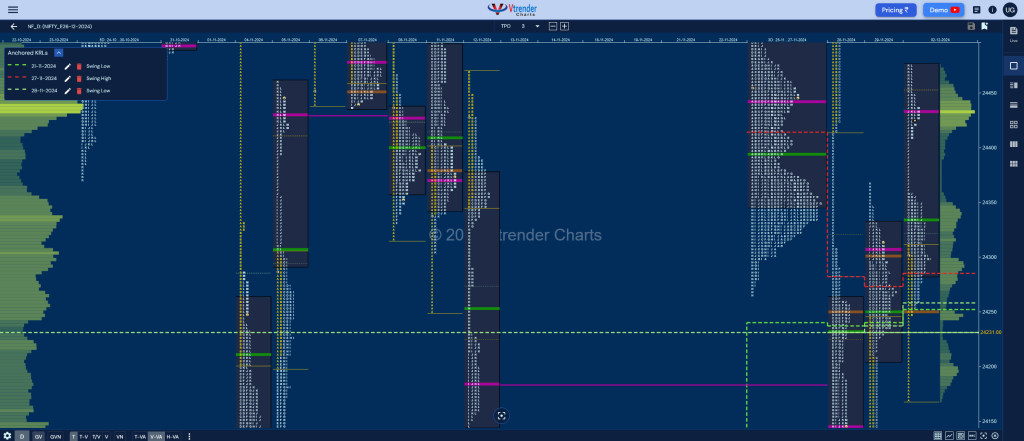

Nifty Dec F: 24428 [ 24475 / 24168 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 36,322 contracts |

| Initial Balance |

|---|

| 142 points (24310 – 24168) |

| Volumes of 79,247 contracts |

| Day Type |

|---|

| Double Distribtion – 307 pts |

| Volumes of 2,29,734 contracts |

NF made an OAIR start but took support right at previous session’s IB low indicating that the buyers were still in control and not only left an A period buying tail from 24246 to 24168 but went on to leave an extension handle at 24359 to form a Double Distribution Trend Day Up but saw the dPOC shifting higher to 24433 into the close signalling some profit booking.

The auction will need to stay above 24433 for more upside towards the 27th Nov’s Swing high of 24524 & 06th Nov’s POC of 24737 whereas on the downside, the DD zone of 24359 to 24408 will be the support zone along with today’s VWAP of 24333 which will need to be held by the buyers.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24433 F and VWAP of the session was at 24333

- Value zones (volume profile) are at 24282-24433-24474

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (22 – 28 Nov) – to be updated…

Monthly Zones

- The settlement day Roll Over point (Dec 2024) is 24125

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

- The VWAP & POC of Sep 2024 Series is 25516 & 25415 respectively

Business Areas for 03rd Dec 2024

| Up |

| 24433 – POC (02 Dec) 24485 – RS POC (28 Nov) 24524 – Swing High (28 Nov) 24577 – Sell tail (11 Nov) 24638 – Sell Tail (07 Nov) 24691 – IB tail mid (07 Nov) 24737 – VPOC (06 Nov) |

| Down |

| 24408 – DD zone (02 Dec) 24359 – Ext Handle (02 Dec) 24297 – PBL (02 Dec) 24246 – Buy Tail (02 Dec) 24207 – IB Tail mid (02 Dec) 24168 – PDL 24125 – RO point (Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.