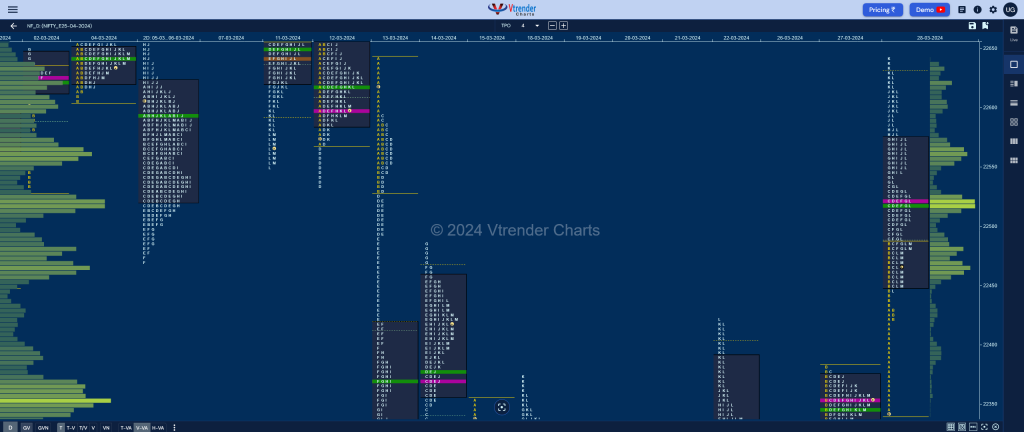

Market Profile Analysis dated 01st April 2024

Nifty Apr F: 22602 [ 22647 / 22515 ] Open Type OA (Open Auction) Volumes of 22,516 contracts Above average Initial Balance 132 points (22647 – 22515) Volumes of 43,554 contracts Above average Day Type Normal – 132 pts Volumes of 1,27,526 contracts Below average NF opened higher making a drive like start on very good […]

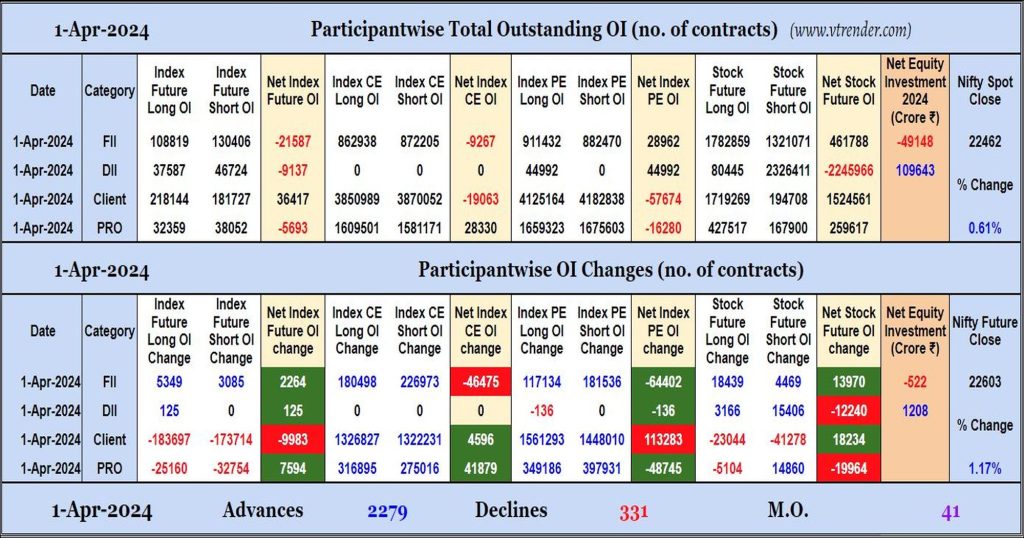

Participantwise Open Interest (Daily changes) – 1st APR 2024

Participantwise Open Interest – Daily changes

Desi MO (McClellans Oscillator for NSE) – 1st APR 2024

MO at 41, Declining volumes dip to 5%

Market Profile Analysis dated 28th March 2024

Nifty Apr F: 22488 [ 22640 / 22340 ] Open Type OTD (Open Test Drive) Volumes of 11,171 contracts Average Initial Balance 147 points (22487 – 22340) Volumes of 41,644 contracts Above average Day Type Trend – 345 pts Volumes of 2,52,094 contracts Above average to be updated… Click here to view the latest profile in […]

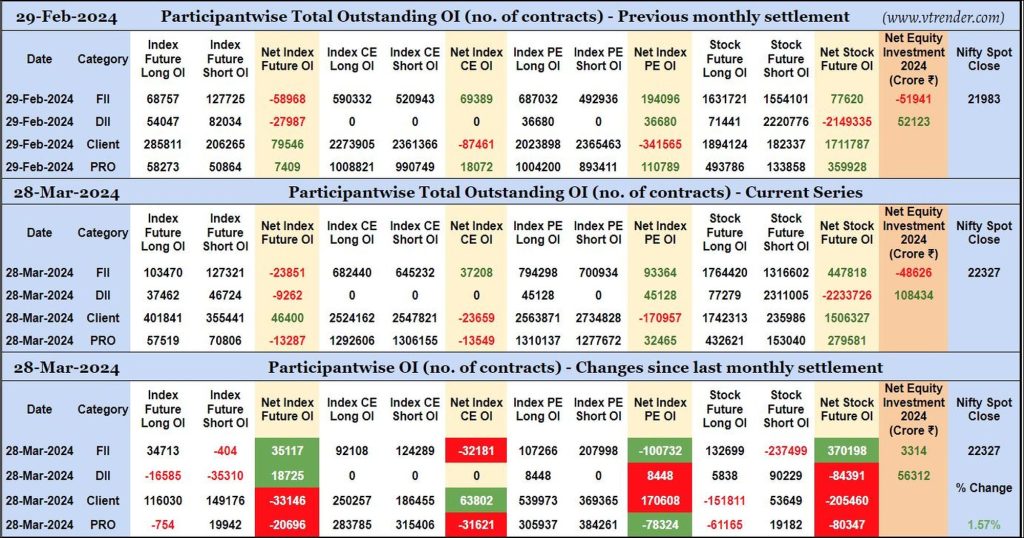

Participantwise Open Interest (Series changes) – 28th MAR 2023

FIIs have added 34K long Index Futures, net 32K short Index CE, net 100K short Index PE and 132K long Stocks Futures contracts since February settlement while covering 237K short Stocks Futures contracts.

FIIs were net buyers in equity segment for ₹3314 crore during March series.

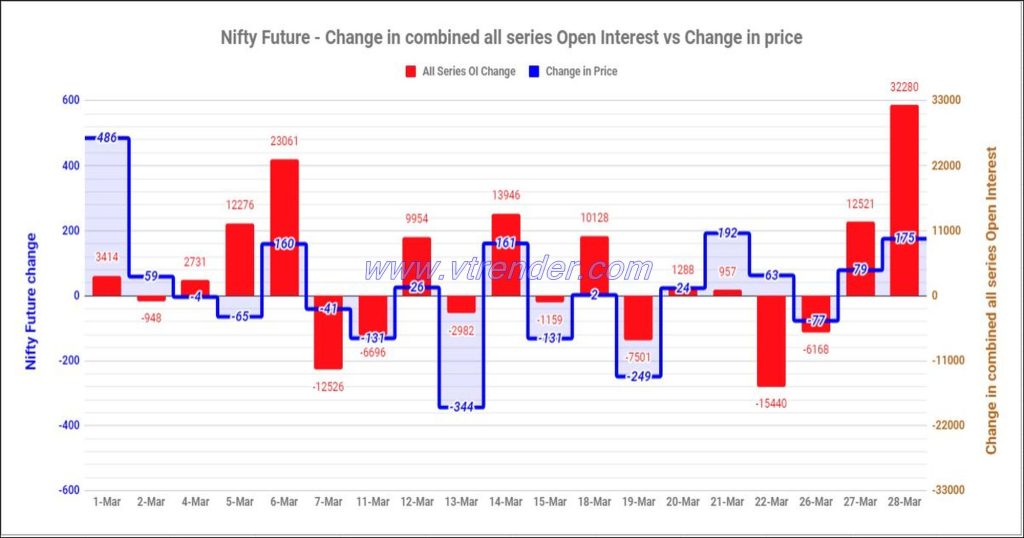

Nifty and Banknifty Futures with all series combined Open Interest – 28th MAR 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

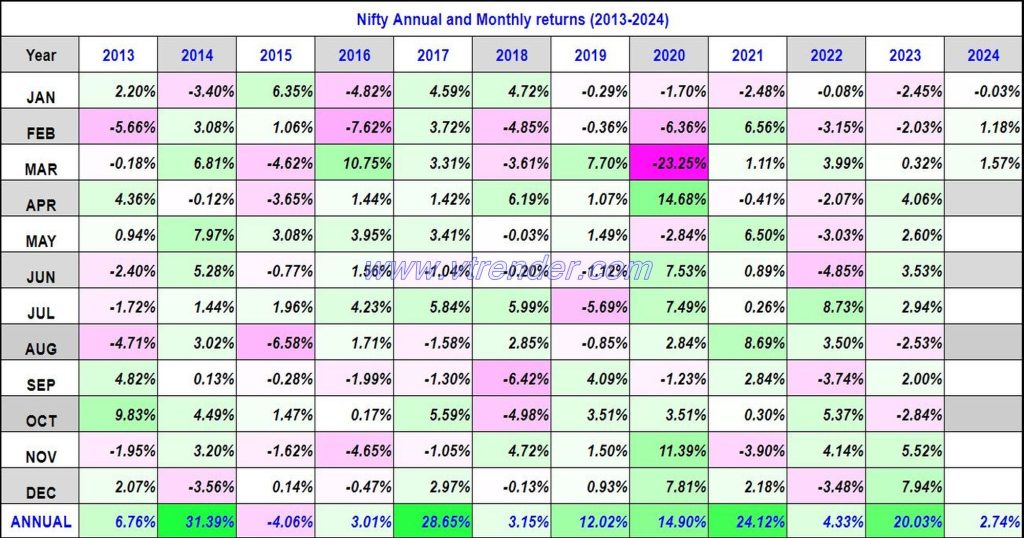

Nifty 50 Monthly and Annual returns (1991-2024) updated 28th MAR 2024

Nifty50 returns Year 2024 2.74% / Nifty50 returns MAR 2024 1.57%

Desi MO (McClellans Oscillator for NSE) – 28th MAR 2024

MO at -1

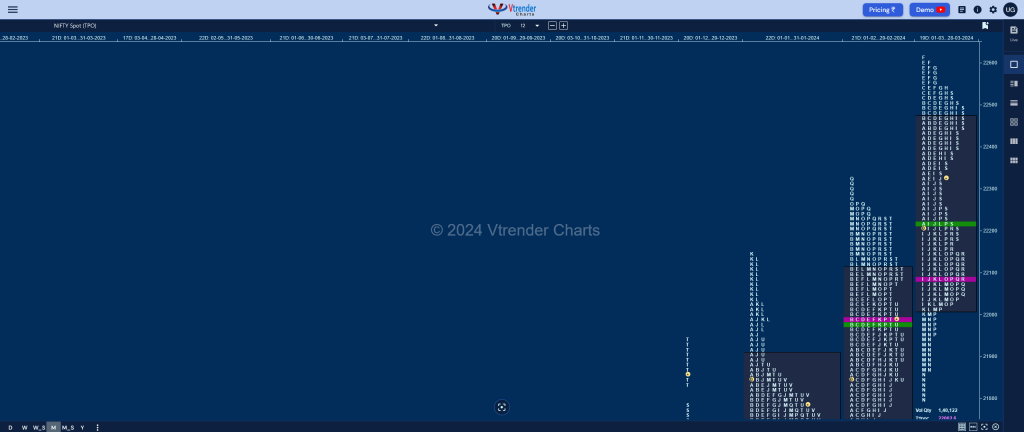

Weekly Spot Charts (25th to 29th Mar 2024) and Market Profile Analysis

Nifty Spot: 22327 [ 22516 / 21947 ] Nifty opened the week with a narrow 126 point range Normal Day and a ‘p’ shape profile leaving an important A period buying tail at the weekly POC of 22002 indicating that the PLR (Path of Least Resistance) was to the upside though it got stalled at the […]

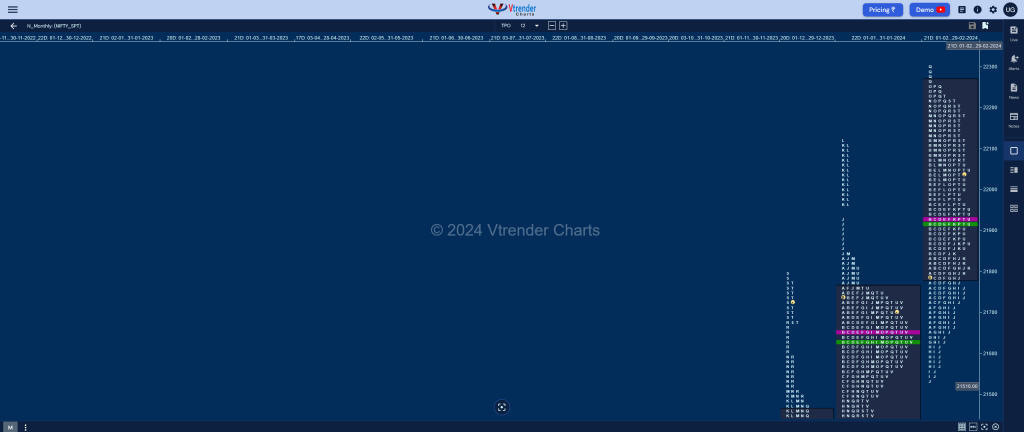

Monthly charts (March 2024) and Market Profile Analysis

Nifty Spot: 22327 [ 22526 / 21710 ] Previous month’s report can be viewed here Nifty opened the month with a Trend Day Up not only leaving an A period buying tail but also another zone of singles at the monthly VAH of 22260 signalling the move away from previous Value as it even went on […]