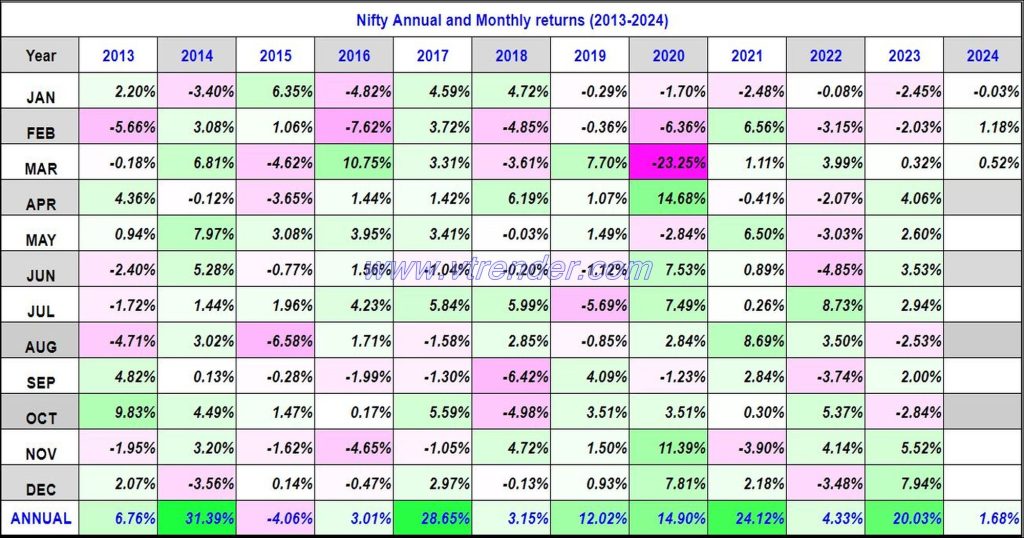

Nifty 50 Monthly and Annual returns (1991-2024) updated 22nd MAR 2024

Nifty50 returns Year 2024 1.68% / Nifty50 returns MAR 2024 0.52%

Desi MO (McClellans Oscillator for NSE) – 22nd MAR 2024

MO at 9

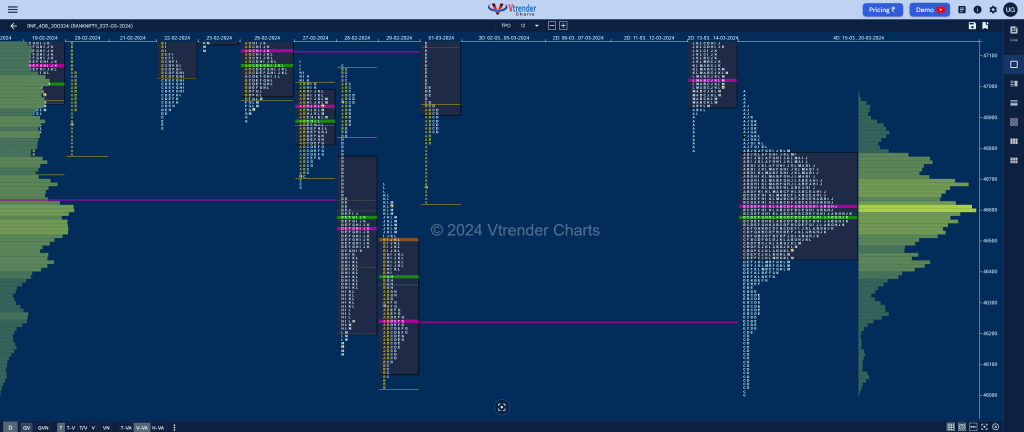

Market Profile Analysis dated 21st March 2024

Nifty Mar F: 22102 [ 22149 / 22020 ] Open Type OAOR (Open Auction Out of Range) Volumes of 19,865 contracts Above average Initial Balance 104 points (22144 – 22040) Volumes of 42,346 contracts Average Day Type Neutral Centre – 129 pts Volumes of 1,33,047 contracts Below average NF opened higher well above 19th Mar’s selling […]

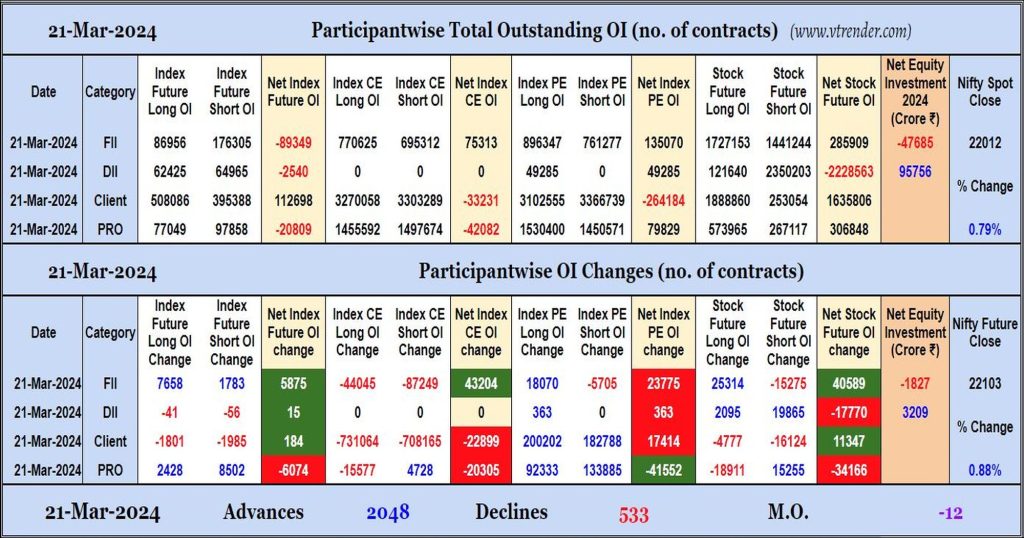

Participantwise Open Interest (Daily changes) – 21st MAR 2024

FIIs have added net longs in Index Futures, Index PE and Stocks Futures, they were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 21st MAR 2024

MO at -12, Declining volumes dip to 10%

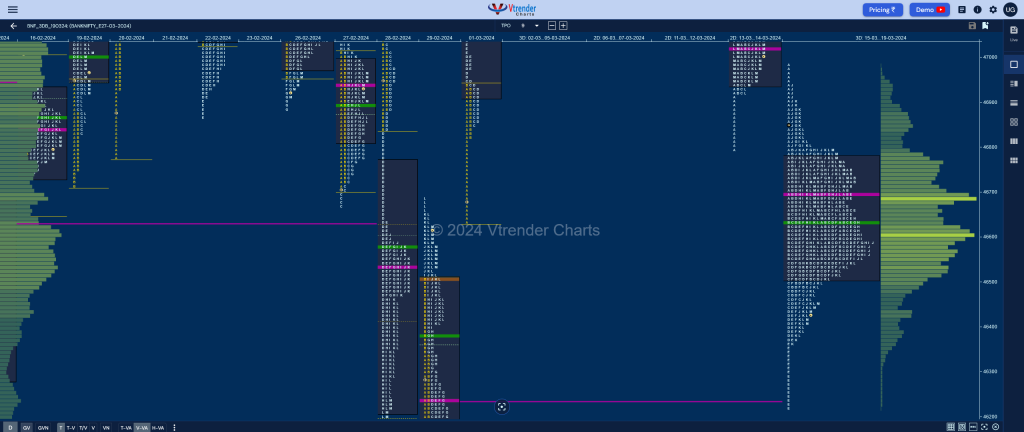

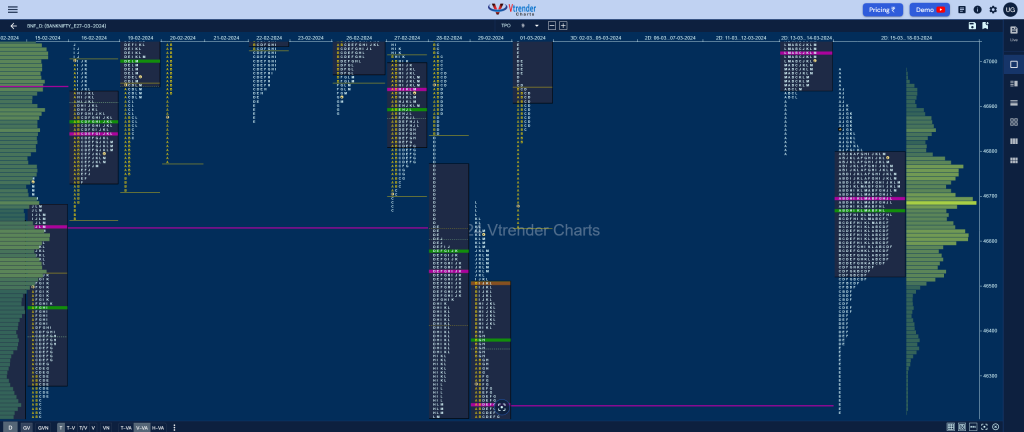

Market Profile Analysis dated 20th March 2024

Nifty Mar F: 21910 [ 21988 / 21798 ] Open Type OAIR (Open Auction In Range) Volumes of 11,071 contracts Average Initial Balance 121 points (21963 – 21842) Volumes of 35,841 contracts Average Day Type Neutral Centre – 191 pts Volumes of 1,37,718 contracts Below average NF opened higher and went on to test yVWAP of […]

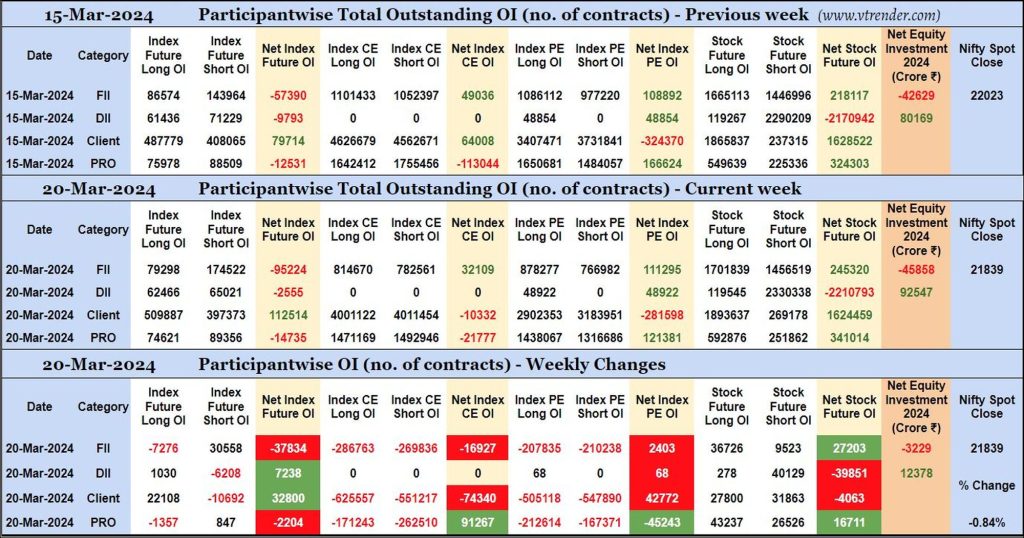

Participantwise Open Interest (Mid-week changes) – 20th MAR 2024

FIIs have added 30K short Index Futures and net 27K long Stocks Futures contracts this week while liquidating 7K long Index Futures contracts and shedding Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹3229 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 20th MAR 2024

MO at -53

Market Profile Analysis dated 19th March 2024

Nifty Mar F: 21886 [ 22094 / 21868 ] Open Type OA (Open Auction) Volumes of 19,232 contracts Above average Initial Balance 156 points (22094 – 21938) Volumes of 52,635 contracts Above average Day Type Normal Variation (‘b’) – 226 pts Volumes of 1,52,613 contracts Average NF made an initiative move away from the 2-day balance […]

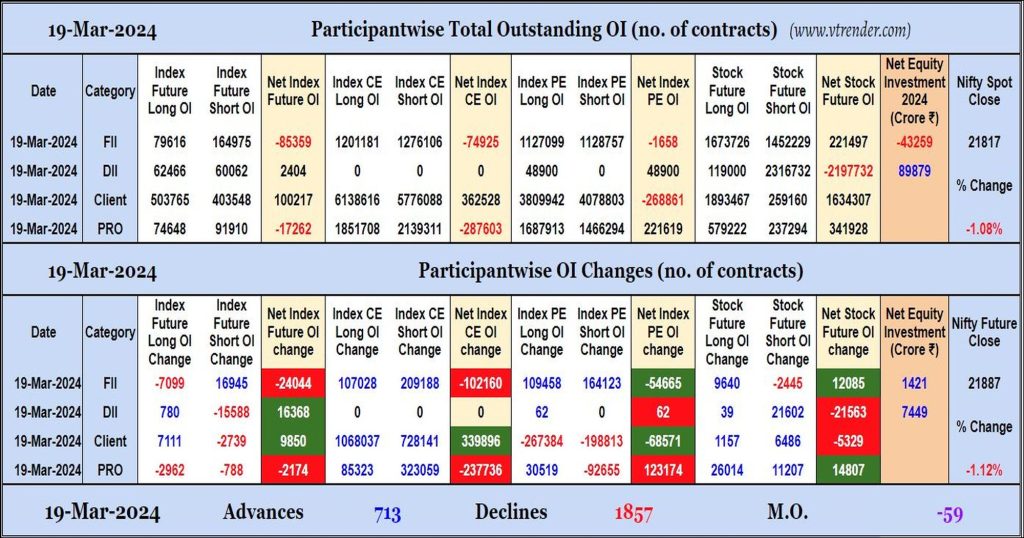

Participantwise Open Interest (Daily changes) – 19th MAR 2024

FIIs have added net shorts in Index Futures, Index CE and Index PE while adding longs in Stocks Futures. They were net buyers in equity segment.