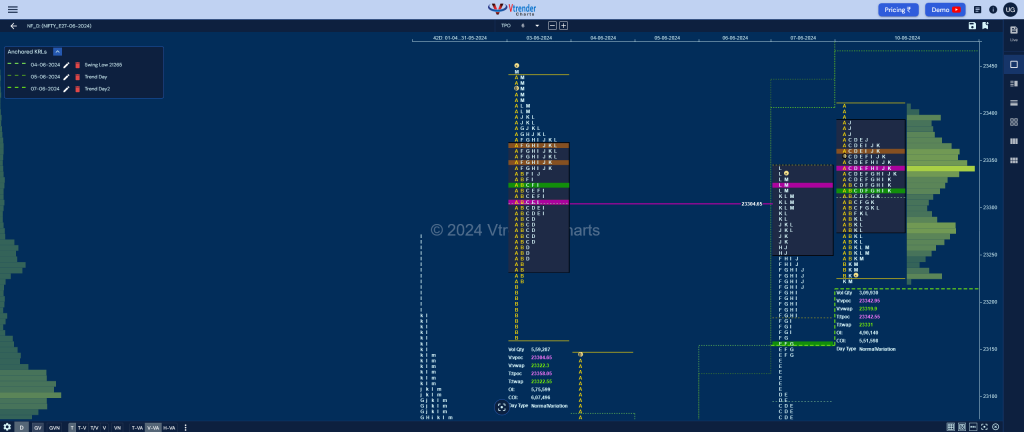

Nifty Jun F: 23247 [ 23410 / 23223 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 57,797 contracts |

| Initial Balance |

|---|

| 180 points (23410 – 23230) |

| Volumes of 1,33,058 contracts |

| Day Type |

|---|

| Normal – 187 pts |

| Volumes of 3,10,009 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23343 F and VWAP of the session was at 23320

- Value zones (volume profile) are at 23276-23343-23389

- HVNs are at 21960 / 22745 / 23328** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 11th Jun 2024

| Up |

| 23258 – M TPO high (10 Jun) 23328 – Jun series POC 23389 – Sell Tail (10 Jun) 23425 – M TPO POC (03 Jun) 23502 – 1.5 Weekly IB 23566 – 2 ATR (VPOC 22794) |

| Down |

| 23219 – AVWAP (07 Jun) 23158 – VWAP (07 Jun) 23097 – 07 Jun H/B 23020 – Ext Handle (07 Jun) 22987 – B TPO VWAP (07 Jun) 22936 – Buy Tail (07 Jun) |

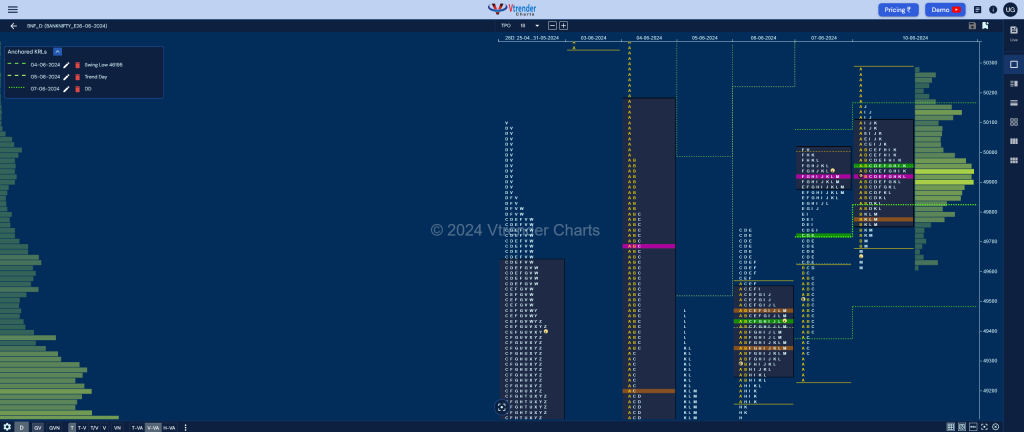

BankNifty Jun F: 49732 [ 50289 / 49617 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,377 contracts |

| Initial Balance |

|---|

| 610 points (50289 – 49680) |

| Volumes of 77,106 contracts |

| Day Type |

|---|

| Normal (‘b’ shape) – 673 pts |

| Volumes of 1,79,185 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49919 F and VWAP of the session was at 49961

- Value zones (volume profile) are at 49769-49919-50107

- HVNs are at 49110** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – to be updated…

- (30 May – 05 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 11th Jun 2024

| Up |

| 49781 – HVN (10 Jun) 49919 – POC (10 Jun) 50158 – Sell Tail (10 Jun) 50384 – A TPO tail (03 Jun) 50566 – B TPO h/b (03 Jun) 50725 – D TPO POC (03 Jun) |

| Down |

| 49700 – M TPO VWAP (10 Jun) 49541 – C TPO h/b (07 Jun) 49333 – Buy Tail (07 Jun) 49110 – Weekly POC 48993 – HVN (05 Jun) 48723 – AVWAP (04 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.