Introduction to Market Profile

What is Market Profile?

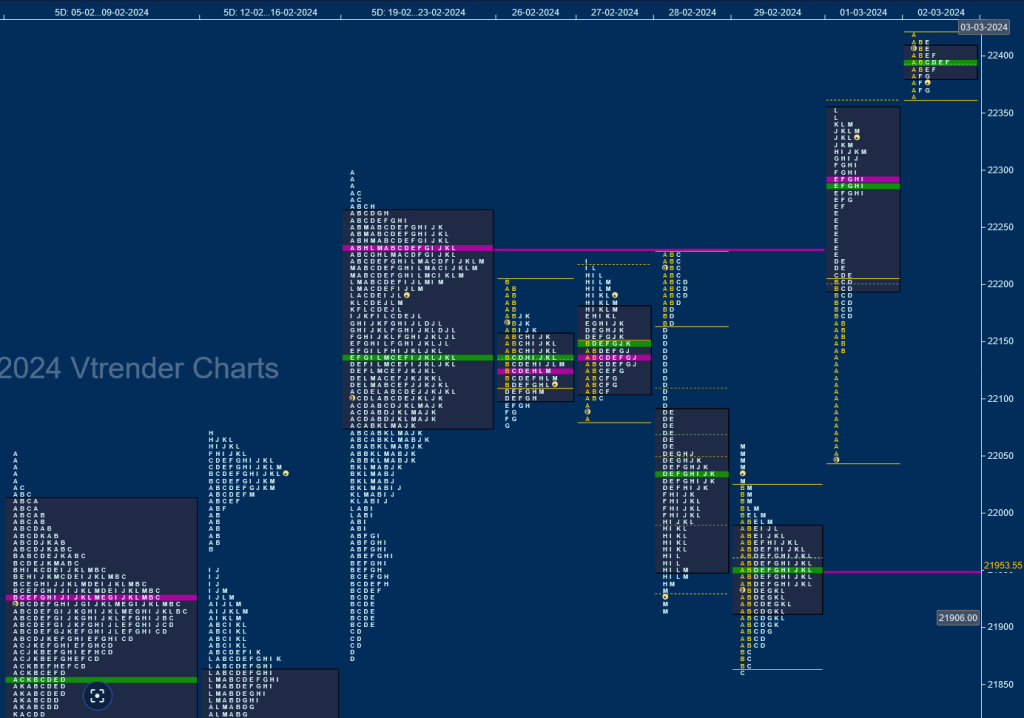

Market Profile offers a unique, three-dimensional perspective on market dynamics, going beyond the traditional use of price in charting to include volume and time. This method plots these three critical factors on a single chart, allowing traders to see the full spectrum of market movement and behavior. It’s like seeing the market in 3D, where price (Y-axis) and time (X-axis) interact to show volume, providing a comprehensive view of market activity.

Market Profile visualizes the market as an ongoing auction where buyers and sellers continuously negotiate to find a fair price, referred to as the market’s value. This approach helps traders understand not just where the market is going, but why it’s moving in that direction.

Key Concepts of Market Profile:

- Price: Represents potential trading opportunities, showing us where the market sees value.

- Time: Helps regulate and reveal the duration of a market opportunity.

- Volume: Indicates the success or failure of the trading opportunities, based on market participation.

Unlike traditional candlestick charts, which focus on the open, high, low, and close, Market Profile charts provide a deeper dive into where transactions are happening, highlighting which market participants are in control at different times of the day.

Live Market Profile Charts

Accessing Market Profile Charts:

Market Profile charts are readily available at charts.vtrender.com where you can observe them live during exchange hours. This access allows for real-time interpretation and analysis, helping traders make informed decisions based on current market conditions.

We have both free and premium versions at the above link. The premium versions allow for live update of data to all users but the free version is a great method of tracking end of day activities also.

Our Premium plans start at only INR 300/- per month and along with live data , also has live Open Interest numbers updating directly on MarketProfile charts, as well as OI spikes to detect big ticket buyers and sellers as well as industry firsts like plotting anchored vwaps on MarketProfile charts with 2 SD bands as well as the ability to draw KRL’s or key reference levels directly on charts.

More at – charts.vtrender.com/pricing

Deep Dive into Market Profile Terminology

Understanding the Market Through Market Profile:

- Timeframes: Market Profile identifies distinct market participants – Scalpers, Day Traders, Short-term Players, Intermediate-term Players, and Long-term Players – each with their own strategies and impact on market movement.

- Value: The “value” in Market Profile is derived from the collective perception of price by all market players during the bid-ask process. This perceived value dictates market movement, with areas where 70% of volume action occurs defined as the “value area” for that timeframe.

- Buyers and Sellers: Participants who believe the market is under or overvalued, respectively, and take actions that move the price accordingly.

- Auction: The core of Market Profile, the auction process, determines the value area through the interactions of buyers and sellers.

- Selling/Buying Tail: Indicates aggressive market movement by sellers or buyers, pushing the price away from previous value areas.

- Point of Control (POC): The price level with the highest volume of trading activity, considered the day or week’s fairest price.

- Excess and Poor Highs/Lows: Terms referring to the extremes of market movement, either signaling the start of a new auction or the exhaustion of the current one.

- Bell Curve: The ideal distribution of market data around the POC, with 68.7% of trading volume on either side.

- Different Day Types: Exploring various market conditions and their implications on trading strategies.

Exploring More on Market Profile

If you want to build a deeper understanding in the MarketProfile do visit – https://vtrender.com/what-is-the-market-profile/

A more comprehensive write up on all the terms used in the MarketProfile is also at – https://vtrender.com/market-profile-terminology/

The above 2 links include a through glossary on the MarketProfile

The Vtrender Advantage

Live Trading with Market Profile:

The Vtrender Mentoring Room is a community where traders can watch Market Profile charts in action and discuss strategies for both intraday and positional trading. This live analysis provides an edge in understanding and applying Market Profile concepts in real-time market situations.

The Live access includes a Live Handholding in Market hours with experienced Market Profile traders to guide you in the finer nuances of the Market Profile. The Live MarketProfile and Orderflow charts are provided as a Free access during the mentoring program

More details are at – https://vtrender.com/mentorship/

For non active derivative traders who do not actively trade markets but would like to know more about how MarketProfile traders approach and trade markets you can consider the Ecourse which has 12 orientation videos and incudes a a deep dive into the fundamental aspects of the MarketProfile. A free access of 8 day pass is provided to both MarketProfile and the Orderflow charts so that you can see the learnings in live market hours

The Ecourse is a DIY program and for a closer look link up at – https://vtrender.com/ecourse/

Exploring More on Market Profile

Interested in diving deeper into Market Profile and discovering more strategies? Check out our additional writings on Market Profile and intraday trading strategies at Vtrender’s Musings on Market Profile.

Stay updated on the latest developments in Market Profile at Market Profile Evolution.