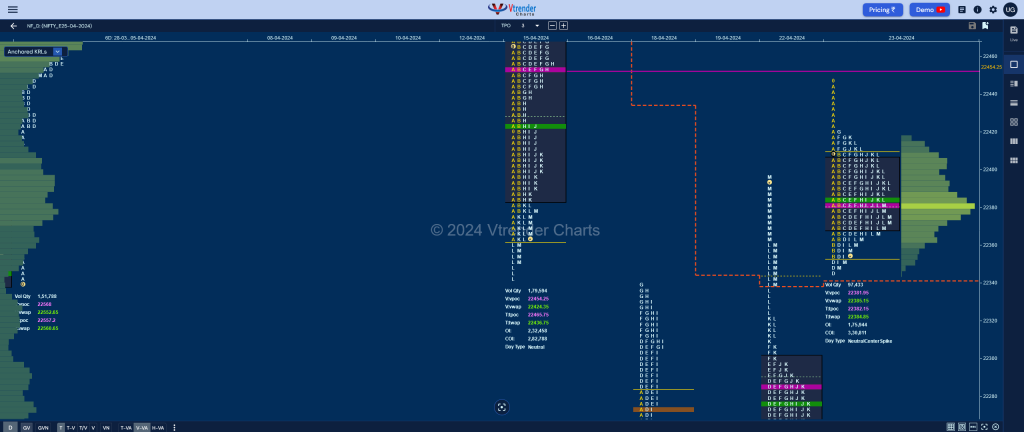

Nifty Apr F: 22371 [ 22419 / 22345 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,375 contracts |

| Initial Balance |

|---|

| 55 points (22408 – 22353) |

| Volumes of 21,516 contracts |

| Day Type |

|---|

| Gaussian Curve – 74 pts |

| Volumes of 97,461 contracts |

to be updated…

.Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22382 F and VWAP of the session was at 22385

- Value zones (volume profile) are at 22368-22382-22405

- NF confirmed a FA at 22845 on 09/04 and tagged the 2 ATR objective downside of 22476 on 15/04

- NF confirmed a FA at 22517 on 15/04 and tagged the 2 ATR objective downside of 22178 on 16/04.

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-18 Apr) – NF opened the week stalling right at previous week’s POC of 22768 and as expected filled up the DD zone while negating the buying singles from 22662 to 22600 and went on to make a Trend Down profile for the week in an expanded range of 740 points making lower lows on all day as it broke below the weekly VPOC of 22354 (22-28 Mar) and went on to tag the HVN of 22080 (15-21 Mar) while leaving similar lows of 22027 and completly lower value at 22027-22213-22322 with this week’s VWAP of 22348 now being a swing sell side reference for the rest of the series.

- (05-11 Apr) – NF has formed a Double Distribution (DD) Trend Up profile on the weekly with completely higher Value at 22669-22768-22837 with the VWAP at 22707 which will be a zone of support along with the DD singles from 22662 to 22600 for the coming week where as on the upside it needs to sustain above 22837 to continue recording new ATHs

- (01-04 Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 24th Apr 2024

| Up |

| 22387 – L TPO VWAP (23 Apr) 22424 – VWAP (15 Apr) 22454 – VPOC (15 Apr) 22503 – D TPO POC (15 Apr) 22552 – 6-day VWAP (28Mar-05Apr) |

| Down |

| 22368 – VAL (23 Apr) 22338 – M TPO low (22 Apr) 22286 – VPOC (22 Apr) 22233 – HVN (22 Apr) 22200 – Buying Tail (22 Apr) |

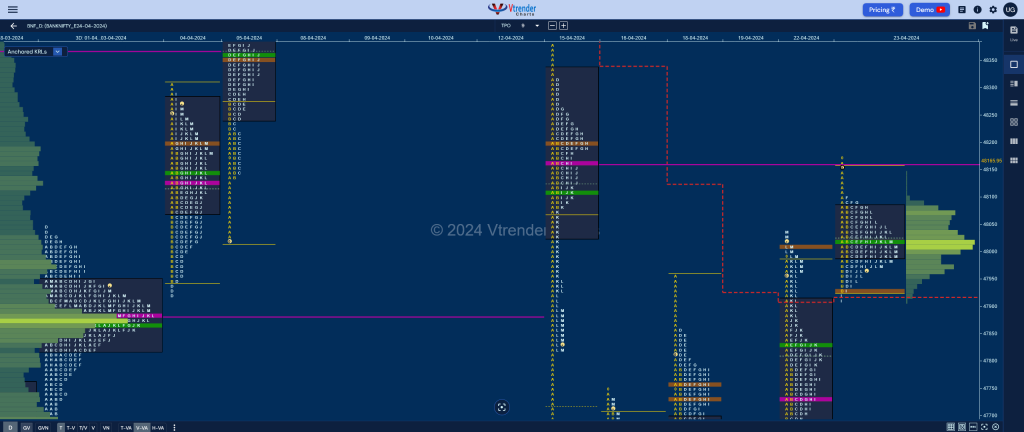

BankNifty Apr F: 47991 [ 48175 / 47895 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,137 contracts |

| Initial Balance |

|---|

| 226 points (48175 – 47925) |

| Volumes of 34,175 contracts |

| Day Type |

|---|

| Normal – 281 points |

| Volumes of 1,01,520 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48022 F and VWAP of the session was at 48019

- Value zones (volume profile) are at 47990-48022-48084

- BNF confirmed a FA at 47596 on 22/04 and tagged the 1 ATR objective of 48073 on 23/04. The 2 ATR target comes to 48549

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-16 Apr) – BNF had a holiday shortended 3-day week but still formed a Triple Distribution Trend Down profile with a huge range of 1493 points aided by 3 gap down opens of 268, 312 & 252 points respectively leaving the first zone of singles from 48670 to 48320 and another extension handle at 48077 with the second low volume zone till 47700 forming overlapping to lower value at 47784-48753-48913 with this week’s VWAP of 48147 being a swing sell side reference for the rest of the series.

- (04 – 10 Apr) – BNF left a Double Distribution Trend Up weekly profile moving away from previous Value and making higher highs on all 5 days but displayed exhaustion via similar highs at 49075 & 49086 resulting in profit booking by the longs as it formed a prominent TPO POC at 48960 where it eventually closed with Value completely higher at 48424-48687-49085 with this week’s VWAP of 48563 which will be an important support for the coming week along with the DD extension handle of 48494.

- (28 Mar-03 Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 24th Apr 2024

| Up |

| 48024 – L TPO VWAP (23 Apr) 48166 – VPOC (15 Apr) 48320 – Selling Tail (15 Apr) 48449 – 15 Apr high 48558 – Gap mid (15 Apr) |

| Down |

| 47925 – Buy tail (23 Apr) 47798 – PBL (22 Apr) 47685 – PBL ( 22 Apr) 47594 – VPOC (19 Apr) 47430 – SOC (19 Apr) |