Nifty Jun F: 9963 [ 9988 / 9780 ]

HVNs – 9093 / 9275 / 9433 / 9785 / 9868

NF opened higher after which it came back lower to test yesterday’s prominent POC of 9785 where it got rejected leaving a small tail from 9792 t0 9780 which confirmed that the PLR was still on the upside as the auction probed higher in the IB where it made a high of 9886 and after a quiet first half of the day, NF made multiple REs (Range Extension) starting from the ‘F’ period as it made new highs for the week & went on to almost tag the 2 IB objective of 9992 as it spiked higher into the close while tagging 9988. Value was mostly higher for the day with the close also at highs so looks like this imbalance is going to continue at open in the next session with the spike zone of 9933 to 9988 as the reference.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV – 2 IB)

- Largest volume was traded at 9933 F

- Vwap of the session was at 9883 with volumes of 164.1 L and range of 208 points as it made a High-Low of 9988-9780

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9851-9933-9973

Main Hypos for the next session:

a) NF needs to sustain above 9973 for a rise to 9999 / 10020-47 / 10076-95 / 10125 / 10150 & 10175-183

b) The auction below 9951 could test lower levels of 9933-11 / 9883-68 / 9851-40 / 9814-05 / 9785 & 9761-56

Extended Hypos:

c) Above 10183, NF can probe higher to 10196-212 / 10240 / 10266 / 10297-301 / 10335-347 & 10365-375

d) Below 9756, the auction can fall further to 9740-15 / 9690 / 9670-56 / 9640-25 / 9594-77 & 9555

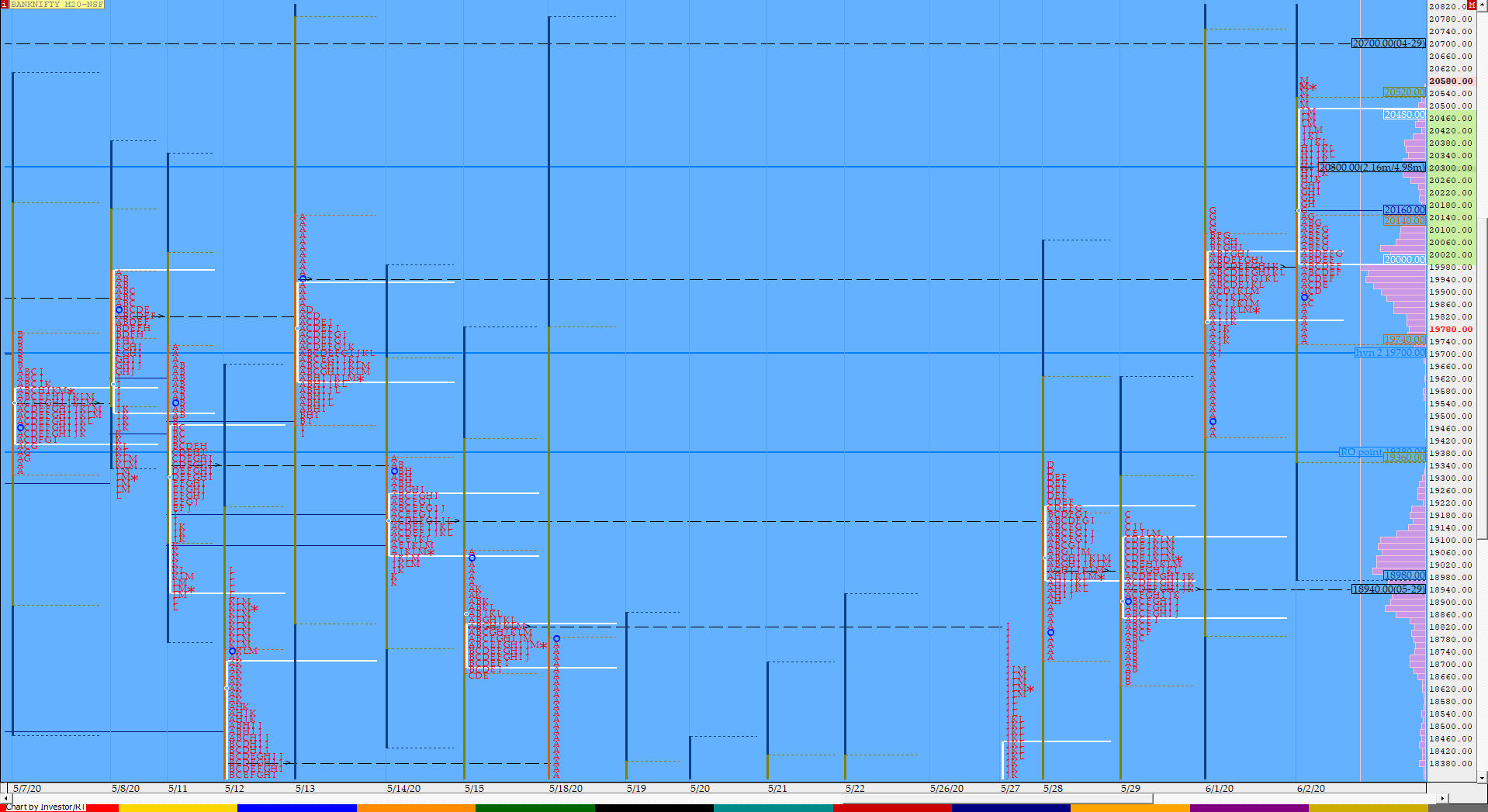

BankNifty Jun F: 20466 [ 20584 / 19750 ]

HVNs – 17800 / 19000 / 19186 / 19980 / 20300

BNF opened right near previous close and remained in previous day’s range till the ‘G’ period forming a nice balance betweeb 20155 to 19750 and similar to NF, had left a small buying tail from 19877 to 19750 which then led to a late RE for the day in the ‘G’ period where the auction left an extension handle at 20155 and went on to form a DD (Double Distrubution) Trend Up profile as it closed with a spike higher of 20421 to 20584 which completed the 2 IB tagret for the day too. Value for the day was mostly higher so the PLR remains on the upside with 20300 being the new reference & support zone for the rest of the week.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV – 2 IB)

- Largest volume was traded at 20300 F

- Vwap of the session was at 20156 with volumes of 75.1 L and range of 834 points as it made a High-Low of 20584-19750

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20035-20300-20573

Main Hypos for the next session:

a) BNF needs to sustain above 20502 for a rise to 20584-600 / 20735-755 / 20819-840 / 20898-914 / 20975-21030 / 21090-116 & 21175-240

b) The auction staying below 20450 could test 20400-394 / 20300 / 20180-124 / 20088-022 / 19980-962 / 19877-820 & 19764-700

Extended Hypos:

c) Above 21240, BNF can probe higher to & 21300-380 / 21431-456 / 21506-528 / 21600-690 / 21762-785 & 21888-932

d) Below 19700, lower levels of 19650-575 / 19500-450 / 19349-295 / 19186 / 19099-085 & 19015-18980 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout