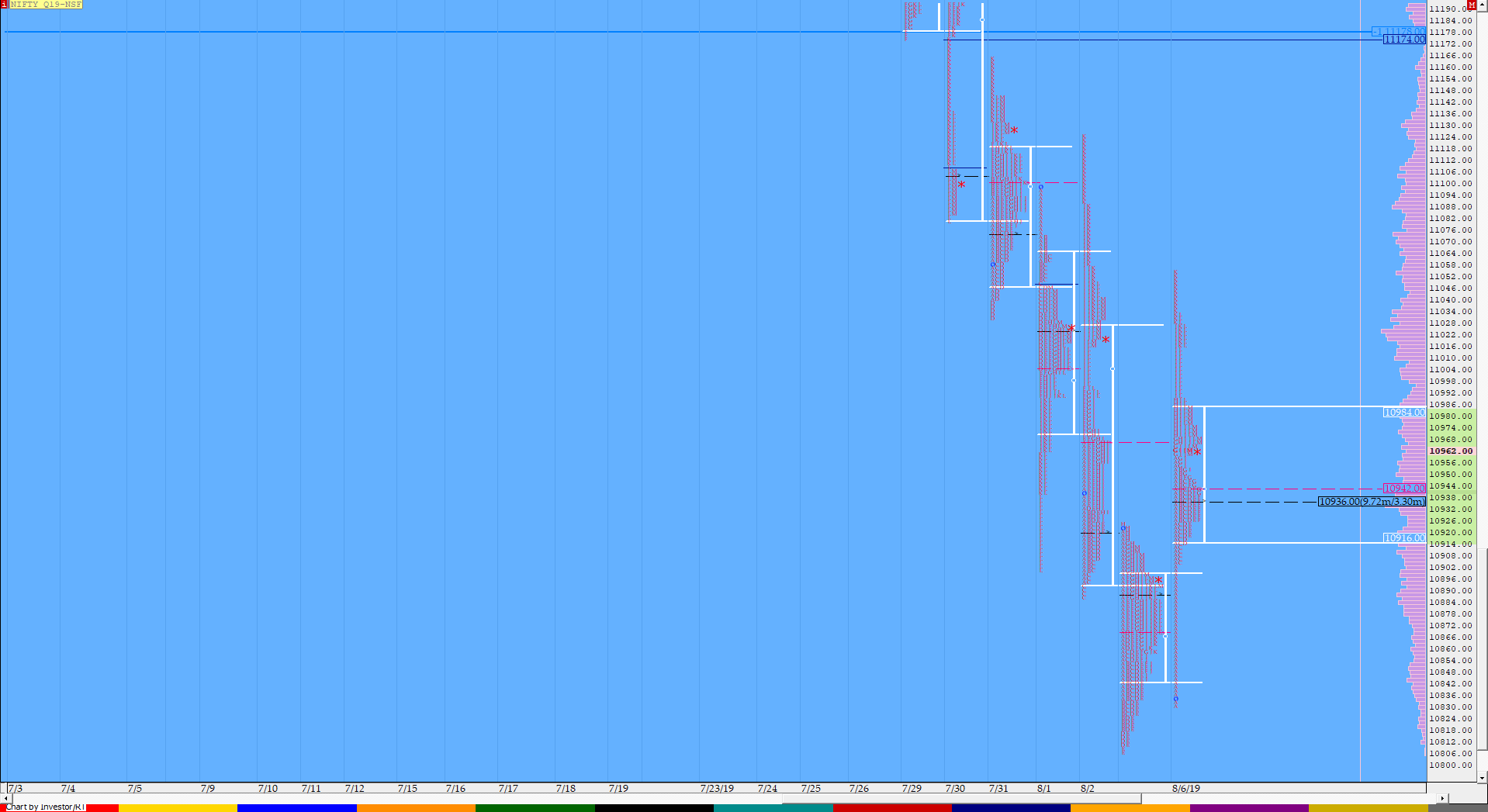

Nifty Aug F: 10843 [ 10880 / 10646 ]

Detailed report to be updated…

- The NF Open was an Open Rejection Reverse – Down (ORR) which failed

- The day type was a Double Distribution Trend Day – Up

- Largest volume was traded at 10852 F

- Vwap of the session was at 10781 with volumes of 160.7 L and range of 233 points as it made a High-Low of 10880-10646

- NF confirmed a multi-day FA at 11083 on 21/08 and tagged the 2 ATR objective of 10736 on 22/08.

- The Trend Day POC & VWAP of 22/08 at 10853 & 10826 would be important references on the upside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10756-10852-10879

Hypos / Estimates for the next session:

a) NF needs to stay above 10853-862 for a rise to 10884-892 & 10912

b) Staying below 10840, the auction can test 10813-807 / 10786 & 10767

c) Above 10912, NF can probe higher to 10930-935 / 10952-960 & 10976-988

d) Below 10767, auction becomes weak for 10743 / 10724-716 & 10680-676

e) If 10988 is taken out, the auction can rise to 11007-10 / 11040 & 11061

f) Break of 10676 can trigger a move lower to 10658 / 10640-631 & 10619-615

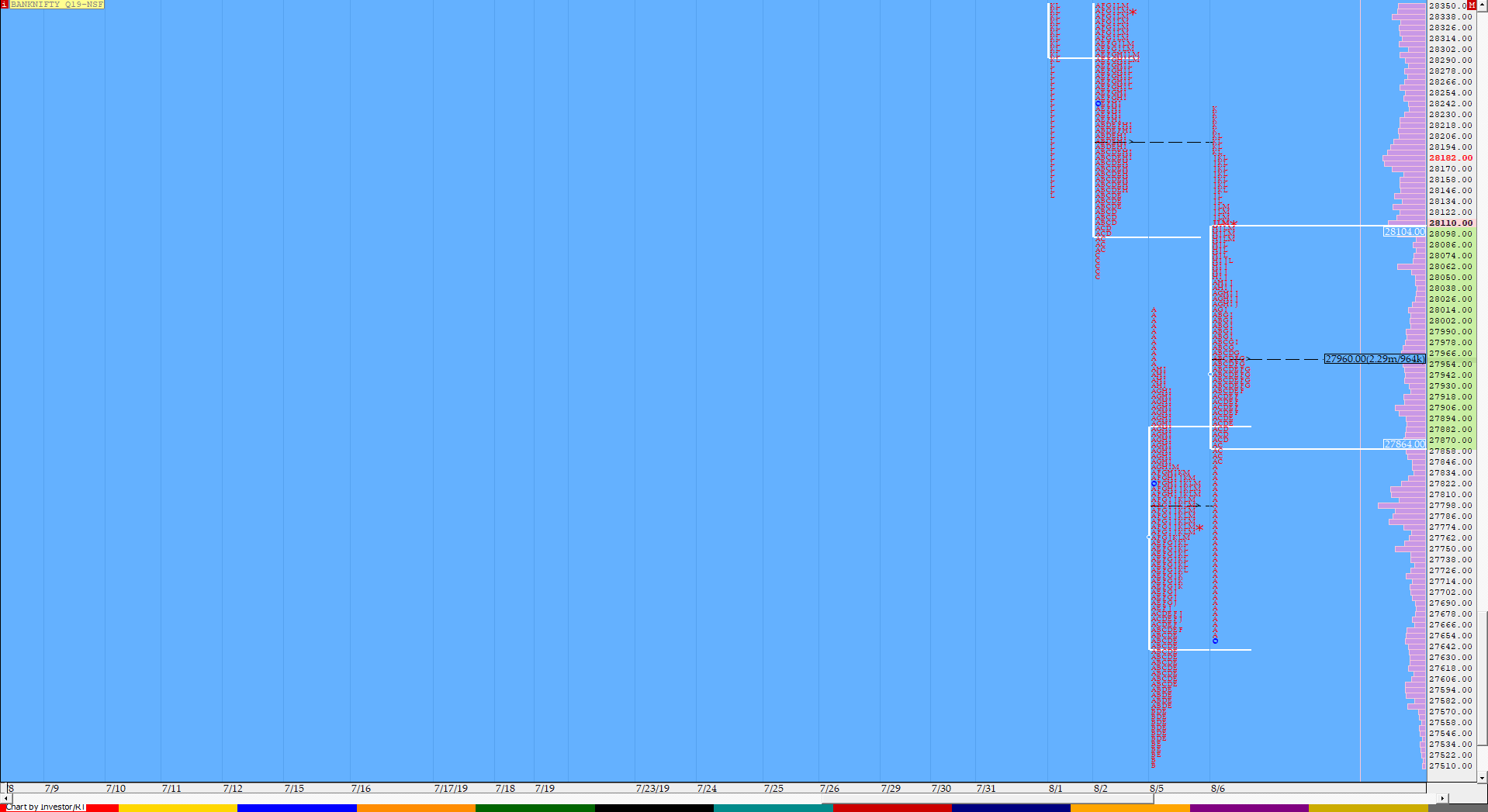

BankNifty Aug F: 27016 [ 27250 / 26615 ]

Detailed report to be updated…

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day (Up)

- Largest volume was traded at 27020 F

- Vwap of the session was also at 26973 with volumes of 48.2 L in a session which traded in a range of 634 points making a High-Low of 27250-26615

- The auction had stayed above the Trend Day POC of 27740 left on 13/08 which was important support and got broken on 22/08.

- The Trend Day POC & VWAP of 22/08 at 27485 & 27406 would be important references on the upside.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27219-27485-27661

Hypos / Estimates for the next session:

a) BNF needs to sustain above 27020 for a move to 27115 & 27185-200

b) Staying below 27020, the auction can test 26973 / 26924-910 & 26860-850

c) Above 27200, BNF can probe higher to 27278-299 / 27325 & 27400-425

d) Below 26850, lower levels of 26801-790 / 26728 & 26640-630 could come into play

e) Sustaining above 27425, BNF can give a fresh move up to 27485-510 & 27570-606

f) Break of 26630 could trigger a move down 26593 / 26530-520 & 26465-440

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout