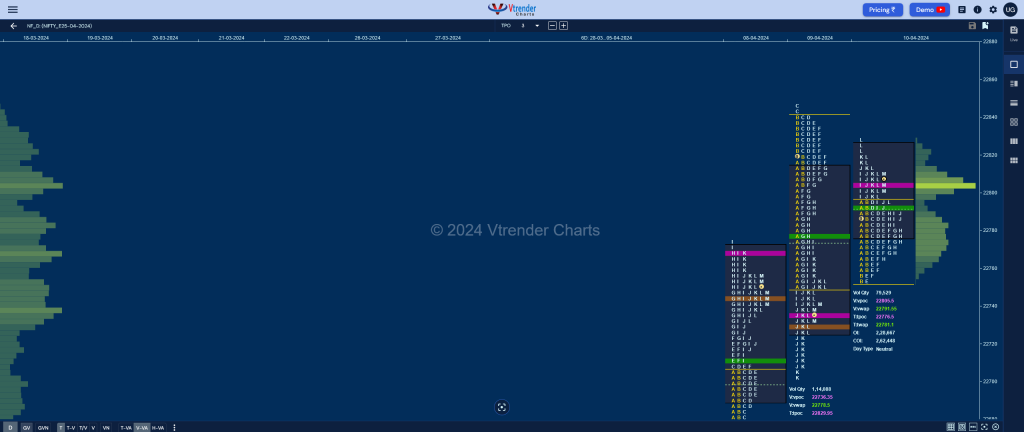

Nifty Apr F: 22812 [ 22829 / 22753 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 11,125 contracts |

| Initial Balance |

|---|

| 42 points (22795 – 22753) |

| Volumes of 20,284 contracts |

| Day Type |

|---|

| Normal Variation – 76 pts |

| Volumes of 79,696 contracts |

NF remained in a very narrow range all day forming an Inside Bar on the daily taking support just above previous session’s IBL of 22751 and stalling well below the FA of 22845 while making a high of 22829 leaving a nice 2-day Gaussian Curve with Value at 22766-22805-22835 and looks set for a move away from here in the coming session

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22805 F and VWAP of the session was at 22791

- Value zones (volume profile) are at 22778-22805-22825

- NF confirmed a FA at 22845 on 09/04 and the 1 ATR downside objective comes to 22660

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (05-11 Apr) – NF has formed a Double Distribution (DD) Trend Up profile on the weekly with completely higher Value at 22669-22768-22837 with the VWAP at 22707 which will be a zone of support along with the DD singles from 22662 to 22600 for the coming week where as on the upside it needs to sustain above 22837 to continue recording new ATHs

- (01-04 Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 12th Apr 2024

| Up |

| 22845 – FA (09 Apr) 22874 – Monthly 2 IB 22917 – 1 ATR (VPOC 22736) 22977 – Weekly ATR 23030 – 1 ATR (FA 22845) 23079 – 1 ATR (WPOC 22607) |

| Down |

| 22791 – VWAP (10 Apr) 22736 – VPOC (09 Apr) 22670 – IB HVN (08 Apr) 22648 – A TPO POC (08 Apr) 22607 – RO point (Apr) 22552 – 6-day VWAP (28Mar-05Apr) |

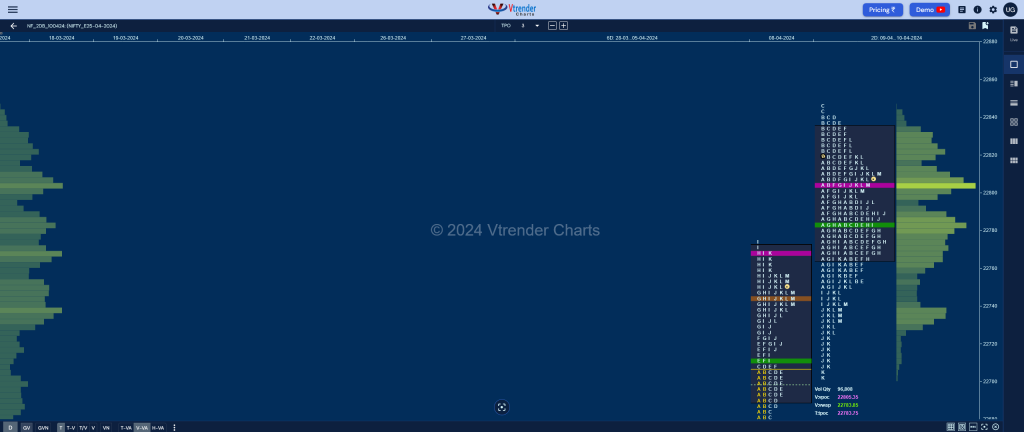

BankNifty Apr F: 49019 [ 49086 / 48760 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,650 contracts |

| Initial Balance |

|---|

| 232 points (48992 – 48760) |

| Volumes of 31,400 contracts |

| Day Type |

|---|

| Normal (p shape) – 326 points |

| Volumes of 1,26,078 contracts |

BNF formed a narrow range ‘p’ shape profile for the day leaving an A period buying tail from 48860 to 48760 even making a look up above previous highs but could only manage to leave similar new highs of 49086 & 49085 indicating exhaustion on the upside which led to profit booking by the longs and a HVN forming at 49060 before it closed around the prominent POC of 48970 leaving completely inside value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48970 F and VWAP of the session was at 48976

- Value zones (volume profile) are at 48887-48970-49035

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (04 – 10 Apr) – BNF left a Double Distribution Trend Up weekly profile moving away from previous Value and making higher highs on all 5 days but displayed exhaustion via similar highs at 49075 & 49086 resulting in profit booking by the longs as it formed a prominent TPO POC at 48960 where it eventually closed with Value completely higher at 48424-48687-49085 with this week’s VWAP of 48563 which will be an important support for the coming week along with the DD extension handle of 48494.

- (28 Mar-03 Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 12th Apr 2024

| Up |

| NA |

| Down |

| NA |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.