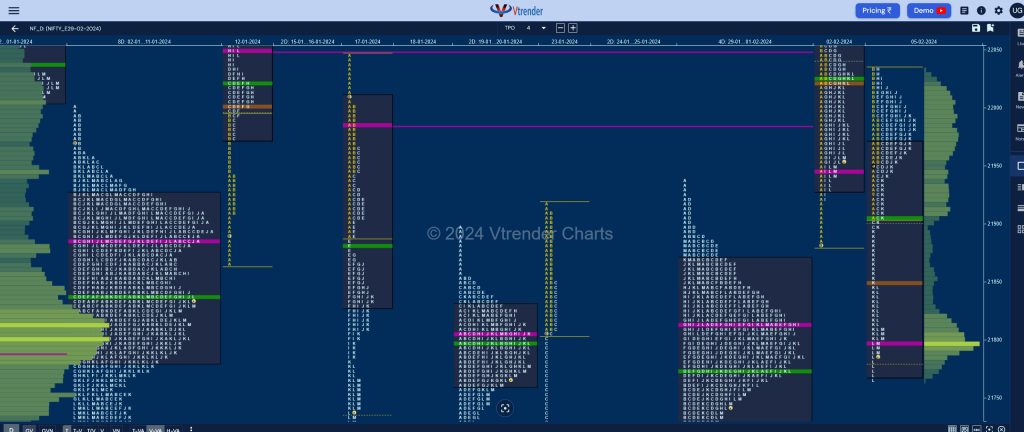

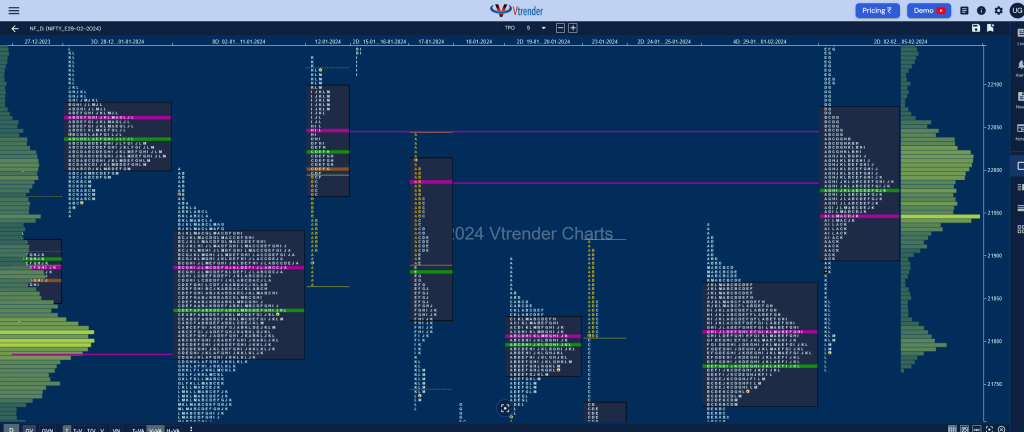

Nifty Feb F: 21803 [ 22036 / 21765 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 15,350 contracts |

| Initial Balance |

|---|

| 135 points (22036 – 21901) |

| Volumes of 40,011 contracts |

| Day Type |

|---|

| Normal Variation – 271 points |

| Volumes of 1,58,291 contracts |

NF made an OAIR start taking support in the A period singles of previous session and went on to probe higher in the B TPO where it tested yVWAP of 22027 while making a high of 22036 stalling right at the halfback point of 22040 of 02nd Feb indicating sellers holding this zone.

The auction then made a typical C side extension to 21896 which was swiftly rejected triggeing a short covering move higher back to 22032 in the H TPO but once again the supply came back here and this time they managed to give a fresh RE in the K period leaving an extension handle and swiped through the 4-day composite (29th Jan to 01st Feb) while making a low of 21765 in the L and saw some profit booking by the sellers as the dPOC shifted lower to 21796 into the close.

NF formed overlapping to lower value but structure wise has left a nice 2-day balance with Value at 21898-21945-22073 which will be the reference on the upside moving forward in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21796 F and VWAP of the session was at 21904

- Value zones (volume profile) are at 21768-21796-21969

- NF confirmed a FA at 21920 on 01/02. This FA was taken out at open on 02/02 and the auction went on to tag the 1 ATR target of 22186 to the upside. This FA was revisited and broken on 05/02 and is no longer a valid reference.

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29 Jan-01 Feb) – NF opened higher this week and remained above previous week’s VWAP of 21540 throughout even making a look up above the highs of 21916 but left a daily FA at 21920 forming overlapping value on all 4 days leaving a Neutral profile and a nice Gaussian Curve with completely higher Value at 21726-21813-21869 with a very prominent POC which will act as a magnet unless we get an initiative move away from here in the coming week

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 06th Feb 2024

| Up |

| 21796 – POC from 05 Feb 21848 – Mid-profile singles 21904 – VWAP from 05 Feb 21945 – SOC from 05 Feb 21982 – SOC from 05 Feb 22032 – Selling tail (05 Feb) |

| Down |

| 21785 – Closing tail (05 Feb) 21733 – Buying tail (01 Feb) 21690 – B TPO halfback (31 Jan) 21652 – Buying Tail (31 Jan) 21611 – IB tail mid (31 Jan) 21581 – Jan series VWAP |

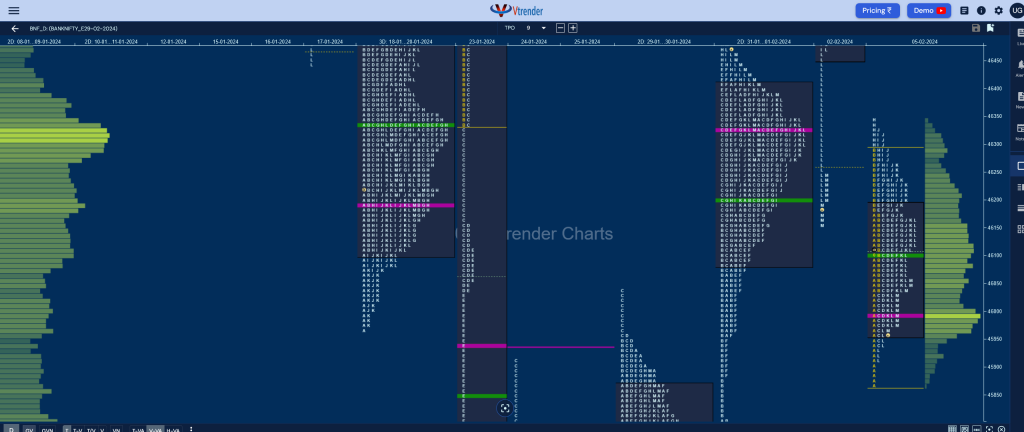

BankNifty Feb F: 46040 [ 46349 / 45867 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 27,824 contracts |

| Initial Balance |

|---|

| 428 points (46295 – 45867) |

| Volumes of 61,497 contracts |

| Day Type |

|---|

| Normal – 482 points |

| Volumes of 1,95,621 contracts |

BNF continued previous session’s imbalance by opening lower and hitting 45867 but stalled right at the 2-day VAH (29-30 Jan) from where it had given an initiative breakout on 31st Jan and settled down to form a relatively narrow range Normal Day and a balanced profile but saw supply coming back just below the Jan series VWAP of 46353 level.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45997 F and VWAP of the session was at 46102

- Value zones (volume profile) are at 45958-45997-46195

- BNF confirmed a FA at 45882 on 01/02 and completed the 1 ATR target of 46639 on the 02/02. The 2 ATR objective comes to 47396

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29-31 Jan) – BNF took support multiple times at previous week’s VWAP of 45492 forming a Neutral Extreme weekly profile to the upside giving a move away from the prominent POC of 45717 on the last day where it went on to hit new highs of 46444 forming overlapping to higher Value at 46429-45717-45994 but this week’s NeuX VWAP of 45883 will be the important reference going forward if it has to continue higher towards the selling tail from 46720 & extension handle of 47115 in the coming week

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 06th Feb 2024

| Up |

| 46059 – M TPO high (05 Feb) 46180 – SOC from 05 Feb 46328 – Selling tail (05 Feb) 46471 – Ext Handle (02 Feb) 46686 – NeuX VWAP (02 Feb) 46800 – HVN from 02 Feb |

| Down |

| 45997 – POC from 05 Feb 45864 – 2-day VAH (29-30 Jan) 45717 – Weekly VPOC 45592 – 2-day VAL (29-30 Jan) 45453 – 2-day tail (29-30 Jan) 45298 – SOC from 25 Jan |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.