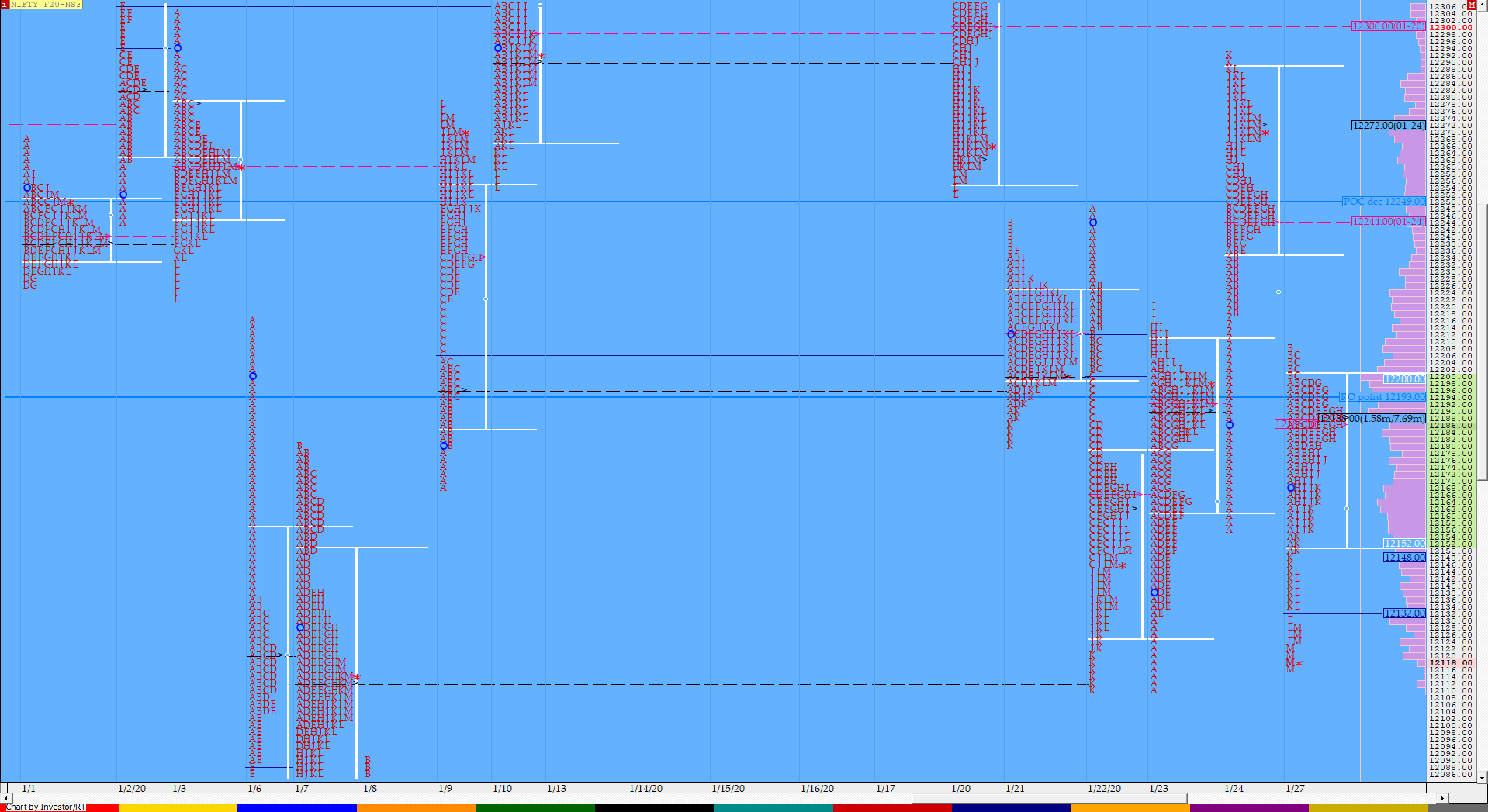

Nifty Jan F: 12126 [ 12210 / 12117 ]

HVNs – (11946-964) / 11994 / 12040 / 12062 / 12189 / 12244 / 11272 / 12305 / 12357 / 12380

NF opened with a big gap down of more than 100 points & probed lower breaking below the PDL (Previous Day Low) as it made a low of 12151 in the opening 10 minutes and gave a retracement after a 120 point dip as it remained inside the buying tail of Friday which was from 12157 to 12218 while making a high of 12210 in the IB (Initial Balance). The auction formed a nice balance for most part of the day inside the IB and this acceptance of the singles was a bearish sign which led to a late RE (Range Extension) in the ‘K’ period as NF closed in a spike lower from 12151 to 12117 which would be the reference for the next open with the PLR (Path of Least Resistance) firmly to the downside.

- The NF Open was an mini Open Rejection Reverse – Up (ORR) which failed

- The day type was a Normal Variation Day – Down (NV) with a spike close

- Largest volume was traded at 12189 F

- Vwap of the session was at 12173 with volumes of 97.3 L and range of 92 points as it made a High-Low of 12210-12117

- NF confirmed a FA at 12319 on 15/01 and tagged the 1 ATR target of 12415 on 20/1. This FA was negated on 20/01 and the 2 ATR move down of 12127 got tagged on 22/01.

- The 20th Jan Trend Day VWAP of 12308 would be important supply point.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12147-12189-12198

Hypos / Estimates for the next session:

a) NF needs to sustain above 12130 for a move to 12147-151 / 12165-179 & 12200-213

b) The auction has immediate support at 12110 below which it could fall to 12090-79 / 12062 & *12045-42*

c) Above 12213, NF can probe higher to 12239-244* & 12268-272*

d) Below 12042 auction could probe lower to 12023 / 12005 & 11990

e) If 12272 is taken out, the auction go up to to *12300-308* & 12326-330

f) Break of 11990 can trigger a move lower to 11974 / 11956* & 11930-926

Nifty SPOT Hypos for the next session:

A) Nifty needs to sustain above 12143-155 for a move to 12182-194 & 12217-230*

B) Immediate support is at 12100-093 below which the auction could test 12070 & 12045-031

C) Above 12230, Nifty can probe higher to 12266-270 & 12295*-300

D) Below 12031, lower levels of 12000-11994* & 11976 could come into play

E) If 12300 is taken out, Nifty can have a fresh leg up to 12321-340 & 12377

F) Break of 11976 could bring lower levels of 11955-936 & 11910-881

BankNifty Jan F: 30897 [ 31240 / 30850 ]

HVNs – 30832 / 30984 / 31100 / 31175 / 31326 / 31455 / 31525 / 31770 / 31840 / 31935

BNF also opened with a huge gap down of 280 points as it tested the Friday’s buying tail of 31138 to 30924 taking support right around the low as it tagged 30950 in the opening minutes and reversed the probe to the upside showing a bit more strength than NF as it got above the high of the buying tail in the IB as it hit 31213. The auction then gave the dreaded ‘C’ side extension and got rejected from the previous day’s VAL (Value Area Low) as it made new highs of 31240 which was a perfect signal for a reversal and also a probable FA (Failed Auction) on the daily time frame. BNF then probed lower as it hit the first objective of tagging the VWAP post the failed ‘C’ side extension but found support there in both the ‘D’ & ‘E’ periods which led to a mini probe higher resulting in a PBH (Pull Back High) of 31173 in the ‘F’ period which meant that the chance of the FA getting confirmed was getting brighter. The ‘H’ period then broke below VWAP to trigger a trending move into the close as the auction made multiple REs lower in the last 4 periods of the day confirming the FA at 31240 while making lows of 30850 leaving a Neutral Extreme profile. The reference for the next open would be from 30950 to 30850 and BNF looks set to tag the 1 ATR objective from the FA which comes to 30782.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 31100 F

- Vwap of the session was at 31056 with volumes of 33.8 L and range of 390 points as it made a High-Low of 31240-30850

- BNF confirmed a FA at 31240 on 27/01 and the 1 ATR target comes to 30782.

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 2 ATR target of 31507 on 20/01. This FA has not been tagged and is now positional resistance.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The 20th Jan Trend Day VWAP of 31396 would be important supply point. This was taken out on 24/01 briefly but closed below it indicating supply still prevalent in this zone.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30954-31100-31182

Hypos / Estimates for the next session:

a) BNF has immediate supply at 30914-925 above which it could rise to 30984 / 31050-60 & 31135-150

b) First zone of support is at 30864-832 below which the auction could test 30782-751 / 30705-680 & 30630-625

c) Above 31150, BNF can probe higher to 31200 / 31240-265 & 31326*

d) Below 30625, lower levels of 30580-560 / 30500 & 30435-430 could be tagged

e) If 31326 is taken out, BNF can give a fresh move up to 31396-403 / 30455-480 & 31525-566

f) Break of 30430 could trigger a move down to 30350-325 / 30281*-261 & 30201-190

BankNifty SPOT Hypos for the next session:

A) BankNifty needs to sustain above 30860-890 for a move to 30925 / 30976-31002 & 31055-065

B) Immediate support is at 30801-764 below which the auction could test 30715 / 30660-619 & 30550

C) Above 31065, BankNifty can probe higher to 31110 / 31153 & 31227-246*

D) Below 30550, lower levels of 30509 / 30450 & 30364 could come into play

E) If 31246 is taken out, BankNifty could rise to 31330 / 31403*-418 & 31488

F) Break of 30364 could trigger a move lower to 30302-276 & 30201

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout