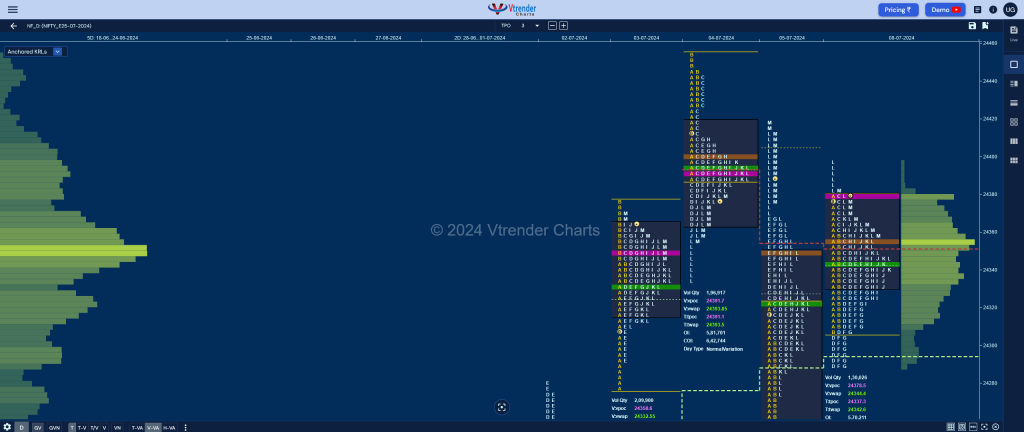

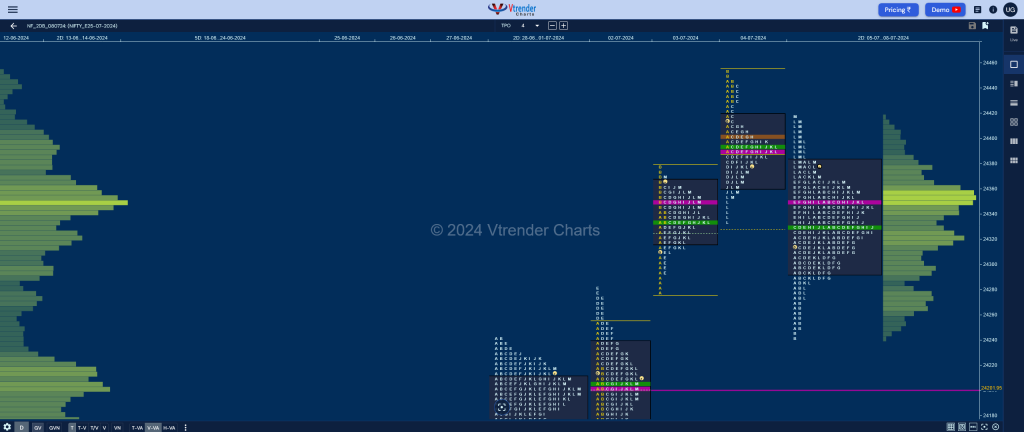

Nifty Jul F: 24375 [ 24399 / 24286 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 18,088 contracts |

| Initial Balance |

|---|

| 77 points (24383 – 24306) |

| Volumes of 40,527 contracts |

| Day Type |

|---|

| Neutral – 113 pts |

| Volumes of 1,30,096 contracts |

NF has formed a narrow range Inside Day leaving a well balanced 2-day composite with Value at 24294-24351-24381 and can move away from here provided we get some initiative volumes at open in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24378 F and VWAP of the session was at 24344

- Value zones (volume profile) are at 24330-24378-24380

- HVNs are at 24201 / 24350** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28 Jun – 04 Jul) – NF has formed a Neutral Extreme profile to the upside leaving a FA at lows of 24082 which will be the swing reference for this series and has formed mostly higher Value at 24084-24201-24329 with this week’s VWAP at 24251 which will be the important support level going forward

Monthly Zones

- The settlement day Roll Over point (July 2024) is 24110

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

Business Areas for 09th Jul 2024

| Up |

| 24381 – 2-day VAH (05-08 Jul) 24444 – Sell Tail (04 Jul) 24496 – Weekly 2 IB 24550 – 2 ATR (VPOC 24202) 24613 – Prev Week Range |

| Down |

| 24351 – 2-day POC (05-08 Jul) 24294 – 2-day VAL (05-08 Jul) 24240 – Swing Low (04 Jul) 24202 – VPOC (02 Jul) 24150 – Buy tail (02 Jul) |

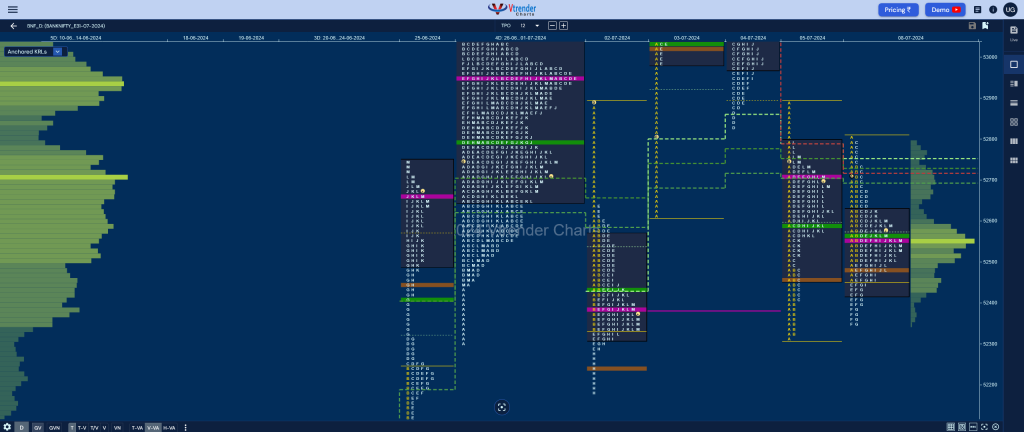

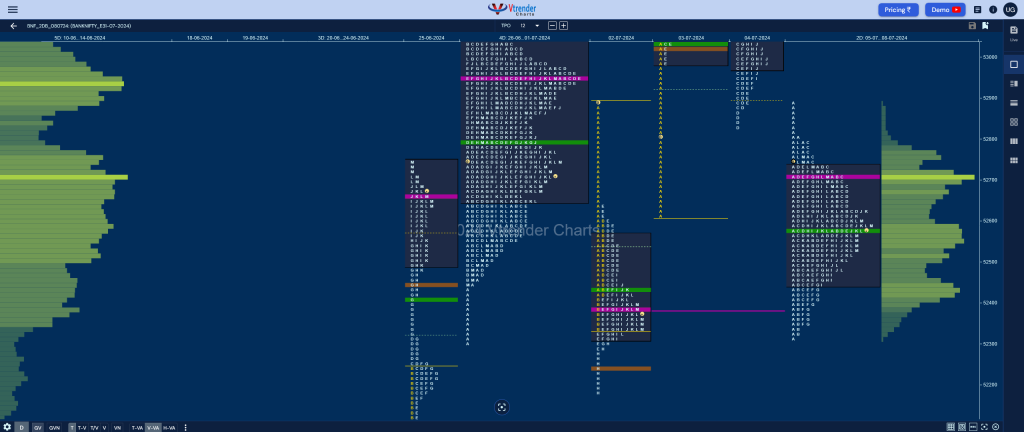

BankNifty Jun F: 52560 [ 52803 / 52350 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 20,689 contracts |

| Initial Balance |

|---|

| 347 points (52803 – 52456) |

| Volumes of 43,217 contracts |

| Day Type |

|---|

| Normal – 588 pts |

| Volumes of 1,30,740 contracts |

BNF has also formed an inside bar both in terms of range & value setting up a nice 2-day composite with Value at 52445-52704-52732 and has a good chance of moving away from here in the coming session(s)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 52554 F and VWAP of the session was at 52569

- Value zones (volume profile) are at 52419-52554-52625

- HVNs are at 53089** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (27 Jun -03 Jul) – BNF has formed a Neutral Centre weekly profile taking support at previous week’s VWAP of 52306 where it left a responsive buying tail and went on to make new ATH of 53249 on the last day before closing right at the POC of 53089. This week’s Value was overlapping to higher at 52630-53089-53194 with the VWAP at 52793 which will be an important support for the coming week

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 09th Jul 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.