Market Profile Analysis dated 24th April 2024

Nifty Apr F: 22414 [ 22488 / 22382 ] Open Type OAIR (Open Auction In Range) Volumes of 6,554 contracts Poor Initial Balance 58 points (22455 – 22397) Volumes of 24,807 contracts Poor Day Type Neutral – 106 pts Volumes of 1,11,041 contracts Poor to be updated… .Click here to view the latest profile in NF […]

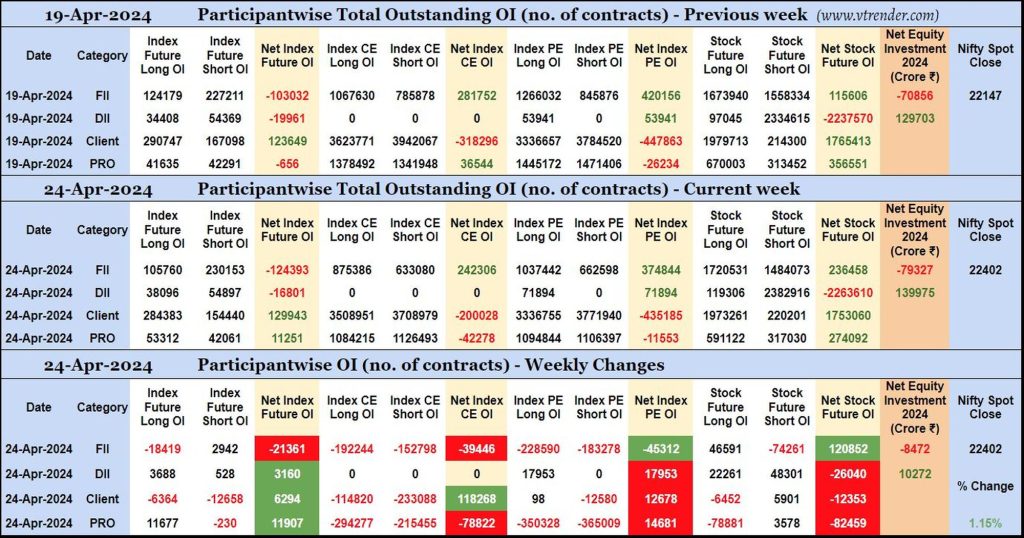

Participantwise Open Interest (Mid-week changes) – 24th APR 2024

FIIs have added 3K short Index Futures and 46K long Stocks Futures contracts so far this week besides liquidating 18K long Index Futures contracts and covering 74K short Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹8472 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 24th APR 2024

MO at 39

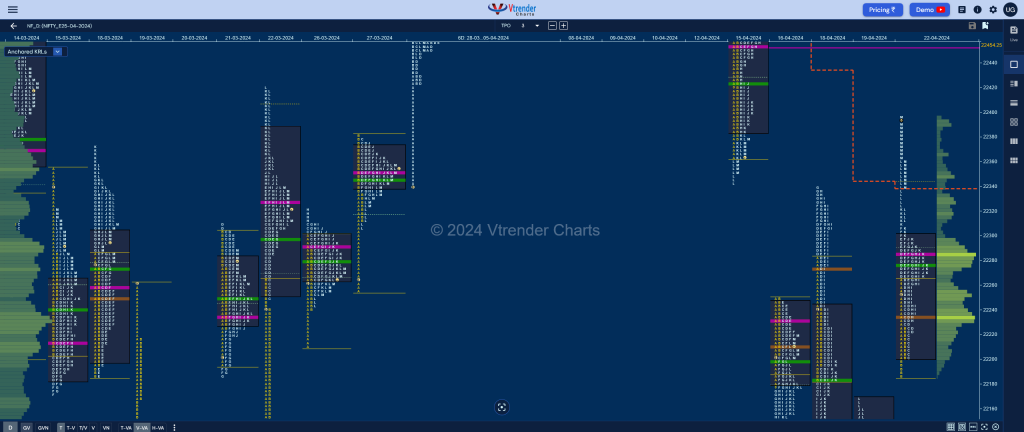

Market Profile Analysis dated 23rd April 2024

Nifty Apr F: 22371 [ 22419 / 22345 ] Open Type OA (Open Auction) Volumes of 10,375 contracts Poor Initial Balance 55 points (22408 – 22353) Volumes of 21,516 contracts Poor Day Type Gaussian Curve – 74 pts Volumes of 97,461 contracts Poor to be updated… .Click here to view the latest profile in NF on […]

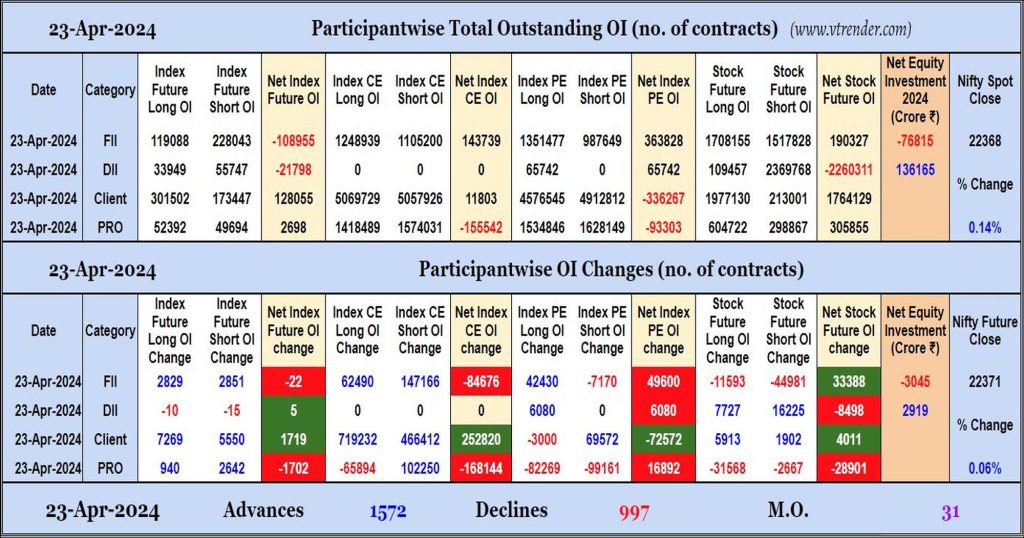

Participantwise Open Interest (Daily changes) – 23rd APR 2024

FIIs have added net shorts in Index CE while adding net longs in Index PE. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 23rd APR 2024

MO at 31

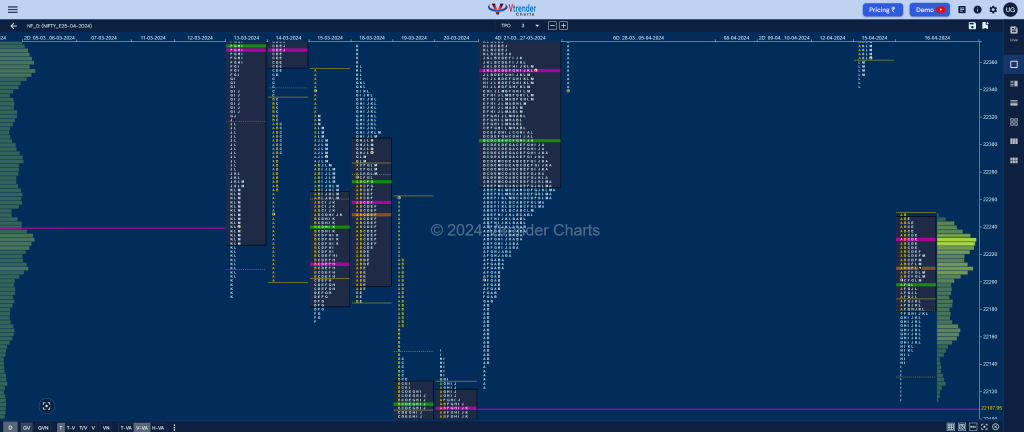

Market Profile Analysis dated 22nd April 2024

Nifty Apr F: 22358 [ 22399 / 22186 ] Open Type OAOR (Open Auction) Volumes of 20,076 contracts Above average Initial Balance 86 points (22272 – 22186) Volumes of 36,452 contracts Below average Day Type Normal Variation – 213 pts Volumes of 1,17,090 contracts Range above average & volumes below average to be updated… .Click here […]

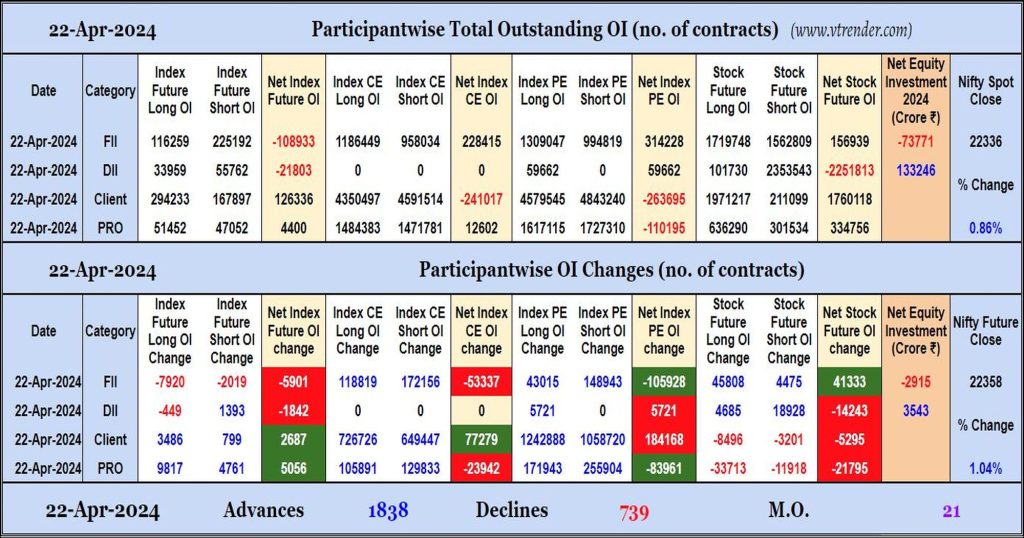

Participantwise Open Interest (Daily changes) – 22nd APR 2024

FIIs have added net shorts in Index Options but net longs in Stocks Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 22nd APR 2024

MO at 21

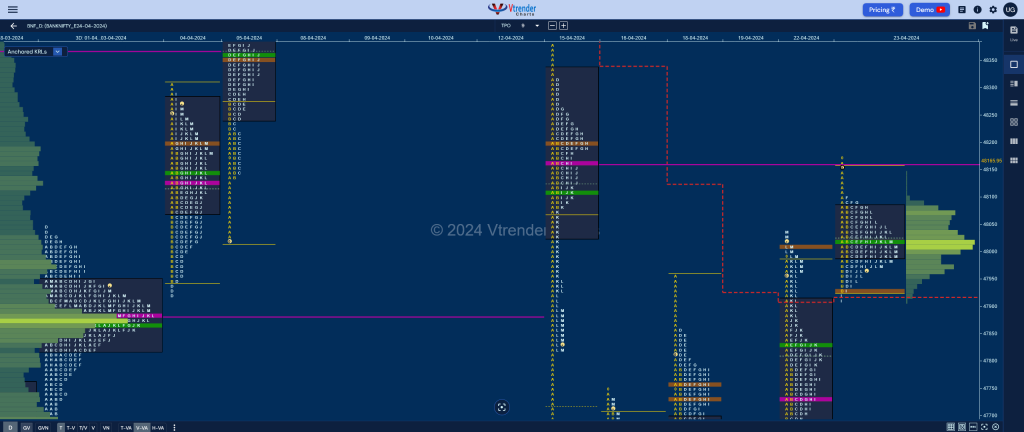

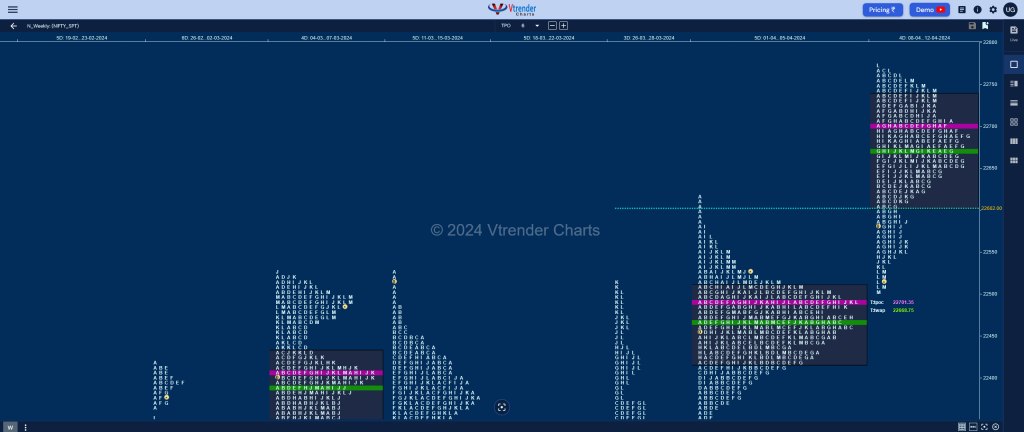

Weekly Spot Charts (15th to 19th Apr 2024) and Market Profile Analysis

Nifty Spot: 22147 [ 22427 / 21777 ] Nifty continued previous week’s imbalance to the downside with a 180 point gap down open on Monday making a low of 22263 in the A period taking support just above the weekly DD singles from 22252 to 22193 (26-28 Mar) after which it made a probe higher making […]