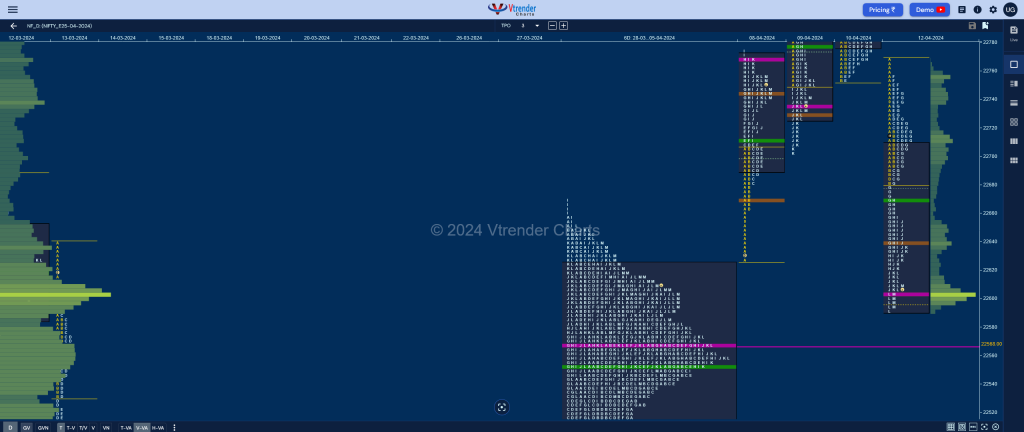

Nifty Apr F: 22601 [ 22767 / 22590 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 20,893 contracts |

| Initial Balance |

|---|

| 86 points (22767 – 22681) |

| Volumes of 51,369 contracts |

| Day Type |

|---|

| Double Distribution – 177 pts |

| Volumes of 1,70,291 contracts |

NF opened below previous lows and made an attempt to get back but was swiftly rejected and formed lower Value for the first half of the day with a PBH at 22757 in the F period confirming that the sellers were in control as they made a fresh RE lower in the G TPO leaving an extension handle at 22681 and went on to enter the 6-day composite Value (28th Mar to 05th Apr) tagging the RO point of 22607 while making a low of 22590 where it saw some profit booking by the shorts as the POC shifted to 22604 leaving a Double Distribution Trend Day Down with completely lower value and can expect this imbalance to continue towards the composite VWAP of 22552 & VAL of 22512 respectively in the coming session

.Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22604 F and VWAP of the session was at 22670

- Value zones (volume profile) are at 22591-22604-22709

- NF confirmed a FA at 22845 on 09/04 and tagged the 1 ATR objective downside of 22660 on 12/04. The 2 ATR target comes to 22476

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (05-11 Apr) – NF has formed a Double Distribution (DD) Trend Up profile on the weekly with completely higher Value at 22669-22768-22837 with the VWAP at 22707 which will be a zone of support along with the DD singles from 22662 to 22600 for the coming week where as on the upside it needs to sustain above 22837 to continue recording new ATHs

- (01-04 Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 15th Apr 2024

| Up |

| 22604 – POC (12 Apr) 22640 – HVN (12 Apr) 22681 – Ext Handle (12 Apr) 22729 – SOC (12 Apr) 22757 – Selling Tail (12 Apr) 22805 – VPOC (10 Apr) |

| Down |

| 22595 – Buy tail (12 Apr) 22552 – 6-day VWAP (28Mar-05Apr) 22512 – 6-day VAL (28Mar-05Apr) 22455 – Buy tail (04 Apr) 22420 – Buy Tail (6-day comp) 22394 – A TPO VWAP (28 Mar) |

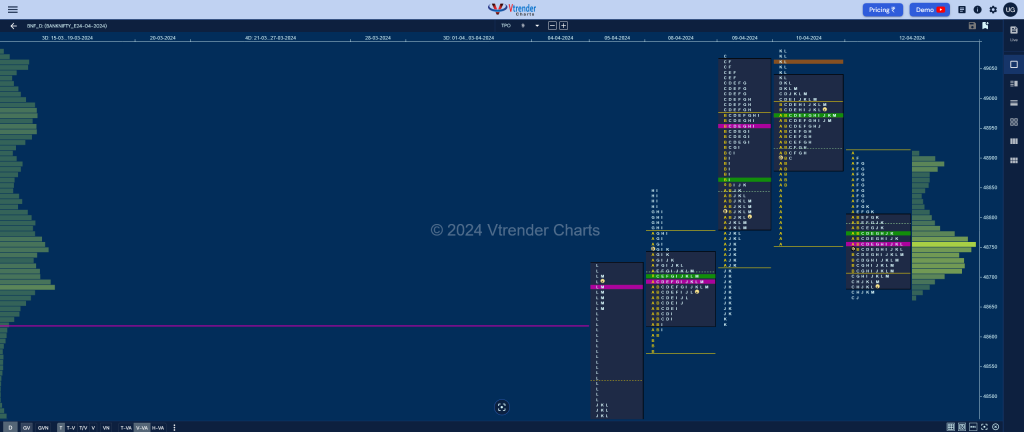

BankNifty Apr F: 48714 [ 48914 / 48666 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,993 contracts |

| Initial Balance |

|---|

| 215 points (48914 – 48699) |

| Volumes of 40,584 contracts |

| Day Type |

|---|

| Normal – 249 points |

| Volumes of 1,19,287 contracts |

BNF formed yet another narrow range Normal Day with completely lower Value and seemed liked a long liquidation profile with similar lows in the 48670 zone and a prominent POC at 48755 staying below which it can go for a test of the extension handle of 48494 & Trend Day VWAP of 48365 from 05th Apr in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48755 F and VWAP of the session was at 48774

- Value zones (volume profile) are at 48687-48755-48804

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (04 – 10 Apr) – BNF left a Double Distribution Trend Up weekly profile moving away from previous Value and making higher highs on all 5 days but displayed exhaustion via similar highs at 49075 & 49086 resulting in profit booking by the longs as it formed a prominent TPO POC at 48960 where it eventually closed with Value completely higher at 48424-48687-49085 with this week’s VWAP of 48563 which will be an important support for the coming week along with the DD extension handle of 48494.

- (28 Mar-03 Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 15th Apr 2024

| Up |

| 48755 – POC (12 Apr) 48899 – Selling Tail (12 Apr) 48970 – VPOC (10 Apr) 49060 – HVN (10 Apr) 49131 – Weekly 3 IB 49238 – 1 ATR (HVN 48789) |

| Down |

| 48670 – Buy tail (12 Apr) 48582 – L TPO h/b (05 Apr) 48447 – K TPO VWAP (05 Apr) 48365 – VWAP (05 Apr) 48236 – C TPO VWAP (05 Apr) 48133 – Buying Tail (05 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.