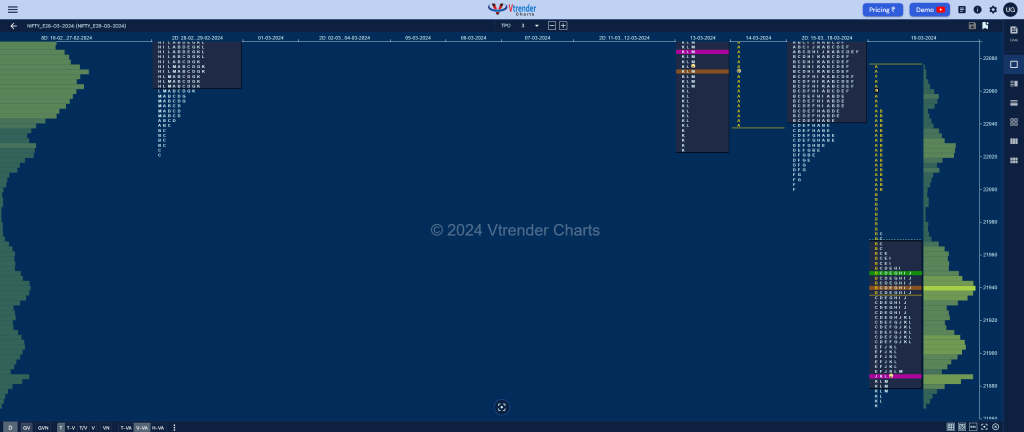

Nifty Mar F: 21886 [ 22094 / 21868 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 19,232 contracts |

| Initial Balance |

|---|

| 156 points (22094 – 21938) |

| Volumes of 52,635 contracts |

| Day Type |

|---|

| Normal Variation (‘b’) – 226 pts |

| Volumes of 1,52,613 contracts |

NF made an initiative move away from the 2-day balance it had been forming negating the FA of 22018 as it went on to tag the important objective of 21900 which was a weekly VPOC and mentioned in previous reports and saw some profit booking coming in as it formed a ‘b’ shape profile for the day making a low of 21868 and saw the POC shift lower to 21887 into the close.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21887 F and VWAP of the session was at 21949

- Value zones (volume profile) are at 21880-21887-21967

- NF confirmed a FA at 22018 on 18/03 and the 1 ATR objective comes to 22229. This FA was broken on 19/03 so is on for the 1 ATR target on downside comes to 21808

- NF confirmed a FA at 22022 on 29/02 and completed the 2 ATR objective of 22456. This FA was broken effectively on 19/03 so is no longer a swing support.

- HVNs are at 22393 / 22443** / 22497 / 22596 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (08-14 Mar) – NF has formed a Double Distribution Trend Down profile on the weekly as it left an initiative selling tail at previous week’s VAH and went on to probe lower swiping through the Value Areas of last couple of weeks tagging the 23-29 Feb’s VPOC of 22113 and made a low of 22025 taking support just above the daily FA of 22022 from 29th Feb. Value for the week was overlapping on both sides at 22286-22442-22593 with the VWAP at 22316 which will be the immediate supply point for the new week

- (01-07 Mar) – NF opened the week with an initiative probe to the upside right from the Mar RO point of 22188 as it left a buying tail from 22259 to 22180 and went on to record similar highs of 22547 & 22545 triggering a round of profit booking as it made a retracement down to 22322 taking support just above previous week’s VAH of 22293 and saw demand coming back resulting in a fresh imbalance and new ATH of 22620 but lack of fresh buying led to another round of profit booking as the auction came down to 22526 before closing the week at 22552 leaving a Normal Variation profile with completely higher Value at 22335-22443-22551 with the VWAP at 22452.

Monthly Zones

- The settlement day Roll Over point (March 2024) is 22188

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

Business Areas for 20th Mar 2024

| Up |

| 21900 – L TPO POC 21949 – VWAP (19 Mar) 22001 – Ext Handle (19 Mar) 22048 – Sell Tail (19 Mar) 22094 – VPOC (18 Mar) 22138 – 2-day VPOC (15-18 Mar) |

| Down |

| 21880 – VAL (19 Mar) 21841 – PBL (14 Feb) 21799 – VPOC (14 Feb) 21753 – DSL (14 Feb) 21713 – DSL (31 Jan) 21681 – Weekly ATR |

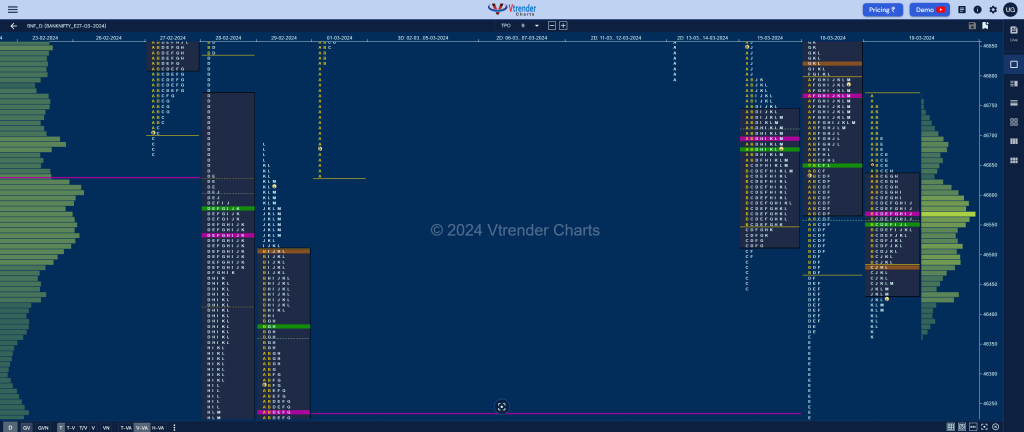

BankNifty Mar F: 46449 [ 46777 / 46364 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,641 contracts |

| Initial Balance |

|---|

| 287 points (46777 – 46490) |

| Volumes of 33,998 contracts |

| Day Type |

|---|

| Normal – 413 points |

| Volumes of 1,24,563 contracts |

BNF remained in the 2-day composite forming a narrow range Normal Day and a 3-1-3 profile which is also a Gaussian Curve so has a very good chance of moving away from here on the weekly settlement day of next session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 46566 F and VWAP of the session was at 46554

- Value zones (volume profile) are at 46434-46566-46631

- BNF confirmed a FA at 47684 on 13/03 and tagged the 2 ATR objective of 464427 on 15/03. This FA is currently on ‘T+5’ Days

- HVNs are at 47521** / 48217 (** denotes series POC)

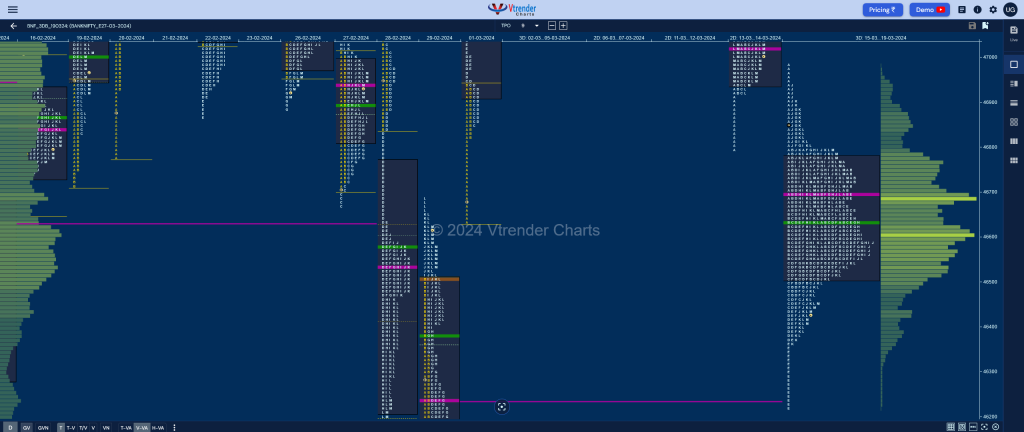

Weekly Zones

- Weekly Charts can be viewed here

- (07-14 Mar) – BNF has formed an inside bar on the weekly with overlapping to lower value at 47000-47518-47593 and is a Trend Down one which has moved away to the downside from the prominent POC of 47518 so this week’s VWAP of 47600 will now be the swing reference for the coming week

- (01-06 Mar) – BNF left a Trend Up weekly profile hitting the 2 IB target of 48343 forming completely higher value at 47444-47567-48229 with a closing HVN at 48217 which will be the immediate reference on the upside in the coming week staying above which it could go for the higher VPOC of 48480 and HVN of 48864 from the weekly profile of 11th to 17th Jan whereas on the downside, this week’s VWAP of 47694 will be an important swing support.

Monthly Zones

- The settlement day Roll Over point (March 2024) is 46610

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

Business Areas for 20th Mar 2024

| Up |

| 46477 – HVN (19 Mar) 46631 – VAH (19 Mar) 46746 – Sell Tail (19 Mar) 46852 – K TPO POC (18 Mar) 46940 – A TPO POC (15 Mar) 47024 – VPOC (14 Mar) |

| Down |

| 46434 – VAL (19 Mar) 46338 – E TPO h/b (18 Mar) 46210 – Swing Low (18 Mar) 46119 – Feb series VWAP 46030 – Swing Low (29 Feb) 45900 – HVN (14 Feb) |