Desi MO (McClellans Oscillator for NSE) – 15th APR 2024

MO at -7

Market Profile Analysis dated 12th April 2024

Nifty Apr F: 22601 [ 22767 / 22590 ] Open Type ORR (Open Rejection Reverse) Volumes of 20,893 contracts Above average Initial Balance 86 points (22767 – 22681) Volumes of 51,369 contracts Range below average but volumes above Day Type Double Distribution – 177 pts Volumes of 1,70,291 contracts Above average NF opened below previous lows […]

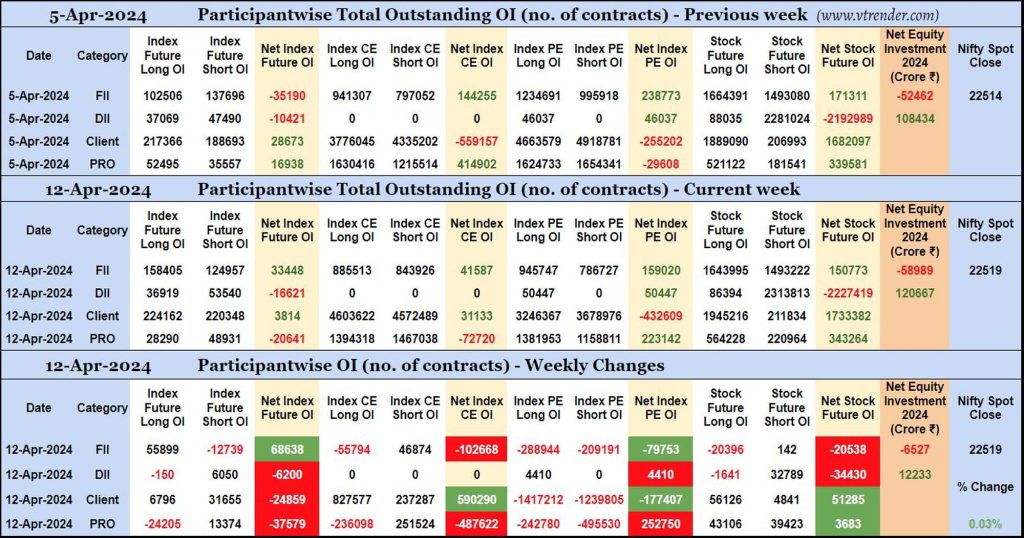

Participantwise Open Interest (Weekly changes) – 12th APR 2024

FIIs have added 55K long Index Futures and 46K short Index CE contracts this week besides covering 12K short Index Futures contracts and liquidating 55K long Index CE and 20K long Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹6527 crore during the week.

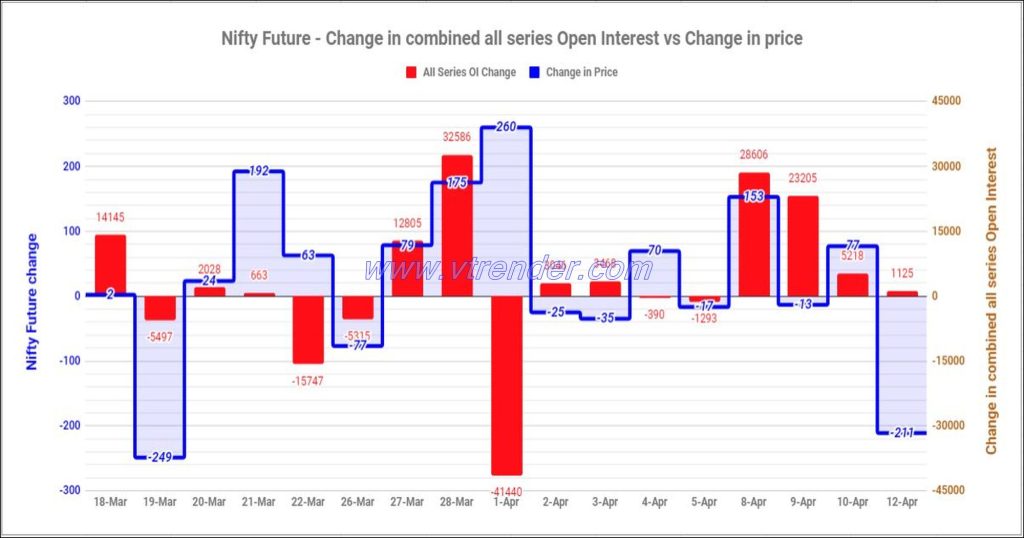

Nifty and Banknifty Futures with all series combined Open Interest – 12th APR 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

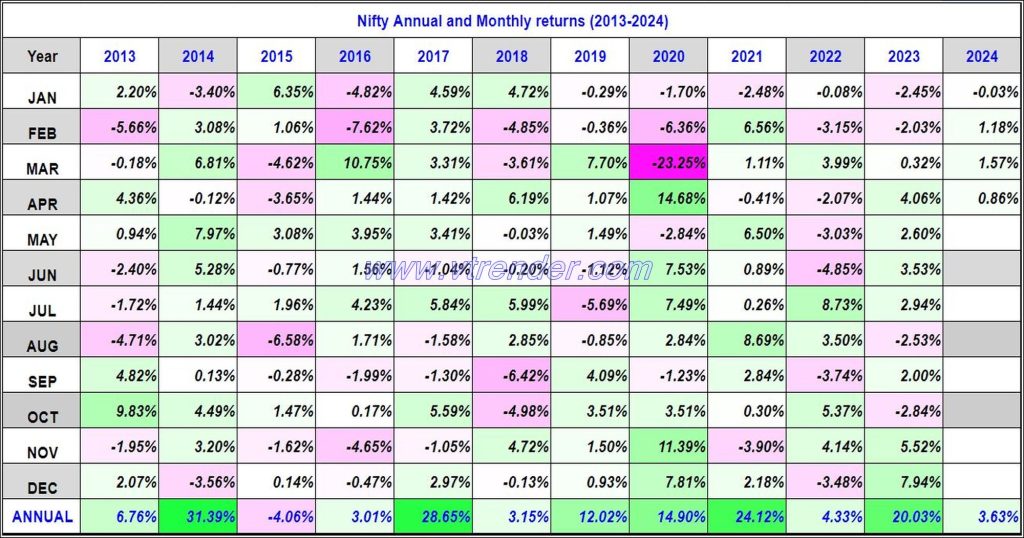

Nifty 50 Monthly and Annual returns (1991-2024) updated 12th APR 2024

Nifty50 returns Year 2024 3.63% / Nifty50 returns APR 2024 0.86%

Desi MO (McClellans Oscillator for NSE) – 12th APR 2024

MO at 28

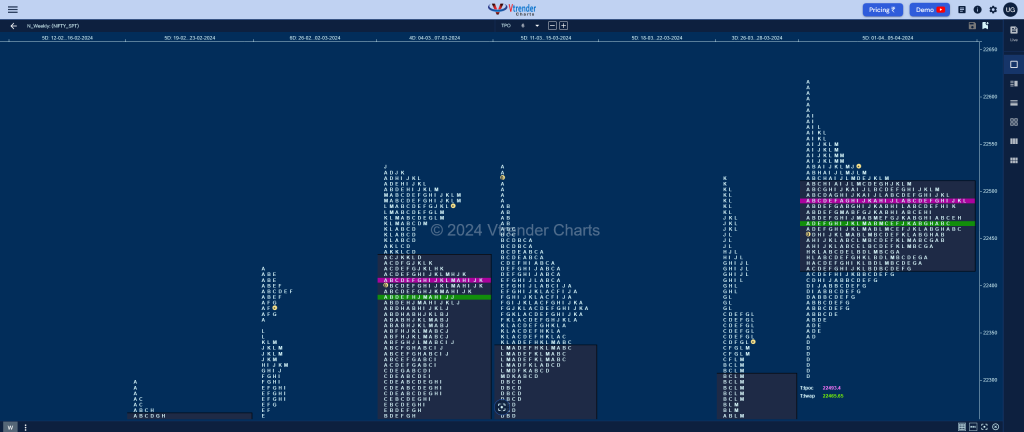

Weekly Spot Charts (08th to 12th Apr 2024) and Market Profile Analysis

Nifty Spot: 22519 [ 22775 / 22503 ] Nifty moved away from previous week’s balance to the upside negating the selling tail from 22580 to 22619 with initiative buying singles from 22586 to 22550 recording new ATH of 22697 on Monday and continued the upmove with higher highs of 22765 in the A period on Tuesday […]

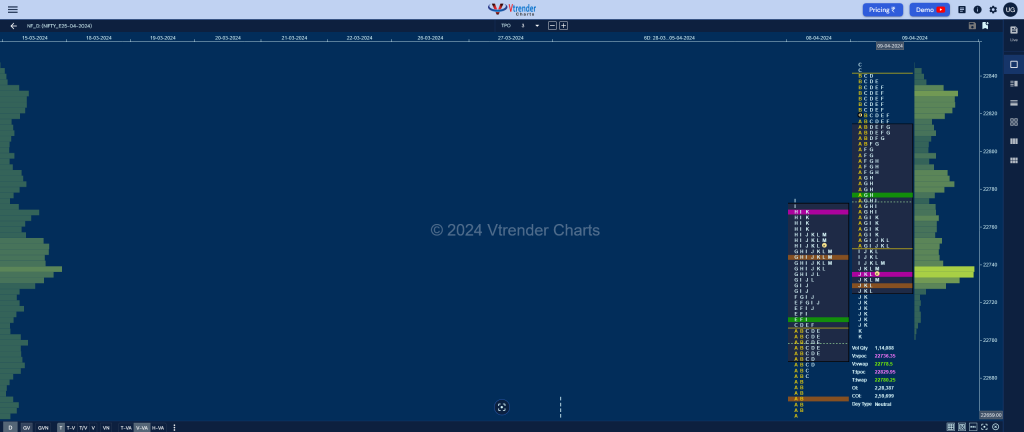

Market Profile Analysis dated 10th April 2024

Nifty Apr F: 22812 [ 22829 / 22753 ] Open Type OAIR (Open Auction In Range) Volumes of 11,125 contracts Below average Initial Balance 42 points (22795 – 22753) Volumes of 20,284 contracts Poor Day Type Normal Variation – 76 pts Volumes of 79,696 contracts Below average NF remained in a very narrow range all day […]

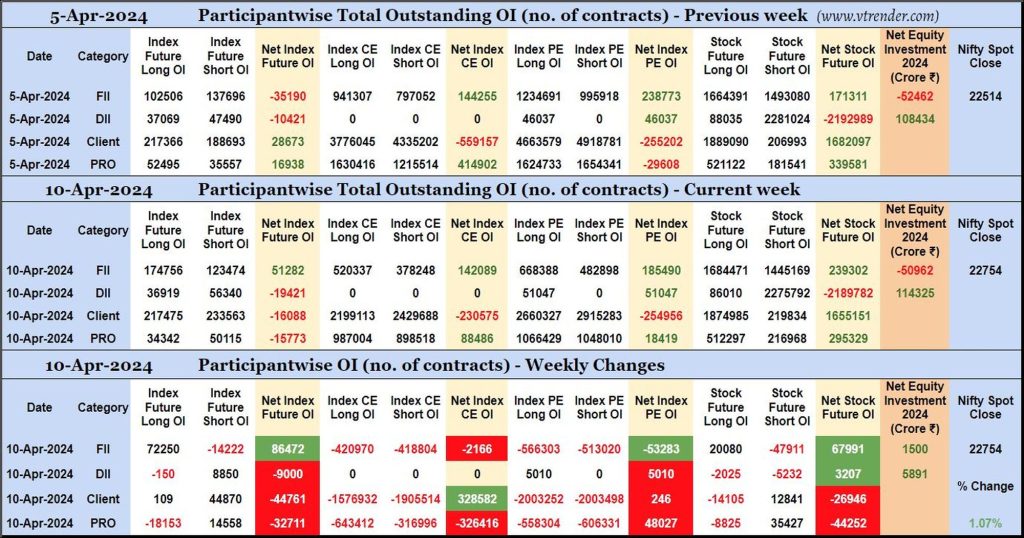

Participantwise Open Interest (Daily changes) – 10th APR 2024

FIIs have added 72K long Index Futures and 20K long Stocks Futures contracts so far this week besides covering 14K short Index Futures and 47K short Stocks Futures contracts. They have shed Open Interest in Index Options.

FIIs have been net buyers in equity segment for ₹1500 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 10th APR 2024

MO at 50