On Orderflow interpretations and Orderflow charts

I thought long and hard on doing a small write- up on Orderflow interpretations and the charts we get based on the data we feed into them , which in turn drive hard rupees into the markets, with an expectation that they would come back to you a percentage which is more than what you initially put in. I know i step on some toes as I do this, but this needs to be said and put out .

Data drives everything. Often wrong interpretation of data is used to drive canards too ! But this post is not on that. Instead let’s focus on the rights .

The tools we use have to have a direct benefit to our trading. They should, why would we use them if there was no benefit? There are various pieces which when they come together help us manage and execute our trades better. When all the pieces add up nicely, we have a good story and we are that much more confident when we execute based on that info. But what if some of the pieces in the story are not saying the right things? Worse, what if they are painting to a different picture than what is the reality. Now that is an issue for a trader already fighting hard in the market to make his trade work. If his tools are going to fight against him or to put it mildly assist him wrongly in the execution of his trade, then imagine the problems our dear trader friend has.

Data is what makes a chart beat and the purpose of the chart is to point you in the right direction. Period.

Assuming there are 3000 contracts for sale in the Banknifty in the middle of the day. This adds up to a volume of 60000 on our Orderflow charts. Whilst this number may deplete or grow depending on the liquidity provided by other market participants at that point in time, only one of 2 things will actually happen

Then there are situations where the 3000 contract mentioned above gets shown as 1400/ 1600 or 1200/ 1800 as the data feed parses the contracts. Now this is done differently by different vendors and has no effect on the overall Order flow read as long as the total volume read is 3000 contracts. But even if it is off by 50 contracts or say 1000 of volume in the BankNifty , would it really affect a market which trades 250000 or 12000 contracts every 30 minutes. And I get people saying , not every tick is accounted for and blah blah blah. Does it really matter?

In a slow or average paced market, a delta calculation is very easy if you have a correct feed and you keep adding the size of the trade on the buy side and sell side to previously accumulated volume. But in a fast break or a sharp rise, price moves quickly and often market orders are filled at the bid when the ask is rising rapidly creating a delta figure which is negative as trade gets subtracted from previously accumulated volumes. You will notice that most trend days have negative delta which does not look good on screen. So what did they come up with ? The concept of delta divergence of the kind used by lagging price based instruments and price. you have to understand here that positive delta does not mean new demand, it can also point to short covering. Granted some times there is factual delta divergence , but if it happens everytime you have not addressed the elephant in the room.

So what is this issue?

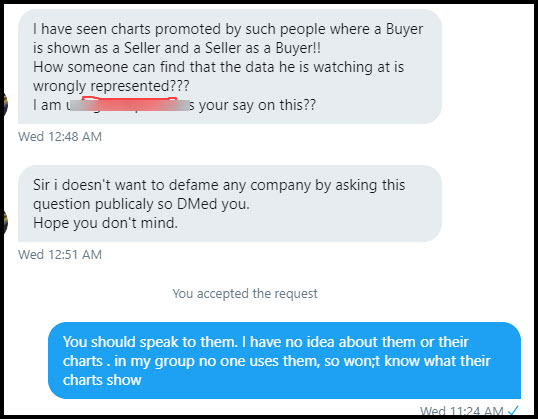

Hopefully after this post I stop getting DM’s of this kind as above. It’s important for you to know when you are reading a chart, what makes the chart tick!