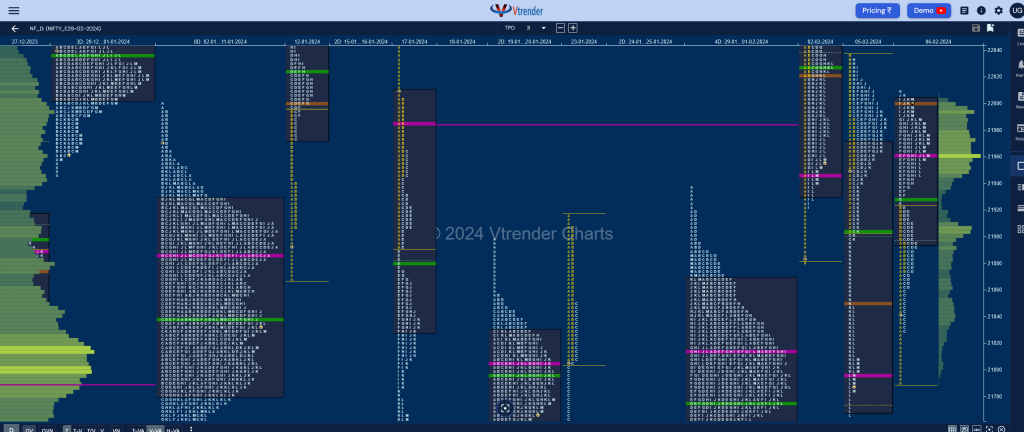

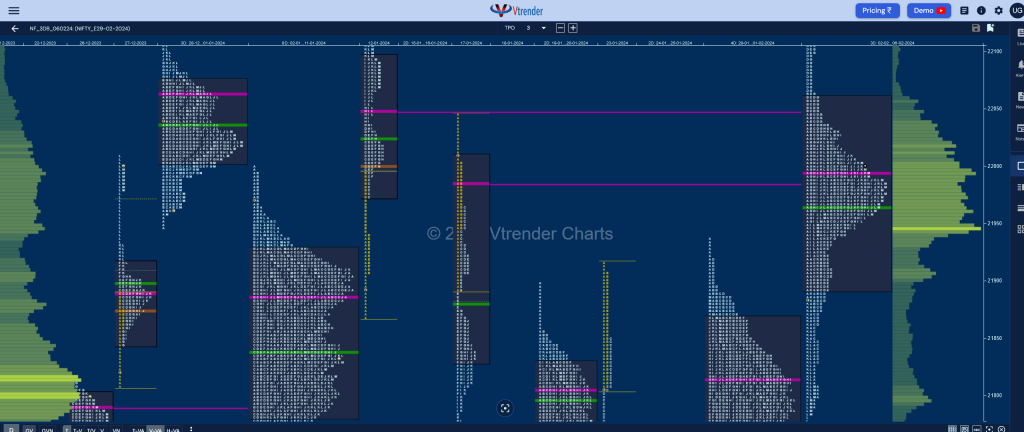

Nifty Feb F: 21979 [ 22015 / 21790 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,245 contracts |

| Initial Balance |

|---|

| 133 points (21923 – 21790) |

| Volumes of 35,675 contracts |

| Day Type |

|---|

| Double Distribution – 225 pts |

| Volumes of 1,29,365 contracts |

NF made an OAIR start but gave a move away from yPOC of 21796 as it left an A period buying tail confirming that the previous day’s sellers had booked out at close and went on to scale into the K period singles and got above the VWAP of 21904 in the B TPO as it made a high of 21929 but made that dreaded C side contra move lower which ate up most of the morning singles but eventually saw demand coming back as seen in the PBL it left at 21830.

The auction then made a RE (Range Extension) to the upside in the E period leaving an extension handle and went on to make higher highs for most of the TPOs till the K where it hit 22015 and saw some profit booking by the buyers as it formed a HVN right at 22000 and gave a pull back down to 21945 in the L TPO taking support just above VWAP before closing the day around the POC of 21960 leaving a Double Distribution Trend Day Up.

NF was completely inside previous day’s range and value also was overlapping for the third successive session forming a nice 3-day balance with Value at 21891-21994-22060 with the VWAP of this composite at 21965 so can give a move away from this zone in the coming session(s) provided it is backed by good initiative volumes.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21962 F and VWAP of the session was at 21927

- Value zones (volume profile) are at 21895-21962-22005

- HVNs are at 21813 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29 Jan-01 Feb) – NF opened higher this week and remained above previous week’s VWAP of 21540 throughout even making a look up above the highs of 21916 but left a daily FA at 21920 forming overlapping value on all 4 days leaving a Neutral profile and a nice Gaussian Curve with completely higher Value at 21726-21813-21869 with a very prominent POC which will act as a magnet unless we get an initiative move away from here in the coming week

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 07th Feb 2024

| Up |

| 21994 – 3-day POC (02-06 Feb) 22060 – 3-day VAH (02-06 Feb) 22107 – SOC from 02 Feb 22140 – SOC from 02 Feb 22189 – Selling tail (02 Feb) |

| Down |

| 21981 – M TPO halfback 21945 – PBL from 06 Feb 21891 – 3-day VAL (02-06 Feb) 21830 – Buying Tail (06 Feb) 21785 – Closing tail (05 Feb) |

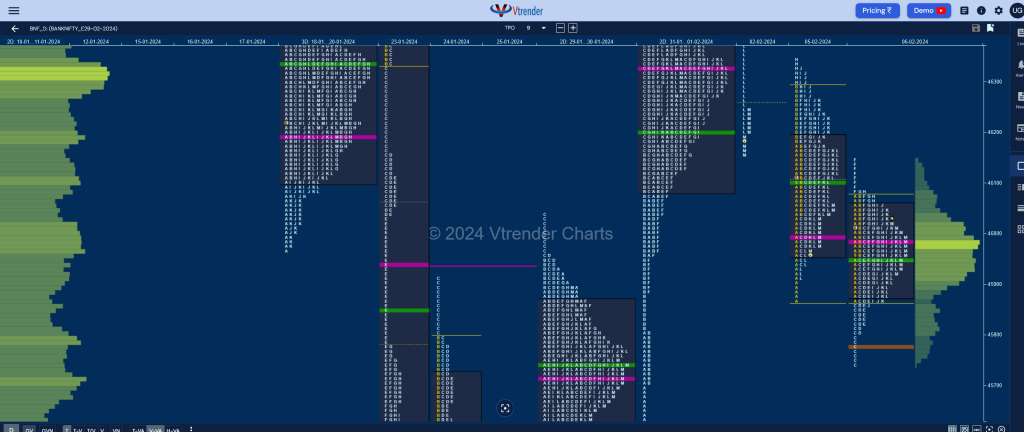

BankNifty Feb F: 45971 [ 46165 / 45740 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 16,393 contracts |

| Initial Balance |

|---|

| 228 points (46097 – 45869) |

| Volumes of 34,875 contracts |

| Day Type |

|---|

| Neutral Centre – 425 points |

| Volumes of 1,68,763 contracts |

BNF also made an OAIR start taking support just above PDL of 45867 as it made a low of 45869 and made couple of attempts to probe above previous session’s M TPO high of 46059 in the A & B periods but could only manage to hit 46097 unable to get above yVWAP of 46102 which then led to a typical C side extension lower as it got into the 2-day Gaussian Curve (29-30 Jan) triggering the 80% Rule but stalled right at the VWAP of that composite which was at 45741 where it saw big demand coming back.

The auction then not only gave the mandatory retracement back to day’s VWAP in the E TPO but went on to make a RE to the upside in the F as it made new highs for the day at 46165 but saw sellers coming back just below 05th Feb’s SOC of 46180 which marked the highs for the day.

BNF then remained largely in the narrow IB (Initial Balance) range of 228 points for the rest of the day forming a nice balance and a prominent POC at 45984 leaving a 3-1-3 profile for the day with a good chance of moving away from here if it gets initiative buying or selling which negates one of the tails from today’s Neutral Centre profile.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45984 F and VWAP of the session was at 45951

- Value zones (volume profile) are at 45880-45984-46056

- BNF confirmed a FA at 45882 on 01/02 and completed the 1 ATR target of 46639 on the 02/02. The 2 ATR objective comes to 47396. This FA has been revisited and is no longer a valid reference.

- HVNs are at 46321 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29-31 Jan) – BNF took support multiple times at previous week’s VWAP of 45492 forming a Neutral Extreme weekly profile to the upside giving a move away from the prominent POC of 45717 on the last day where it went on to hit new highs of 46444 forming overlapping to higher Value at 46429-45717-45994 but this week’s NeuX VWAP of 45883 will be the important reference going forward if it has to continue higher towards the selling tail from 46720 & extension handle of 47115 in the coming week

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 07th Feb 2024

| Up |

| 45984 – POC from 06 Feb 46085 – Selling tail (06 Feb) 46180 – SOC from 05 Feb 46328 – Selling tail (05 Feb) 46471 – Ext Handle (02 Feb) 46686 – NeuX VWAP (02 Feb) |

| Down |

| 45951 – VWAP from 06 Feb 45805 – Buying tail (06 Feb) 45717 – Weekly VPOC 45592 – 2-day VAL (29-30 Jan) 45453 – 2-day tail (29-30 Jan) 45298 – SOC from 25 Jan |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.