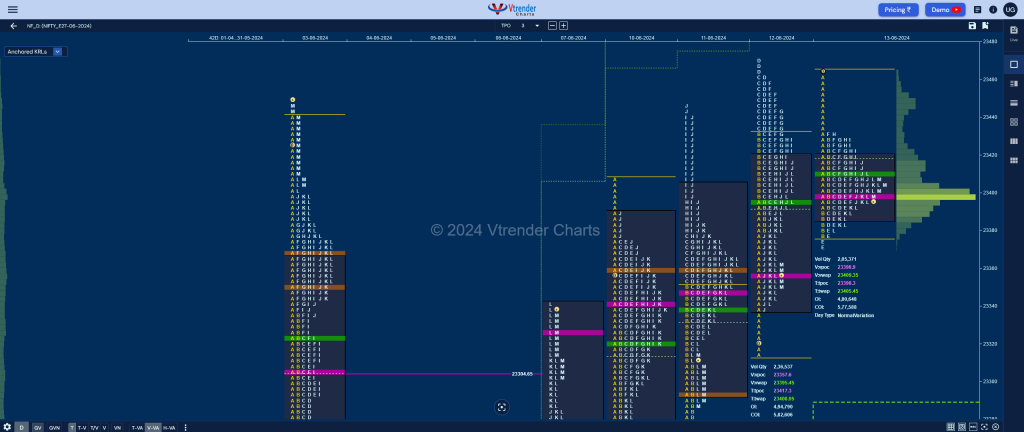

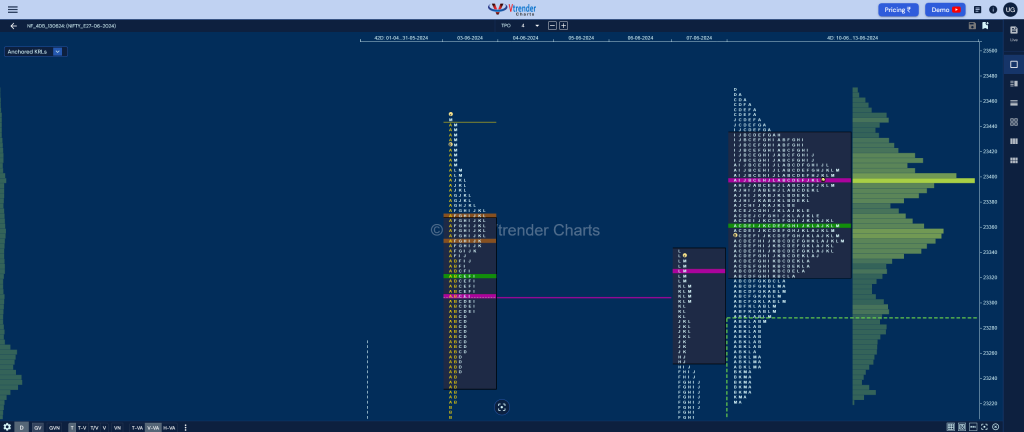

Nifty Jun F: 23399 [ 23482 / 23371 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 31,068 contracts |

| Initial Balance |

|---|

| 105 points (23482 – 23376) |

| Volumes of 65,059 contracts |

| Day Type |

|---|

| Normal – 111 pts |

| Volumes of 2,05,751 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23399 F and VWAP of the session was at 23409

- Value zones (volume profile) are at 23385-23399-23418

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 14th Jun 2024

| Up |

| 23409 – VWAP (13 Jun) 23457 – IB tail mid (13 Jun) 23502 – 1.5 Weekly IB 23550 – 2 ATR (VPOC 22794) 23598 – 1 ATR (Swing low 23220) 23669 – 1 ATR (AVWAP 23291) |

| Down |

| 23398 – Jun series POC 23357 – VPOC (12 Jun) 23291 – AVWAP (07 Jun) 23244 – A TPO POC (11 Jun) 23205 – I TPO VWAP (07 Jun) 23158 – VWAP (07 Jun) |

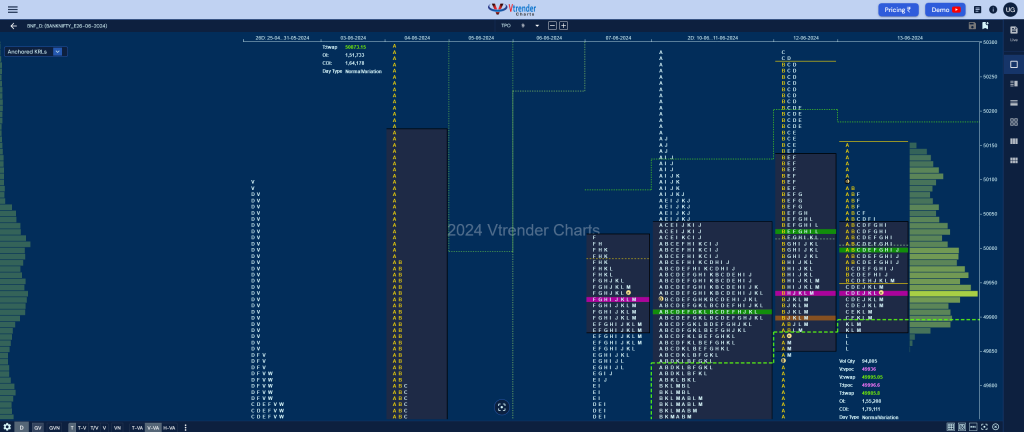

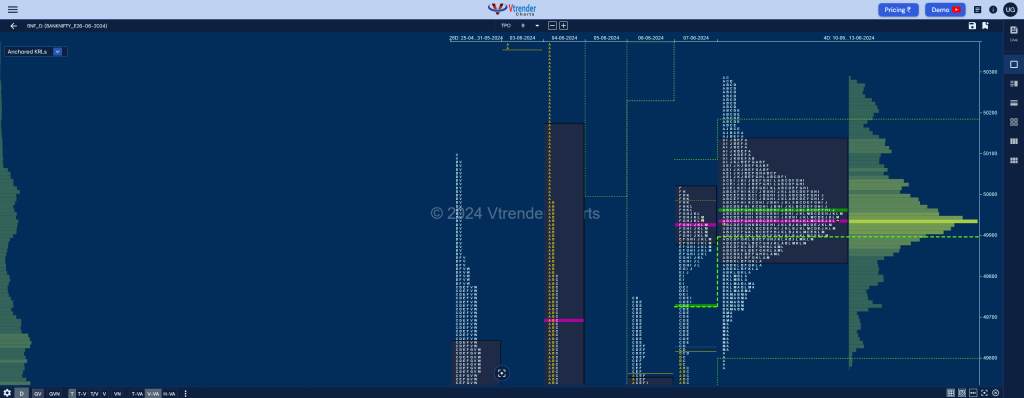

BankNifty Jun F: 49912 [ 50155 / 49850 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 14,978 contracts |

| Initial Balance |

|---|

| 205 points (50155 – 49950) |

| Volumes of 34,294 contracts |

| Day Type |

|---|

| Normal Variation – 305 pts |

| Volumes of 94,870 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49936 F and VWAP of the session was at 49995

- Value zones (volume profile) are at 49886-49936-50038

- HVNs are at 49110 / 49931** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – BNF has formed a Normal Variation weekly profile getting rejected from previous week’s POC of 49110 forming overlapping to higher Value at 49611-49931-50236 with a close around the prominent POC so can give a move away from here in the coming week

- (23-29 May) – to be updated…

- (30 May – 05 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 14th Jun 2024

| Up |

| 49931 – Jun Series POC 50022 – I TPO POC (13 Jun) 50130 – 4-day VAH (10-13 Jun) 50290 – Swing High (12 Jun) 50384 – A TPO tail (03 Jun) 50566 – B TPO h/b (03 Jun) |

| Down |

| 49898 – AVWAP (07 Jun) 49775 – Weekly VWAP 49670 – A TPO POC (11 Jun) 49541 – C TPO h/b (07 Jun) 49333 – Buy Tail (07 Jun) 49223 – K TPO POC (06 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.