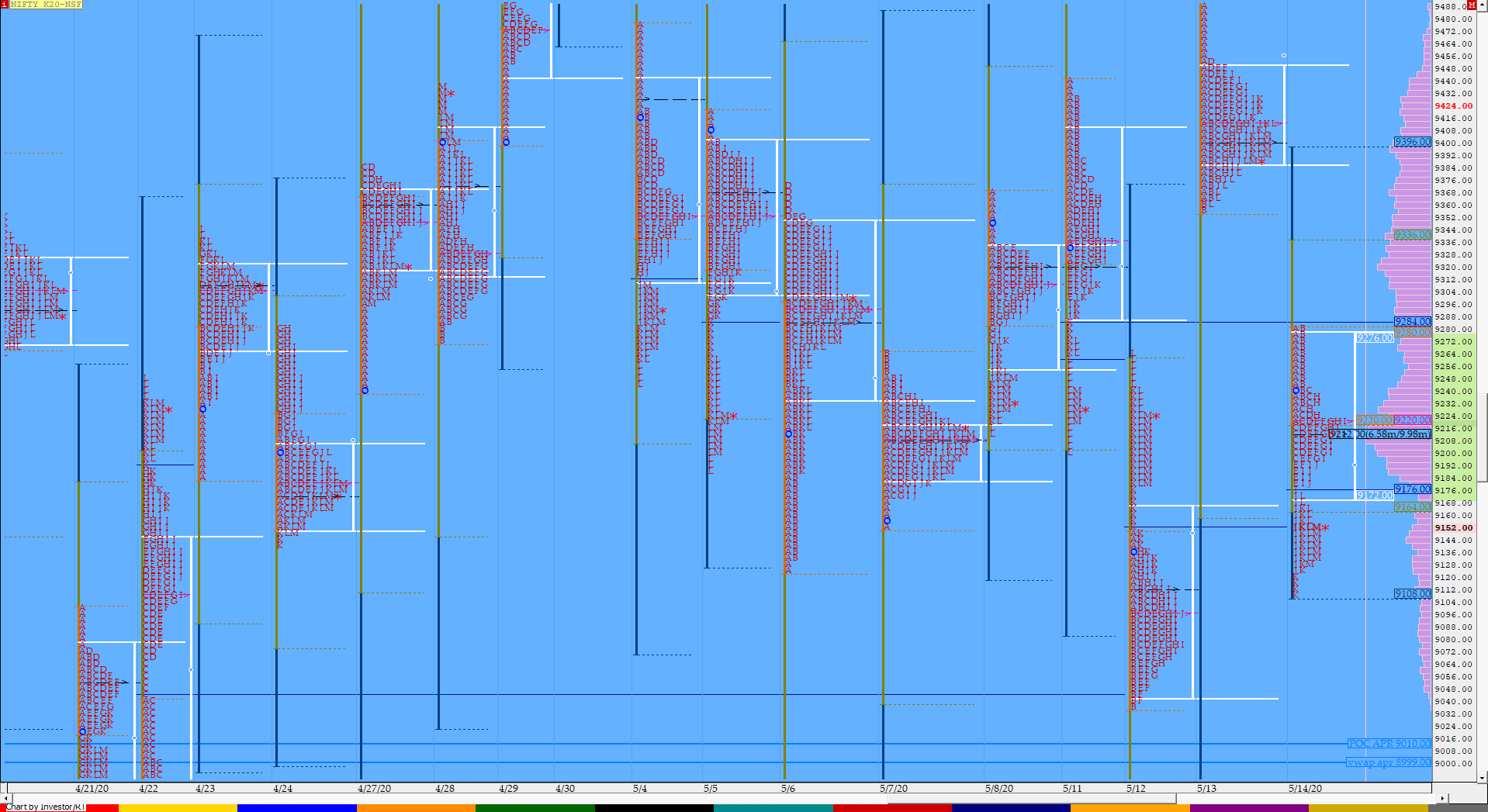

Nifty May F: 9144 [ 9282 / 9110 ]

HVNs – 9111 / 9145 / 9213 / (9285) / 9320 / 9400 / 9800 / 9822-40

Previous day’s report ended with this ‘Staying below 9400, the auction could go in for a test of the HVNs of 9320 / 9218 & 9111 where as on the upside it would need to get accepted in today’s selling tail which could lead to a good short covering move higher towards the VPOC of 9831‘

NF opened with a gap down of 151 points and remained below the HVN of 9320 as it probed lower for the first 5 periods making multiple REs (Range Extension) hitting lows of 9183 in the ‘E’ period and in the process tagging the lower HVN of 9218. The auction then made a retracement to VWAP but left a PBH (Pull Back High) at 9238 which indicated that the downside probe for the day was still not over & thus it began a new leg lower starting from the ‘I’ period as it made a fresh RE and left an extension handle at 9183 after which it went on to break below previous week’s low of 9125 finally making a low of 9110 in the ‘K’ period almost completing the 3 IB objective for the day. NF then gave a pull back to 9176 before closing the day at 9145 getting good volumes here and almost shifting the dPOC down from 9213 which indicated that the shorts were booking out. The day’s profile resembled a DD (Double Distribution) with Value completely lower but the auction seemed to have taken support at the VPOC of 9111 and will need to get accepted below it for more downside. On the upside, NF needs to take out the extension handle of 9183 above which it has the HVN of 9213 & the PBH of 9238 as important levels.

- The NF Open was a Open Auction In Range (OAOR)

- The day type was a Normal Variation Day – Down [NV]

- Largest volume was traded at 9145 F

- Vwap of the session was at 9200 with volumes of 175.9 L and range of 173 points as it made a High-Low of 9282-9110

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9120-9145-9223

Main Hypos for the next session:

a) NF needs to sustain above 9159 for a rise to 9176-88 / 9213-24 / 9246 / 9272-82 / 9312-20 & 9356-66

b) The auction remains weak below 9132 and could test 9110 / 9087-69 / 9042-12 / 8989-75 / 8949-40 & 8916

Extended Hypos:

c) Above 9366, NF can probe higher to 9385-9400* / 9420-44 / 9460-75 / 9503-30 & 9555

d) Below 8916, the auction can fall further to 8891-76 / 8845 / 8822-13 / 8792-60* & 8721-06

BankNifty May F: 19039 [ 19340 / 18957 ]

HVNs – 18350 / 18855 / 19140 / 19340 / 19620 / 19830 / (21600) / (21850)

Previous day’s report ended with this ‘The PLR would be to the downside till the selling tail of today is not taken out towards the HVNs of 19340 / 18855 & 18350.‘

BNF also opened lower and got stalled right at the HVN of 19340 before playing out a rare narrow range day of just 383 points which was the lowest since March 2020 forming a nice Gaussian profile with a prominent POC at 19140 as it made a low of 18953 taking support in the spike zone of 12th May. Value for the day was lower so the PLR seems to be towards the VPOC of 18350 till the auction stays below 19090 but would need to get accepted below 18900 in the coming session.

- The BNF Open was a Open Auction In Range (OAOR)

- The day type was a Normal Variation Day – Down [NV]

- Largest volume was traded at 19140 F

- Vwap of the session was at 19152 with volumes of 61.9 L and range of 383 points as it made a High-Low of 19340-18957

- BNF confirmed a FA at 18209 on 12/05 and tagged the 2 ATR objective of 19668 on 13/05. This FA is currently on ‘T+3’ Days.

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19090-19140-19282

Main Hypos for the next session:

a) BNF has supply at 19076-90 which if taken out could rise to 19140-170 / 19260-278 / 19340 / 19425-460 / 19534 / 19590-620* & 19680-700

b) The auction has immediate support at 18977 below which it could test 18915-855 / 18792-696 / 18570-543 / 18480-414 / 18375-350 & 18270-209

Extended Hypos:

c) Above 19700, BNF can probe higher to 19780-835 / 19934 / 20013-120 / 20199-220 / 20324-396 & 20430

d) Below 18209, lower levels of 18160-100 / 18000-17977 / 17850-828 / 17750-705 & 17650-590 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout