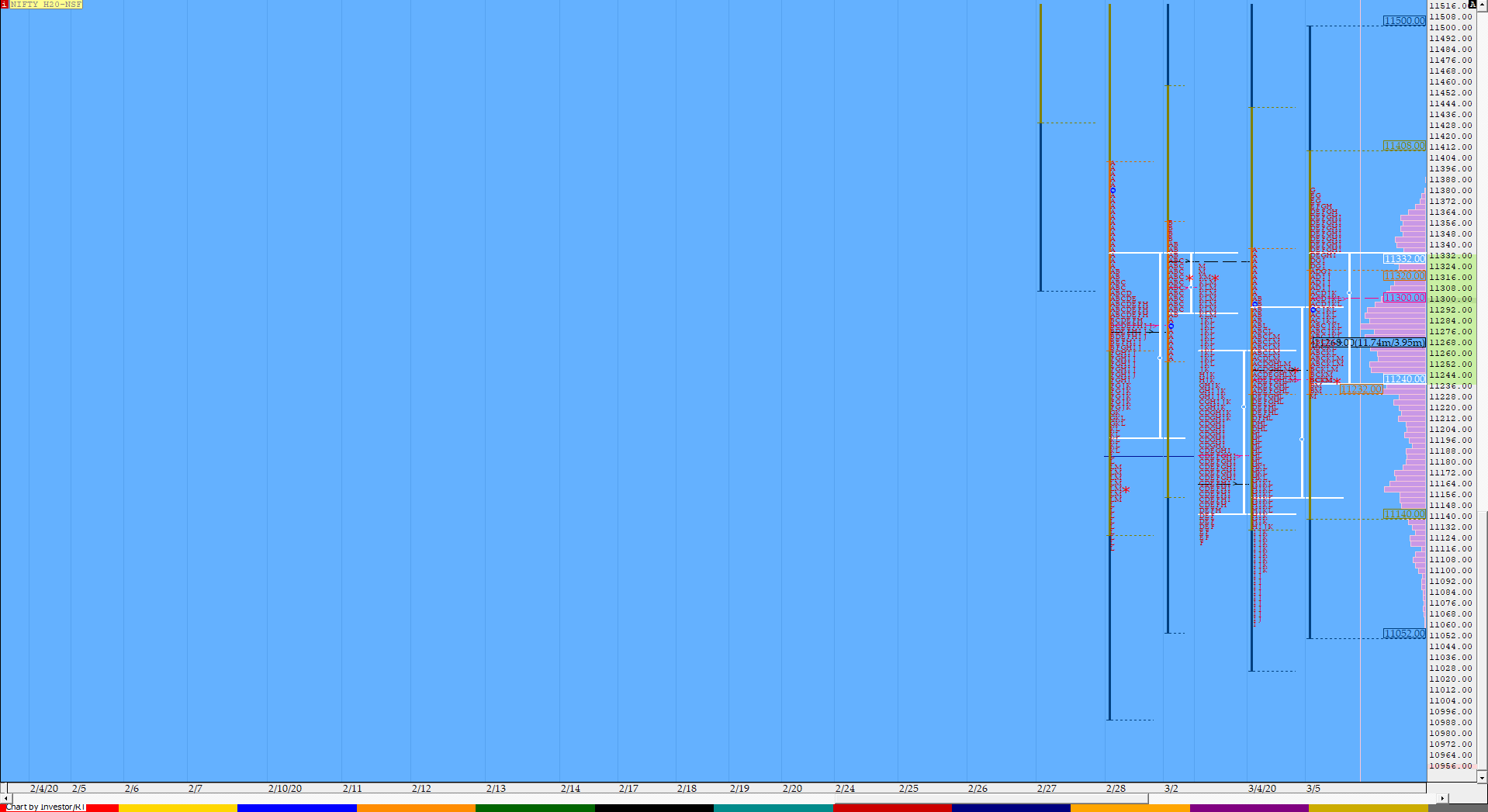

Nifty Mar F: 11255 [ 11382 / 11230 ]

HVNs – (11105) / (11145) / 11165-175 / (11250) / 11270-290 / (11340-360) / 11580

NF opened with a gap up of almost 50 points and probed higher but once again got rejected from that 11321 level as it made a high of 11323 in the opening minutes & started to probe lower playing out the 45 degree Rule in the opposite direction as opposed to the previous day close as it tagged the YPOC of 11245 while making a low of 11232 in the IB (Initial Balance). The auction then reversed the probe to the upside moving towards the VAH of the 4-day composite as it made a RE (Range Extension) to the upside in the ‘D’ period where it made highs of 11364 (composite VAH) to the dot and followed it up by marginal new highs in the E & G periods making new highs of 11382 but was clearly unable to move away from the 4-day composite as it formed a balance above IBH till the ‘H’ period building volumes at 11360. The ‘I’ period then made the initiative move of breaking below the IBH and this led to a one time frame move lower into the close as NF not only tagged the composite POC of 11280 but went on to make new lows for the day into the close leaving a Neutral Day with a test of that composite VAL of 11184 coming soon. The composite continued to get filled today also which is now a 5-day balance with Value at 11207-11270-11366 which can be viewed here and the auction looks set to give a fresh move away from this composite in the coming session(s).

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 11270 F

- Vwap of the session was at 11306 with volumes of 165.1 L and range of 152 points as it made a High-Low of 11382-11230

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11241-11270-11335

Main Hypos for the next session:

a) NF has immediate supply at 11260-270 above which it could rise to 11285-305 / 11321-350 & 11364-376

b) The auction has support at 11240-235 below which could it fall to 11220 / 11195-190 / 11165 & 11145-124

Extended Hypos:

c) Above 11376, NF can probe higher to 11396-404 / 11424-442 & 11465

d) Below 11124, the auction can move lower to 11106-100 / 11080-055 & 11031-024

e) If 11024 is broken, NF can move down to 10985-974 / 10958 / 10938-921 & 10880

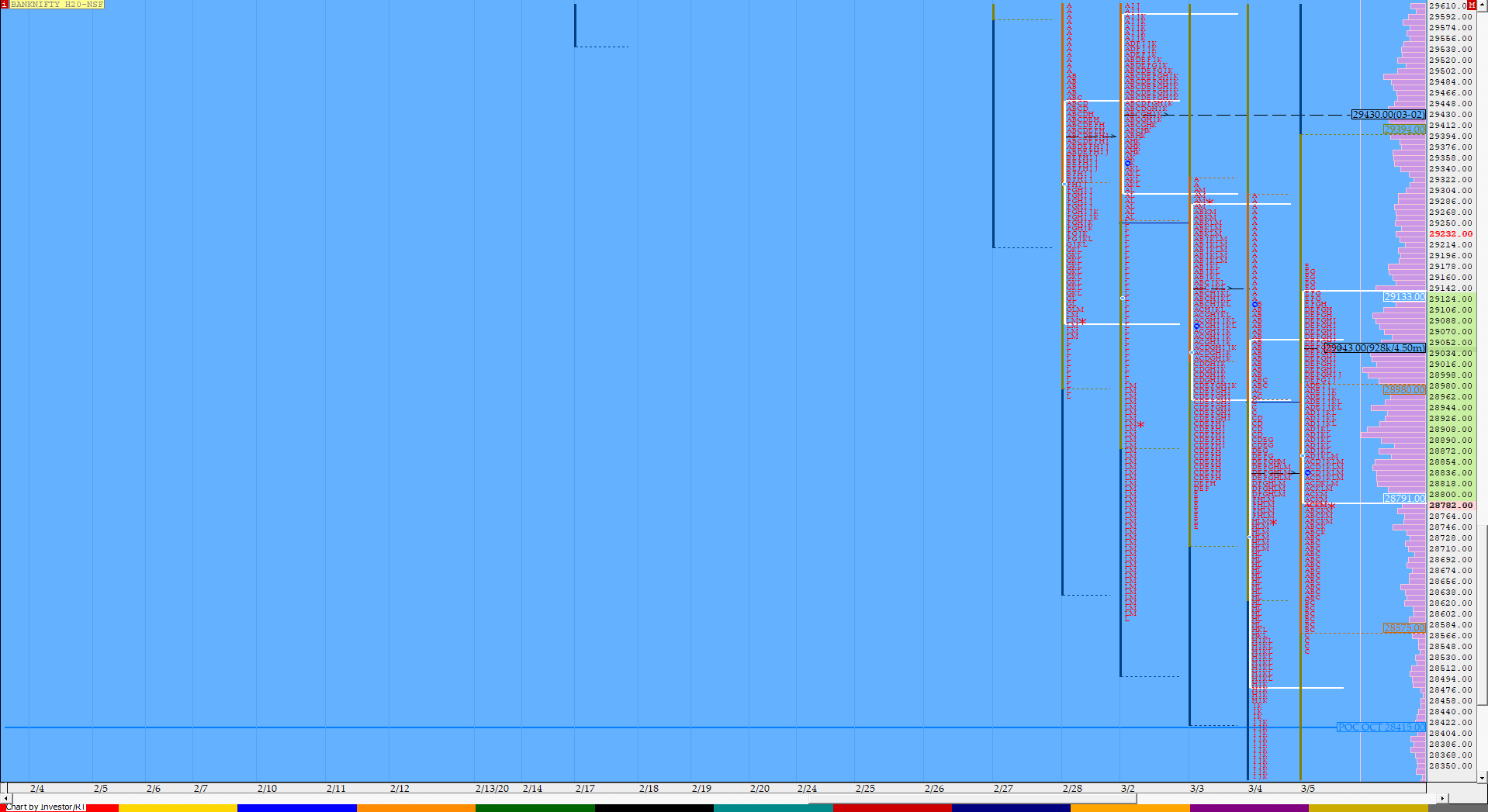

BankNifty Mar F: 28829 [ 29180 / 28547 ]

HVNs – 28395 / 28511 / 28835 / 28920 / 29040-090 / 29100 / 29220-270 / 29425-455 / 29550

Report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day

- Largest volume was traded at 29043 F

- Vwap of the session was at 28905 with volumes of 56 L and range of 633 points as it made a High-Low of 29180-28547

- BNF confirmed a FA at 28547 on 05/03 and tagged the 1 ATR move of 29049 on same day. The 2 ATR objective from this FA comes to 29551

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28739-29043-29059

Main Hypos for the next session:

a) BNF needs to scale above 28865 & sustain for rise to 28905-920 / 29000 / 29060-100 / 29150-179 & 29210-275

b) The auction has immediate support at 28835-825 below which it could fall to 28760-751 / 28693-625 / 28560-511 / 28460 / 28395-368 & 28300

Extended Hypos:

c) Above 29275, BNF can probe higher to 29360-430* / 29500 / 29552-596 / 29632-700 & 29815-890

d) Below 28300, lower levels of 28225-200 / 28150-083 / 28035-27970 / 27900-880 & 27840-774 could be tagged

e) If 27774 is taken out, BNF can fall further to 27675-650 / 27570 / 27495-420 & 27352-340

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout