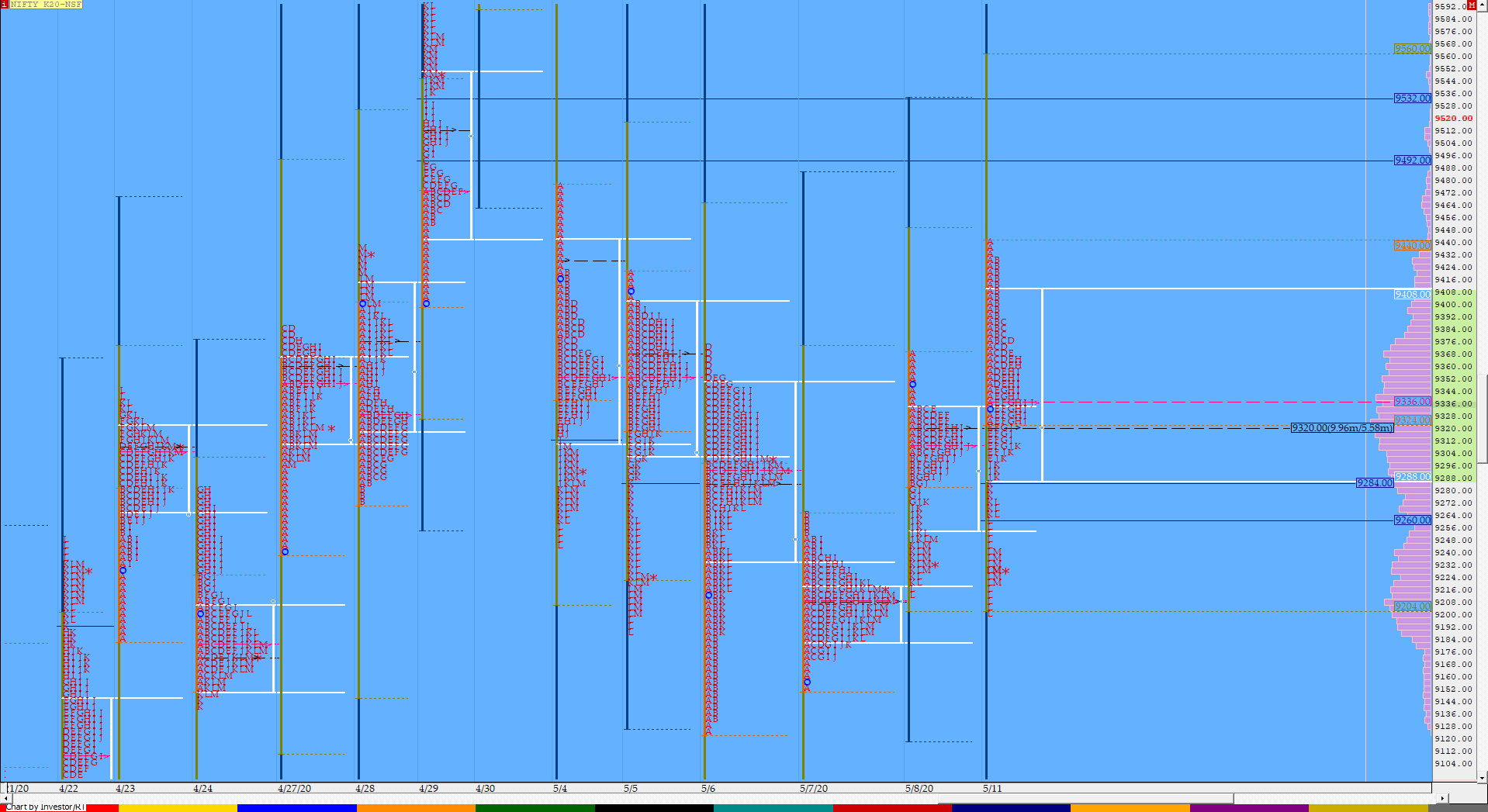

Nifty May F: 9225 [ 9443 / 9202 ]

HVNs – 9204 / (9285) / 9320 / 9375 / 9800 / 9822-40

NF opened with a gap up of 100 points and took support just above the yPOC of 9320 giving an OTD (Open Test Drive) as it scaled above PDH (Previous Day High) of 9369 and went on to tag 9443 in the ‘A’ period but could not make a new high in the ‘B’ period and in fact went on to break below VWAP which meant that the morning buyers had all booked out and as often happens, break of VWAP of a Drive Open leads to new lows which is what happened as NF made a OTF (One Time Frame) probe lower in the first half resulting in a RE (Range Extension) lower in the ‘E’ period as it hit 9301. The auction then stalled the OTF in the ‘F’ period and gave a retracement to VWAP in the ‘H’ period as it left a PBH at 9366 confirming that the PLR for the day was still to the downside. NF then initiated a fresh OTF move lower for the rest of the day as it made a fresh RE down in the ‘J’ period after which it left an extension handle at 9292 in the ‘I’ period and closed in a spike from 9265 to 9202 finally tagging that VPOC of 9204 and in the process completing the 80% Rule in previous week’s Value before closing the day at 9225 leaving an outside bar on daily with an overlapping POC at 9320. The May series has been in an balance since last Monday and the composite Value as of now is at 9225-9320-9384 with a low volume zone from 9225 to 9295 which could be the zone which could be filled in the coming session(s) before we get a fresh move away from here. However, the inability of NF to stay above 9215 could lead to more downside and a test of previous week low pf 9125 & the monthly POC of 9012.

- The NF Open was a Open Test Drive – Up (OTD) which failed

- The day type was a Normal Variation Day – Down (NV) with a spike close

- Largest volume was traded at 9320 F

- Vwap of the session was at 9336 with volumes of 162.2 L and range of 241 points as it made a High-Low of 9443-9202

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9302-9320-9418

Main Hypos for the next session:

a) NF needs to sustain above 9240 for a rise to 9267-9292 / 9321-36 / 9366-76 / 9395 & 9416-42

b) The auction has immediate support at 9225-13 below which could fall to 9188-80 / 9161-40 / 9111 / 9090-63 & 9040-12

Extended Hypos:

c) Above 9442, NF can probe higher to 9462-75 / 9518-49 / 9574-94 & 9616-25

d) Below 9012, the auction can fall further to 8989-75 / 8940 / 8900 / 8876-45 & 8822-13

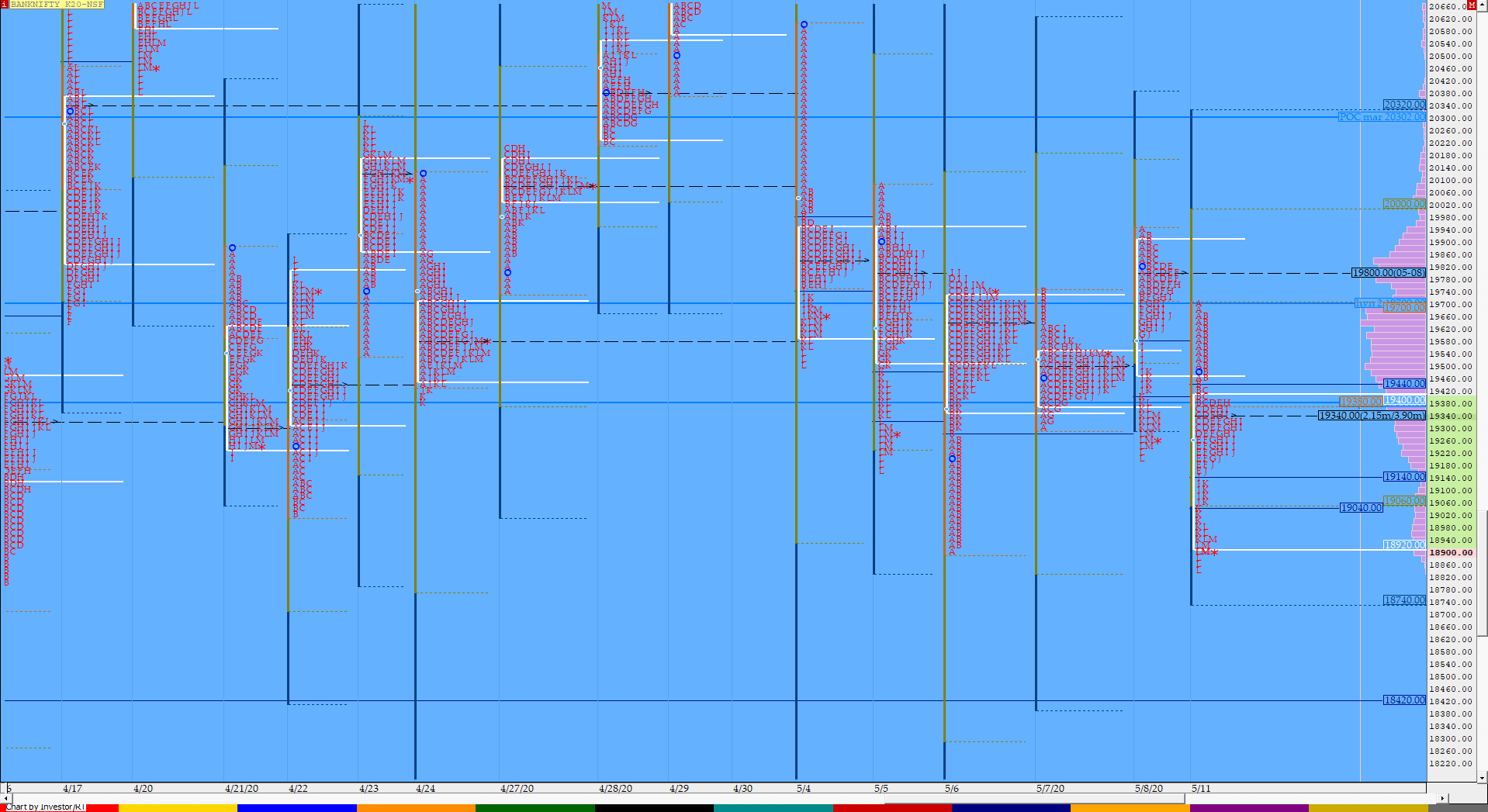

BankNifty May F: 18914 [ 19700 / 18855 ]

HVNs – 19340 / 19465-510 / 19650 / 19830 / (21600) / (21850)

BNF also opened higher but was still in the low volume zone of the previous session as it probed higher taking out the extension handle of 19608 & even getting above Friday’s Trend Day VWAP of 19651 as it made highs of 19700 in the ‘A’ period. The stalling of the auction at this HVN and the inability to remain above 19651 led to a break below VWAP in the ‘B’ period as it left an extension handle at 19475 and this in turn gave a rare back to back Trend Day Down in BNF as it gave a OTF move lower all day making multiple REs on the downside along with the afternoon pull back in the ‘H’ period where it left a PBH at 19393 before resuming the OTF lower for the rest of the day leaving a second extension handle at 19163 before spiking into the close as it broke previous week lows of 18900 to hit 18855 in the ‘L’ period leaving a spike zone reference from 18855 to 19076 for the next open. The day was an outside bar which closed at 18914 but more importantly, BNF seems to be moving away from the previous week’s Value and a break below today’s low could lead to a test of the VPOC of 18300 in the coming sessions.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 19280 F

- Vwap of the session was at 19340 with volumes of 64.4 L and range of 845 points as it made a High-Low of 19700-18855

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 18946-19340-19431

Main Hypos for the next session:

a) BNF needs to sustain above 18946 for a rise to 18990-19010 / 19076-188 / 19280-290 / 19350-393 / 19458-490 & 19555-602

b) The auction remains weak below 18900 for a fall to 18855-764 / 18690-608 / 18563 / 18453-420 / 18300 & 18236-204

Extended Hypos:

c) Above 19602, BNF can probe higher to 19659-735 / 19800-836 / 19890 / 19945-20012 / 20076-160 & 20220-324

d) Below 18204, lower levels of 18160-100 / 18000-17977 / 17850-828 / 17750-705 / 17580* & 17460 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout