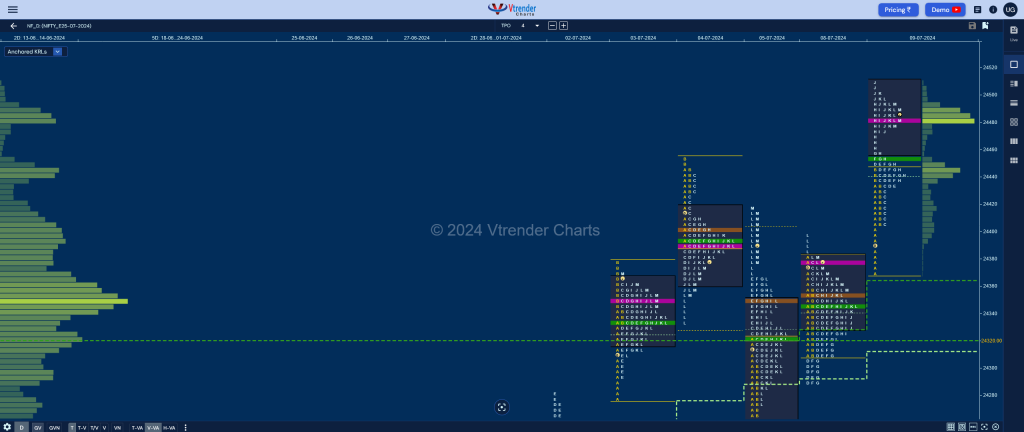

Nifty Jul F: 24485 [ 24510 / 24371 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 13,719 contracts |

| Initial Balance |

|---|

| 75 points (24446 – 24371) |

| Volumes of 34,447 contracts |

| Day Type |

|---|

| Double Distribution – 139 pts |

| Volumes of 1,46,868 contracts |

NF moved away from the balance it has been forming with a Double Distribution Trend Day Up but saw the POC shift higher to 24482 which will be the reference for the next open with todays VWAP of 24455 & buying tail from 24405 being the new swing supports on downside.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24482 F and VWAP of the session was at 24455

- Value zones (volume profile) are at 24459-24482-24509

- NF confirmed a FA at 24286 on 08/07 and completed the 1 ATR objective of 24462 on 09/07. The 2 ATR target comes to 24638

- HVNs are at 24201 / 24350** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28 Jun – 04 Jul) – NF has formed a Neutral Extreme profile to the upside leaving a FA at lows of 24082 which will be the swing reference for this series and has formed mostly higher Value at 24084-24201-24329 with this week’s VWAP at 24251 which will be the important support level going forward

Monthly Zones

- The settlement day Roll Over point (July 2024) is 24110

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

Business Areas for 10th Jul 2024

| Up |

| 24503 – Sell tail (09 Jul) 24555 – 2 ATR (VPOC 24202) 24582 – 1 ATR (24405) 24624 – Weekly 3 IB 24659 – 1 ATR (yPOC 24482) |

| Down |

| 24482 – POC (09 Jul) 24455 – VWAP (09 Jul) 24405 – Buy Tail (09 Jul) 24350 – 4-day VPOC (03-08 Jul) 24286 – FA (08 Jul) |

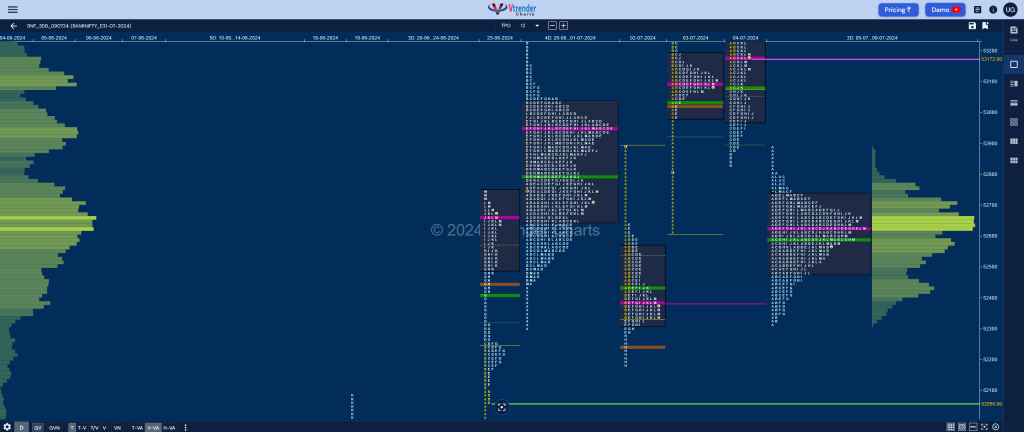

BankNifty Jun F: 52615 [ 52743 / 52500 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,148 contracts |

| Initial Balance |

|---|

| 198 points (52698 – 52500) |

| Volumes of 24,540 contracts |

| Day Type |

|---|

| Normal – 244 pts |

| Volumes of 79,503 contracts |

BNF contnued to coil now extablishing up a nice 3-day composite with Value at 52445-52704-52732 and has a good chance of moving away from here in the coming session(s)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 52635 F and VWAP of the session was at 52640

- Value zones (volume profile) are at 52419-52554-52625

- HVNs are at 53089** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (27 Jun -03 Jul) – BNF has formed a Neutral Centre weekly profile taking support at previous week’s VWAP of 52306 where it left a responsive buying tail and went on to make new ATH of 53249 on the last day before closing right at the POC of 53089. This week’s Value was overlapping to higher at 52630-53089-53194 with the VWAP at 52793 which will be an important support for the coming week

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 10th Jul 2024

| Up |

| 52629 – 3-day POC (05-09 Jul) 52738 – 3-day VAH (05-09 Jul) 52880 – Tail (04 Jul) 53053 – 04 Jul Halfback 53177 – VPOC (04 Jul) 53301 – Swing High (04 Jul) |

| Down |

| 52610 – M TPO VWAP (09 Jul) 52486 – 3-day VAL (05-09 Jul) 52327 – Buy Tail (05 Jul) 52190 – F TPO POC (25 Jun) 52067 – Buy Tail (25 Jun) 51920 – 3-day VAH (20-24 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.