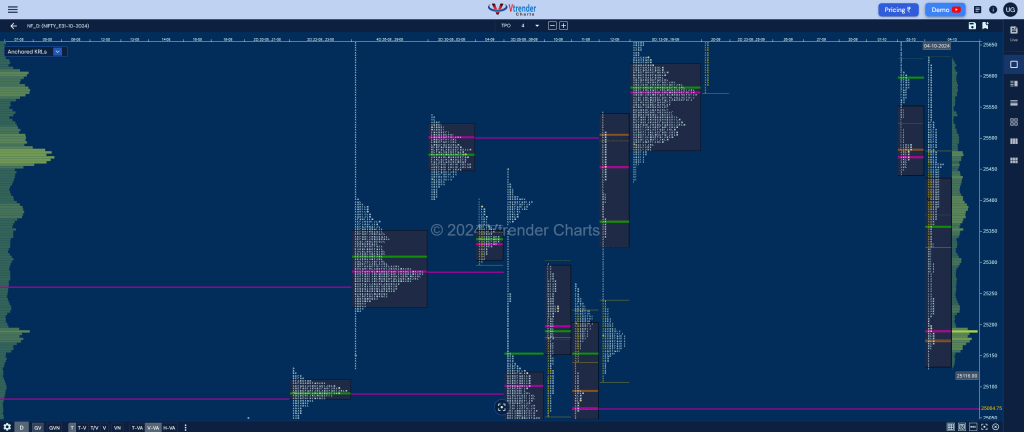

Nifty Oct F: 25173 [ 25631 / 25129 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 45,332 contracts |

| Initial Balance |

|---|

| 155 points (25480 – 25325) |

| Volumes of 1,11,553 contracts |

| Day Type |

|---|

| Neutal Extreme – 501 pts |

| Volumes of 4,67,477 contracts |

NF continued previous session’s imbalance with a gap down and new lows of 25325 but left an A period buying as it got back into previous range and tagged the HVN of 25480 in the B TPO which was followed by a RE (Range Extension) in the D to 25524 confirming that the shorter term PLR (Path of Least Resistance) was to the upside.

The auction then made a retracement to 25453 leaving a PBL in the E period confirming that the buyers remained in control and more confirmation came in big RE it made in the F TPO where it scaled above yVWAP of 25599 and tagged the Halfback of 25628 in the marginal RE it made to 25631 in the F almost completing the 2 IB objective of 25635 but saw big supply coming back not only marking the end of the bounce but leading to a RE lower in the H.

NF continued to trend lower till the L period breaking below the 12th Sep extension handle of 25238 and completing the 2 IB target of 25170 while making a low of 25129 but saw the POC shifting lower to 25190 signalling profit booking by the sellers as it formed another HVN at 25175 eventually closing there leaving a Neutral Extreme Day Down.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25190 F and VWAP of the session was at 25358

- Value zones (volume profile) are at 25134-25190-25434

- HVNs are at 25469 / 26347 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (27Sep-03Oct) – NF started the week with new ATH of 26403 but formed a narrow range Gaussian Curve indicating poor trade facilitation and this prompted the sellers to come back aggressively as they completed an elongated Trend Down profile of 963 points as they went on to break the Swing reference of 26091 and made a low of 25440 with the POC stationed higher at 26347 hinting at more downside in the coming week. This week’s VWAP of 25917 now stands to be the swing level for the rest of the series as the down move can extend to the lower weekly (06-12 Sep) VPOC of 25200 & buying tail from 24992 to 24951 apart from the VWAP of 24871 (16-22 Aug)

- (20-26 Sep) – NF has formed an elongated trend up profile in a range of 764 points with 3 extension handles at 25921, 26155 & 26244 closing around the RO (RollOver) point of 26310 and has left completely higher Value at 25991-26216-26269 with the VWAP at 26091 which will be the Swing support for the new series going forward

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 26310

- The VWAP & POC of Sep 2024 Series is 25516 & 25415 respectively

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

Business Areas for 07th Oct 2024

| Up |

| 25175 – HVN (04 Oct) 25215 – Ext Handle (04 Oct) 25257 – H TPO h/b (04 Oct) 25325 – NeuX IBL (04 Oct) 25380 – 04 Oct Halfback 25440 – Daily Ext Handle |

| Down |

| 25162 – Buy tail (04 Oct) 25121 – Buy Tail (12 Sep) 25064 – VPOC (11 Sep) 25002 – Buy Tail (09 Sep) 24951 – Swing Low (09 Sep) 24900 – A TPO POC (20 Aug) |

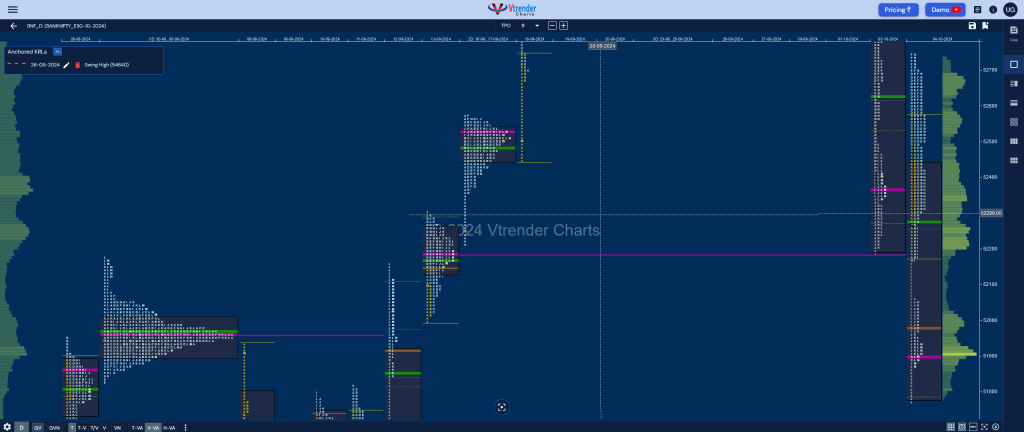

BankNifty Oct F: 51871 [ 52741 / 51771 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 14,815 contracts |

| Initial Balance |

|---|

| 408 points (52570 – 52162) |

| Volumes of 49,221 contracts |

| Day Type |

|---|

| Neutral Extreme – 970 pts |

| Volumes of 1,85,490 contracts |

BNF opened with a look down below PDL tagging 13th Sep’s VPOC of 52184 where it got swiftly rejected triggering a quick bounce above YPOC of 52369 as it made new highs of 52750 in the B period and gave a retracement lower to 52280 in the C side taking support at VWAP hinting that the supply was not active.

The auction then went on to make a RE in the D TPO scaling above yVWAP of 52627 and made higher highs in the E & F also but showed signs of sellers coming back in the G period as it confirmed similar highs of 52741 stalling right at the E TPO’s halfback of previous profile resulting in a big drop lower which was followed by the break of VWAP in the H along with an extension handle at IBL of 52162 confirming complete control by the sellers.

BNF went on to make multiple REs lower till the L TPO making a low of 51771 where it saw profit booking happening as it left a responsive buying tail till 51862 along with the POC shifting to 51902 which will be the opening reference for the next session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51902 F and VWAP of the session was at 52275

- Value zones (volume profile) are at 51785-51902-52436

- HVNs are at 53444 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (26Sep-01Oct) – BNF has formed another DD on the weekly but this time to the downside after it left poor highs at ATH of 54640 indicating exhaustion and went on to move away from the HVN of 54432 with a zone of singles from 54125 to 53737 forming completely lower value at 53252-53444-53816 with the POC shifting to the lower distribution so will be the reference for the coming week with the DD VWAP of 53904 now being a swing supply point.

- (19 – 25 Sep) – BNF formed a DD (Double Distibution) Trend Up profile on the weekly with completely higher Value at 54291-54335-54485 with the important VWAP being at 54074 and the DD singles from 54080 to 53888 which will be the support zone to watch as the new series develops

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 54340

- The VWAP & POC of Sep 2024 Series is 52281 & 51404 respectively

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

Business Areas for 07th Oct 2024

| Up |

| 51902 – POC (04 Oct) 51979 – HVN (04 Oct) 52062 – I TPO tail (04 Oct) 52162 – Ext Handle (04 Oct) 52275 – NeuX VWAP (04 Oct) 52390 – G TPO POC (04 Oct) |

| Down |

| 51867 – Buy tail (04 Oct) 51770 – J TPO h/b (12 Sep) 51647 – VPOC (12 Sep) 51561 – Buy tail (12 Sep) 51461 – VPOC (11 Sep) 51362 – J TPO h/b (09 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.