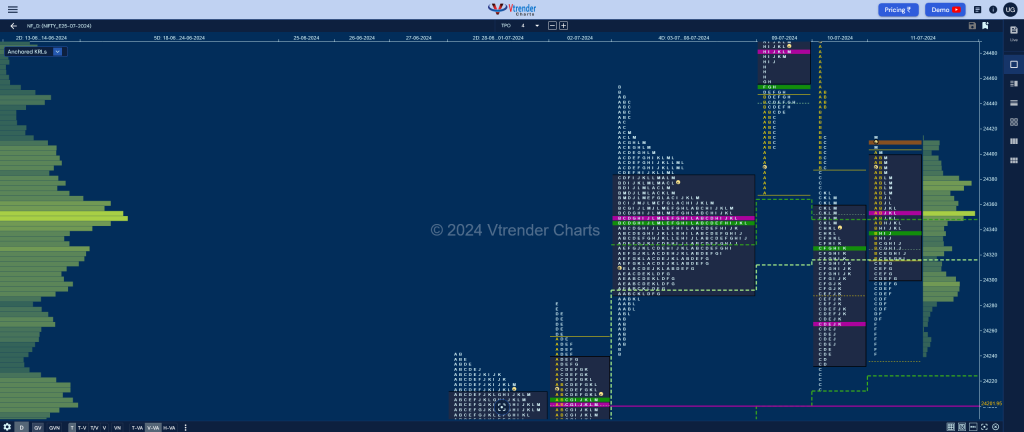

Nifty Jul F: 24382 [ 24418 / 24241 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 17,047 contracts |

| Initial Balance |

|---|

| 88 points (24404 – 24315) |

| Volumes of 44,449 contracts |

| Day Type |

|---|

| Neutral – 179 pts |

| Volumes of 2,31,355 contracts |

NF has formed an inside bar forming slightly higher value taking support at yPOC of 24267 as it tested the selling zone of previous profile with a late spike which needs to be validated in the next session for more upside.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24352 F and VWAP of the session was at 24339

- Value zones (volume profile) are at 24303-24352-24399

- HVNs are at 24201 / 24350** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (05 – 11 Jul) – NF has formed a narrow range balance & a Neutral Centre weekly profile taking support just above previous week’s prominent POC of 24201 filling up the upper half with the Value at 24256-24353-24385 while the VWAP is at 24348

- (28 Jun – 04 Jul) – NF has formed a Neutral Extreme profile to the upside leaving a FA at lows of 24082 which will be the swing reference for this series and has formed mostly higher Value at 24084-24201-24329 with this week’s VWAP at 24251 which will be the important support level going forward

Monthly Zones

- The settlement day Roll Over point (July 2024) is 24110

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

Business Areas for 12th Jul 2024

| Up |

| 24409 – HVN (11 Jul) 24449 – Sell Tail (10 Jul) 24503 – Sell tail (09 Jul) 24562 – 2 ATR (VPOC 24202) 24627 – 2 ATR (POC 24467) |

| Down |

| 24365 – L TPO VWAP 24316 – PBL (11 Jul) 24267 – POC (10 Jul) 24233 – Buy tail (10 Jul) 24202 – VPOC (02 Jul) |

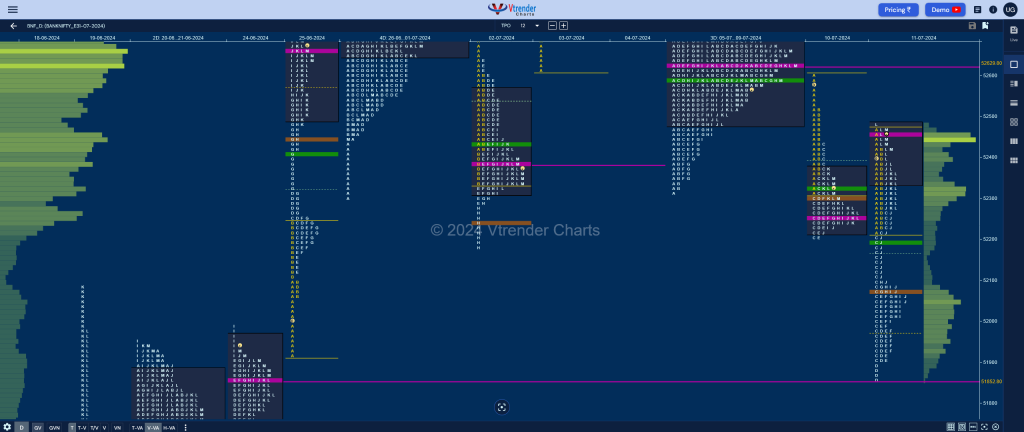

BankNifty Jun F: 52439 [ 52495 / 51860 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,148 contracts |

| Initial Balance |

|---|

| 198 points (52698 – 52500) |

| Volumes of 24,540 contracts |

| Day Type |

|---|

| Normal – 244 pts |

| Volumes of 79,503 contracts |

BNF resumed the aborted downmove of previous session and went on to make new lows of the series at 51860 taking support just above 24th Jun’s VPOC of 51852 and saw some profit booking along with demand taking it back to hit new highs for the day at 52495 into the close leaving a Neutral Day with the POC shifting higher to 52454 which will be the opening reference for tomorrow

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 52454 F and VWAP of the session was at 52199

- Value zones (volume profile) are at 52335-52454-52486

- HVNs are at 53089** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (04 – 10 Jul) – BNF opened the week with new ATH of 53301 but could not sustain forming a Normal Variation profile to the downside breaking below the important support of 52793 and tested previous week’s responsive tail as it made a low of 52205 holding just above the buy side level of 52190 leaving a composite ‘b’ shape kind of a profile with mostly lower Value at 52300-52631-52777 with the VWAP at 52622

- (27 Jun -03 Jul) – BNF has formed a Neutral Centre weekly profile taking support at previous week’s VWAP of 52306 where it left a responsive buying tail and went on to make new ATH of 53249 on the last day before closing right at the POC of 53089. This week’s Value was overlapping to higher at 52630-53089-53194 with the VWAP at 52793 which will be an important support for the coming week

Monthly Zones

- The settlement day Roll Over point (July 2024) is 52830

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 12th Jul 2024

| Up |

| 52454 – POC (11 Jun) 52520 – Sell Tail (10 Jul) 52635 – VPOC (09 Jul) 52799 – Sell Tail (08 Jul) 52955 – PBL (04 Jul) 53053 – 04 Jul Halfback |

| Down |

| 52422 – M TPO low (11 Jul) 52254 – J TPO VWAP (11 Jul) 52075 – HVN (11 Jul) 51982 – SOC (11 Jul) 51852 – VPOC (24 Jun) 51711 – VWAP (24 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.