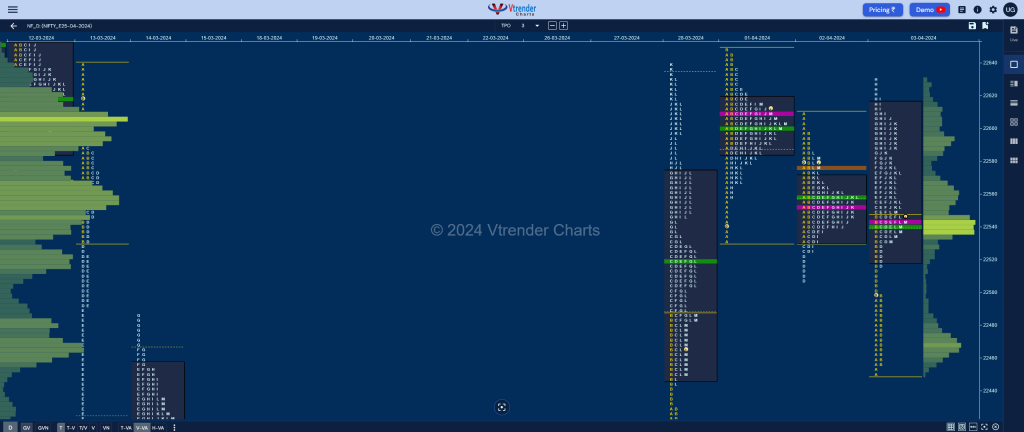

Nifty Apr F: 22542 [ 22630 / 22450 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 18,087 contracts |

| Initial Balance |

|---|

| 97 points (22547 – 22450) |

| Volumes of 40,287 contracts |

| Day Type |

|---|

| Normal Variation – 180 pts |

| Volumes of 1,25,588 contracts |

NF opened with a big gap down getting into the demand zone from 28th Mar as it made a low of 22450 taking support above the extension handle of 22430 as buyers came back strongly to leave a fresh one at 22515 and get back into previous range & value completing the 80% Rule post the C side extension to 22555 which gave a dip to 22517 in the D TPO.

The auction resumed the One Time Frame (OTF) probe higher till the H period where it made a high of 22630 but saw some supply coming back as could be seen in the small responsive tail at top triggering a retracement back to day’s VWAP & POC into the close as it hit 22532 in the M TPO.

We have overlapping value so far on all days of this new series with inventory still building up at the Roll Over point of 22608 which remains to be the important reference going into this week’s settlement as well as rest of the series with today’s VWAP of 22541 along with extension handle of 22515 being the support zone

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22543 F and VWAP of the session was at 22541

- Value zones (volume profile) are at 22519-22543-22616

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 04th Apr 2024

| Up |

| 22549 – M TPO high 22587 – SOC (03 Apr) 22618 – Sell tail (03 Apr) 22645 – Sell tail (01 Apr) 22680 – 2-day VPOC (11-12 Mar) 22719 – POC (07 Mar) |

| Down |

| 22541 – VWAP (03 Apr) 22515 – Ext Handle (03 Apr) 22468 – A TPO POC (03 Apr) 22430 – Ext Handle (28 Mar) 22394 – A TPO VWAP (28 Mar) 22352 – POC (27 Mar) |

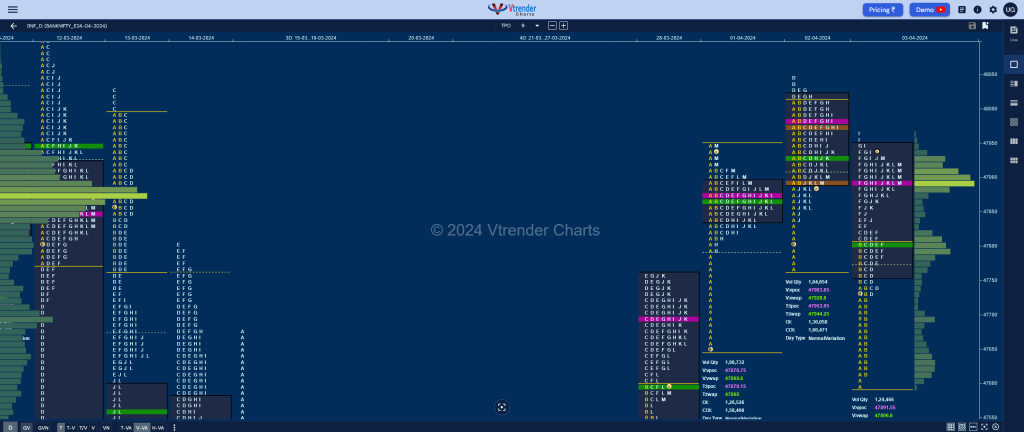

BankNifty Apr F: 47912 [ 47967 / 47580 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 17,442 contracts |

| Initial Balance |

|---|

| 233 points (47813 – 47580) |

| Volumes of 35,675 contracts |

| Day Type |

|---|

| Normal Varation – 387 points |

| Volumes of 1,36,673 contracts |

BNF also opened with a gap down of almost 200 points but took support at 28th Mar’s VWAP of 47593 indicating demand coming back who then drove it higher till the I period falling just short of previous session’s POC of 47983 leaving a Normal Varation Day with moslty overlapping Value.

We have a nice 3-day Gaussian Curve forming with Value at 47820-47881-47945 and a good chance of moving away from this balance in the coming session(s) provided it is backed with some initiative volumes.

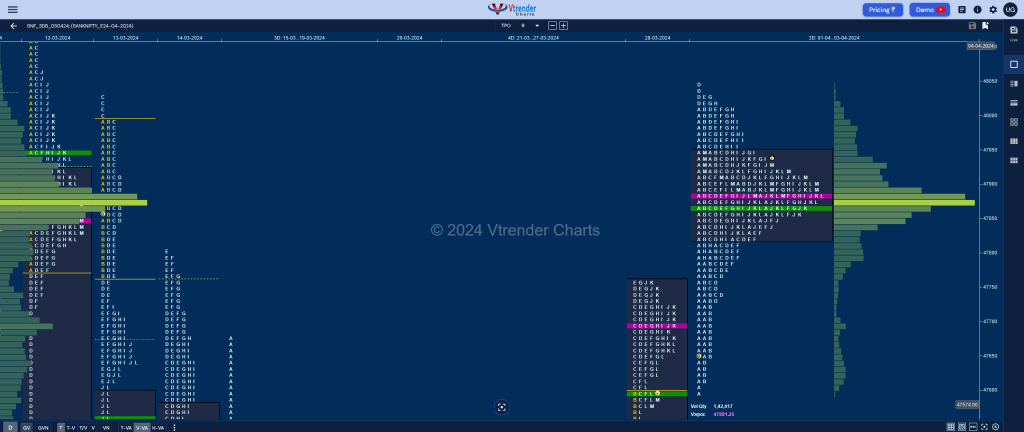

BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47891 F and VWAP of the session was at 47806

- Value zones (volume profile) are at 47761-47891-47946

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28Mar-03Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 04th Apr 2024

| Up |

| 47948 – Selling tail (03 Apr) 48025 – Sell tail (02 Apr) 48152 – Weekly VPOC (07-13 Mar) 48250 – SOC (12 Mar) 48373 – VPOC (07 Mar) 48474 – HVN (07 Mar) |

| Down |

| 47891 – POC (03 Apr) 47778 – PBL (03 Apr) 47616 – Buying Tail (03 Apr) 47520 – 28 Mar Halfback 47411 – A TPO h/b (28 Mar) 47337 – HVN (28 Mar) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.