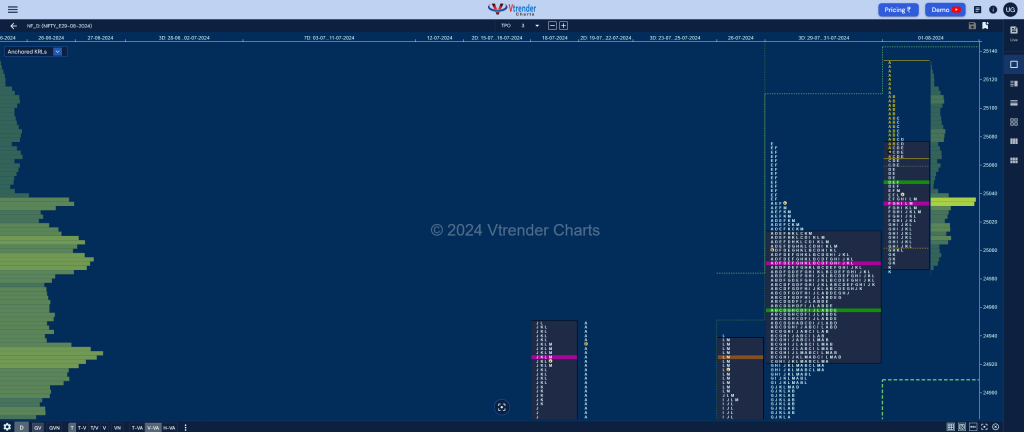

Nifty Aug F: 25032 [ 25132 / 24985 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 30,173 contracts |

| Initial Balance |

|---|

| 73 points (25132 – 25060) |

| Volumes of 62,160 contracts |

| Day Type |

|---|

| Normal Variation – 147 pts |

| Volumes of 2,29,057 contracts |

NF opened higher even scaling above ATH of 25075 to hit new highs of 25132 but buyers failed to keep it up as sellers took advantage of this and left an important A period selling tail and forced a move back into the 3-day composite even entering into the Value area but took support right at the POC of 24990 leaving a long liquidation kind of a profile for the day with a close around the POC of 25035 which will be the opening reference for the next session and would remain weak below it for a test of the composite lows of 24833

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25035 F and VWAP of the session was at 25049

- Value zones (volume profile) are at 24988-25035-25075

- HVNs are at 24930 / 24996** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (26Jul – 01Aug) – NF has formed a composite ‘p’ shape profile on the weekly timeframe representing weak Market Structure as after starting last Friday with a big Trend Day Up of 487 points it remained in a narrow range for the rest of the days indicating poor trade facilitation at these new ATH levels. Value for the week was completely higher at 24853-24996-25042 and the auction will need to show initiative buying above 25042 in the coming week to continue higher with this week’s VWAP of 24909 being the swing reference on the downside below which it could go in for a test of the Trend Day VWAP of 24748 and the Halfback of 24696 along with extension handles of 24637 & 24576

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 02nd Aug 2024

| Up |

| 25035 – POC (01 Aug) 25075 – Monthly IBH 25110 – Sell Tail (01 Aug) 25161 – 1 ATR (HVN 24924) 25227 – 1 ATR (POC 24990) 25272 – 1 ATR (yPOC 25035) |

| Down |

| 25028 – M TPO low (01 Aug) 24990 – 3-day POC (29-31 Jul) 24946 – PBL (31 Jul) 24909 – AVWAP (26 Jul Trend Day) 24853 – Weekly VAL 24792 – Ext Handle (26 Jul) |

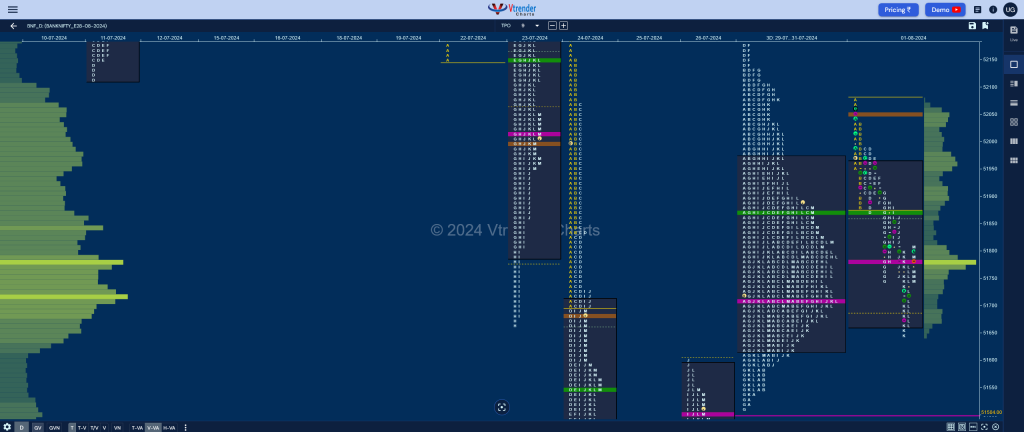

BankNifty Aug F: 51753 [ 52080 / 51635 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 18,522 contracts |

| Initial Balance |

|---|

| 203 points (52080 – 51877) |

| Volumes of 34,891 contracts |

| Day Type |

|---|

| Normal Variation – 445 pts |

| Volumes of 1,14,021 contracts |

BNF opened higher above the FA point of 51887 but could not hold after making a high of 52080 as it got back into the 3-day composite Value triggeing the 80% Rule which it almost completed by making a low of 51635 in the K period and this look up above Value with rejection has a good chance of the auction continuing to probe lower to test the Tends Day VPOC of 51504 & VWAP of 51251 along with the Swing Low of 50900 in the coming session(s) with today’s VWAP of 51867 being the level to hold on the upside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51779 F and VWAP of the session was at 51867

- Value zones (volume profile) are at 51662-51779-51958

- BNF formed a FA at 51878 on 31/07 but got negated the same day so staying above it can go for the 1 ATR objective of 52506 in the coming session(s). BNF has closed below this FA on 01/08 so remains weak for a probe to 1 ATR downside target of 51250

- HVNs are at NA (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

Business Areas for 02nd Aug 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.