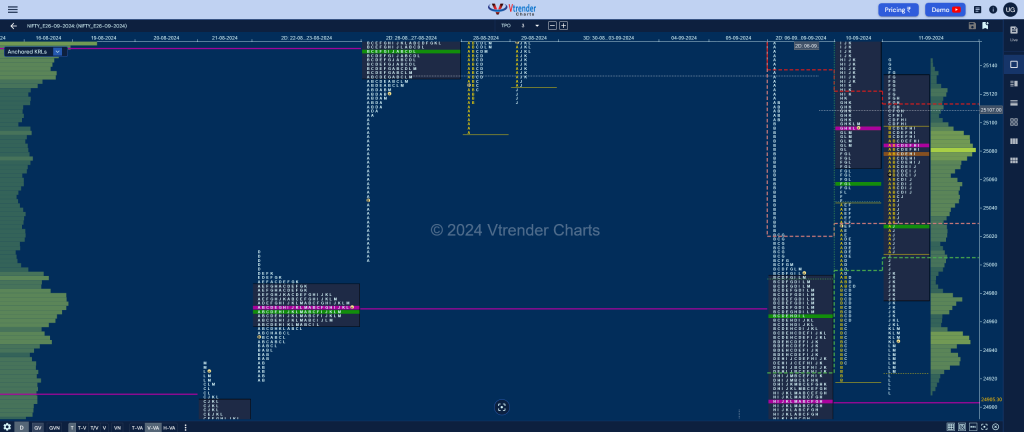

Nifty Sep F: 24938 [ 25145 / 24908 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 18,102 contracts |

| Initial Balance |

|---|

| 86 points (25096 – 25010) |

| Volumes of 44,178 contracts |

| Day Type |

|---|

| Neutral Extreme – 237 pts |

| Volumes of 1,96,003 contracts |

NF made an OAIR start breaking below previous day’s extension handle of 25045 and made a low of 25010 taking support just above the SOC of 24992 indicating demand coming back as it left an A period buying tail and tagged the yPOC of 25096 in the IB which was followed by a typical C side play to 25108 on low volumes which gave a retracement back to VWAP which was defended by the morning buyers resulting in couple of REs to the upside in the F & G TPOs marking a high of 24145 stalling below the sell side HVN of 25160.

The auction then reversed the probe to the downside leaving the first SOC (Scene Of Crime) at 25107 and breaking below day’s VWAP with another one at 25075 as it went on to leave an extension handle at 25010 to make a RE lower and completed the 2 IB objective of 24924 in the L TPO while making a low of 24908 holding just above the 2-day VPOC (06-09 Sep) of 24905 leaving a Neutral Extreme (NeuX) day.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25084 F and VWAP of the session was at 25027

- Value zones (volume profile) are at 24975-25084-25131

- NF confirmed a FA at 25113 on 29/08 and completed the 1 ATR objective of 25286 on the same day. This FA was revisited and broken on 06/09 with initiative selling tagging the 1 ATR target of 24940 whereas the 2 ATR comes to 24767

- HVNs are at 25339** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (30Aug-05Sep) – NF has formed a Neutral profile with completely higher Value at 25253-25338-25414 with the VWAP at 25303 as it probed higher for the first 2 sessions hitting new ATH of 25399 & 25420 respectively but failed to get fresh demand and instead got initiative sellers at 25409 who pushed the auction lower where it took support right at previous week’s POC of 25168 and gave a bounce back to 25324 which was again met with supply resulting in a close below Value

- (23-29 Aug) – NF has formed a Double Distribution (DD) profile with completely higher value at 25121-25168-25245 with the DD zone being from 25094 to 24994 and this week’s VWAP at 25186

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 25270

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

Business Areas for 12thSep 2024

| Up |

| 24960 – L TPO high (11 Sep) 25010 – Ext Handle (11 Sep) 25044 – AVWAP (10 Sep) 25084 – POC (11 Sep) 25126 – G TPO VWAP (11 Sep) 25160 – HVN (10 Sep) |

| Down |

| 24941 – M TPO h/b (11 Sep) 24905 – 2-day VPOC (06-09 Sep) 24867 – 2-day VAL (06-09 Sep) 24816 – Swing Low (09 Sep) 24782 – Weekly VWAP (16-22 Aug) 24721 – VPOC (19 Aug) |

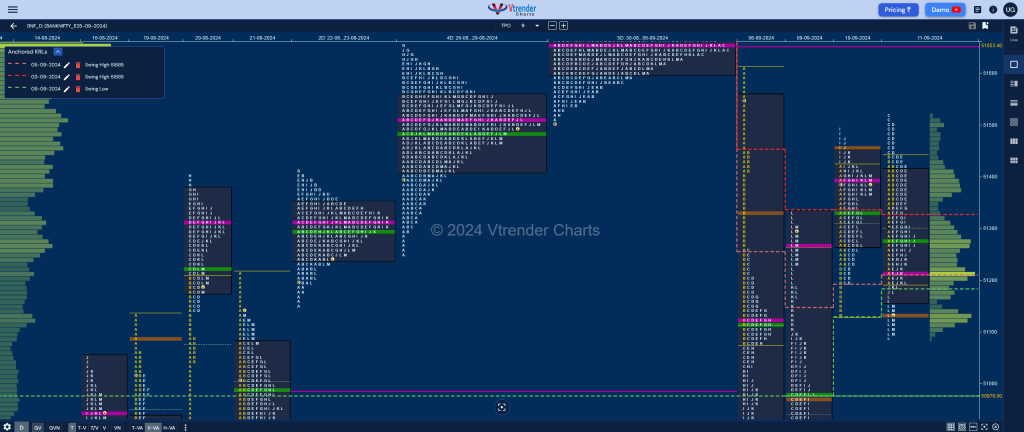

BankNifty Sep F: 51124 [ 51519 / 51086 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 11,114 contracts |

| Initial Balance |

|---|

| 239 points (51438 – 51200) |

| Volumes of 31,813 contracts |

| Day Type |

|---|

| Neutral Extreme – 432 pts |

| Volumes of 1,30,391 contracts |

BNF also made an OAIR start and the probe lower took support just above previous day’s buying tail from 51192 as it made a low of 51200 and went on to probe higher making the dreaded C side extension to 51519 tagging 06th Sep’s initiative seller level but could not sustain.

The auction then probed lower breaking below the IBL confirming a FA (Failed Auction) at top and completed the 1 ATR target of 51141 while making a low of 51086 into the close but saw profit booking by sellers as it formed a HVN at 51135 which will be the opening reference for the next session with today’s VWAP of 51278 being a fresh supply level.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51215 F and VWAP of the session was at 51278

- Value zones (volume profile) are at 51163-51215-513411

- BNF confirmed a FA at 51519 on 11/09 and completed the 1 ATR target of 51141 on the same day & the 2 ATR comes to 50763

- HVNs are at 51656** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29Aug-04Sep) – BNF opened the week & the new series taking support just above the weekly HVN of 51295 but has formed a narrow 573 points range balance with overlapping to higher Value at 51550-51656-51721 with an attempt to probe higher on 03rd Sep being rejected as big supply came back at the tag of the weekly VPOC of 51853 so a bigger imbalance is on the cards in the coming week for a move away from this week’s prominent POC of 51656 with the daily FA at 51525 being an immediate support

- (22-28 Aug) – BNF has formed a Gaussian Curve on the weekly timeframe with completely higher value at 51402-51514-51584 with the VWAP being at 51452 and has a lower HVN at 51295

Monthly Zones

- The settlement day Roll Over point (Sep 2024) is 51415

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

Business Areas for 12th Sep 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.