Desi MO (McClellans Oscillator for NSE) – 5th APR 2024

MO at 84

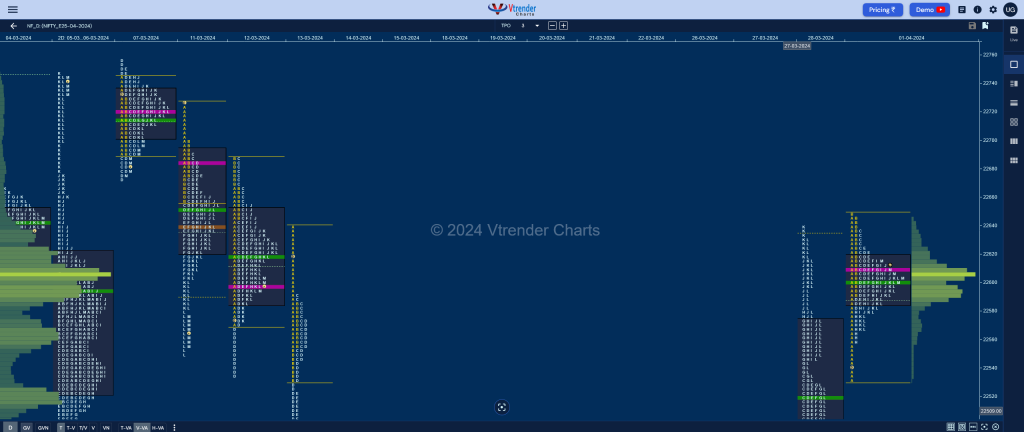

Weekly Spot Charts (01st to 05th Apr 2024) and Market Profile Analysis

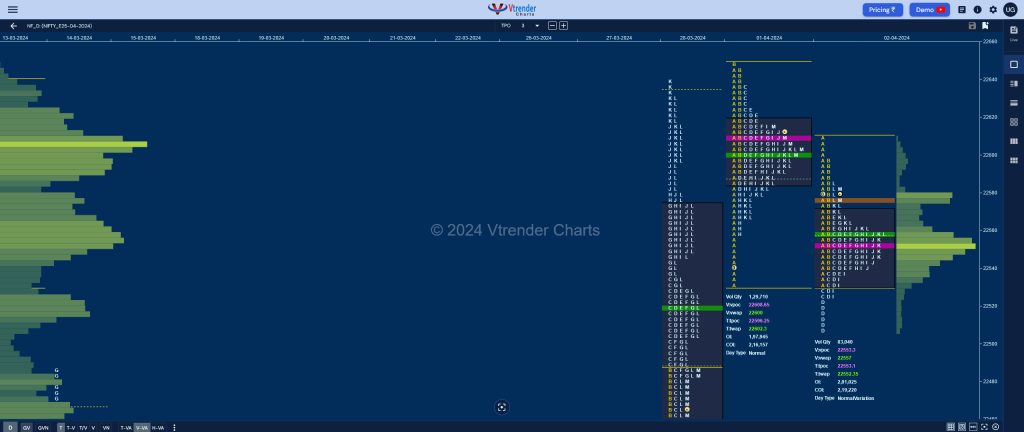

Nifty Spot: 22513 [ 22619 / 22304 ] Nifty opened the week with similar highs of 22524 & 22529 in the Initial Balance on Monday and formed back to back narrow range Normal Days building prominent POCs at 22460 & 22423 and opened lower on Wednesday where it left an initiative buying tail along with an […]

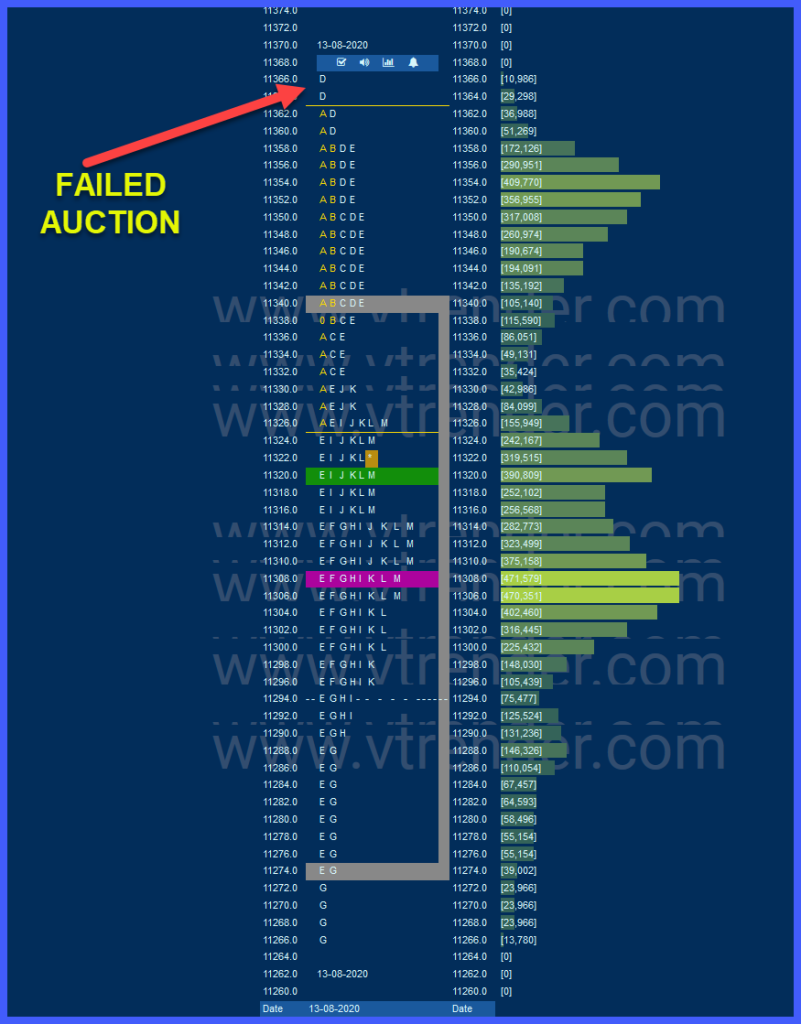

Mastering the Market with Failed Auctions: A Trader’s Guide

Introduction to Failed Auctions in Trading In the realm of market trading, understanding the nuances of various concepts can significantly enhance a trader’s strategy and overall performance. One such intriguing concept is the “failed auction,” which offers a fascinating insight into market dynamics and potential trading opportunities. This blog post delves into the essence of […]

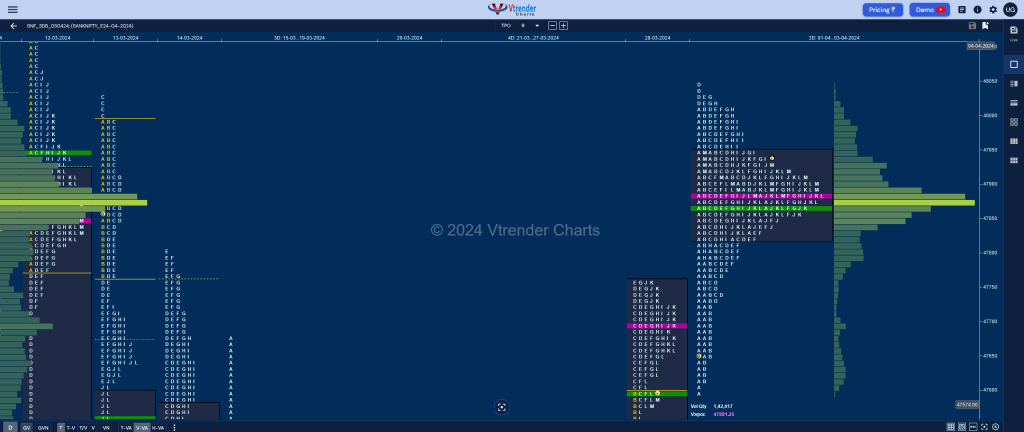

Market Profile Analysis dated 04th April 2024

Nifty Apr F: 22612 [ 22669 / 22420 ] Open Type ORR (Open Rejection Reverse) Volumes of 19,860 contracts Above average Initial Balance 187 points (22662 – 22475) Volumes of 61,106 contracts Above average Day Type Neutral Centre – 249 pts Volumes of 2,18,360 contracts Above average NF opened with a gap up hitting new highs […]

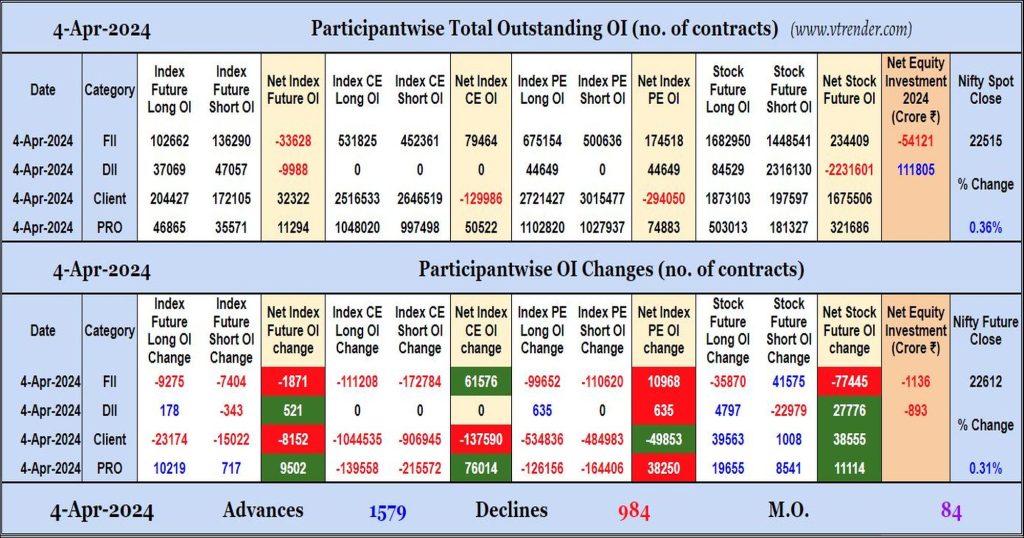

Participantwise Open Interest (Daily changes) – 4th APR 2024

FIIs have shed Open Interest in Index Futures & Index Options while adding 41K short Stocks Futures contracts and liquidating 35K long Stocks Futures contracts. They were net sellers in equity segment also.

Desi MO (McClellans Oscillator for NSE) – 4th APR 2024

MO at 84

Market Profile Analysis dated 03rd April 2024

Nifty Apr F: 22542 [ 22630 / 22450 ] Open Type OAOR (Open Auction Out of Range) Volumes of 18,087 contracts Above average Initial Balance 97 points (22547 – 22450) Volumes of 40,287 contracts Average Day Type Normal Variation – 180 pts Volumes of 1,25,588 contracts Below average NF opened with a big gap down getting […]

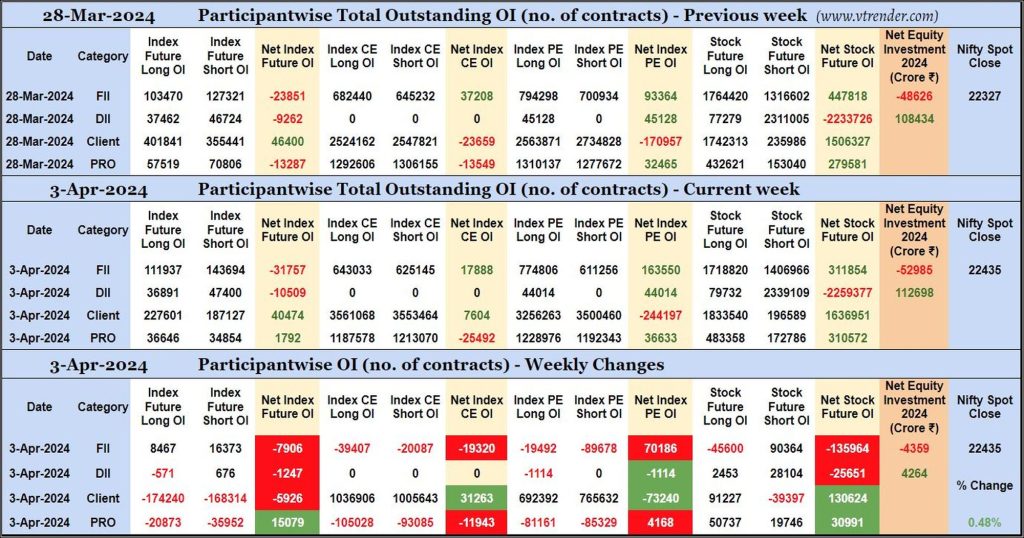

Participantwise Open Interest (Mid-week changes) – 3rd APR 2024

FIIs have added 14K short Index Futures and 62K short Stocks Futures contracts so far this week besides liquidating 2K long Index Futures and 61K long Stocks Futures contracts. They have shed Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹2214 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 3rd APR 2024

MO at 81

Market Profile Analysis dated 02nd April 2024

Nifty Apr F: 22577 [ 22611 / 22507 ] Open Type OAIR (Open Auction In Range) Volumes of 13,694 contracts Average Initial Balance 80 points (22611 – 22532) Volumes of 31,294 contracts Average Day Type Normal – 104 pts Volumes of 83,787 contracts Below average NF opened lower getting into the buying tail from 22558 to […]