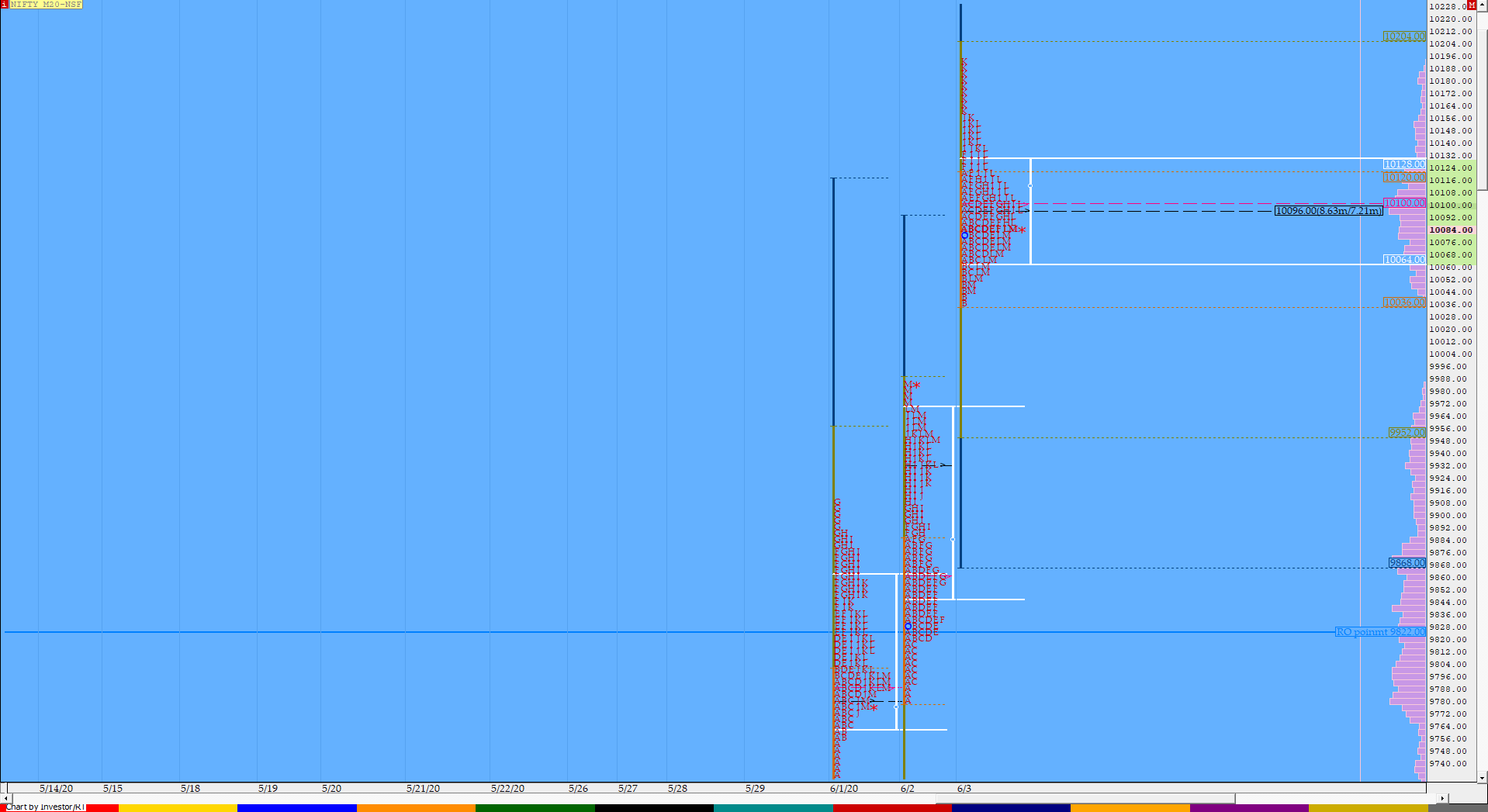

Nifty Jun F: 10072 [ 10193 / 10036 ]

HVNs – 9093 / 9275 / 9433 / 9785 / 9868 / 10100

NF continued the previous day’s imbalance close in form of a big gap up of 118 points and played out a typical OAOR (Open Auction Out of Range) day forming a nice balance inside the IB for most part of the day before it spiked higher in the ‘K’ period as it hit 10193 but this move away from the day’s prominent POC of 10100 was swiftly rejected as the auction left a selling tail from 10156 to 10193 which led to a big liquidation drop as it almost tested the morning lows of 10036 before closing the day at 10072. Value for the day was higher but the excess at top could mean that the upside probe which started last week has ended and NF could begin to form a balance here or give a retracement to 9933 / 9868 & 9785 in the coming session(s).

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 10100 F

- Vwap of the session was at 10103 with volumes of 169.3 L and range of 157 points as it made a High-Low of 10193-10036

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10067-10100-10131

Main Hypos for the next session:

a) NF needs to sustain above 10080 for a rise to 10100 / 10122-131 / 10156 / 10180-190 / 10212 & 10240-266

b) The auction remains weak below 10067 for a test of 10050-44 / 10023 / 9999-87 / 9962-33* / 9911-00 & 9868*

Extended Hypos:

c) Above 10266, NF can probe higher to 10297-302 / 10335-347 / 10365-375 / 10401-410 & 10440-455

d) Below 9868, the auction can fall further to 9851-40 / 9814-05 / 9785-56 / 9740-15 & 9690

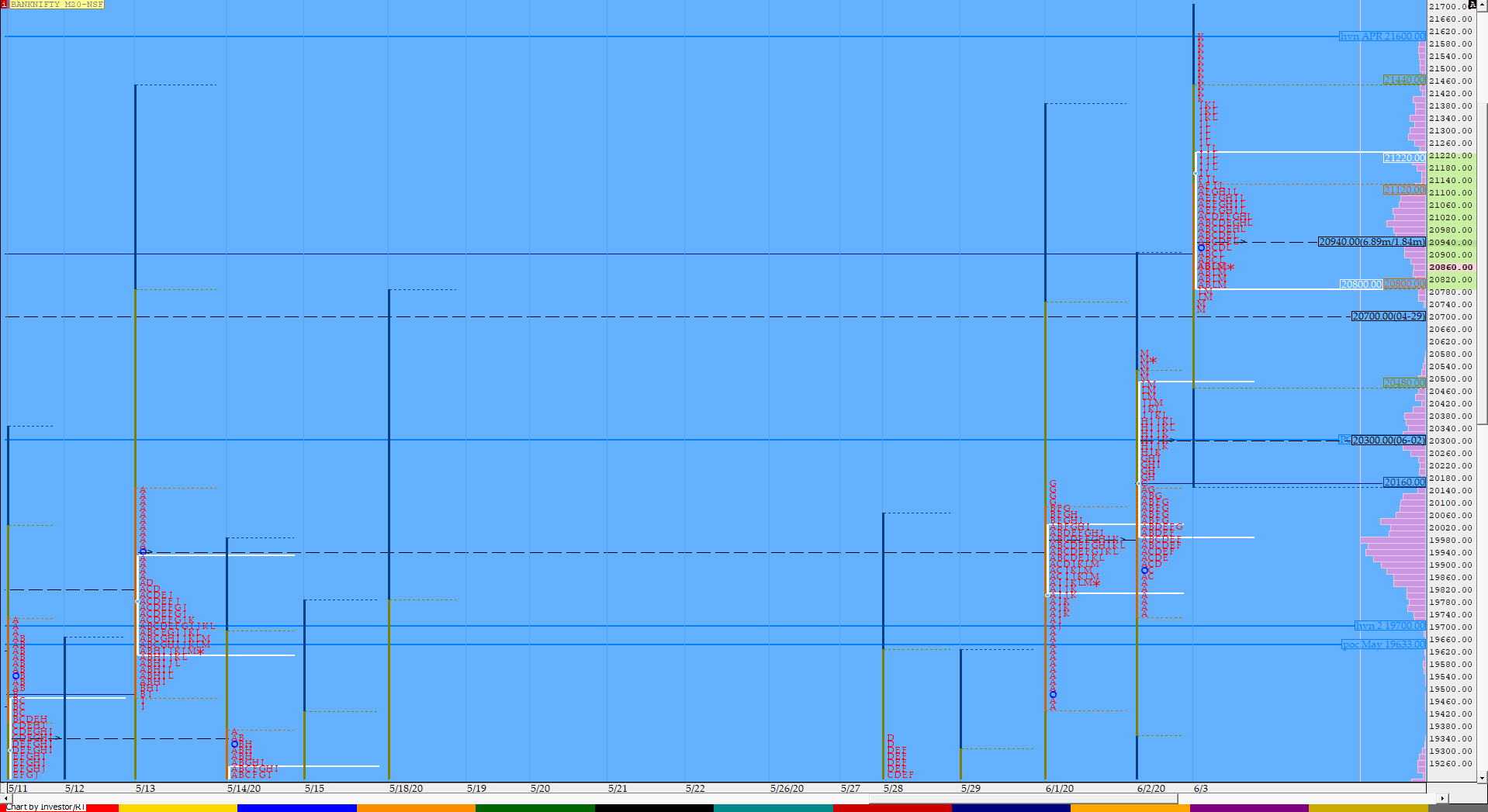

BankNifty Jun F: 20882 [ 21611 / 20739 ]

HVNs – 17800 / 19000 / 19186 / 19980 / 20300 / 20940

BNF also opened with a gap up of 469 points & formed a balance inside IB for the first half of the day before it gave a good range extesion in the ‘I’ period and similar to NF, spiked in the ‘K’ period completing the 2 IB objective as it made a high of 21611 from where it quickly gave up all the gains as it left a long tail at top from 21399 to 21611 and went on to make new lows for the day at 20739 before closing just below the dPOC of 20940 to leave a Neutral Day with higher Value.

- The BNF Open was a Open Auction Out Range (OAOR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 20940 F

- Vwap of the session was at 21095 with volumes of 93.6 L and range of 872 points as it made a High-Low of 21611-20739

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20778-20940-21140

Main Hypos for the next session:

a) BNF needs to sustain above 20885 for a rise to 20940-952 / 21000-093 / 21125-140 / 21201-300 / 21399 & 21525-608

b) Staying below 20856, the auction could test 20775-765 / 20701 / 20585-450 / 20395-300* / 20186 & 20130-088

Extended Hypos:

c) Above 21608, BNF can probe higher to & 21662-690 / 21764-785 / 21888-932 / 22000-110 / 22200 & 22350-380

d) Below 20088, lower levels of 20022 / 19980-877 / 1982-764 / 19700-650 / 19575-500 & 19450-344 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://www.explara.com/e/vtrendertradingroomlive