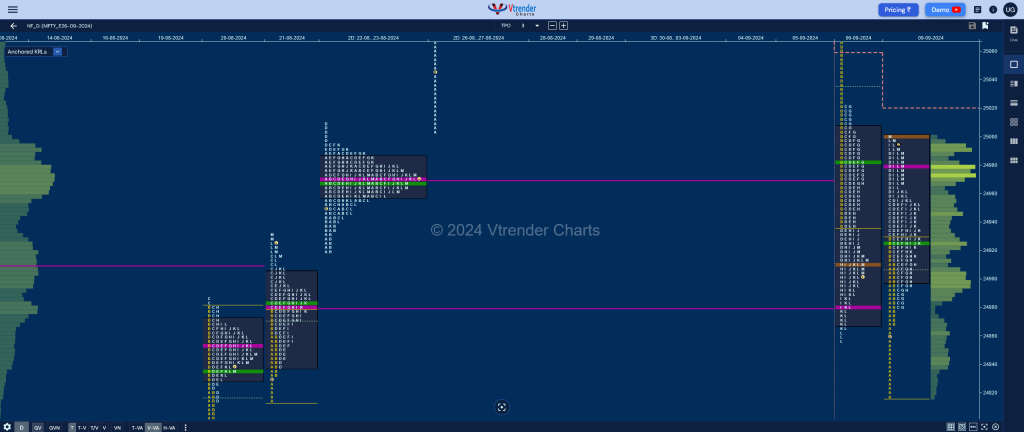

Nifty Sep F: 24985 [ 25000 / 24816 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 31,510 contracts |

| Initial Balance |

|---|

| 112 points (24928 – 24816) |

| Volumes of 66,658 contracts |

| Day Type |

|---|

| Normal Variation – 185 pts |

| Volumes of 2,13,948 contracts |

NF opened with a look down below previous low but failed to get fresh supply as it tested the A period buying tail from 21st Aug and got some demand coming back triggering a move back into previous range and value.

The auction confirmed a A period buying tail and remained above VWAP all day to make multiple REs to the upside forming a Normal Variation profile scaling about the Trend Day VWAP of 24983 and tagging the BRN of 25000 into the close.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24979 F and VWAP of the session was at 24924

- Value zones (volume profile) are at 24897-24979-24999

- NF confirmed a FA at 25113 on 29/08 and completed the 1 ATR objective of 25286 on the same day. This FA was revisited and broken on 06/09 with initiative selling tagging the 1 ATR target of 24940 whereas the 2 ATR comes to 24767

- HVNs are at 25339** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (30Aug-05Sep) – NF has formed a Neutral profile with completely higher Value at 25253-25338-25414 with the VWAP at 25303 as it probed higher for the first 2 sessions hitting new ATH of 25399 & 25420 respectively but failed to get fresh demand and instead got initiative sellers at 25409 who pushed the auction lower where it took support right at previous week’s POC of 25168 and gave a bounce back to 25324 which was again met with supply resulting in a close below Value

- (23-29 Aug) – NF has formed a Double Distribution (DD) profile with completely higher value at 25121-25168-25245 with the DD zone being from 25094 to 24994 and this week’s VWAP at 25186

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 25270

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

Business Areas for 10thSep 2024

| Up |

| 25022 – AVWAP (05 Sep) 25060 – B TPO tail mid (06 Sep) 25113 – Sell Tail (06 Sep) 25156 – A TPO VWAP (06 Sep) 25195 – POC (04 Sep) 25235 – VPOC (05 Sep) |

| Down |

| 24979 – POC (09 Sep) 24924 – VWAP (09 Sep) 24881 – PBL (09 Sep) 24842 – Buy Tail mid (09 Sep) 24782 – Weekly VWAP (16-22 Aug) 24721 – VPOC (19 Aug) |

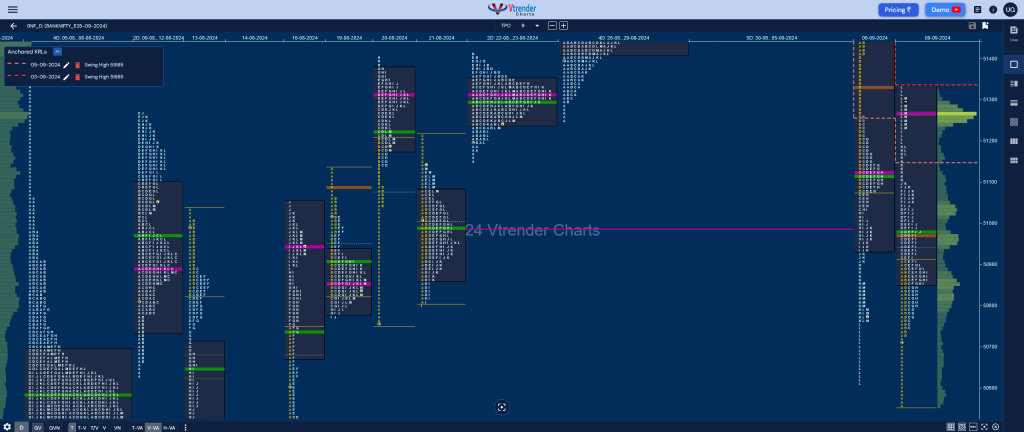

BankNifty Sep F: 51267 [ 51330 / 50555 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,323 contracts |

| Initial Balance |

|---|

| 354 points (50910 – 50555) |

| Volumes of 41,571 contracts |

| Day Type |

|---|

| Normal Variation – 774 pts |

| Volumes of 1,47,805 contracts |

BNF opened right at previous session’s buying tail and made a look down below the lows almost testing the 16th Aug NeuX SOC of 50528 while making a low of 50555 and found some demand coming back as it left an A period buying tail and got back into previous value.

The auction not only took out the extension handle of 50905 in the IB but went on to scale above the SOC of 51033 and with a K TPO probe even took out the Trend Day VWAP of 51114 as it went on to tag the HVN of 51327 leaving a spike from 51194.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51267 F and VWAP of the session was at 50984

- Value zones (volume profile) are at 50853-51267-51329

- HVNs are at 51656** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29Aug-04Sep) – BNF opened the week & the new series taking support just above the weekly HVN of 51295 but has formed a narrow 573 points range balance with overlapping to higher Value at 51550-51656-51721 with an attempt to probe higher on 03rd Sep being rejected as big supply came back at the tag of the weekly VPOC of 51853 so a bigger imbalance is on the cards in the coming week for a move away from this week’s prominent POC of 51656 with the daily FA at 51525 being an immediate support

- (22-28 Aug) – BNF has formed a Gaussian Curve on the weekly timeframe with completely higher value at 51402-51514-51584 with the VWAP being at 51452 and has a lower HVN at 51295

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 51415

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

Business Areas for 10th Sep 2024

| Up |

| 51285 – M TPO RS (09 Sep) 51410 – Ext Handle (06 Sep) 51513 – A TPO VWAP (06 Sep) 51600 – 5-day VAL (30Aug-05Sep) 51727 – 5-day VAH (30Aug-05Sep) 51852 – VPOC (03 Sep) |

| Down |

| 51268 – POC (09 Sep) 51155 – AVWAP (05 Sep) 51054 – J TPO POC (09 Sep) 50983 – VWAP (09 Sep) 50850 – H TPO POC (09 Sep) 50725 – Buy Tail (09 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.