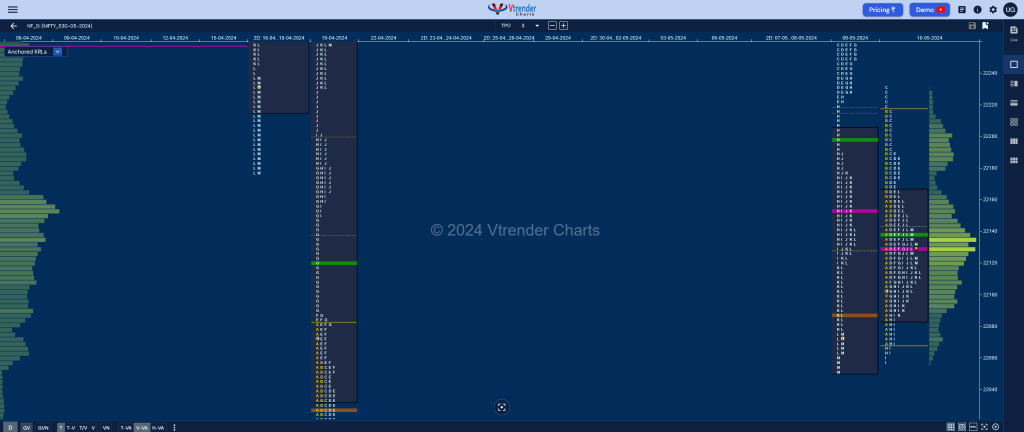

Nifty May F: 22140 [ 22230 / 22050 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 35,500 contracts |

| Initial Balance |

|---|

| 150 points (22217 – 22068) |

| Volumes of 96,163 contracts |

| Day Type |

|---|

| ‘Neutral Centre‘ – 179 pts |

| Volumes of 2,86,527 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22130 F and VWAP of the session was at 22138

- Value zones (volume profile) are at 22083-22130-22165

- NF has immediate supply point at AVWAP of 22394 from Swing High of 22888 from 03/05

- NF confirmed a FA at 22230 on 10/04 and the 1 ATR objective to the downside comes to 22000.

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 13th May 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

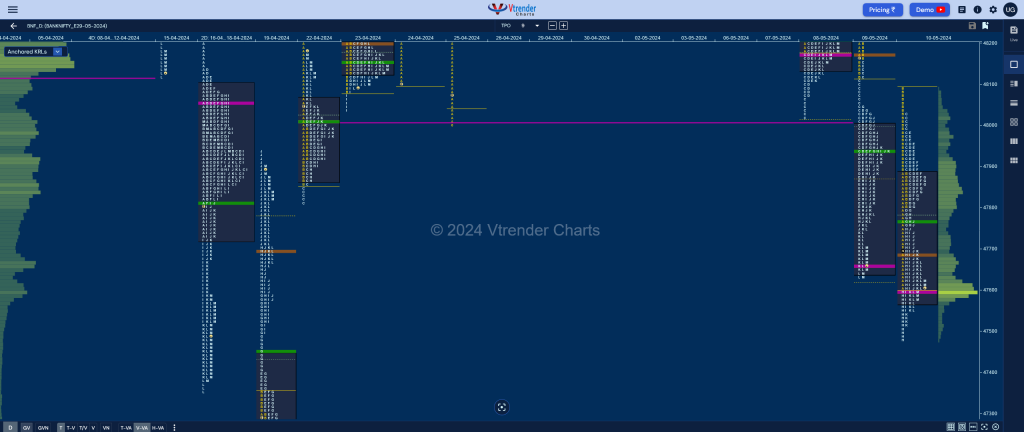

BankNifty May F: 47607 [ 48090 / 47479 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,549 contracts |

| Initial Balance |

|---|

| 485 points (48090 – 47605) |

| Volumes of 51,229 contracts |

| Day Type |

|---|

| Normal – 610 points |

| Volumes of 1,35,053 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47594 F and VWAP of the session was at 47629

- Value zones (volume profile) are at 47566-47594-47883

- NF has immediate supply point at AVWAP of 48769 from Swing High of 49927 from 30/04

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 13th May 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.