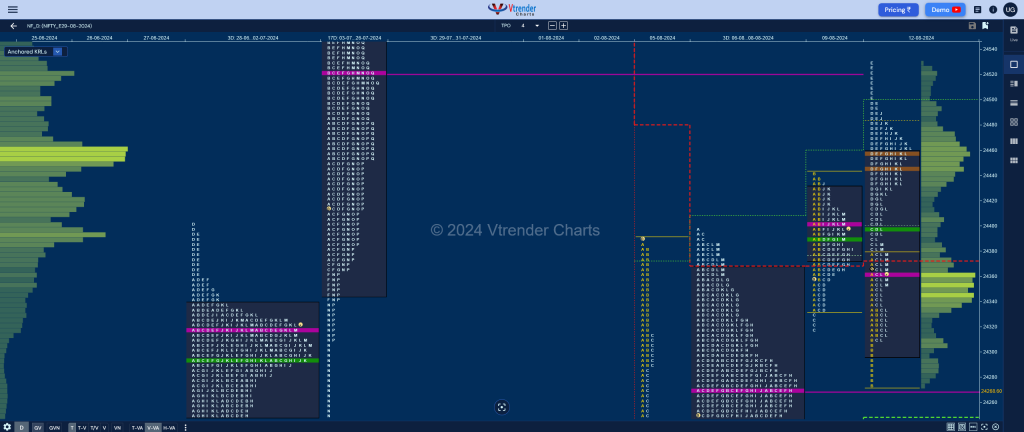

Nifty Aug F: 24356 [ 24530 / 24272 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 26,361 contracts |

| Initial Balance |

|---|

| 112 points (24384 – 24272) |

| Volumes of 65,491 contracts |

| Day Type |

|---|

| Normal Variation – 258 pts |

| Volumes of 2,63,966 contracts |

NF made a weak open below previous VWAP & continued to probe lower breaking below PDL (Previous Day Low) in the A period and continuing the imbalance in the B where it made a low of 24272 stalling just above the 4-day (05-08 Aug) composite VPOC of 24271 which showed demand coming back as it left a buying tail at the close of IB (Initial Balance).

The auction then went on to make a rare successful RE (Range Extension) to the upside in the C side with an extension handle at 24384 followed by a bigger one in the D TPO with another handle at 24415 as it went on to scale above the RO point of 24460 and persevered with the upmove in the E period too as it tagged the 17-day (03-26 Jul) composite VPOC of 24522 while making a high of 24530 marking the end of the imbalance as it left a small responsive selling tail and forged a narrow range balance till the K TPO building couple of HVNs at 24445 & 24457 taking support at 24415.

NF was all set to close as a Double Distribution Trend Day Up but an uncharacteristic break of VWAP in the L period triggered a swipe down to 24311 before settling around the POC of 24362 leaving a 3-1-3 profile with both range & value being outside bars.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24362 F and VWAP of the session was at 24399

- Value zones (volume profile) are at 24299-24362-24457

- HVNs are at 24271 / 24342** / 24930 / 24996 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (02-08 Aug) – NF opened with a gap down of 200+ points on Friday well below the POC & VWAP of previous week and left an A period selling tail and formed lower value which was followed by another big gap down of 323 points on Monday where it went on to form a Trend Day Down making a low of 29312 and remained in this range for the rest of the week leaving a FA at 24398 on Wednesday and completing the 1 ATR of 24121 on Thursday where it closed with a mini spike leaving a Double Distribution (DD) Trend Down profile for the week with completely lower Value at 24075-24271-24387 and the DD zone from 24398 to 24700 which could see filling up in the coming week if the FA of 24398 gets negated with this week’s VWAP of 24296 being an important supply point in between whereas on the downside, the HVNs of 24088 & 24063 would be the immediate support levels below which the responsive buying tails of 24012 & 23950 could come into play

- (26Jul – 01Aug) – NF has formed a composite ‘p’ shape profile on the weekly timeframe representing weak Market Structure as after starting last Friday with a big Trend Day Up of 487 points it remained in a narrow range for the rest of the days indicating poor trade facilitation at these new ATH levels. Value for the week was completely higher at 24853-24996-25042 and the auction will need to show initiative buying above 25042 in the coming week to continue higher with this week’s VWAP of 24909 being the swing reference on the downside below which it could go in for a test of the Trend Day VWAP of 24748 and the Halfback of 24696 along with extension handles of 24637 & 24576

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 13th Aug 2024

| Up |

| 24362 – POC (12 Aug) 24401 – 12 Aug halfback 24453 – Monthly IBL 24500 – Sell tail (12 Aug) 24550 – Gap mid (05 Aug) 24629 – 1 ATR (yPOC 24362) |

| Down |

| 24355 – M TPO low (12 Aug) 24310 – Buy Tail (12 Aug) 24271 – 4-day VPOC (05-08 Aug) 24215 – VWAP (08 Aug) 24141 – SOC (08 Aug) 24088 – HVN (06 Aug) |

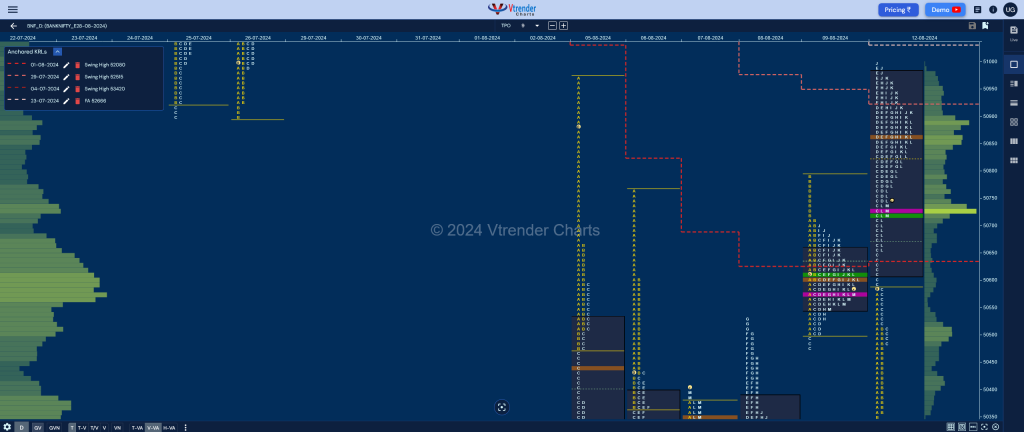

BankNifty Aug F: 50721 [ 50998 / 50341 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 17,646 contracts |

| Initial Balance |

|---|

| 220 points (50562 – 50341) |

| Volumes of 40,558 contracts |

| Day Type |

|---|

| Double Distribution – 657 pts |

| Volumes of 1,60,763 contracts |

BNF also opened below previous day’s VWAP and looked down below the lows getting into the 4-day composite Value but did not find sell side volumes as can be seen in the below average stats not only for the open but also for the Initial Balance.

With the downside showing poor trade facilitation, the buyers took control of the auction driving it up with a rare C side extension handle at 50562 and went on to make REs in the D & E periods testing previous week’s high of 50976 while hitting 50986 almost completing the 3 IB target of the day which was at 51002 marking the end of the imbalance.

BNF left a PBL at 50773 in the G TPO and made another attempt to extend higher in the J period but could only manage marginal new highs of 50998 indicating short term exhaustion which triggered a liquidation break down to 50652 in the L before closing around the VWAP of 50715 leaving an Outside Day with mostly higher value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 50730 F and VWAP of the session was at 50715

- Value zones (volume profile) are at 50609-50730-50984

- HVNs are at 50225** (** denotes series POC)

Weekly Zones

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

Business Areas for 13th Aug 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.