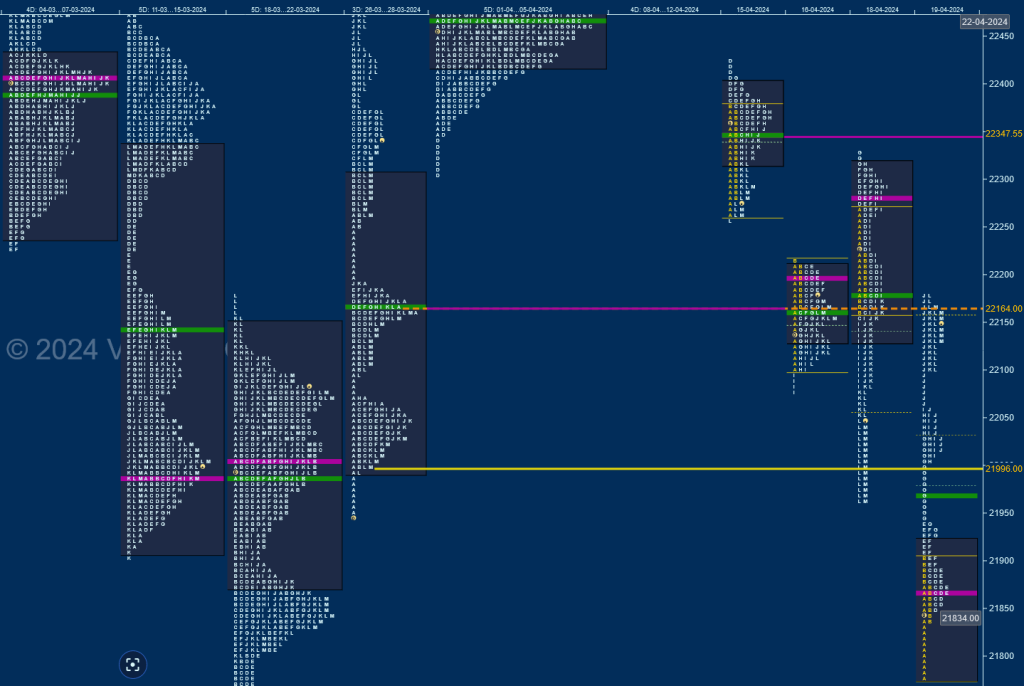

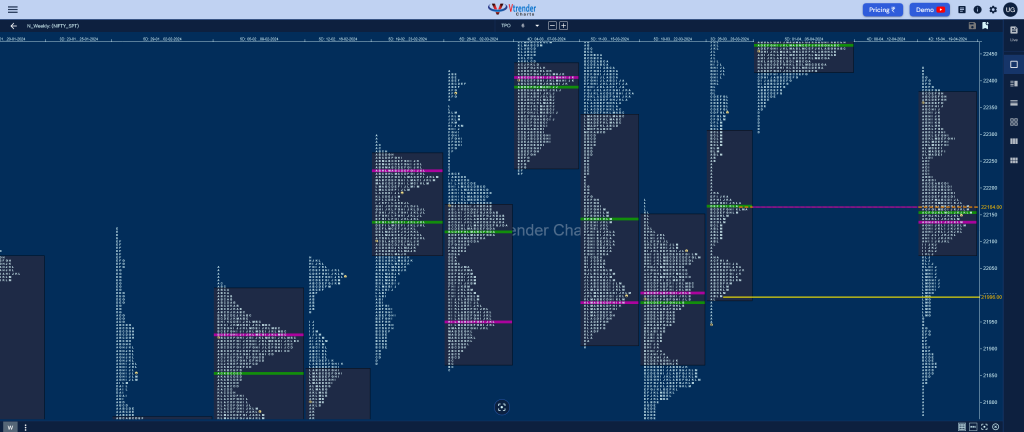

Nifty Spot: 22147 [ 22427 / 21777 ]

Nifty continued previous week’s imbalance to the downside with a 180 point gap down open on Monday making a low of 22263 in the A period taking support just above the weekly DD singles from 22252 to 22193 (26-28 Mar) after which it made a probe higher making couple of REs in an attempt to get into the weekly Gaussian Curve (01st to 05th Apr) but was rejected from 22427 indicating that the PLR (Path of Least Resistance) was to the downside triggering new lows of 22259 and a Neutral Day with the POC at 22347.

The auction followed it with another lower open on Tuesday negating the above mentioned DD singles and breaking below that week’s VPOC of 22165 as it made a low of 22103 in the A period after which it remained in a narrow 110 point range for most part of the day with a lone attempt to extend lower in the I TPO where it made a low of 22079 holding just above 28th Mar’s daily extension handle of 22073 as the buyers came back pushing it back to 22180 into the close and opening higher on Thursday into Monday’s range but saw rejection resulting in a drop back into Tuesday’s range & value and a typical C side extension to 22153 which got confirmed as a FA as Nifty made multiple REs to the upside almost completing the 1 ATR objective of 22331 while making a high of 22326 but saw the sellers come back strongly as they not only left a SOC at 22283 but went on to negate the FA of 22153 and went on to complete the 1 ATR target of 21977 on the downside leaving a Neutral Extreme Day Down.

Friday saw another lower open as the auction completed the 2 ATR objective of 21799 from the negated FA of 22153 and tested March’s monthly buying tail of 21793 while making a low of 21777 and left an initiative buying tail till 21836 marking the end of the downside as finally the buyers made a statement for the first time in the week leaving couple of extension handles at 21937 & 22060 and forming a Trend Day Up making a high of 22179 leaving an elognated 650 point weekly profile with completely lower Value at 22079-22137-22376 with a close around the prominent POC of 22137 which will be the opening reference for the coming week.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 22nd Apr

| Up |

| 22153 – SOC (18 Apr) 22193 – I TPO h/b (18 Apr) 22230 – SOC (18 Apr) 22283 – POC (18 Apr) 22347 – VPOC (15 Apr) |

| Down |

| 22137 – Weekly POC 22060 – Ext Handle (19 Apr) 22007 – Mid-profile tail (19 Apr) 21977 – G TPO h/b (19 Apr) 21937 – Ext Handle (19 Apr) |

Hypos for 23rd Apr

| Up |

| 22349 – L TPO high (22 Apr) 22404 – Selling Tail (15 Apr) 22451 – Buying Tail (05 Apr) 22493 – VPOC (05 Apr) 22532 – Ext Handle (12 Apr) |

| Down |

| 22335 – M TPO low (22 Apr) 22286 – 22 Apr halfback 22225 – B TPO h/b (22 Apr) 22179 – PBH (19 Apr) 22137 – Weekly POC |

Hypos for 24th Apr

| Up |

| 22385 – L TPO h/b (23 Apr) 22435 – IB tail mid (23 Apr) 22493 – VPOC (05 Apr) 22532 – Ext Handle (12 Apr) 22586 – Weekly SOC |

| Down |

| 22349 – L TPO high (22 Apr) 22293 – VPOC (22 Apr) 22225 – B TPO h/b (22 Apr) 22179 – PBH (19 Apr) 22137 – Weekly POC |

Hypos for25th Apr

| Up |

| 22420 – K TPO h/b (24 Apr) 22460 – PBH (24 Apr) 22510 – Closing tail (12 Apr) 22549 – K TPO h/b (12 Apr) 22586 – Weekly SOC |

| Down |

| 22386 – Buy tail (24 Apr) 22349 – L TPO high (22 Apr) 22293 – VPOC (22 Apr) 22257 – PBL (22 Apr) 22212 – Buying Tail (22 Apr) |

Hypos for26th Apr

| Up |

| 22606 – Selling tail (25 Apr) 22658 – VPOC (12 Apr) 22701 – Wkly VPOC (08-12 Apr) 22755 – Selling tail (10 Apr) 22799 – 2 ATR (yPOC 22401) |

| Down |

| 22549 – M TPO low (25 Apr) 22485 – Ext Handle (25 Apr) 22457 – Monthly POC (Apr) 22401 – POC (25 Apr) 22339 – Buying Tail (25 Apr) |

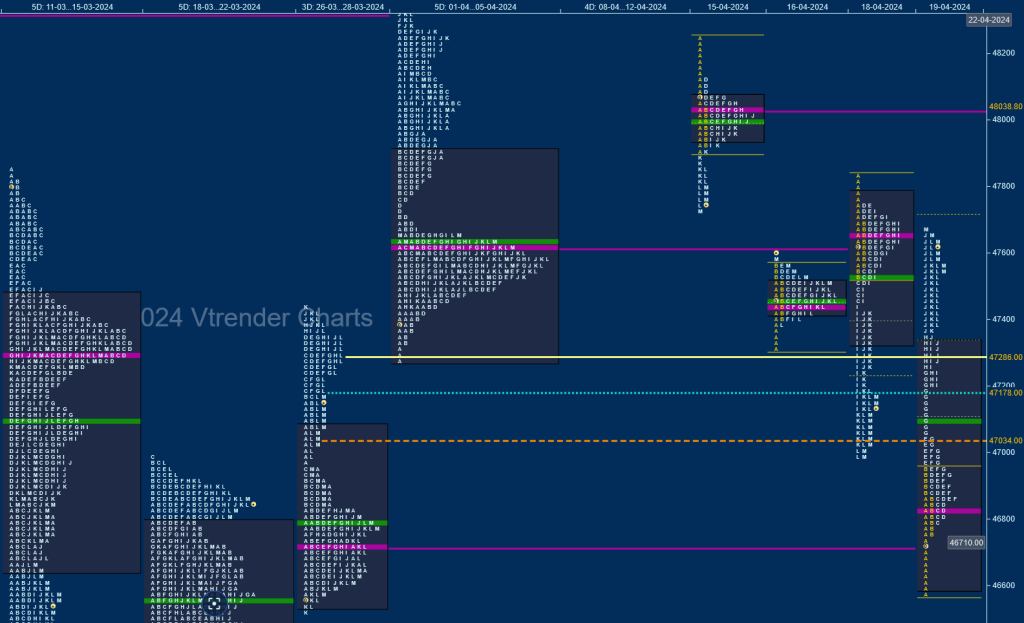

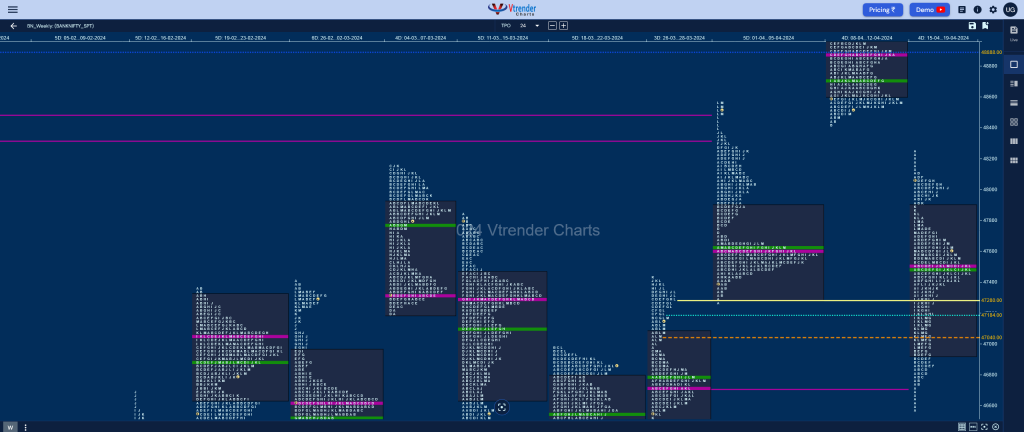

BankNifty Spot: 47574 [ 48255 / 46579 ]

BankNifty opened with a big gap down of 507 points on Monday well below the extension handle of 48363 (01-05 Apr) and formed a narrow range ‘b’ shape profile for most part of the day building a prominent POC at 48038 but went on to spike lower to 47725 after leaving an extension handle at 47905 and continued this imbalance with another lower open on Tuesday making a low of 47316 at the open taking support just above March’s POC of 47300 and formed a narrow range ‘p’ shape Normal Day with a prominent POC at 47435 indicating some short covering.

The auction then opened with a probe higher on Thursday but could only manage to tag 47829 stalling just below the Monday’s K TPO singles from 47905 to 47848 marking the return of supply who then were successful in forming a Double Distribution (DD) Trend Day Down with an extension handle at 47465 and a test of March’s VWAP of 47051 while making a low of 46982 and saw the downmove continue with another lower open on Friday where it tagged the weekly VPOC of 46713 (26-28 Mar) and made a low of 46579 taking support just above that week’s low and left an A period buying tail till 46750 indicating that the shorts were booking out and buyers were back.

BankNifty trended higher for most part of day leaving couple of extension handles at 47045 & 47357 as it not only got into the DD zone but went on to tag the POC of 47661 while making a high of 47668 leaving an elongated 1676 point range yet balanced 3-1-3 weekly profile with completely lower Value at 46927-47500-47882 with 47748 & 47905 being the hurdles on the upside above which it could go for the daily VPOC of 48038 and this week’s selling tail whereas on the downside will remain week below 47500 for a move towards 47357 & 47045 below which it could test Friday’s POC of 46829 and the buying tail of this week.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 22nd Apr

| Up |

| 47610 – M TPO h/b (19 Apr) 47749 – Selling Tail (18 Apr) 47905 – Ext Handle (15 Apr) 48038 – VPOC (15 Apr) 48187 – IB tail mid (15 Apr) |

| Down |

| 47551 – M TPO low (19 Apr) 47357 – Ext Handle (19 Apr) 47190 – Roll Over point (Apr) 47045 – Ext Handle (19 Apr) 46952 – IBH (19 Apr) |

Hypos for 23rd Apr

| Up |

| 47928- A TPO h/b (22 Apr) 48038 – VPOC (15 Apr) 48187 – IB tail mid (15 Apr) 48311 – Gap mid (15 Apr) 48477 – 12 Apr low |

| Down |

| 47902 – M TPO low (22 Apr) 47782 – PBL (22 Apr) 47671 – Buy tail (22 Apr) 47551 – M TPO low (19 Apr) 47357 – Ext Handle (19 Apr) |

Hypos for 24th Apr

| Up |

| 47997 – POC (23 Apr) 48135 – A TPO h/b (23 Apr) 48311 – Gap mid (15 Apr) 48477 – 12 Apr low 48613 – VPOC (12 Apr) |

| Down |

| 47947 – VAL (23 Apr) 47827 – VPOC (22 Apr) 47702 – C TPO h/b (22 Apr) 47551 – M TPO low (19 Apr) 47357 – Ext Handle (19 Apr) |

Hypos for25th Apr

| Up |

| 48196 – POC (24 Apr) 48311 – Gap mid (15 Apr) 48477 – 12 Apr low 48613 – VPOC (12 Apr) 48757 – F TPO h/b (12 Apr) |

| Down |

| 48132 – PBL (24 Apr) 47997 – VPOC (23 Apr) 47887 – 22 Apr H/B 47782 – PBL (22 Apr) 47628 – FA (22 Apr) |

Hypos for26th Apr

| Up |

| 48505 – M TPO high (25 Apr) 48669 – Daily SOC (12 Apr) 48757 – F TPO h/b (12 Apr) 48879 – POC (10 Apr) 49010 – Sell tail (10 Apr) |

| Down |

| 48470 – M TPO h/b (25 Apr) 48320 – IBH (25 Apr) 48206 – POC (25 Apr) 48087 – PBL (25 Apr) 47960 – A TPO h/b (25 Apr) |