Exploring the Dynamics of Order Flow in Market Trading

Introduction to Order Flow in Trading Order flow is not just another trading concept; it’s a deep dive into the actual transactions that drive market movements. Unlike traditional tools that only reflect the outcomes of market actions, order flow offers a direct view into the real transactions and intentions of market participants. This blog aims […]

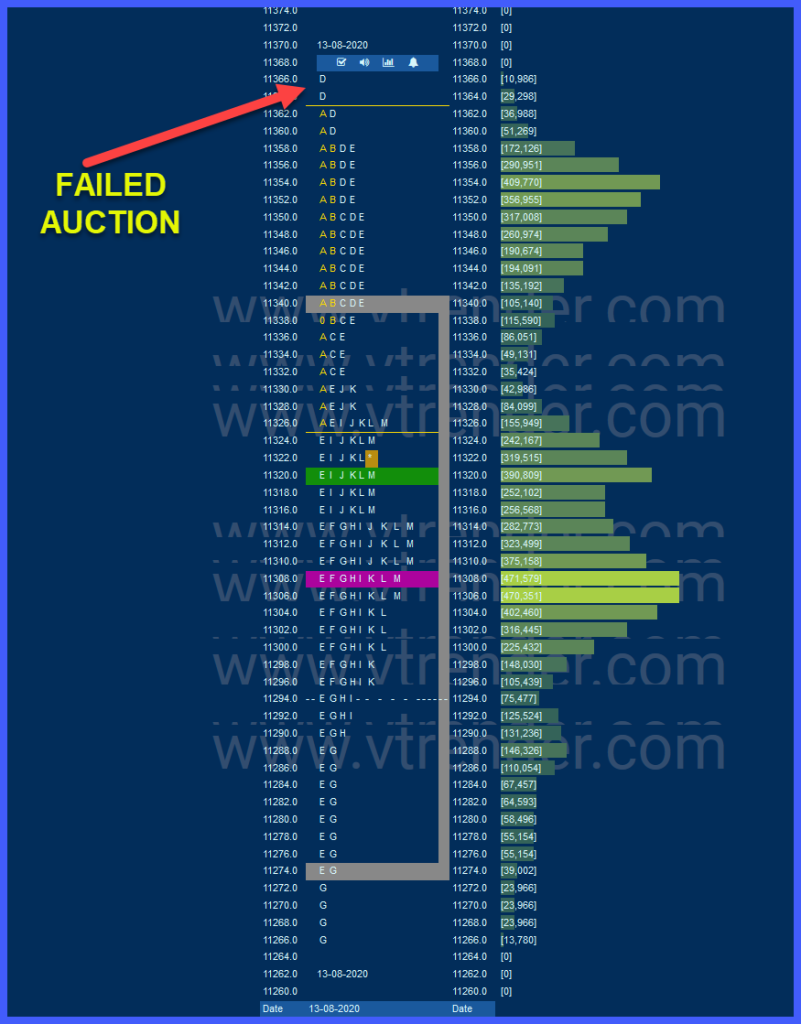

Mastering the Market with Failed Auctions: A Trader’s Guide

Introduction to Failed Auctions in Trading In the realm of market trading, understanding the nuances of various concepts can significantly enhance a trader’s strategy and overall performance. One such intriguing concept is the “failed auction,” which offers a fascinating insight into market dynamics and potential trading opportunities. This blog post delves into the essence of […]

Master Professional Trading: A Beginner’s Guide to Elevating Your Market Game

In the vast ocean of financial markets, every trader is on a quest to find the treasure trove of success. Yet, this journey is fraught with waves of data, winds of market volatility, and the sirens of quick profits. It’s a voyage that separates traders into two distinct fleets: the Amateurs, navigating by the stars […]

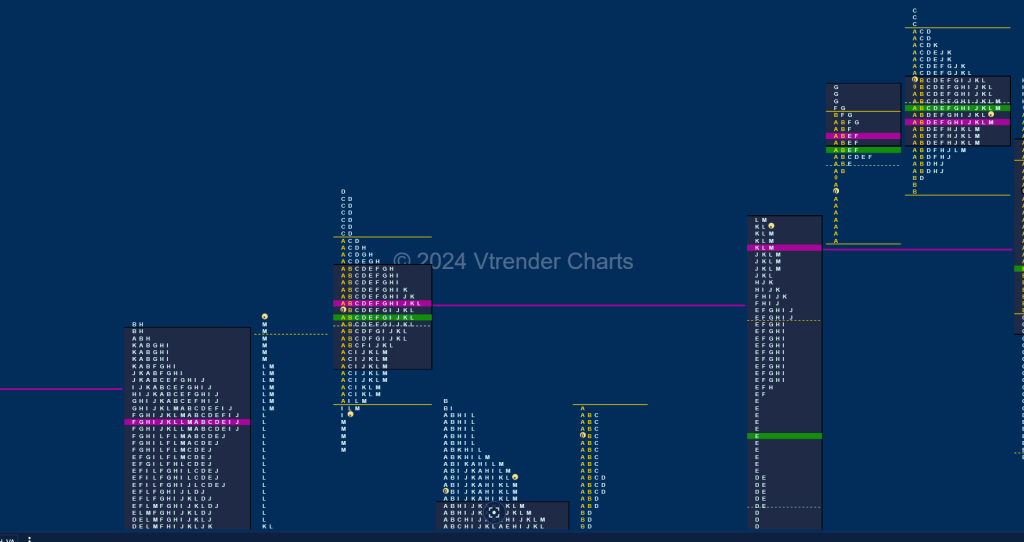

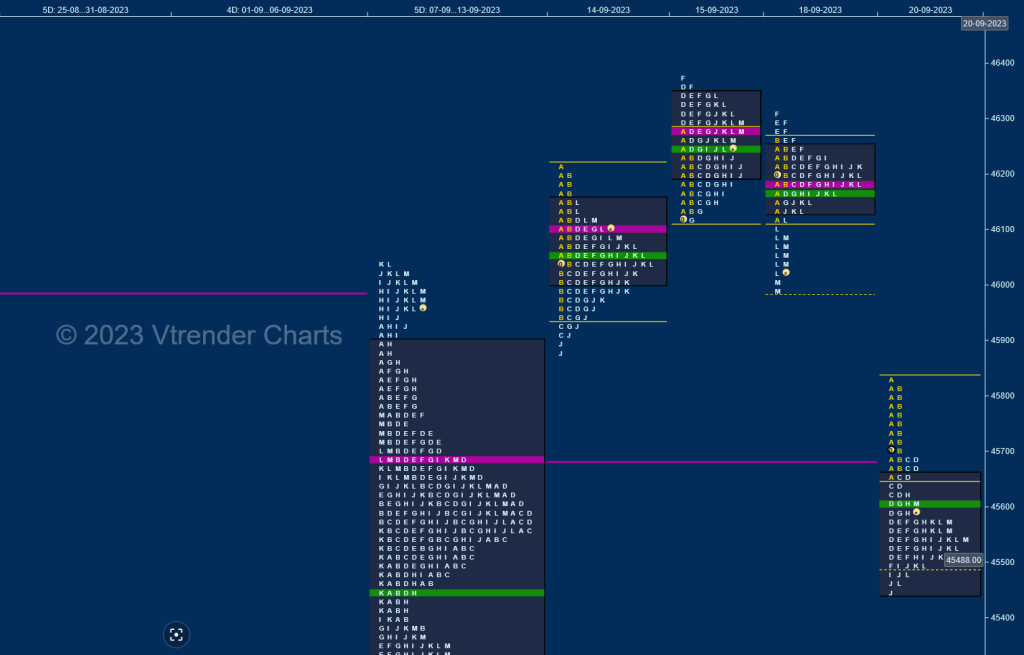

Understanding Market Profile: A Modern Trader’s Guide

Introduction to Market Profile What is Market Profile? Market Profile offers a unique, three-dimensional perspective on market dynamics, going beyond the traditional use of price in charting to include volume and time. This method plots these three critical factors on a single chart, allowing traders to see the full spectrum of market movement and behavior. […]

Decoding Market Profile: Mastering Trading Through Behavioral Insights

Introduction to Market Dynamics The trading landscape is a complex ecosystem, woven from the threads of psychological patterns, strategic analysis, and the relentless pursuit of understanding market behaviors. Recently, conversations initiated on my Twitter account (@Am_Shai) have illuminated the nuanced facets of Market Profile, sparking enriching discussions and leading to a cascade of email dialogues. […]

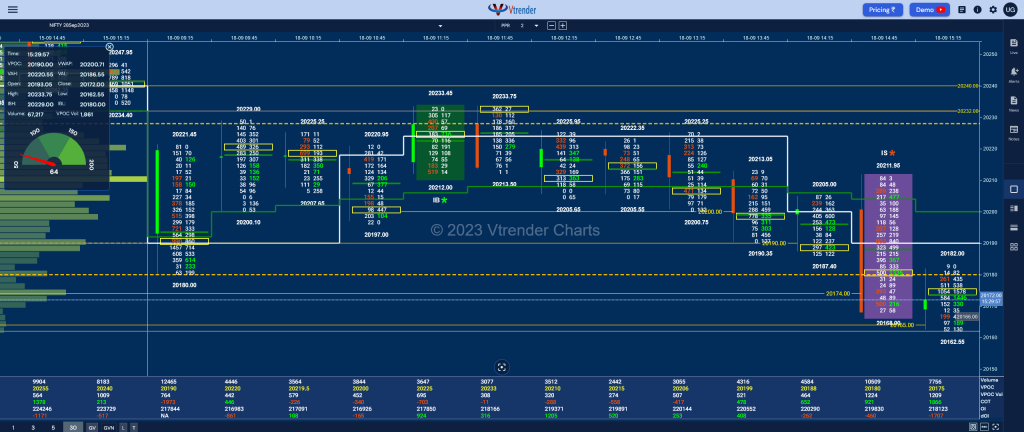

Working with Market Orders in Orderflow: A Trader’s Guide

Unravel the mysteries of market orders in orderflow trading with our comprehensive guide. Dive into the dynamics of Delta, the aggressive nature of Initiative Buyers and Sellers, and the profound impact of market orders on price bars. Whether you’re a novice or a seasoned trader, this guide illuminates the path to mastering market movements and crafting winning strategies in the fast-paced world of trading.

BankNifty Settlement for 1st nov

Here’s a quick look at what the Banknifty can do for the settlement dated 01st nov This is an outlook via MarketProfile and Orderflow The charts used are at charts.vtrender.com and you can access them via the Vtrender Charts link at the top

What professional traders focus on!

Despite trading in identical markets and adhering to similar timings, traders diverge significantly in their strategies. In simple terms, the world of trading splits into two groups: Amateur Traders and Professional Traders What sets amateur traders apart from the pros? Amateurs get get bogged down by intricate chart analysis. >> They struggle to identify clear […]

The Big Open Interest addition in Banknifty on 0410

Yesterday there was a large addition in the Banknifty Futures What happened? The bigger question for us as traders, where did it happen Check the video for more The Open Interest and the Orderflow charts can be seen at charts.vtrender.com Login to break free with charts with a real edge

Market Structure: A Deep Dive into Nifty, Banknifty, and Finnnifty Day Trading

A look at Market Structure for the day Unlock the secrets of market structure with a special focus on Nifty, Banknifty, and Finnnifty. In this comprehensive 30-minute guide, we explore the nuances of day trading while shedding light on the broader frameworks of structure, sentiment, and trader inventory. Whether you’re a seasoned trader or just […]