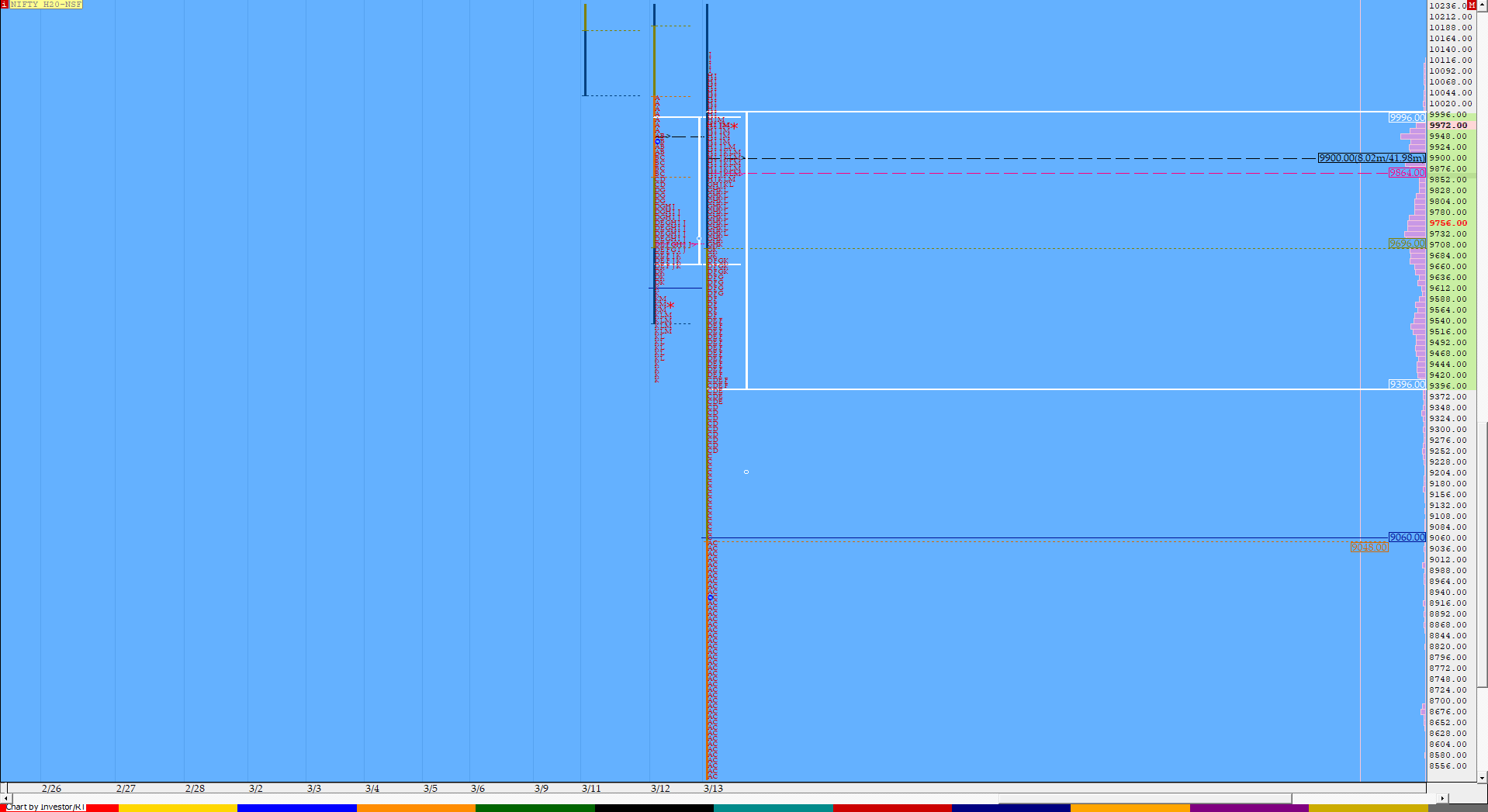

Nifty Mar F: 9898 [ 10130 / 8299 ]

HVNs – (8680) / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544 / 10911

Report to be updated…

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Trend Day – Up

- Largest volume was traded at 9900 F

- Vwap of the session was at 9550 with volumes of 516.2 L and range of 1831 points as it made a High-Low of 10130-8299

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9500-9900-10037

Main Hypos for the next session:

a) NF needs to sustain above 9960 for a rise to 10020-050 / 10090-125 / 10196-266 / 10335-347 & 10440-449*

b) The auction has immediate support at 9890 below which could it fall to 9850 / 9800-9775 / 9715 / 9650-15 & 9550

Extended Hypos:

c) Above 10449, NF can probe higher to 10506 / 10544*-560 / 10595-615 / 10660-718 & 10787

d) Below 9550, the auction can move lower to 9500 / 9425-15 / 9370 / 9250 / 9200-170 & 9050-9000

-Additional Hypos on downside-

e) Below 9000, the auction could further fall to 8950 / 8900-8888 / 8680 & 8600

f) If 8600 is taken out, NF could start a fresh leg down to 8525 / 8400 / 8299 & 8200

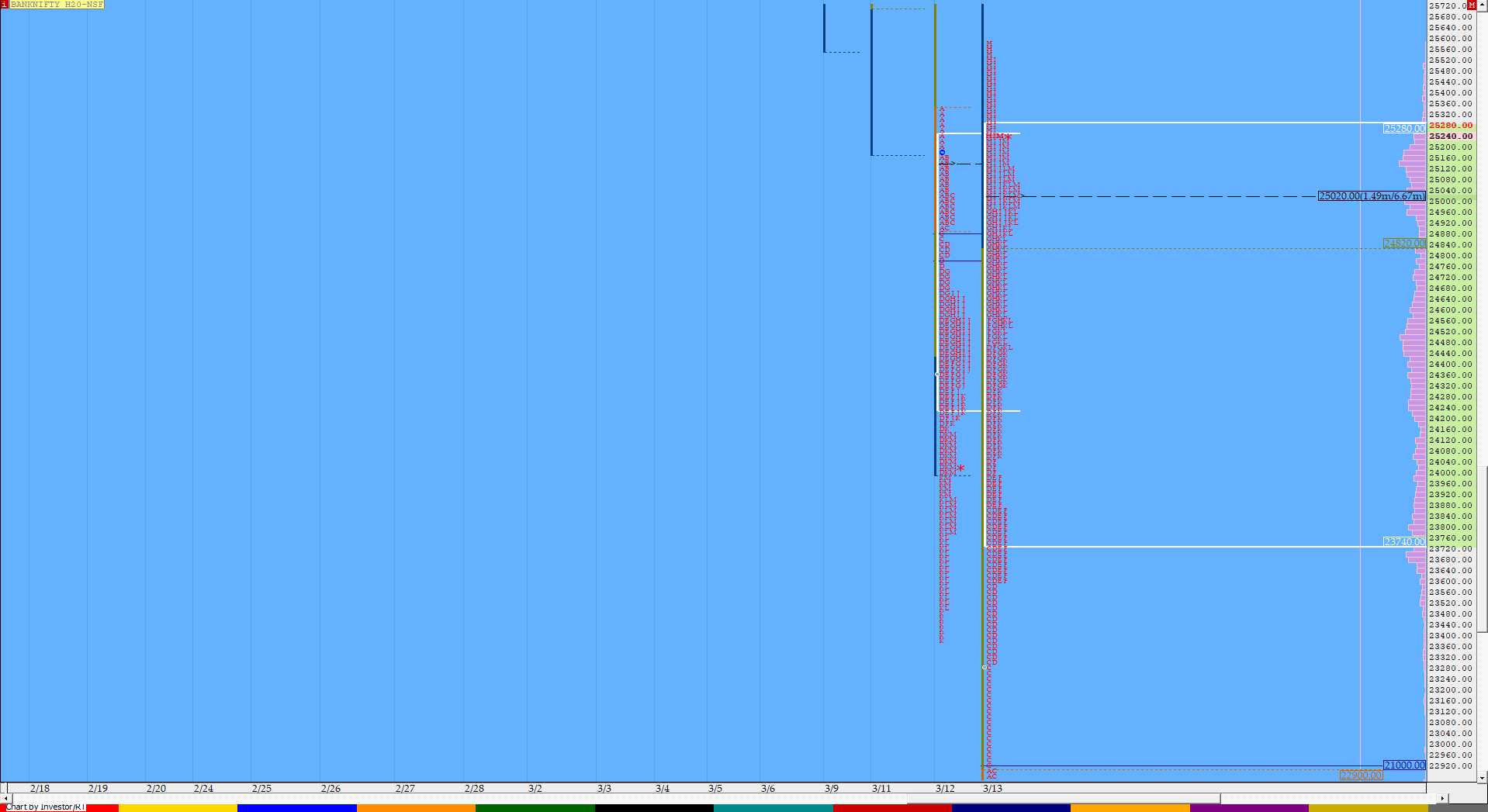

BankNifty Mar F: 25029 [ 25592 / 21000 ]

HVNs – (23680) / (23920) / 24260 / 24500 / 24980 / 25039 / 25156 / (26150) / 26480

Report to be updated…

- The BNF was an Open Auction Out of Range (OAOR)

- The day type was a Trend Day – Up

- Largest volume was traded at 25039 F

- Vwap of the session was at 24530 with volumes of 83.3 L and range of 4592 points as it made a High-Low of 25592-21000

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 24604-25039-25340

Main Hypos for the next session:

a) BNF needs to sustain above 25039 for rise to 25170-200 / 25275 / 25500-600 / 25800-935 & 26150

b) Staying below 25020, the auction could fall to 24894 / 24750-735 / 24550-460 / 24300-175 & 24084-030

Extended Hypos:

c) Above 26150, BNF can probe higher to 26355 / 26490* / 26545-600 / 26700-805 & 26857-896

d) Below 24030, lower levels of 23950-910 / 23675-625 / 23380-300 & 23000 could be tagged

-Additional Hypos-

e) Below 23000, the auction could further fall to 22911 / 22700 / 22430 & 22300-200

f) If 22200 is taken out, BNF could start a fresh leg down to 21800 / 21500 & 21000

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout