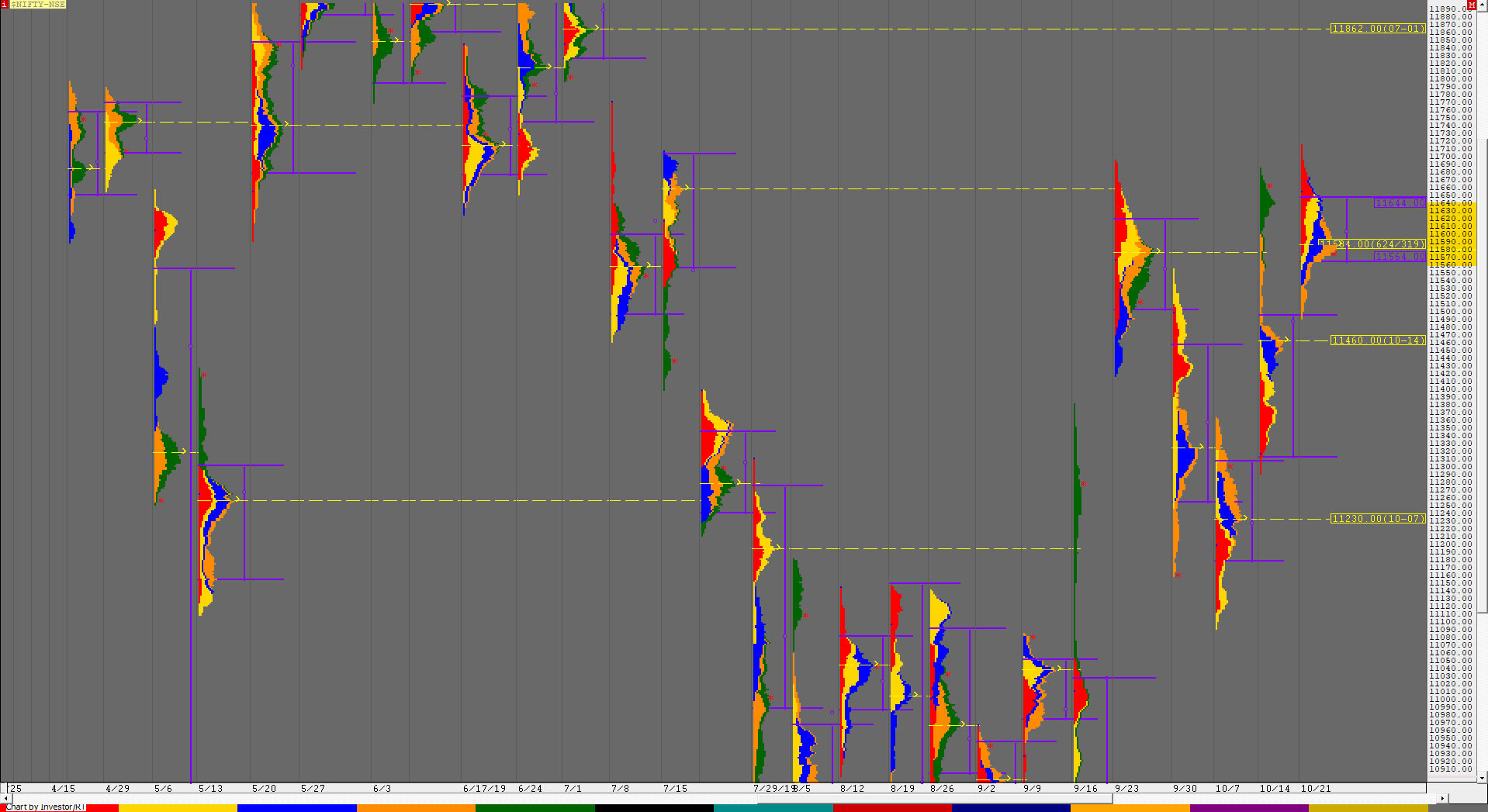

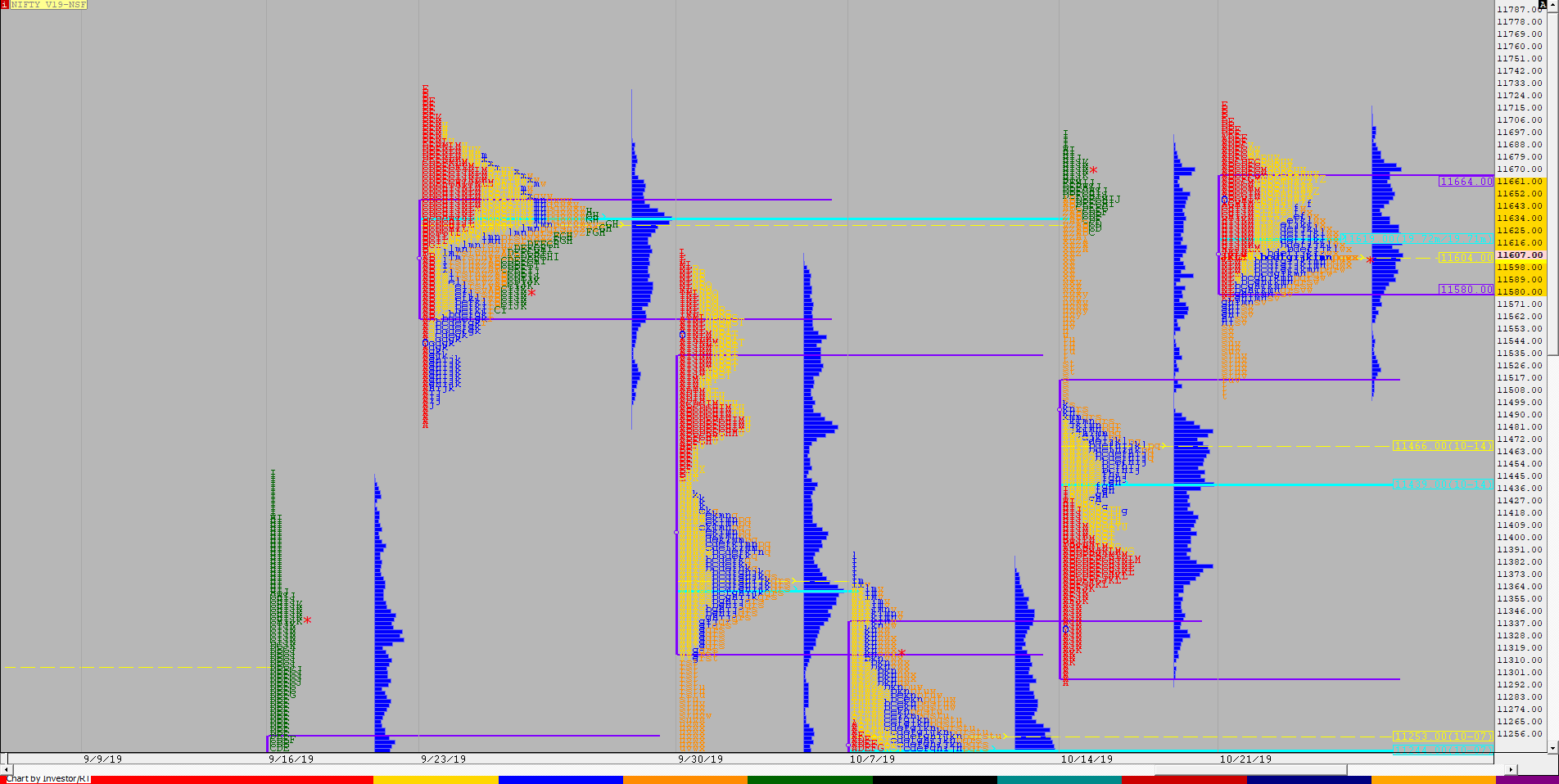

Nifty Spot Weekly Profile (22nd to 25th October)

Spot Weekly 11584 [ 11714 / 11490 ]

Nifty continued the imbalance of previous week at open on Tuesday (as Monday was a holiday) as it got above previous week’s high to tag 11714 completing the 2 ATR objective of 11711 from the daily FA at 11411 but got rejected from this positional supply zone as the Trend Day of 8th July had a selling tail from 11706 to 11772 after the gap down open from 11811 after which Nifty had left a pull back high on daily exactly at the same level on the 17th of July. (Check the profile chart from 8th to 19th July here) The auction then began a slow retracement lower to form a balance for the rest of the week which was normal after the trending profile of previous week as the Value had to catch up with the price which had moved too far away and in fact the probe down this week was halted right at the weekly VAH of 11494 as Nifty reversed after making a low of 11490 on Friday to close at 11584. The weekly profile is a Gaussian one with higher Value at 11564-11584-11644 with a close at the prominent POC so can give a good move away from here in the coming expiry week with the PLR remaining to the upside.

Weekly Hypos for Nifty (Spot):

A) Nifty has immediate supply at 11611-620 above which it could test 11656-665 / 11714-719 & 11772

B) Immediate support is at 11568-557 below which the auction could test 11501-490 / *11458*-427* & 11395-385

C) Above 11772, Nifty can probe higher to 11811-828 / *11862*-882 & 11912-937

D) Below 11385, lower levels of 11345 / 11310-290 & 11255-230* could come into play

E) If 11937 is taken out & sustained, Nifty can have a fresh leg up to 11976-991 / 12018-25 & 12042-46

F) Break of 11230 could bring lower levels of 11184-180 / 11142-127 & 11090-73

NF (Weekly Profile)

11609 [11715 / 11502]

NF made a narrow range weekly profile of just 212 points after it got rejected from above previous week’s high after tagging 11715 on Tuesday as it made lower lows on the remaining 3 days of the week to hit 11502 on Friday testing the previous week’s VAH where it took support to close at the prominent POC of the current week leaving a Gaussian profile with higher Value at 11580-11604-11664 and looks good for a move away from this balance in the coming week.

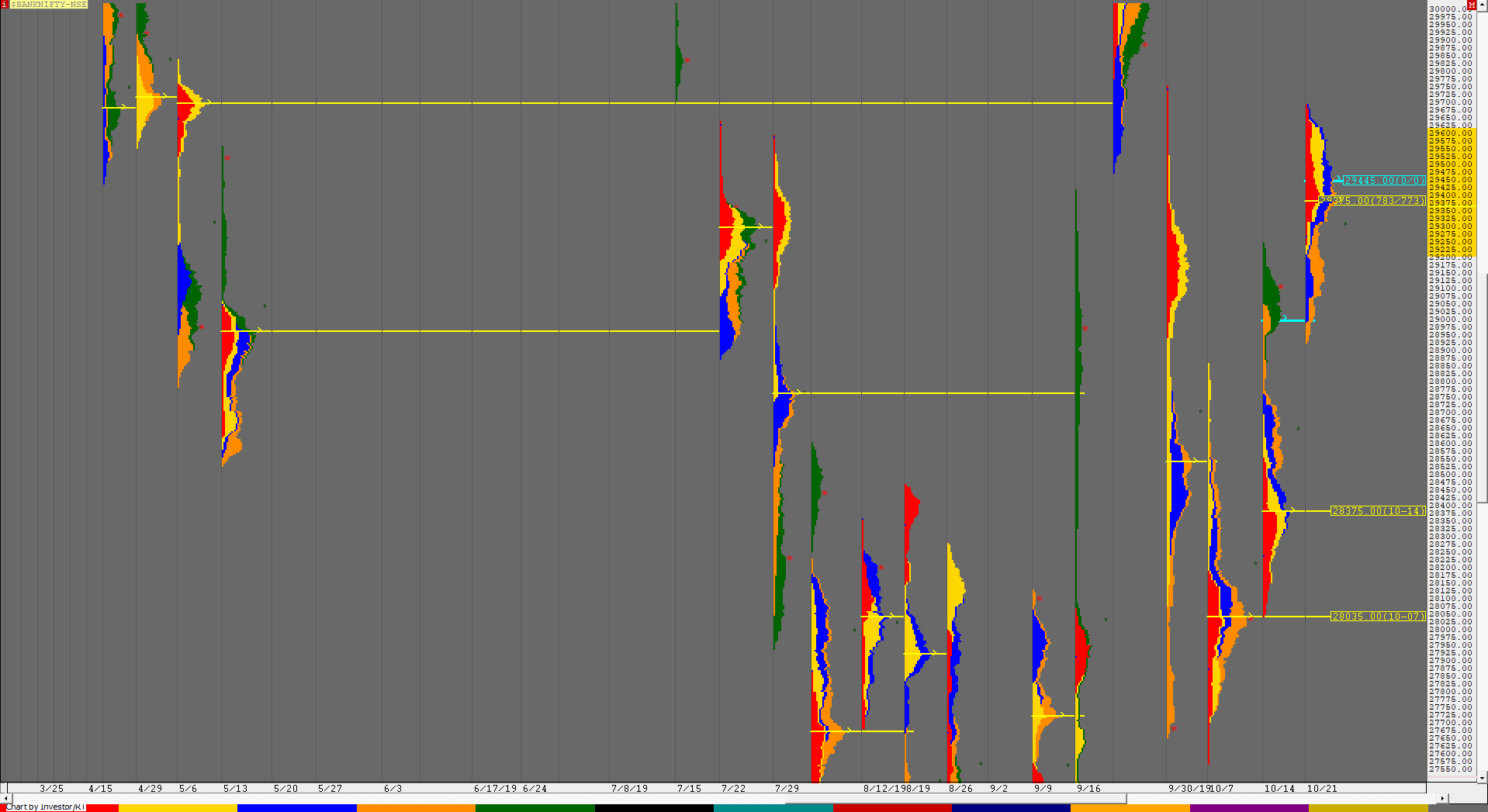

BankNifty Spot Weekly Profile (22nd to 25th October)

29396 [ 29693 / 28924 ]

BankNifty also continued the imbalance of previous week starting with a big gap up of almost 300 points getting accepted above previous week’s high confirming an OAOR (Open Auction Out of Range) start for the week as it went on to make a RE to the upside making a high of 29690 in the first half of the day. The auction however could not extend higher and this led to a retracement of the entire move up as it closed around the open price indicating that the imbalance to the upside could be ending. BankNifty then probed lower on the next day in spite of opening higher as it tested Tuesday’s buying tail of 29316 to 29120 getting back into previous week’s range making a low of 29214 where it was swiftly rejected and went on to make highs of 29644 but once again closed around the open price of the day forming a 2 day balance. The auction then made a third consecutive gap up open on Thursday and went on to make marginally new highs for the week in the opening minutes as it tagged 29693 which was confirming a weekly FA at 29214 but never sustained above 29690 and this led to a liquidation move as BankNifty made a trending move lower for the rest of the day while making new lows for the week at 28994 taking support at previous week’s HVN of 28995 (Read previous week’s report here) though the lows did not look secure as the profile had left poor lows. The sequence of opening with a gap & then making a probe down continued for the 4th day on Friday as BankNifty made a high of 29321 in the IB after which it made a RE to the downside making new lows for the week but once again left similar lows at 28932 & 28924 as it seemed to be taking support once again at that HVN of 28995 and this triggered a fresh probe higher as the auction went on to leave a Neutral Extreme profile on the daily making highs of 29452 before closing the week at 29396 just below the level it has opened the week at which was 29416 thus confirming a balanced weekly profile with higher Value at 29225-29375-29600. BankNifty has left a second successive weekly VPOC at 28361 which means the PLR is still to the upside but will need to sustain above 29500 and negate that weekly FA of 29693 to continue higher where it could get into the 5-day (23rd-27th Sep) composite Value of 29730-29875-30396 (View the profile here) in the coming week. On the downside, there is a low volume zone between 29395 to 29130 which would be the immediate reference below which it would get weaker and could give an initiative move to the downside targeting the weekly VPOCs of 28361 & 28035.

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 29413-417 for a move to 29488-500 / 29585-600 & 29671-693

B) Immediate support is at 29325-320 below which the auction could test 29240 / 29143-123 & 29070-59

C) Above 29693, BankNifty can probe higher to 29730-757 / 29850-874* & 29930

D) Below 29059, lower levels of 28985-980 / 28924-901 & 28816-810 could come into play

E) If 29930 is taken out, BankNifty could rise to *30016-50* / 30105-113 & 30170-190

F) Break of 28810 could trigger a move lower to 28766-757 / 28715 & 28640-625

G) Sustaining above 30190, the auction can tag higher levels of 30230-277 / 30364-388 & 30451

H) Staying below 28625, BankNifty can probe down to 28560 / 26488-477 & 28413

BNF (Weekly Profile)

29432 [ 29747 / 28912 ]

BNF also made a balanced profile for the week staying in a relatively narrow range of 726 points with higher Value at 29232-29440-29680 closing near the POC to leave a good chance of giving a move away from here in the coming week.