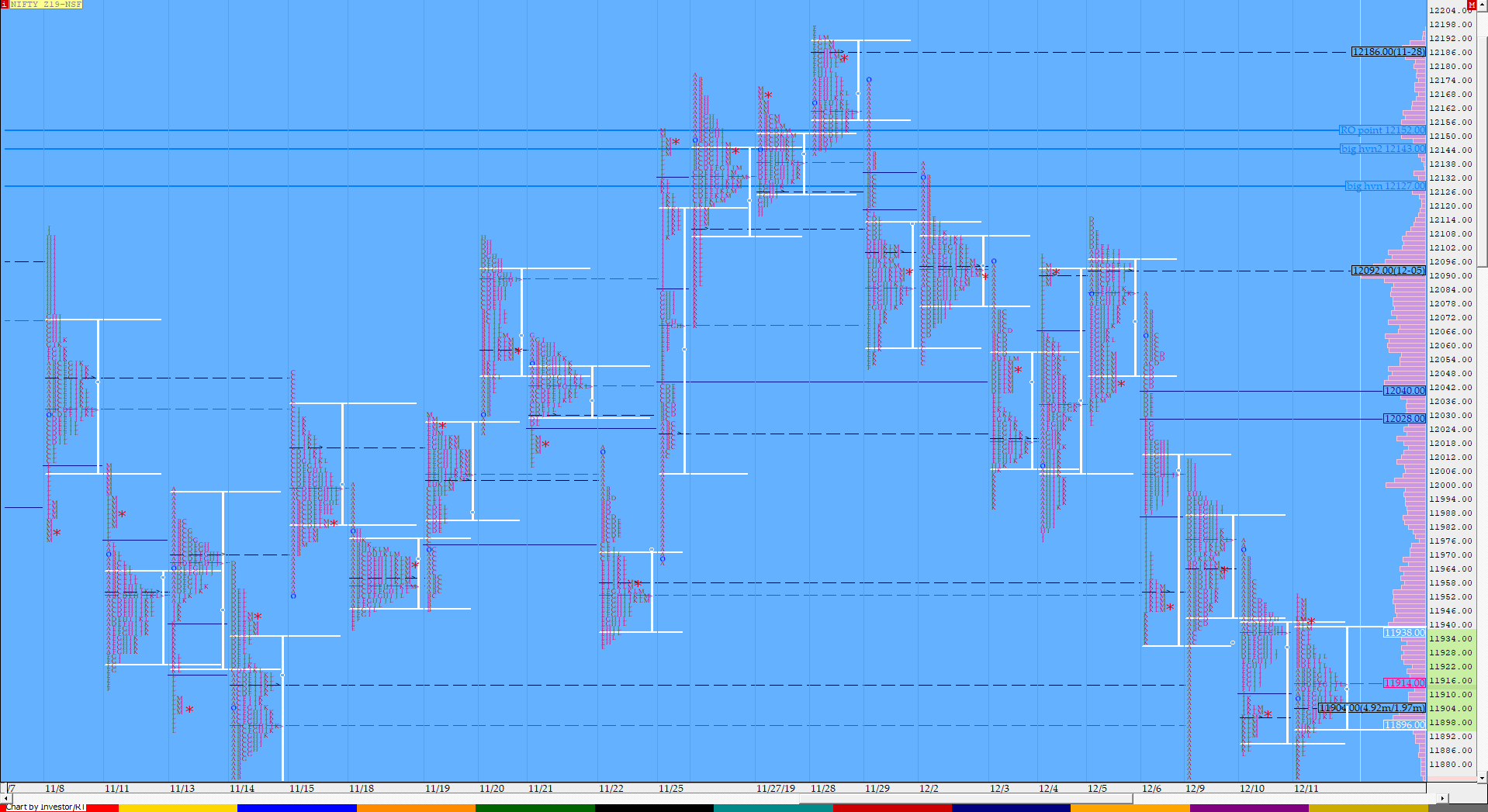

Nifty Dec F: 11938 [ 11954/ 11872 ]

HVNs – 11900-910 / (11940) / 11965 / 12090 / 12108 / 12128-143 / 12192

NF opened in the spike zone giving yet another OAIR start but took support at 11892 just above the spike lows after which it stayed in a very narrow IB range of only 48 points for most part of the day forming a balance in previous day’s low volume area till the ‘J’ period as it looked headed for a rare Non-Trend Day. The auction finally made a RE (Range Extension) to the downside in the ‘K’ period as it broke below PDL (Previous Day Low) making lows of 11872 narrowly missing the 1.5 IB objective and this failure in spite of NF staying below the IB for more than 30 minutes led to a sharp inventory adjustment move higher as it not only got back into the IB range but also went on to make new highs for the day at 11954 confirming a Neutral Day and closed just around the IBH & VAH with a small buying tail at lows. We have a nice 2-day balance in NF (link to the chart given below) and staying above today’s high could bring a test of that composite VPOC of 12048 in the coming session(s).

(Click here to view the NF form a 2-day Gaussian profile)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 11910 F

- Vwap of the session was at 11912 with volumes of 72.3 L and range of 82 points as it made a High-Low of 11954-11872

- NF confirmed a FA at 12116 on 05/12 and tagged the 2 ATR objective of 11924 on 09/12. This FA is currently on ‘T+5’ Days

- The Trend Day VWAP of 06/12 at 12005 will be important reference on the upside.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11895-11910-11938

Hypos / Estimates for the next session:

a) NF needs to sustain above 11940-946 above which it could rise to 11965-971 / 11990 & 12003-10

b) Immediate support is at 11925 below which it could fall to 11905-900 / 11880 & 11860

c) Above 12010, NF can probe higher to 12027-30 / 12048-54 & 12075

d) Below 11860, auction becomes weak for *11848*-843 / 11816*-810 & 11792-790

e) If 12075 is taken out, the auction go up to to 12090-96 / 12116-120 & 12138-141

f) Break of 11790 can trigger a move lower to 11771-767 / 11749-744 & 11729

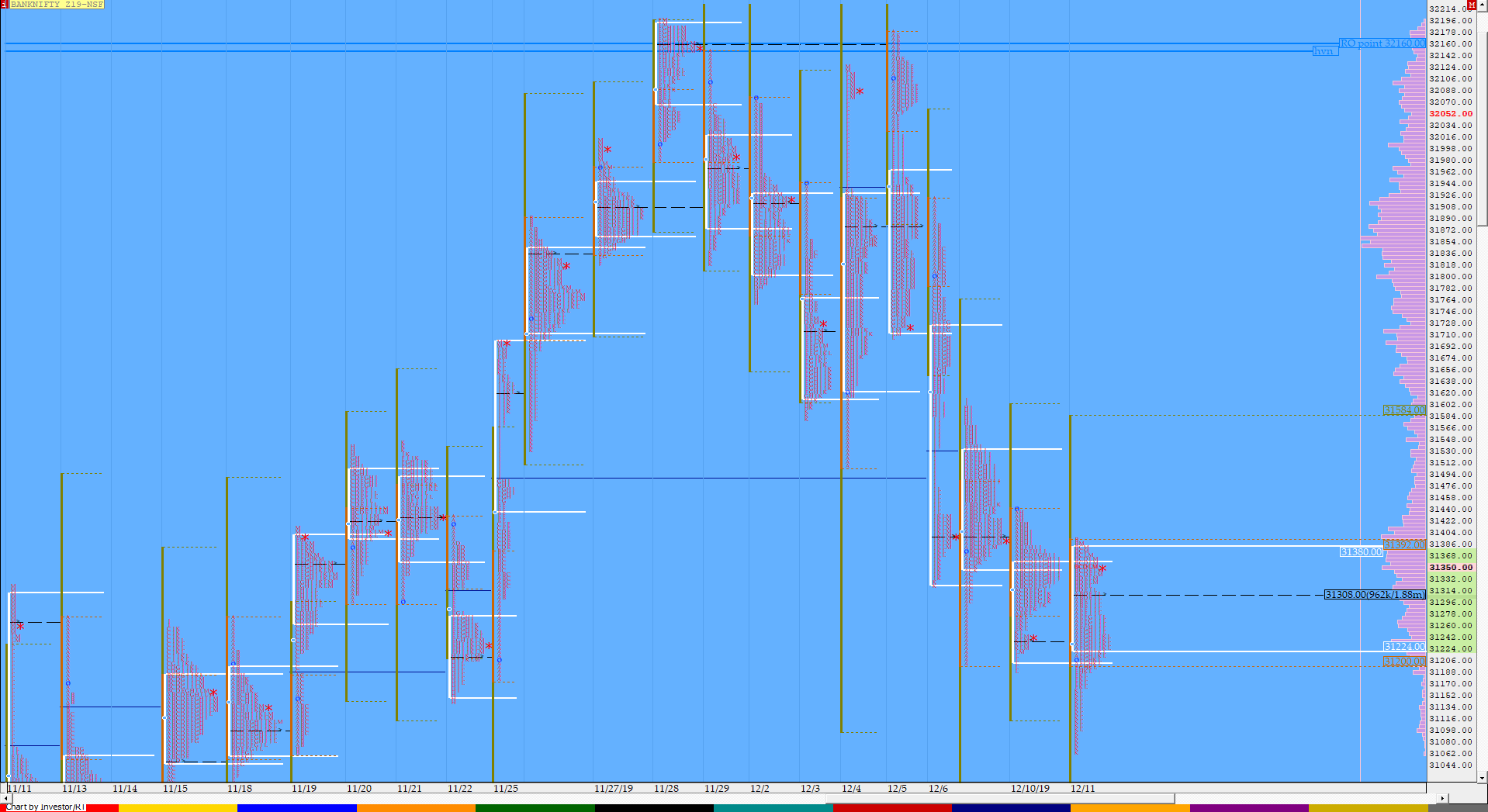

BankNifty Dec F: 31314 [ 31396 / 31065]

HVNs – 31110 / (31265) / 31310 / 31370-400 / 31660 / 31855 / 32090 / [32150-160]

Report to be updated…

(Click here to view the new 3-day composite in BNF with overlapping POC)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 31370 F

- Vwap of the session was at 31259 with volumes of 29.7 L and range of 330 points as it made a High-Low of 31396-31065

- BNF confirmed a FA at 32173 on 05/12 and tagged the 2 ATR target of 31501 on 06/12. This FA is currently on ‘T+5’ Days

- The Trend Day VWAP of 06/12 at 31625 will be important reference on the upside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31234-31370-31380

Hypos / Estimates for the next session:

a) BNF needes to sustain above 31320 for a move to 31368-385 / 31437-445 & 31485

b) Immediate support is at 31320-310 below which the auction could test 31264-220 / 31180-150 & 31104

c) Above 31485, BNF can probe higher to 31550 / 31600-625 & 31689-705

d) Below 31104, lower levels of 31065-49 / 31002 & 30968-947 could be tagged

e) If 31705 is taken out, BNF can give a fresh move up to 31760-811 / 31855 & 31890-920

f) Below 30947, we could see lower levels of 30891-885 / 30836 & 30770-750

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout