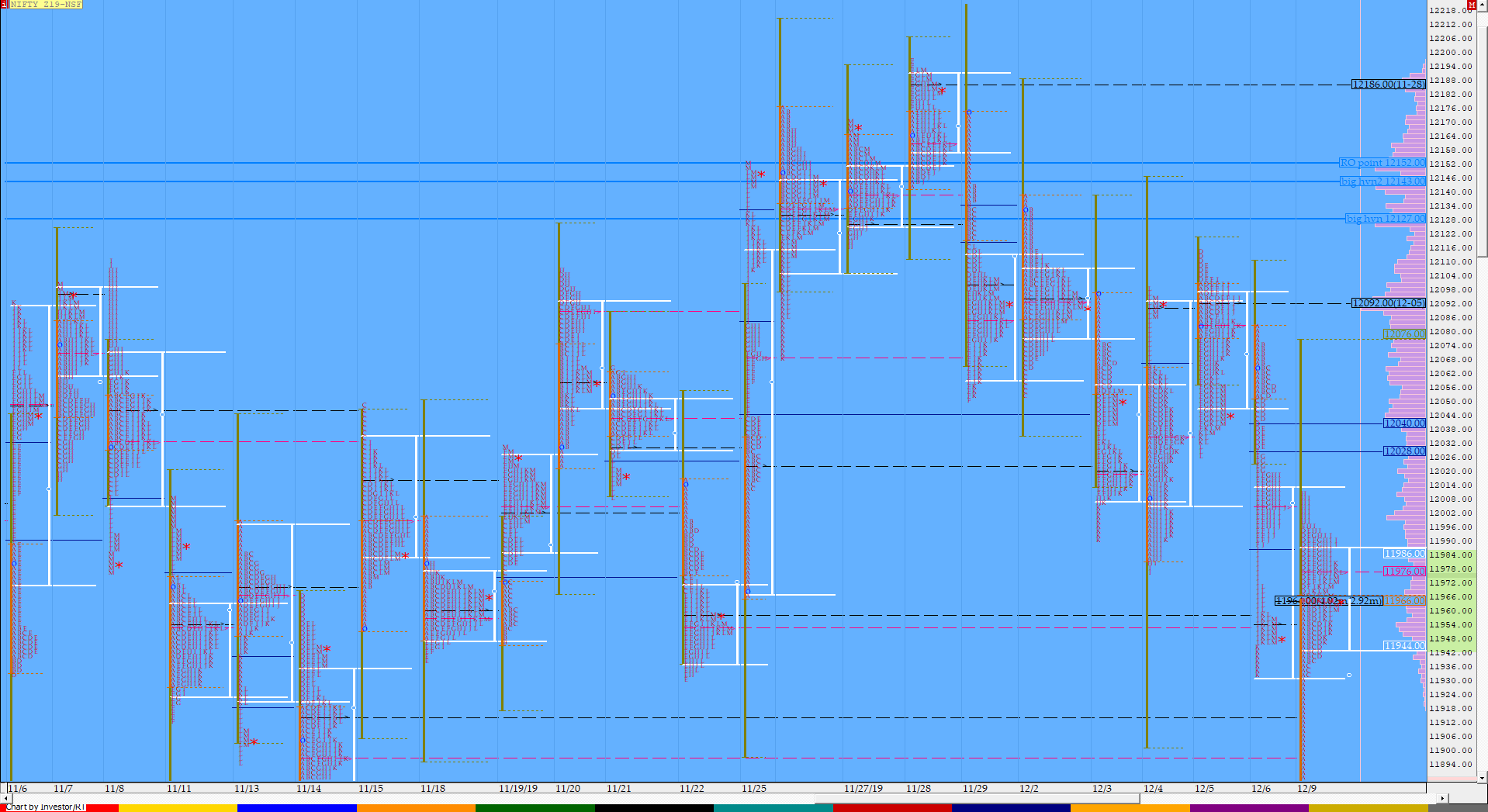

Nifty Dec F: 11967 [ 12012/ 11918 ]

HVNs – 11914 / 11955-965 / 12090 / 12108 / 12128-143 / 12192

A Trend Day is followed by a balance most of the times & today was a good example of the same. NF opened the day with a freak tick at 11855 but was immediately back in previous day’s range as it left a small tail at lows from the actual low of 11918 to 11938 in the IB (Initial Balance) as it scaled above the yPOC of 11953 to make a high of 11965. The ‘C’ period then probed into the morning tail but took support right above the PDL as it made a low of 11932 which indicated that the morning buyers were defending their zone. The auction then made a RE (Range Extension) in the D period as it completed the 1.5 IB extension higher and made a marginally higher high of 11996 in the ‘E’ period but was looking exhausted as the next 2 periods remained inside the range of ‘E’ after which NF made a fresh RE to the upside in the ‘H’ period taking out the Trend Day VWAP of 12005 for a brief while but as expected the supply was back in full force as the auction made highs of 12012 and made a sharp pull back over the next 3 periods as it broke below VWAP making lows of 11946 in the ‘K’ period before closing the day around the combo of the dPOC & VWAP to leave a balanced profile for the day with Value completely inside the previous day’s Value and has a good chance of giving a move away from here in the next session. The MPLite chart of the 2-day composite can be viewed here.

- The NF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 11965 F

- Vwap of the session was at 11968 with volumes of 73.5 L and range of 94 points as it made a High-Low of 12012-11918

- NF confirmed a FA at 12116 on 05/12 and tagged the 2 ATR objective of 11924 on 09/12. This FA is currently on ‘T+3’ Days

- The Trend Day VWAP of 06/12 at 12005 will be important reference on the upside.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11942-11965-11986

Hypos / Estimates for the next session:

a) NF has immediate supply at 11975-980 above which it could rise to 12003-10 / 12027-30 & 12048-54

b) The auction has support at 11950 below which it could fall to 11930 / 11914-901 & 11883

c) Above 12054, NF can probe higher to 12075 / 12090-96 & 12116-120

d) Below 11883, auction becomes weak for 11860 / 11848-843 & 11816*-810

e) If 12120 is taken out, the auction go up to to 12138-141 / 12166 & 12186*-192

f) Break of 11810 can trigger a move lower to 11795 / 11771-767 & 11749-744

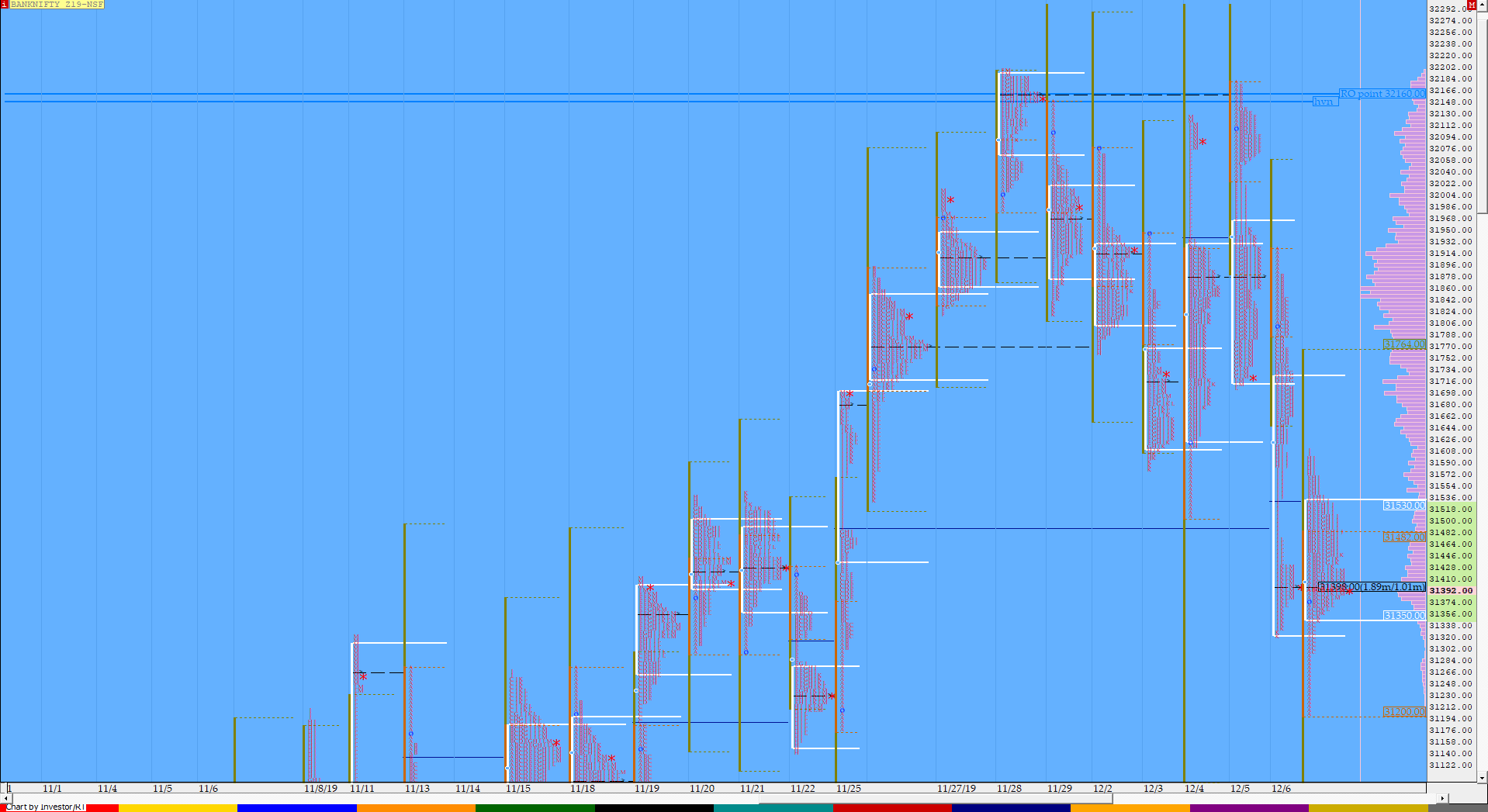

BankNifty Dec F: 31398 [ 31612 / 31201 ]

HVNs – [31380-400] / 31660 / 31855 / 32090 / [32150-160]

BNF opened with what seemed like an OTD (Open Test Drive) Down as it tagged the yPOC of 31400 at open & fell by almost 200 points in the opening 15 minutes giving a rare follow up post a trend day but the next 15 minutes not only reversed the entire move down but the auction went on to make new highs of 31485 in the IB as it left a big buying tail from 31368 to 30201. Similar to NF, the ‘C’ period in BNF also tested the buying tail as it made lows of 31300 but was swiftly rejected from below PDL after which it went on to make a RE to the upside in the ‘D’ period & followed it up with a higher high of 31570 in the ‘E’ period. The auction then consolidated for the next 2 periods staying above VWAP & made a fresh RE higher in the H period as it tagged 31600 and made a marginally higher high of 31612 in the ‘I’ period but in BNF too, strong supply was back around the Trend Day VWAP which led to the retracement of the entire move up as the ‘K’ period made lows of 31349 before the auction closed the day in the HVZ (High Volume Zone) of 31380 to 31400. Value for the day was inside the Trend Day’s lower half and BNF also has made a nice 2-day balance with Value at 31363-31396-31699 and the close has been right at the POC so could give a move away from here in the coming session.

(Click here to view the 2-day composite in BNF)

- The BNF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 31380 F

- Vwap of the session was at 31438 with volumes of 30.3 L and range of 411 points as it made a High-Low of 31612-31201

- BNF confirmed a FA at 32173 on 05/12 and tagged the 2 ATR target of 31501 on 06/12. This FA is currently on ‘T+3’ Days

- The Trend Day VWAP of 06/12 at 31625 will be important reference on the upside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31356-31380-31519

Hypos / Estimates for the next session:

a) BNF needes to sustain above 31440 for a move to 31485 / 31550 & 31600-625

b) Staying below 31380, the auction could test 31334-344 / 31280 & 31201-195

c) Above 31625, BNF can probe higher to 31689-705 / 31760 & 31855-860

d) Below 31195, lower levels of 31137 / 31073-049 & 31002 could be tagged

e) If 31860 is taken out, BNF can give a fresh move up to 31890-920 / 31965 & 32019-25

f) Below 31002, we could see lower levels of 30968-947 / 30891* & 30836

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout